Is Fuel Allowance Taxable In Pakistan Taxation of certain allowances The following allowances paid on or after first day of July 2002 irrespective of the level of salary have been made taxable a Senior Post Allowance

KARACHI Federal Board of Revenue FBR has said that for determination of tax the salary income shall include the value of all perquisites allowances and benefits received by employees FBR has clarified that withdrawal of exemption reduced rates should not be confused with imposition of new taxes It is very clearly and candidly informed that the present budget proposals do not contain any new item for taxation of pensions or major components of

Is Fuel Allowance Taxable In Pakistan

Is Fuel Allowance Taxable In Pakistan

https://assets.change.org/photos/8/xl/xt/cExlXtyeGNLjCoS-1600x900-noPad.jpg?1643371791

Fuel Mileage Allowance HSKSG

https://www.hsksg.co.uk/wp-content/uploads/2022/06/Petrol-resized.jpg

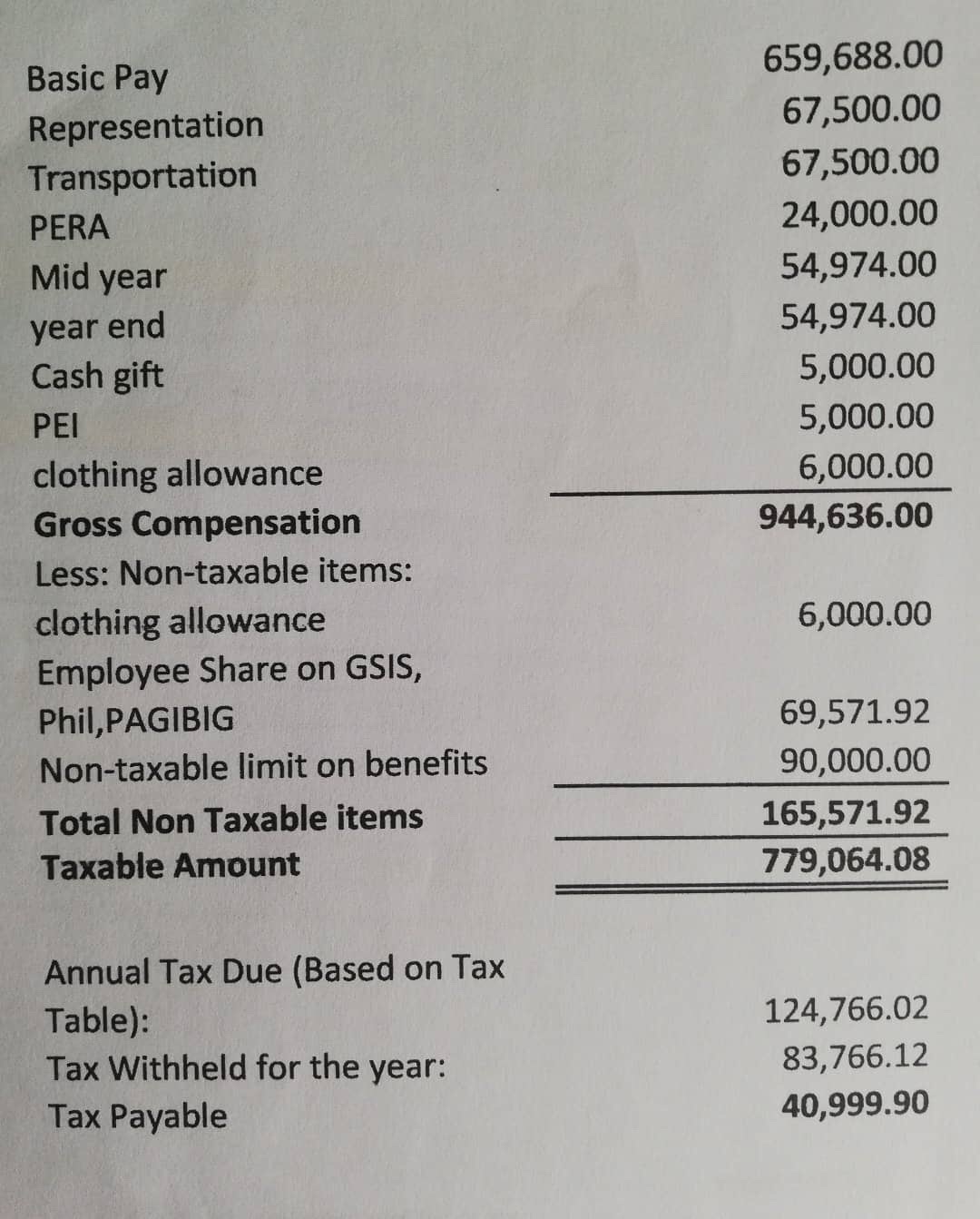

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

Significant exemptions available under salary income are as follows Medical allowance expenses Reimbursement of expenses on medical treatment or hospitalisation or both received by an employee is exempt from tax The deduction of allowance is restricted to individual having taxable income up to Rs 1 500 000 The deduction is allowed upon furnishing of NTN or name of educational institution

Calculating your taxable income in Pakistan involves understanding not just your basic salary but also the value of any perquisites allowances and benefits provided by your employer This article delves into the relevant tax rules to help you navigate these aspects of your salary package Tax borne by the employer is a perquisite in the hands of the employee and is therefore taxable Deductible allowance in respect of Zakat paid by a person is available to such person

Download Is Fuel Allowance Taxable In Pakistan

More picture related to Is Fuel Allowance Taxable In Pakistan

How To Claim Fuel Allowance JobAlert ie

https://jobalert-blog-assets.s3.eu-west-1.amazonaws.com/651bfb9607aacc002948ff1e/How to claim: Fuel Allowance.png

What Date Is Fuel Allowance Lump Sum Paid YouTube

https://i.ytimg.com/vi/3wCdoe95Ihk/maxresdefault.jpg

Oklahoma Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/07/Oklahoma-Taxable-Fuel-Bond.jpg

Same is the case with other types of allowances such as entertainment allowances travel allowances and fuel allowances Medical Allowance Exemption Limit Medical Allowance up to 10 of Basic Salary is exempt from Tax and is available as deductions from salary Income to calculate Taxable Income Same is the case with other types of allowances such as entertainment allowances travel allowances and fuel allowances According to the income tax slabs for FY 2021 22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600 000 per annum

[desc-10] [desc-11]

Waterford News Star New Online System For Fuel Allowance Scheme

https://waterford-news.ie/wp-content/uploads/2022/12/FuelAllowance.jpg

Utah Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/04/Utah-Taxable-Fuel-Bond.jpg

https://download1.fbr.gov.pk › Docs

Taxation of certain allowances The following allowances paid on or after first day of July 2002 irrespective of the level of salary have been made taxable a Senior Post Allowance

https://pkrevenue.com › salary-income-to-include-all...

KARACHI Federal Board of Revenue FBR has said that for determination of tax the salary income shall include the value of all perquisites allowances and benefits received by employees

John Paul O Shea Fuel Allowance Expansion Update John Paul O Shea

Waterford News Star New Online System For Fuel Allowance Scheme

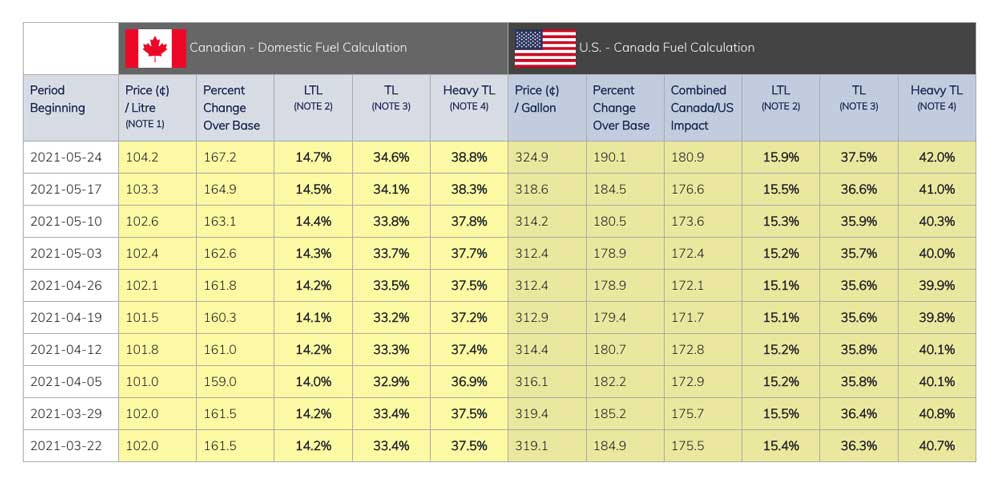

How Does The Fuel Surcharge Work Brimich Logistics

Petition Raise Government Fuel Allowance For Self Employed United

Texas Taxable Fuel Bond Surety Bond Authority

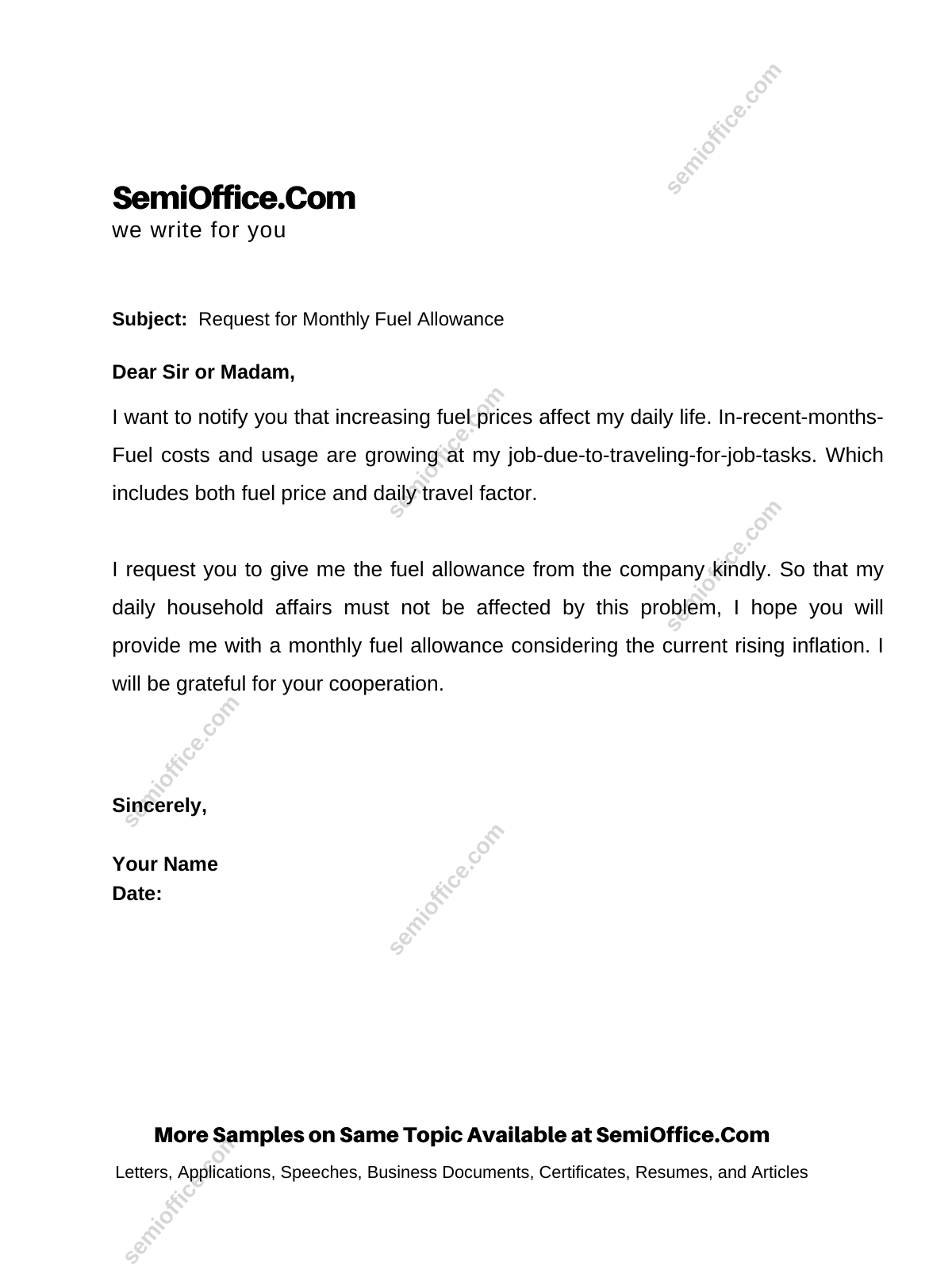

Request For Fuel Allowance To Company Employer SemiOffice Com

Request For Fuel Allowance To Company Employer SemiOffice Com

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Type Of Allowance For Employees In Malaysia

Idaho Taxable Fuel Bond Surety Bond Authority

Is Fuel Allowance Taxable In Pakistan - [desc-13]