Is Fuel Allowance Taxable Income Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and generally is subject to federal income tax withholding Social Security and Medicare taxes

What is a gas stipend Is a vehicle stipend taxable income What is the difference between a vehicle stipend and mileage reimbursement What is a FAVR reimbursement How do cents per mile CPM programs work Do any particular states have laws to keep in mind when it comes to gas or vehicle stipends Can gas cards be used as fuel stipends Car allowances are taxable income and subject to withholding unless you substantiate business use see the rules for accountable plans Mileage reimbursements are not taxed unless they exceed the IRS business mileage rate

Is Fuel Allowance Taxable Income

Is Fuel Allowance Taxable Income

https://www.wikihow.com/images/f/f2/Calculate-Your-Income-Tax-in-India-Step-5.jpg

Oklahoma Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/07/Oklahoma-Taxable-Fuel-Bond.jpg

How To Claim Fuel Allowance JobAlert ie

https://jobalert-blog-assets.s3.eu-west-1.amazonaws.com/651bfb9607aacc002948ff1e/How to claim: Fuel Allowance.png

For the actual amount of the expense either before or after you incur the expense such as paying for the petrol you use when you use your car for work it s a reimbursement If you receive an allowance from the Australian Government see Government payments and allowances If fuel is provided by the employer for personal use the value of the fuel will have to be included in income in addition to the ALV The value of fuel provided in kind is its FMV based on facts and circumstances

The IRS generally treats a car allowance as taxable income because it is considered compensation and is taxed along with your regular income at the federal and state levels Employers and employees must also pay FICA and Medicare taxes on the allowance Gas stipends vehicle stipends and car allowances all fall under the category of compensation in the eyes of the IRS meaning they are taxable income for employees The only exception is if employers pay the stipend or reimbursements as part of a non taxable accountable plan

Download Is Fuel Allowance Taxable Income

More picture related to Is Fuel Allowance Taxable Income

What Date Is Fuel Allowance Lump Sum Paid YouTube

https://i.ytimg.com/vi/3wCdoe95Ihk/maxresdefault.jpg

Is A Car Allowance Taxable Income MileIQ MileIQ How Car

https://bambubet.com/c496e478/https/e52a07/assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7a6f87abc4b53809476_610ddbe9e53d9932903dfde3_car-allowance-taxable-income.jpeg

Utah Taxable Fuel Bond Surety Bond Authority

https://suretybondauthority.com/wp-content/uploads/2017/04/Utah-Taxable-Fuel-Bond.jpg

You can deduct actual car expenses which include depreciation or lease payments gas and oil tires repairs tune ups insurance and registration fees Or instead of figuring the business part of these actual expenses you may be able to use the standard mileage rate to figure your deduction While car allowances offer numerous benefits it is crucial to recognize that in most cases they are considered taxable income Failure to account for the taxable nature of car allowances can lead to unintended financial implications catching employees and employers off guard during tax season

You can have income of up to 512 per week or 1 024 per week for a couple and still qualify for Fuel Allowance Your capital savings property and investments are also assessed The first 50 000 of your capital is not included in the means test If your assignment is indefinite you must include in your income any amounts you receive from your employer for living expenses even if they are called travel allowances and you account to your employer for them

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

https://www.motus.com/wp-content/uploads/2019/06/car-allowance-taxable.jpg

Petition Raise The Tax Free Allowance On Fuel Mileage For Business

https://assets.change.org/photos/5/dk/mq/qpDKmQTQYSczofk-1600x900-noPad.jpg?1648497090

https://www.irs.gov/pub/irs-pdf/p5137.pdf

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and generally is subject to federal income tax withholding Social Security and Medicare taxes

https://www.compt.io/gas-stipends-answers-to-9-common-questions

What is a gas stipend Is a vehicle stipend taxable income What is the difference between a vehicle stipend and mileage reimbursement What is a FAVR reimbursement How do cents per mile CPM programs work Do any particular states have laws to keep in mind when it comes to gas or vehicle stipends Can gas cards be used as fuel stipends

What You Need To Know When Claiming A Car Allowance Fiscal Private

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

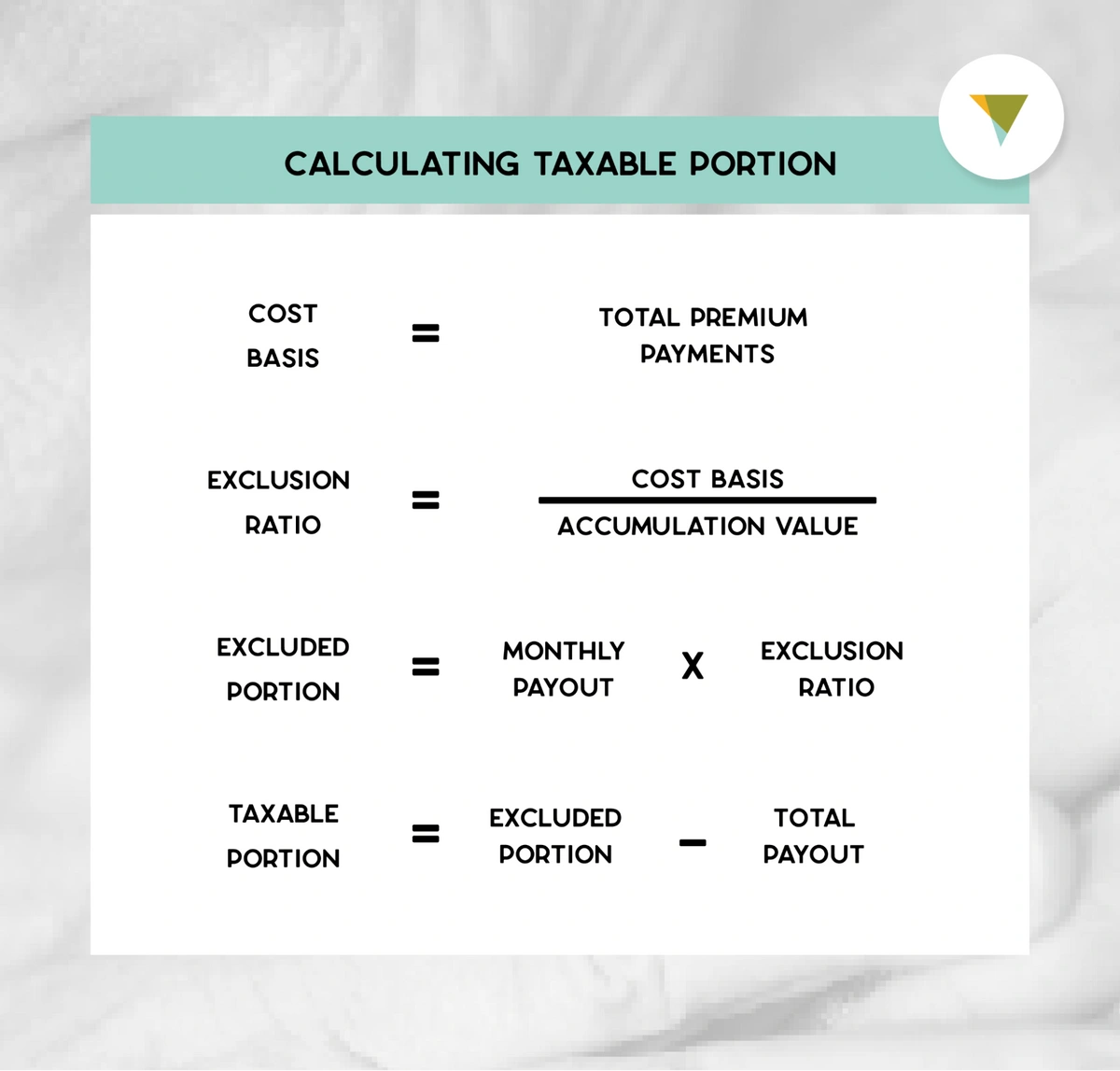

How To Calculate The Taxable Income Of An Annuity

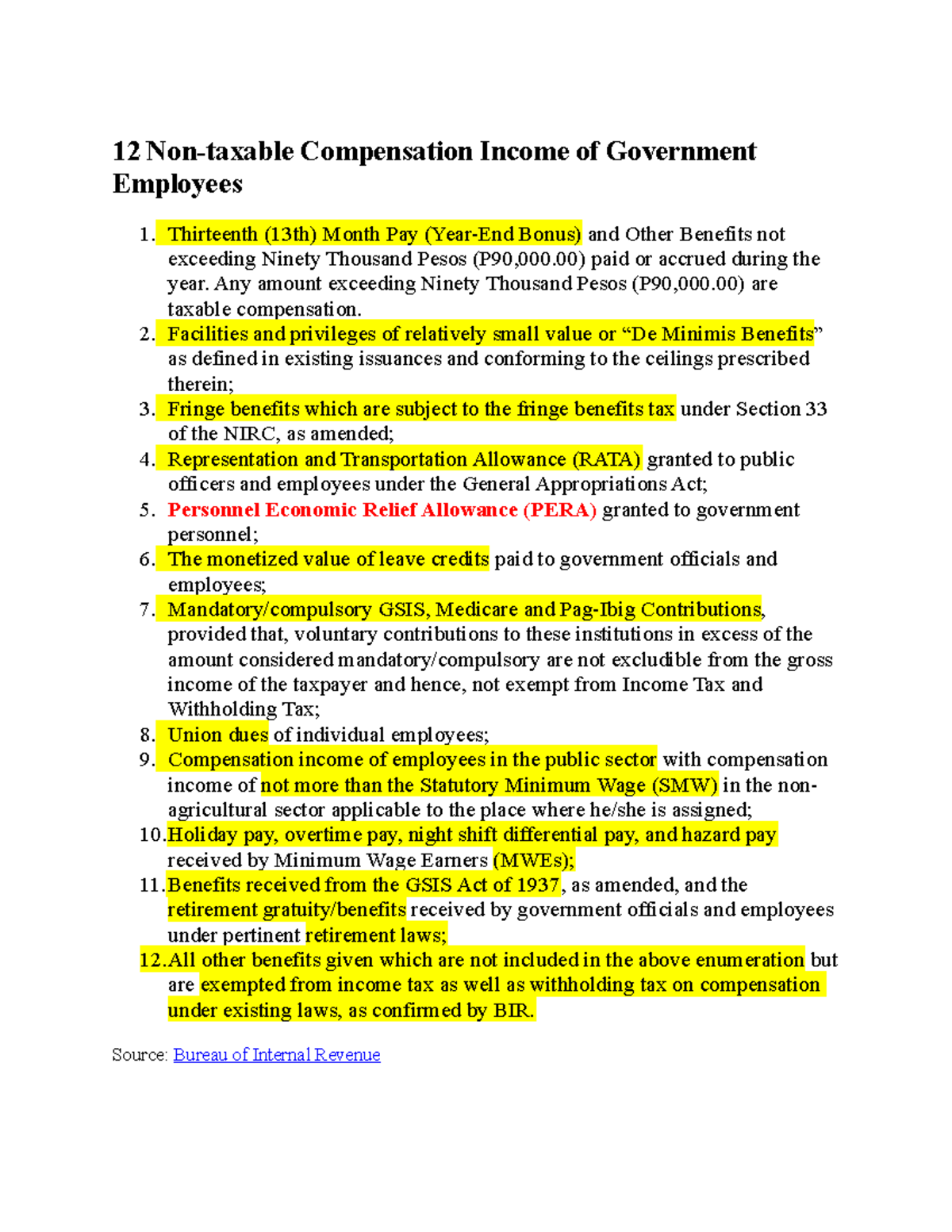

12 Non Taxable Compensation Of Government Employees 12 Non taxable

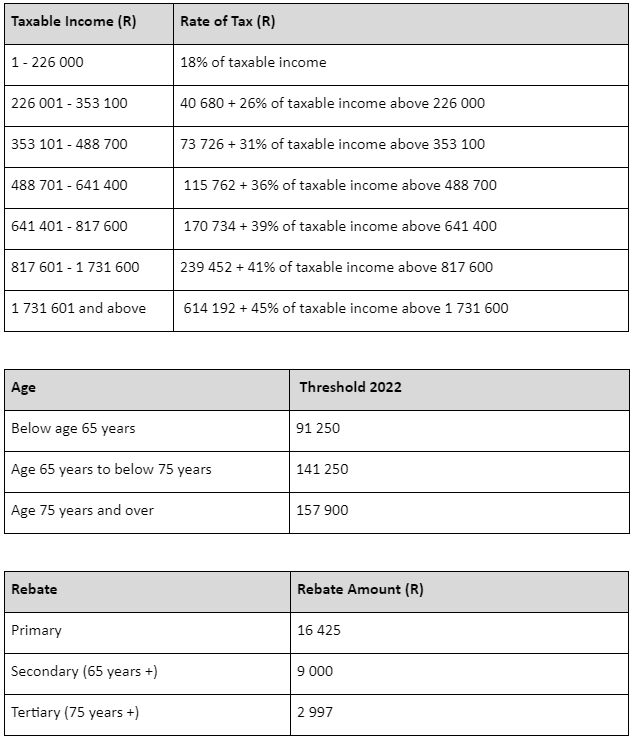

National Budget Speech 2022 SimplePay Blog

Is A Car Allowance Taxable Income

Is A Car Allowance Taxable Income

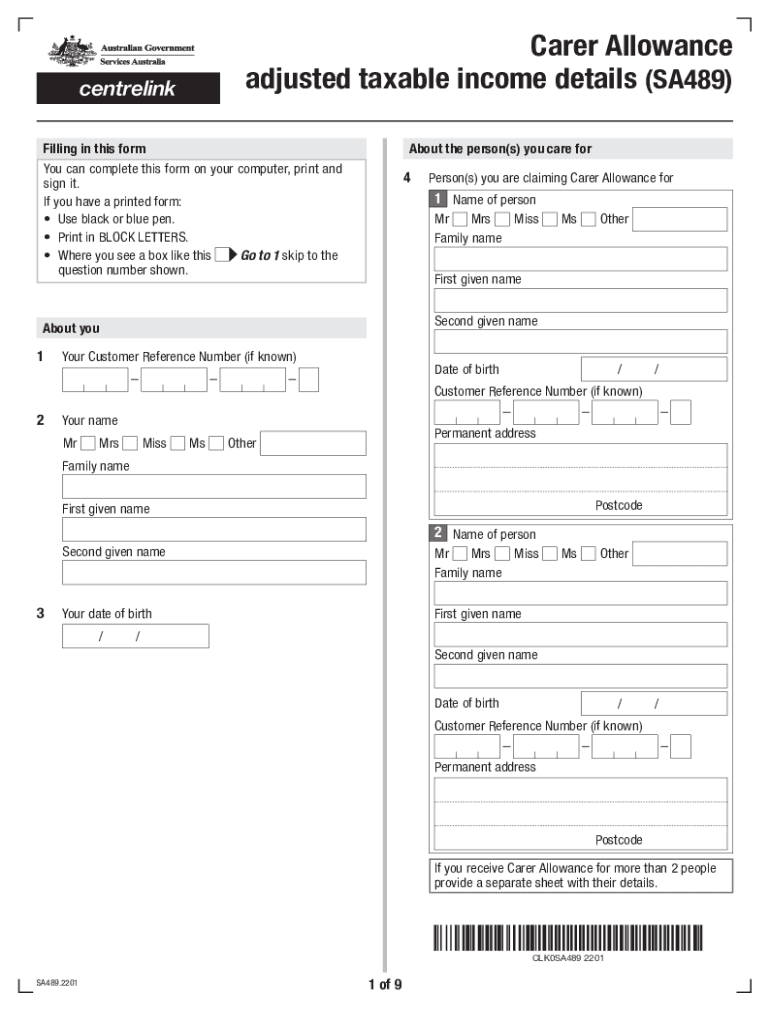

Carer Allowance Sa489 2022 2024 Form Fill Out And Sign Printable PDF

Employee Allowances For The 2023 Tax Year Fincor

From The Energy Crisis To Today The Evolution Of Fuel Allowance In

Is Fuel Allowance Taxable Income - The IRS generally treats a car allowance as taxable income because it is considered compensation and is taxed along with your regular income at the federal and state levels Employers and employees must also pay FICA and Medicare taxes on the allowance