Is Family Tax Benefit A Commonwealth Income Support Payment Family Tax Benefit A 2 part payment that helps with the cost of raising children To get this you must have a dependent child or full time secondary student aged 16 to 19 who

To be eligible for the first payment you must have been residing in Australia and be receiving one of the following payments or hold one of the following concession cards Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the

Is Family Tax Benefit A Commonwealth Income Support Payment

Is Family Tax Benefit A Commonwealth Income Support Payment

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

How Much Is Family Tax Benefit GeniusWriter

https://geniuswriter.net/wp-content/uploads/2021/11/top-view-of-tax-form-laptop-and-blue-card-with-tax-word-at-workplace-1536x1025.jpg

Hidden Benefits Putting Your Family On The Payroll For Tax Purposes

http://www.nxtgennexus.com/wp-content/uploads/2017/08/Taxes_stock-1080x675.jpg

Paid Parental Leave scheme Paid Parental Leave scheme provides Parental Leave Pay to support to eligible working parents to take time off work after a birth or adoption Family Family Tax Benefit is a payment to help families with the cost of raising child ren To be eligible for Family Tax Benefit you must be a parent guardian carer including foster

The Energy Supplement provides assistance with household expenses including energy costs to pensioners and income support recipients Since 20 March Family Tax Benefit Part A will increase by up to 204 40 per year for families with a child under 13 years and 255 50 per year for those with a child 13 years and over

Download Is Family Tax Benefit A Commonwealth Income Support Payment

More picture related to Is Family Tax Benefit A Commonwealth Income Support Payment

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

https://s3-ap-southeast-2.amazonaws.com/vacancy-care-enthusiast/~www/wp/aws/wp-content/uploads/2019/08/02110051/brothers-457237_1280-768x512.jpg

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

Family Tax Benefit Part B This payment is for parents and carers in single income families who care for a child at least 35 of the time This payment is income tested but not assets tested Juston he Family Tax Benefit FTB is a two part payment to assist with the cost of raising children To qualify for the FTB a person must have a dependent child or full time

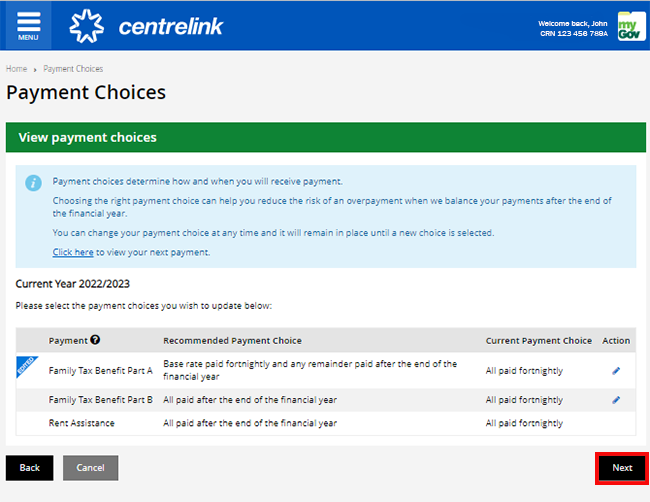

The meaning of a dependent child for DVA income support purposes is not the same as the meaning for Family Tax Benefit purposes For income support Family Tax Benefit can be paid either fortnightly or as a lump sum after the end of the financial year to a bank credit union or building society account

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

https://www.pitcher.com.au/wp-content/uploads/2023/05/FedBudget_FullReport_230510_table.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

https://www.servicesaustralia.gov.au/family-tax-benefit

Family Tax Benefit A 2 part payment that helps with the cost of raising children To get this you must have a dependent child or full time secondary student aged 16 to 19 who

https://treasury.gov.au/sites/default/files/2020...

To be eligible for the first payment you must have been residing in Australia and be receiving one of the following payments or hold one of the following concession cards

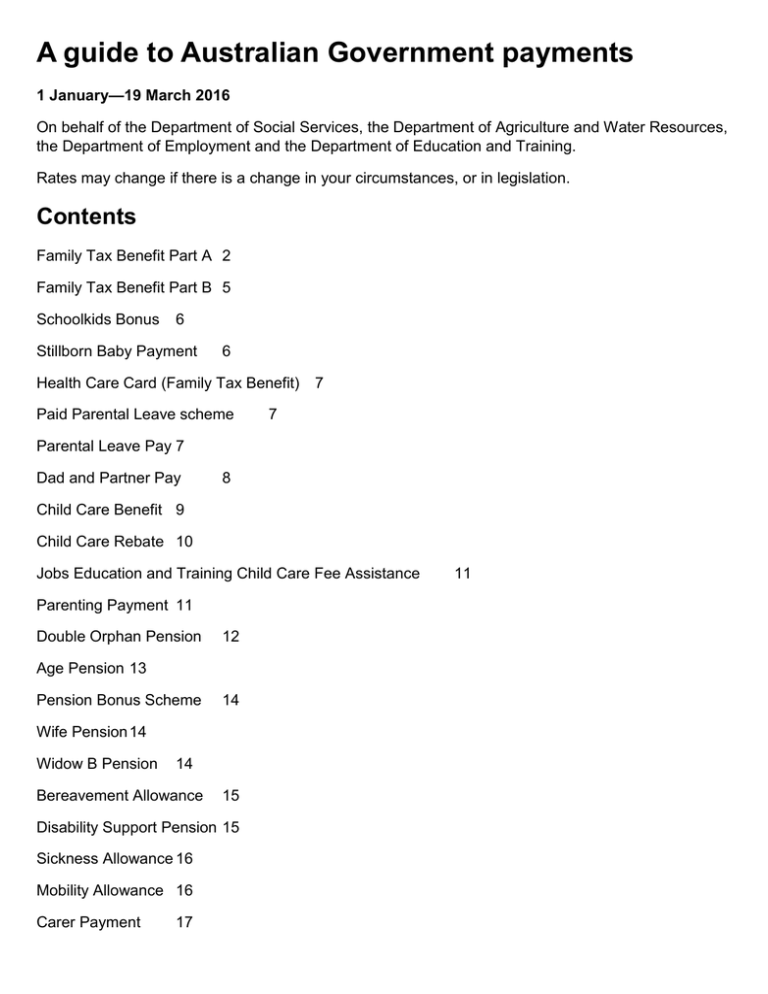

A Guide To Australian Government Payments

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

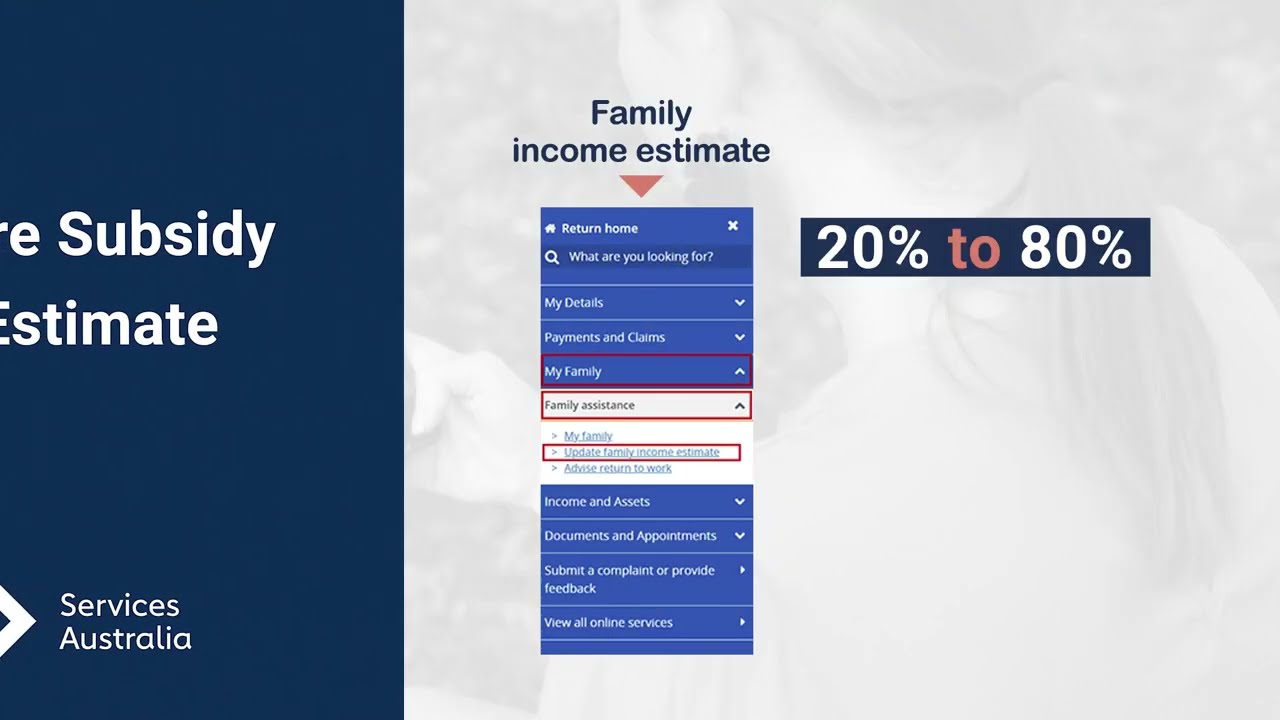

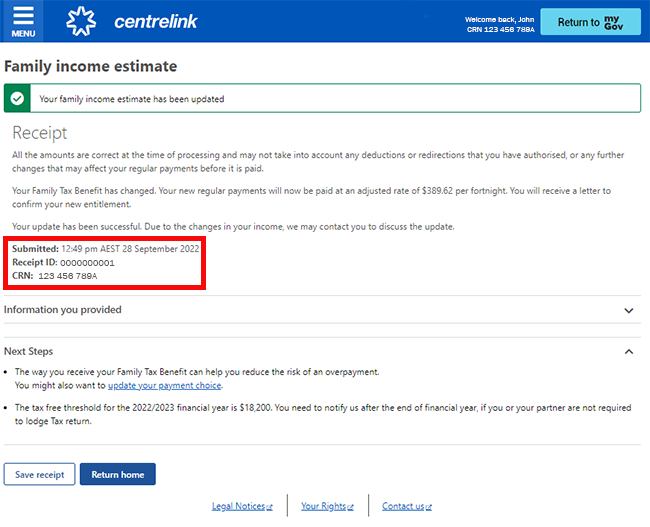

Centrelink Online Account Help Update Your Family Income Estimate And

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

FREE Government Spectacle Program Comforteyecare

FREE Government Spectacle Program Comforteyecare

How Does Family Tax Benefit Really Work Grandma s Jars

Can Expats Claim FTB With Overseas Income Odin Mortgage

Centrelink Online Account Help Update Your Family Income Estimate And

Is Family Tax Benefit A Commonwealth Income Support Payment - The Energy Supplement provides assistance with household expenses including energy costs to pensioners and income support recipients Since 20 March