Is Fuel Tax Deductible Limited Company If you re claiming tax relief for fuel when using a company owned car you must keep hold of all of your receipts We ve got an article explaining everything you

Car purchased through limited company deductible expenses If the company owns the vehicle then the company can of course claim all expenses that relate to that For example if a company buys a piece of equipment for 1 000 and it has a useful life of 10 years the company will depreciate the asset by 100 each year

Is Fuel Tax Deductible Limited Company

Is Fuel Tax Deductible Limited Company

https://www.expeditersonline.com/cms/uploads/2022-3rd-quarter-ifta-fuel-tax-rates-4-august-2022_001.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/ny/api/res/1.2/4oVLwF5RIk.VRMeiL2y7jA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

Here we ll look at the tax deductible expenses your limited company can claim how to claim them and what to watch out for to stay out of HMRC s bad books Limited Allowable limited company expenses refer to the legitimate costs that businesses can deduct from their taxable income ultimately reducing their tax liability Allowable business expenses are essential

If your limited company has a commercial vehicle you can claim all of the costs of the vehicle including road tax insurance fuel leasing and even washing and repairs There are more specific rules Tax deductible expenses for limited companies 4min read by Nick Green Last updated 11 December 2023 As HMRC will tell you it s important for your limited company to pay the right amount of tax But

Download Is Fuel Tax Deductible Limited Company

More picture related to Is Fuel Tax Deductible Limited Company

Types Of Taxes In Malaysia For Companies

https://static.wixstatic.com/media/34b1e8_fc87743491494405aeb614e8c07d4f5f~mv2.png/v1/fill/w_980,h_980,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/34b1e8_fc87743491494405aeb614e8c07d4f5f~mv2.png

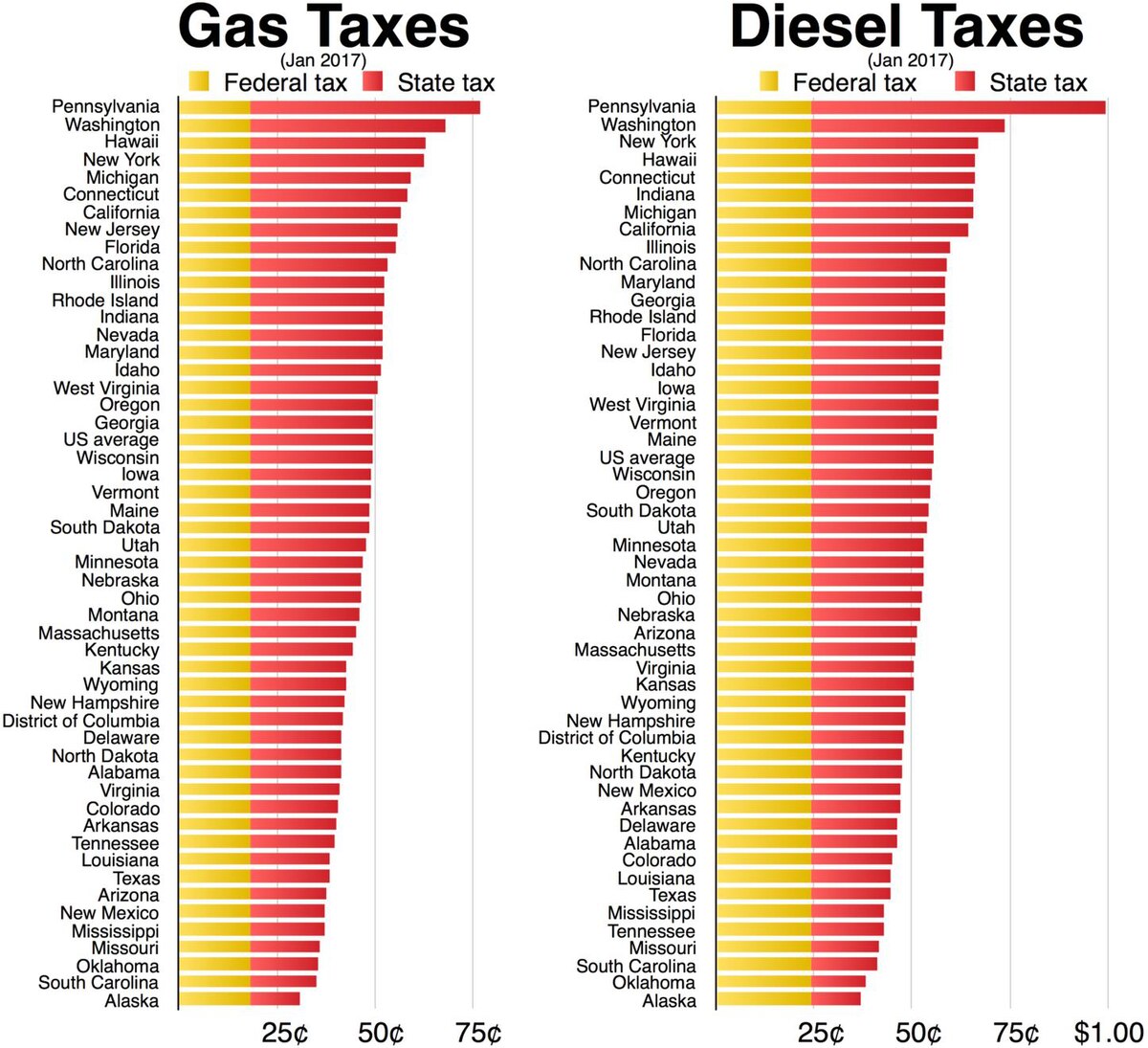

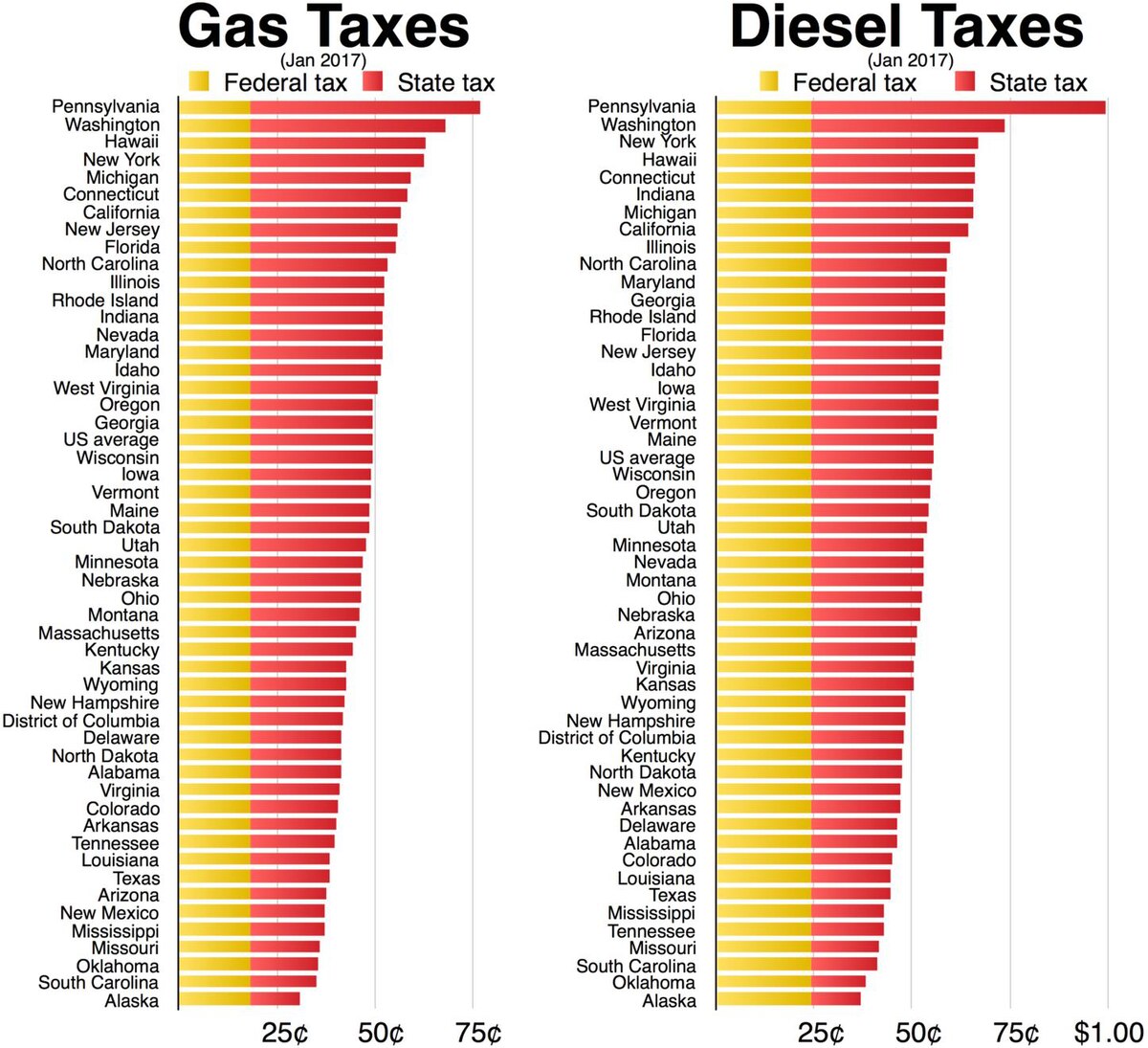

Why Do Canadians Pay So Much IFTA Fuel Tax When They Buy Fuel In The

https://www.pstc.ca/wp-content/uploads/2012/04/Diesel-Taxes-Jan-2012.jpg

Sars 2022 Weekly Tax Tables Brokeasshome

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

The list of tax deductible expenses is long but includes things like office stationery insurance and bank charges and even heating and lighting for your office or On top of this you can claim for parking costs and fuel and any repairs or servicing needed Employee costs As well as staff s pay their bonuses pensions

Allowable expenses are tax deductible meaning HMRC allows you to offset those expenses against your annual corporation tax bill The rules for limited Tax deductible expenses for limited companies If you re running a limited company this article will provide details os some of the tax deductible expenses for limited

Fuel Taxes In The United States Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/a/a8/Gas_and_Diesel_taxes.pdf/page1-1200px-Gas_and_Diesel_taxes.pdf.jpg

Tax Deductible Bricks R Us

https://www.bricksrus.com/wp-content/uploads/2018/03/35808436_l-1.jpg

https://www. crunch.co.uk /knowledge/article/what...

If you re claiming tax relief for fuel when using a company owned car you must keep hold of all of your receipts We ve got an article explaining everything you

https://www. lovewell-blake.co.uk /news/which-car...

Car purchased through limited company deductible expenses If the company owns the vehicle then the company can of course claim all expenses that relate to that

Are Limited Liability Company Startup Costs Tax Deductible

Fuel Taxes In The United States Wikipedia

UK Petrol Prices Fuel Tax Is Crippling Our Economy Daily Mail Online

Tips For Getting Your Fuel Tax Credits Claim Right Marsh Partners

Is Your Business Loan Tax Deductible

Infographic Is My Move Tax Deductible Wheaton

Infographic Is My Move Tax Deductible Wheaton

Tax To Blame For High Fuel Prices Auto Express

Purchase Fuel Tax Bond From The Leading Surety Bond Provider In America

Pre tax Deductions Intuit payroll

Is Fuel Tax Deductible Limited Company - The tax will be calculated depending on the price of the car the transmission type fuel type etc Therefore it is more efficient in terms of tax to simply