Is Food Reimbursement Taxable The taxable amount of a benefit is reduced by any amount paid by or for the employee For example an employee has a taxable fringe benefit with a FMV of 300 If the employee pays

For amounts incurred or paid after 2017 the 50 limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income as a Per diem pay is used to reimburse mileage meals lodging and some other fixed allowances With per diem payments the IRS says your employee accounted to you if the reimbursement does not exceed the

Is Food Reimbursement Taxable

Is Food Reimbursement Taxable

https://nestlersgroup.com/wp-content/uploads/2023/09/Tax-free-benefits-romania-Nestlers-group-1.jpg

Is Work From Home Reimbursement Taxable

https://babatax.com/wp-content/uploads/2023/08/Is-work-from-home-reimbursement-taxable-1024x683.jpg

Is Employee Mileage Reimbursement Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Is employee mileage reimbursement taxable_featured.jpg#keepProtocol

The employee incurs gas expenses of 60 pays 150 per night for lodging and spends 40 on meals The company will reimburse the employee for the mileage rate Employee tax implications Employees may be required to include meal allowances as taxable income depending on the applicable tax laws However certain types of allowances or reimbursement methods may be

Planning around the 50 disallowance rule for meals Only 50 of otherwise allowable meal expenses are deductible as business expenses Sec 274 n 1 This includes Local governments must carefully consider whether reimbursements for employee meals are taxable For example the Internal Revenue Service IRS code and regulations

Download Is Food Reimbursement Taxable

More picture related to Is Food Reimbursement Taxable

General Food Reimbursement Invoice Template Image picture Free Download

https://img.lovepik.com/free-template/20210805/bg/be0d2746992b92555e348f0b7087ae8e_55743.png_detail.jpg!detail808

Vehicle Programs Is Mileage Reimbursement Taxable Motus

https://www.motus.com/wp-content/uploads/2022/02/Is-Mileage-Reimbursement-Taxable.jpg

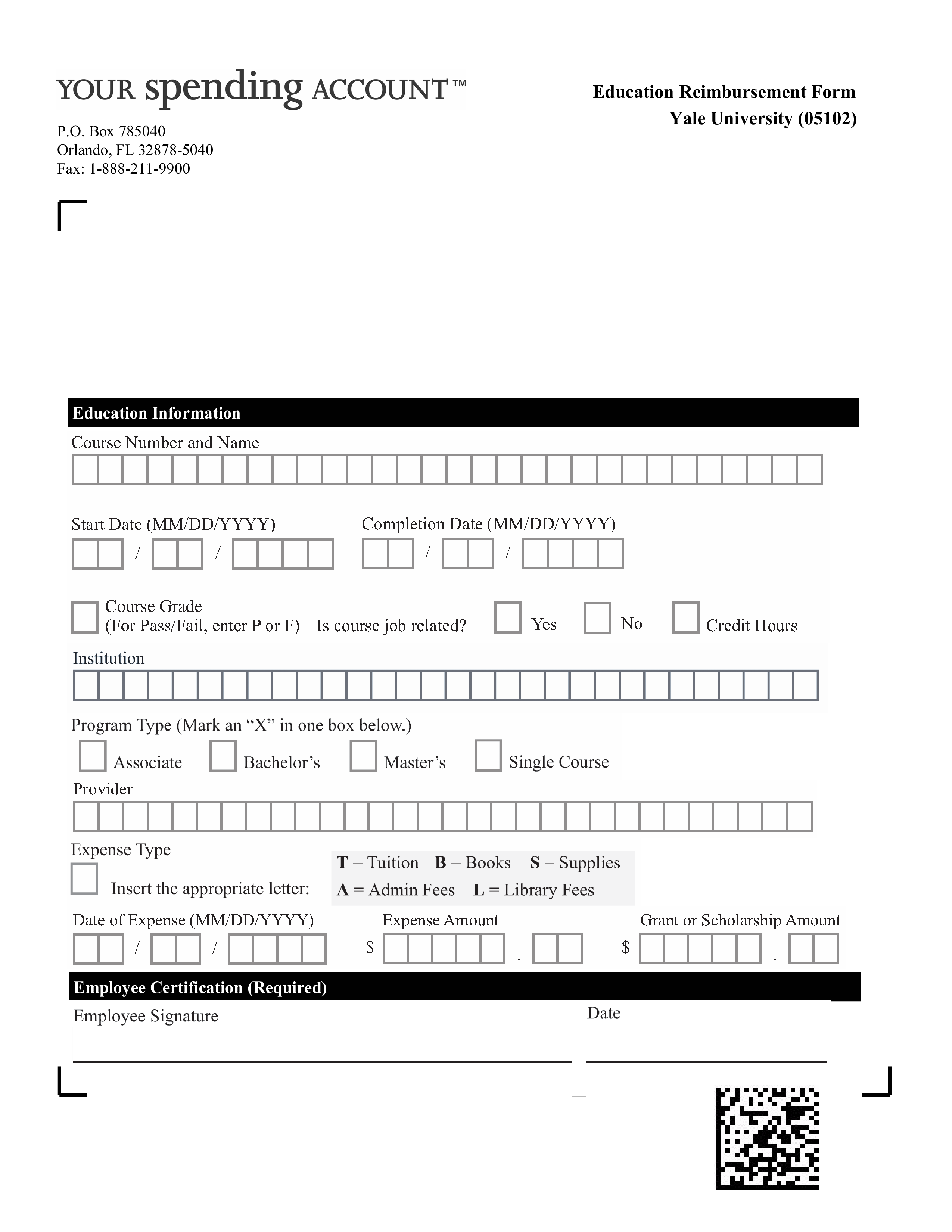

Is Tuition Reimbursement Taxable A Guide ClearDegree

https://www.cleardegree.com/wp-content/uploads/2020/04/CD-BLog-Image-4-3-1536x1122.jpg

If you have to travel for work your employee can reimburse you for the cost of meals or provide you with a lump sum per diem for your business trip Here is everything you need to know about IRS meal allowances per diem An employee may exclude from gross income the value of meals furnished by an employer during working hours if the employee could not otherwise obtain proper meals

The final regulation regarding food and beverage expense deductions clarifies that the limited deduction is available for food or beverages provided to employees and to the Answer In short no But that s provided your employer completes the pay stub accurately as part of their expense reimbursement process If they incorrectly lump the reimbursed amount with your wages it s taxed If you re worried talk to your accounting department before your employer reimburses you

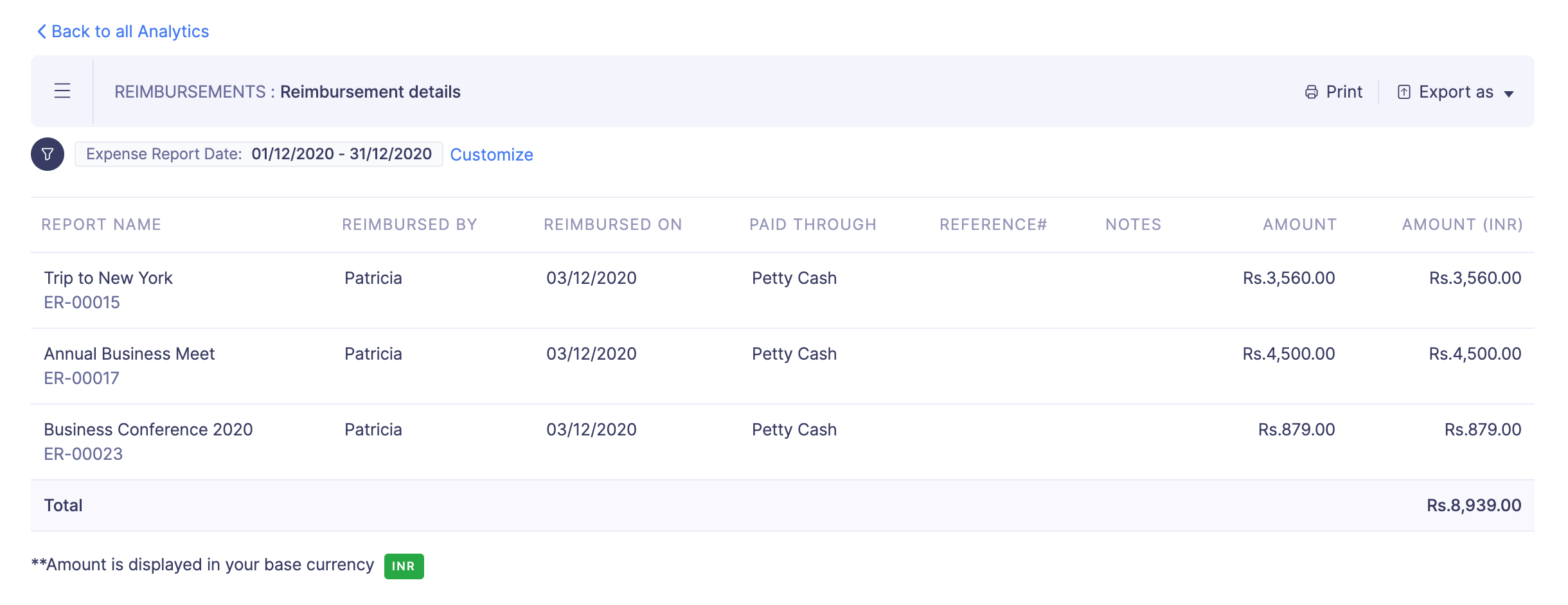

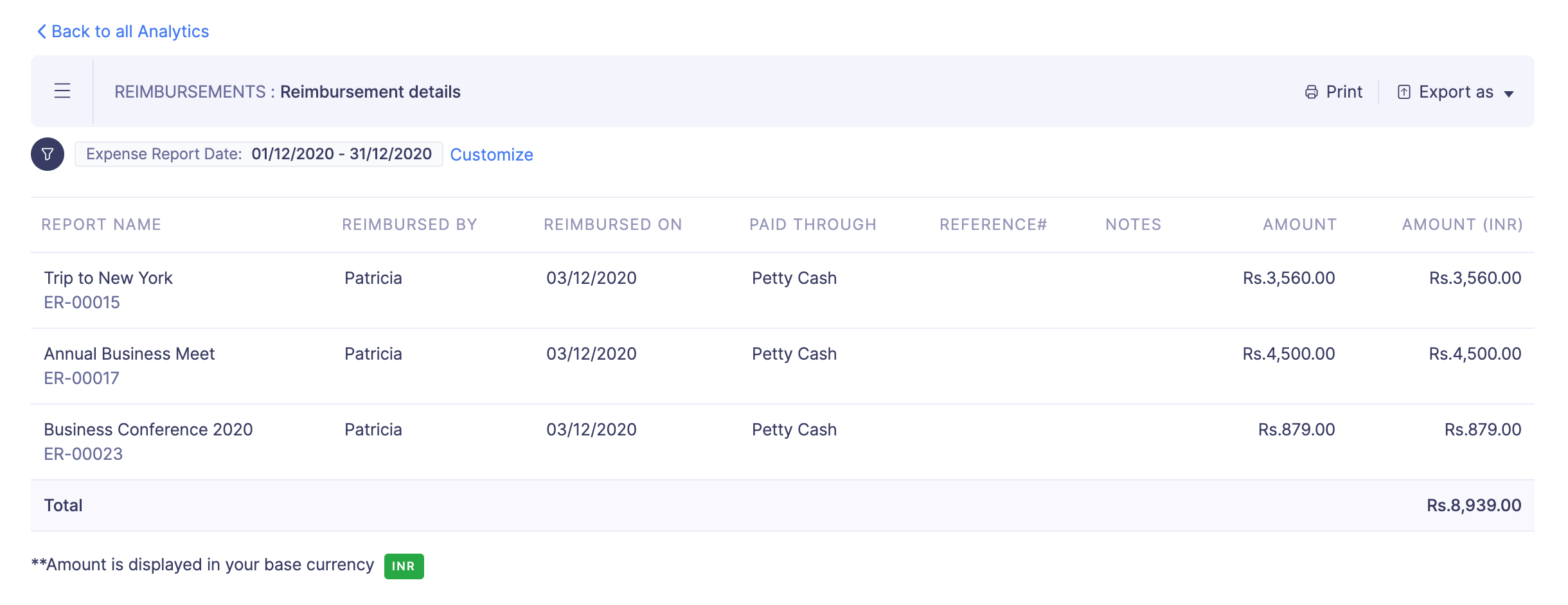

Reimbursement Analytics User Guide Zoho Expense

https://www.zoho.com/expense/help/analytics/reimbursement/reimbursement-details.png

Justification Letter For Late Reimbursement PDF

https://imgv2-2-f.scribdassets.com/img/document/489058724/original/44cc6655ef/1702337135?v=1

https://www.irs.gov/pub/irs-pdf/p5137.pdf

The taxable amount of a benefit is reduced by any amount paid by or for the employee For example an employee has a taxable fringe benefit with a FMV of 300 If the employee pays

https://www.irs.gov/publications/p15b

For amounts incurred or paid after 2017 the 50 limit on deductions for food or beverage expenses also applies to food or beverage expenses excludable from employee income as a

Is Health Insurance Reimbursement Taxable

Reimbursement Analytics User Guide Zoho Expense

Food Reimbursement PDF

Education Reimbursement Form Templates At Allbusinesstemplates

ACLA Low Reimbursement Jeopardizes Monkeypox Lab Testing Effort G2

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Employee Expense Reimbursement Form Fillable Printable Pdf Porn Sexiz Pix

Reimbursement Receipt PDF

Food Bid

Is Food Reimbursement Taxable - The employee incurs gas expenses of 60 pays 150 per night for lodging and spends 40 on meals The company will reimburse the employee for the mileage rate