Is Fuel A Taxable Benefit The taxable benefit is given in addition to the employee s regular wage it s like an extra perk an employee receives on top of their everyday earnings All taxable benefits are

Fuel benefit occurs when an employer pays for private fuel such as for travelling to and from work for an employee The value of the benefit and the amount of tax an employee In 2022 a set monthly car allowance to pay for a lease maintenance or gas is taxable but the mileage reimbursement is not as long as it stays below the requirements of the IRS

Is Fuel A Taxable Benefit

Is Fuel A Taxable Benefit

https://suretybondauthority.com/wp-content/uploads/2017/04/Utah-Taxable-Fuel-Bond.jpg

Will The Fuel Card charging Pass Become A Taxable Benefit In Kind In

https://assets.ey.com/content/dam/ey-sites/ey-com/en_be/topics/tax/tax-alerts/2022/img/ey-alert-fuel-card-charging-pass-taxable-benefit-in-kind-316440366.jpg

Oklahoma Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/07/Oklahoma-Taxable-Fuel-Bond.jpg

If fuel is provided by the employer for personal use the value of the fuel will have to be included in income in addition to the ALV The value of fuel provided in kind is its FMV When an employer provides fuel for a company car a taxable benefit is likely to arise The taxable benefit is specifically known as the fuel benefit charge The fuel benefit charge

What is a company car fuel benefit This tax is for employees who have been given a company car and free fuel to use during personal hours A company car fuel benefit is a If you are undertaking qualifying business travel in a company car the rates that your employer can reimburse you up to on a tax NIC free basis are different and depend on

Download Is Fuel A Taxable Benefit

More picture related to Is Fuel A Taxable Benefit

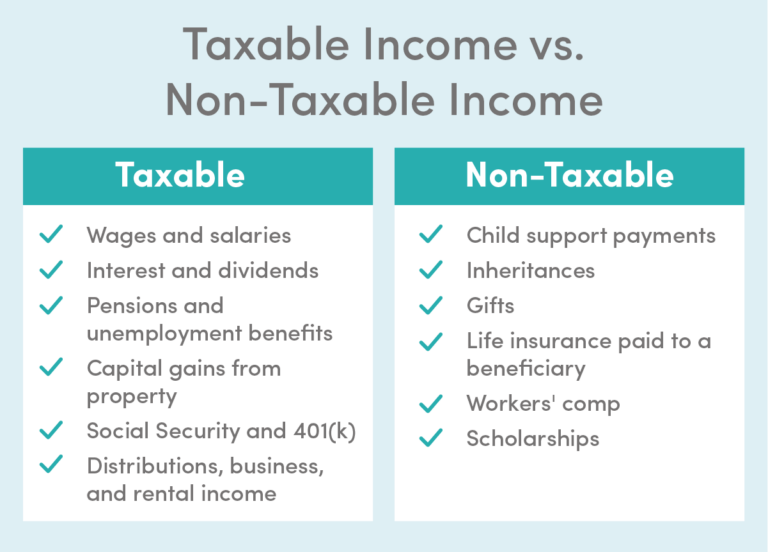

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

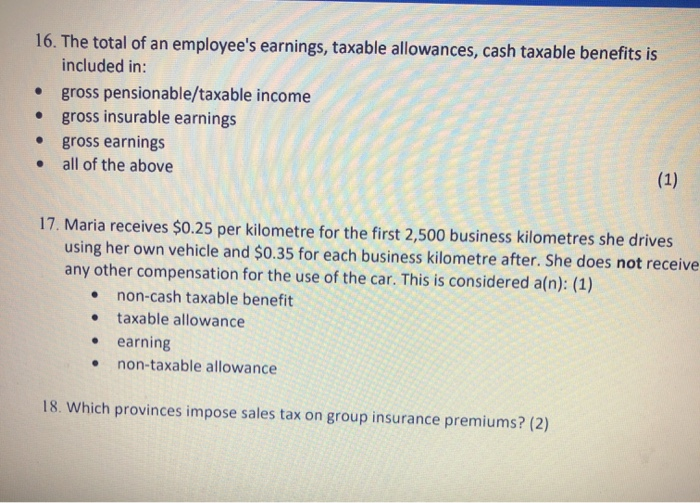

Solved 16 The Total Of An Employee s Earnings Taxable Chegg

https://media.cheggcdn.com/study/bd2/bd2e695c-dadd-4045-b35d-528f2f924689/image.png

Texas Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/07/Texas-Taxable-Fuel-Bond.jpg

No commuter benefits do not cover gas costs on a pre tax basis But an employer may elect to cover fuel related costs for employees as a taxable benefit or offer an occasional Fuel Benefit is the value of fuel that will be taxed on a company car driver It is the salary equivalent in the eyes of HMRC though like most benefits it escapes National

If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal Are fuel cards a Benefit in Kind Use of a fuel card for business purposes is not classed as a taxable benefit and you won t have to pay tax on a fuel card unless it is used to cover

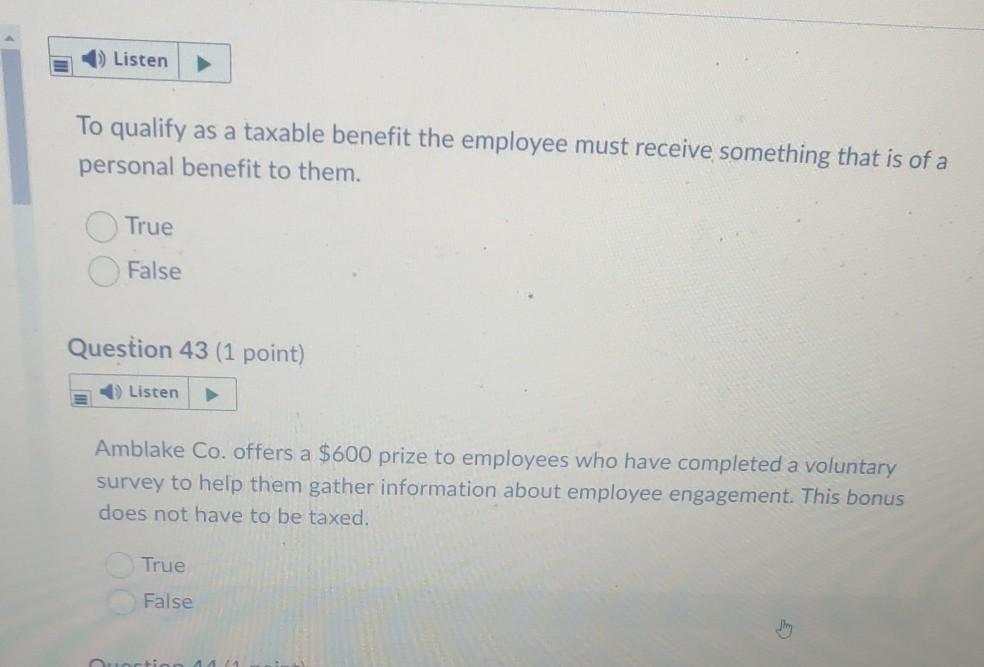

Solved Listen To Qualify As A Taxable Benefit The Employee Chegg

https://media.cheggcdn.com/study/193/193d969d-f086-4fa0-a5de-f796b26b721e/image

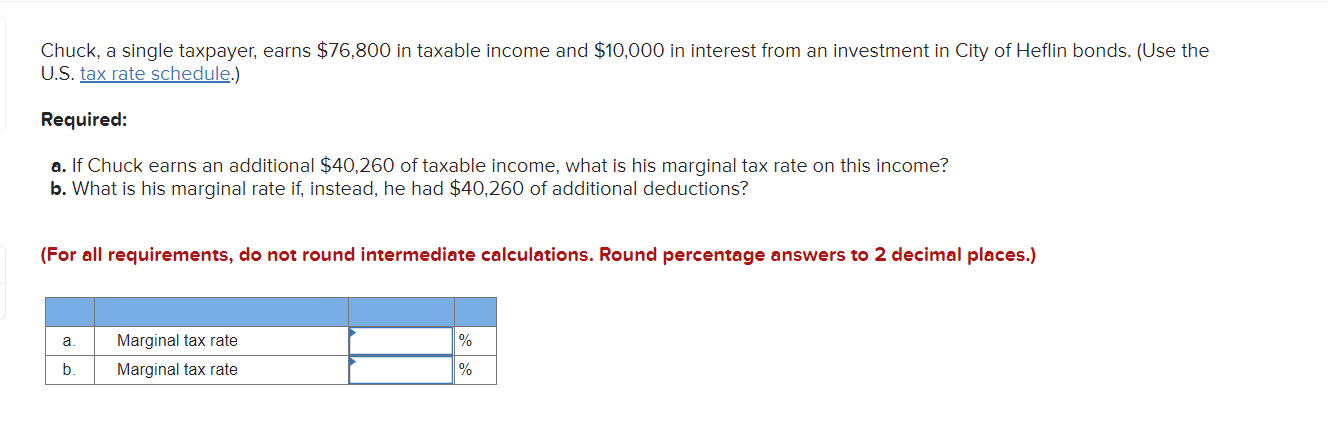

Solved Chuck A Single Taxpayer Earns 76 800 In Taxable Chegg

https://media.cheggcdn.com/media/48c/48c3c7d9-945c-4341-9c7f-181e7eb7c905/phpwLScGV.png

https://quickbooks.intuit.com/ca/resources/payroll/...

The taxable benefit is given in addition to the employee s regular wage it s like an extra perk an employee receives on top of their everyday earnings All taxable benefits are

https://www.oldfieldadvisory.com/articles/2019/10/...

Fuel benefit occurs when an employer pays for private fuel such as for travelling to and from work for an employee The value of the benefit and the amount of tax an employee

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Listen To Qualify As A Taxable Benefit The Employee Chegg

Solved Please Note That This Is Based On Philippine Tax System Please

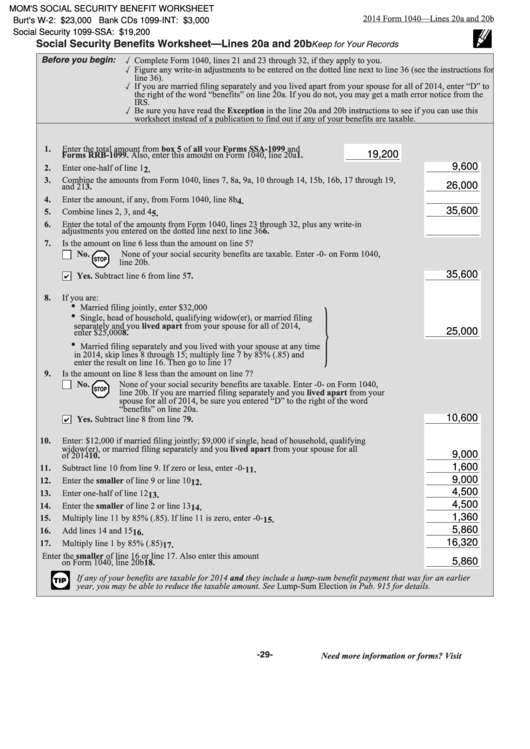

Fillable Social Security Benefits Worksheet 2022 Fillable Form 2023

Iowa Taxable Fuel Bond Surety Bond Authority

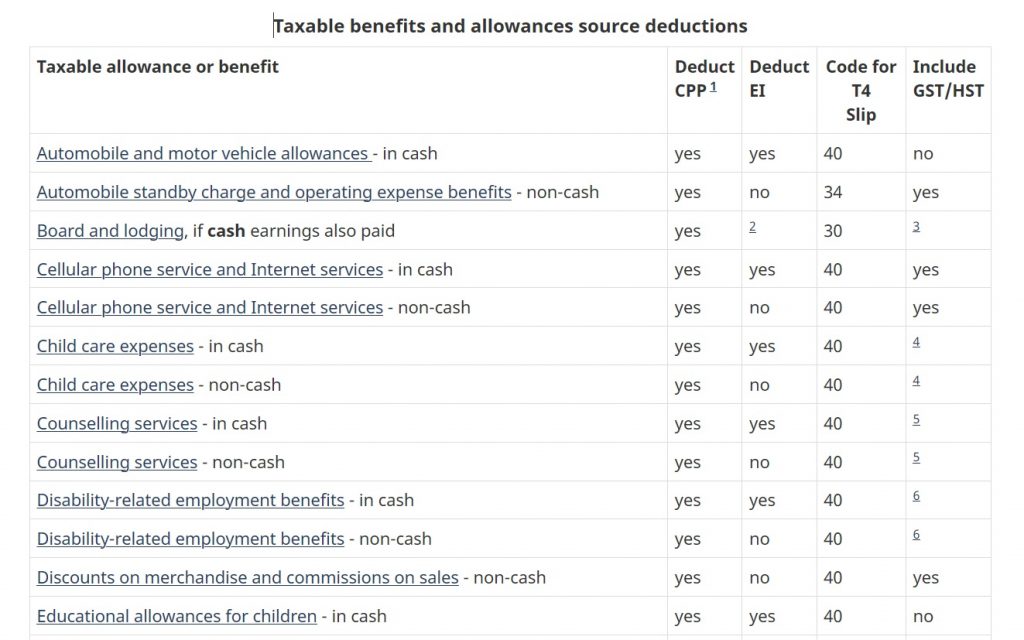

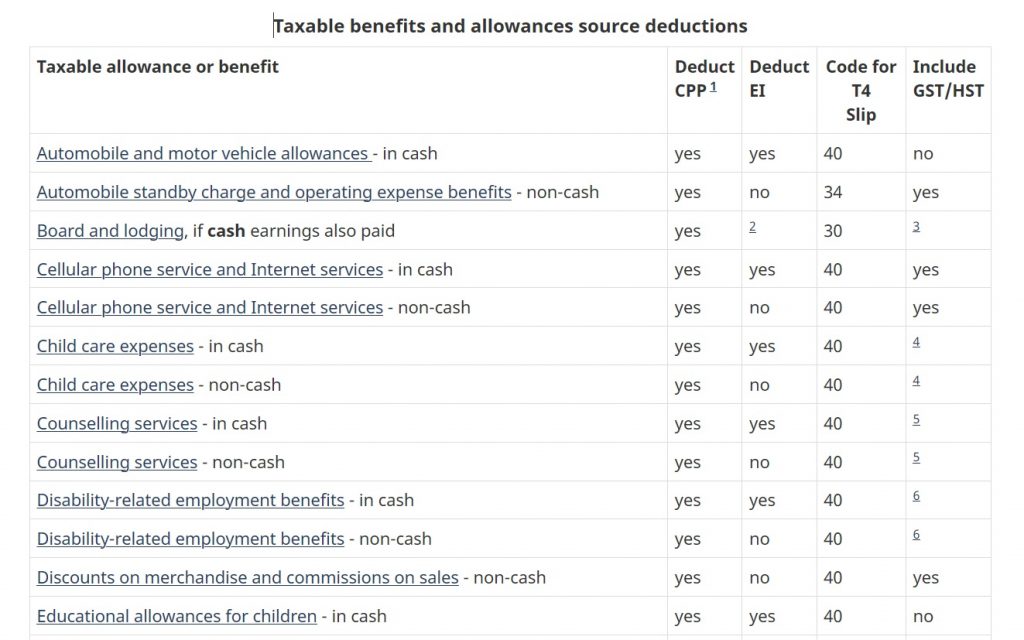

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Montana Taxable Fuel Bond Surety Bond Authority

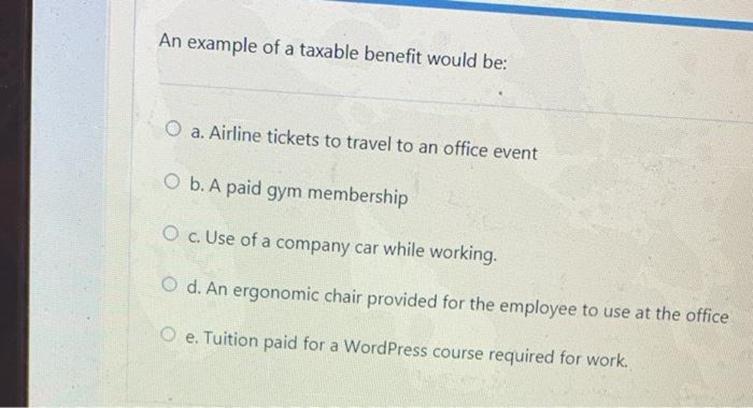

Get Answer An Example Of A Taxable Benefit Would Be O A Airline

Idaho Taxable Fuel Bond Surety Bond Authority

Is Fuel A Taxable Benefit - When an employer provides fuel for a company car a taxable benefit is likely to arise The taxable benefit is specifically known as the fuel benefit charge The fuel benefit charge