Is Fixed Deposit Interest Taxable In Singapore Is the foreign sourced offshore income considered received in Singapore and subject to tax No The foreign sourced offshore income used by your company in this manner

Firstly to answer your question your FD is definitely not taxable if you using all the big name banks in SG But to add on to the other redditors points FD returns generally not Interest Relating to Bank Deposit Loan Trade Debt You must report interest from bank deposits loans and trade debts when you file your GST returns whether received from a

Is Fixed Deposit Interest Taxable In Singapore

Is Fixed Deposit Interest Taxable In Singapore

https://i.ytimg.com/vi/xxNcZBhxh7w/maxresdefault.jpg

Comparing Fixed Deposit Rates Post Office Vs SBI And Other Banks

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

IOB Fixed Deposit Interest Rates January 2024

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/12/iob-fd-interest-rates.jpg

Judicial pronouncements have generally determined that where interest income is derived other than purely from investment transactions or when the placement of deposits is Singapore sourced interest income is taxable when it arises and foreign sourced interest is taxable when it is remitted or deemed to be remitted to Singapore

Generally interest income derived from Singapore approved banks or licensed finance companies is not taxable All foreign sourced income received by Singapore source investment income that is income that is not considered to be gains or profits from a trade business or profession derived directly by individuals from specified

Download Is Fixed Deposit Interest Taxable In Singapore

More picture related to Is Fixed Deposit Interest Taxable In Singapore

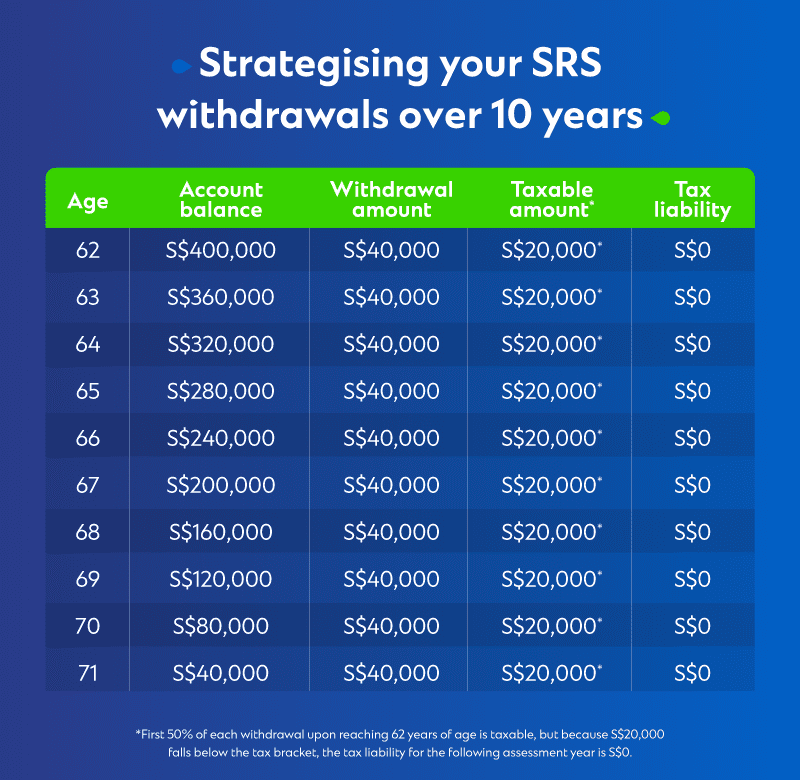

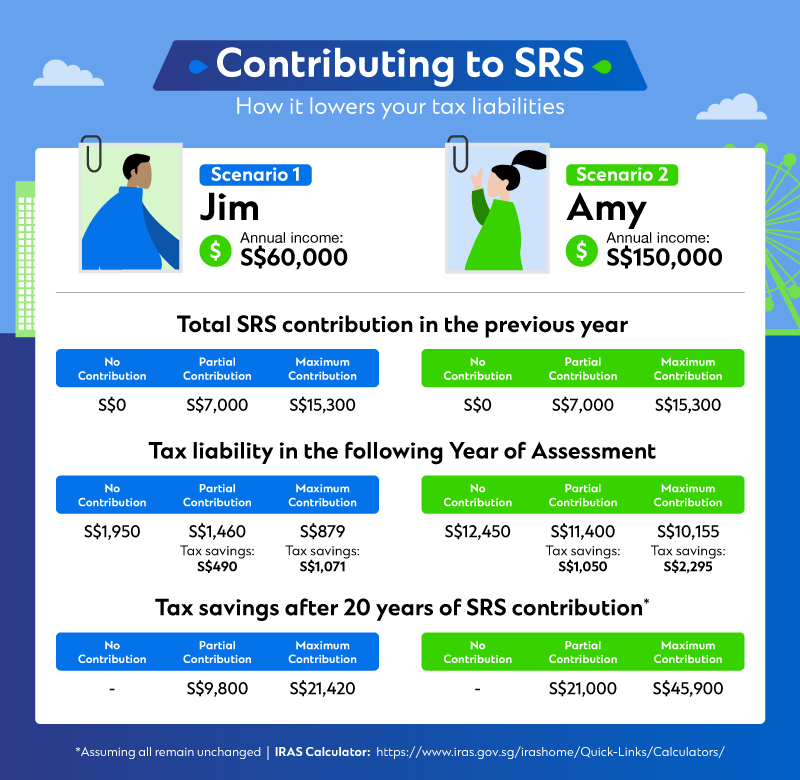

Srs Top Up Limit Corbin oLyons

https://av.sc.com/sg/content/images/sg-srs-table-1.png

Fixed Deposits In Singapore Interest Rates Alternatives More

https://smartwealth.sg/wp-content/uploads/2022/01/fixed-deposits.png

Srs Top Up Limit Corbin oLyons

https://av.sc.com/sg/content/images/sg-infographic-1-800-x-780px.png

Otherwise the withholding tax rate is 22 for individuals or prevailing corporate tax rate for non individuals Director s remuneration 22 Any payment for services rendered Taxable income Resident and nonresident companies are subject to tax on income accruing in or derived from Singapore and foreign income remitted or deemed remitted

Interest Rates Non promotional interest rates for fixed deposits are currently relatively low even compared to virtually risk free investments like SSB Read Also 2024 Edition Complete Guide To This means that it can t be money you re transferring from a savings account with the same bank to the fixed deposit Are fixed deposits taxable in Singapore

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/03/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-April-2020_Featured.png?fit=1239%2C891&ssl=1

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

https://www.iras.gov.sg/taxes/corporate-income-tax...

Is the foreign sourced offshore income considered received in Singapore and subject to tax No The foreign sourced offshore income used by your company in this manner

https://www.reddit.com/r/singaporefi/comments/...

Firstly to answer your question your FD is definitely not taxable if you using all the big name banks in SG But to add on to the other redditors points FD returns generally not

Good News SBI HDFC Bank

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

Overview Of Fixed Deposit Interest Rates Advantages Types GST Guntur

How Do UOB DBS OCBC Fixed Deposit Rates Compare To Other Banks In

Fixed Deposit Interest Rates Highest FD Interest Rate Of 9 These

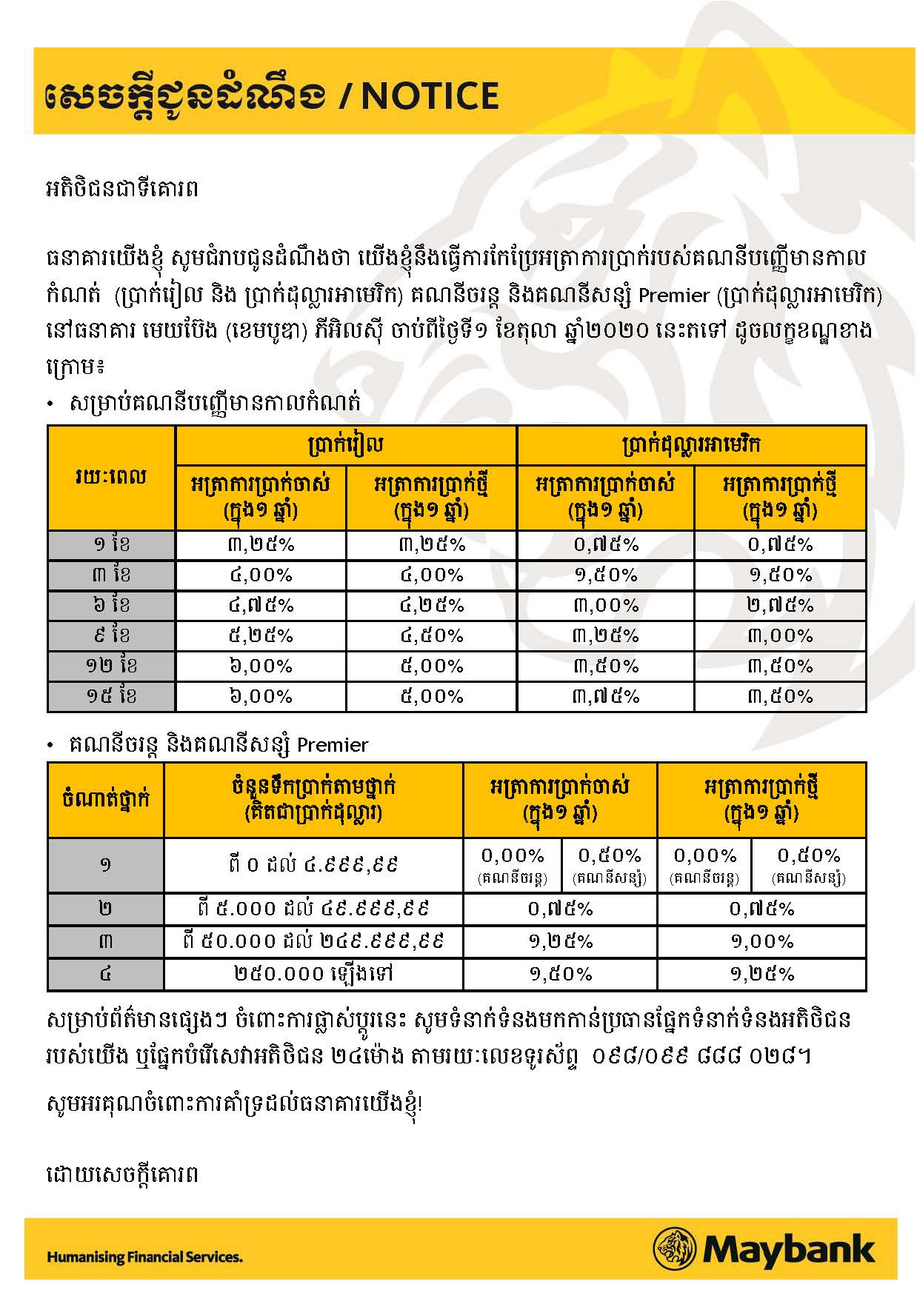

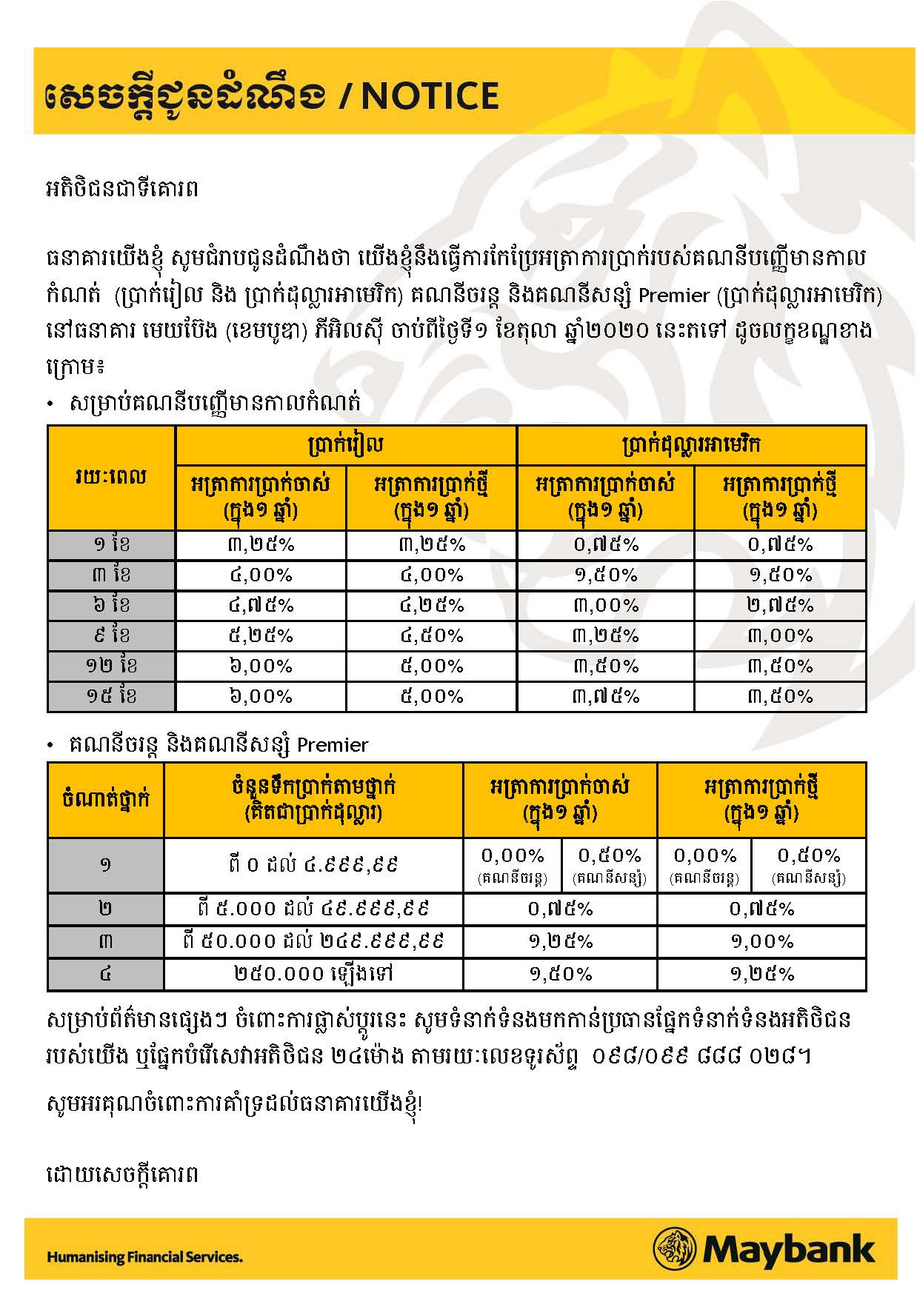

Maybank Fixed Deposit Rate 2018 Best Maybank Fixed Deposit Rates Vrogue

Maybank Fixed Deposit Rate 2018 Best Maybank Fixed Deposit Rates Vrogue

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

Safe Mode Of Investment

Bank Of India Fixed Deposit Interest Rates BOI FD

Is Fixed Deposit Interest Taxable In Singapore - Singapore source investment income that is income that is not considered to be gains or profits from a trade business or profession derived directly by individuals from specified