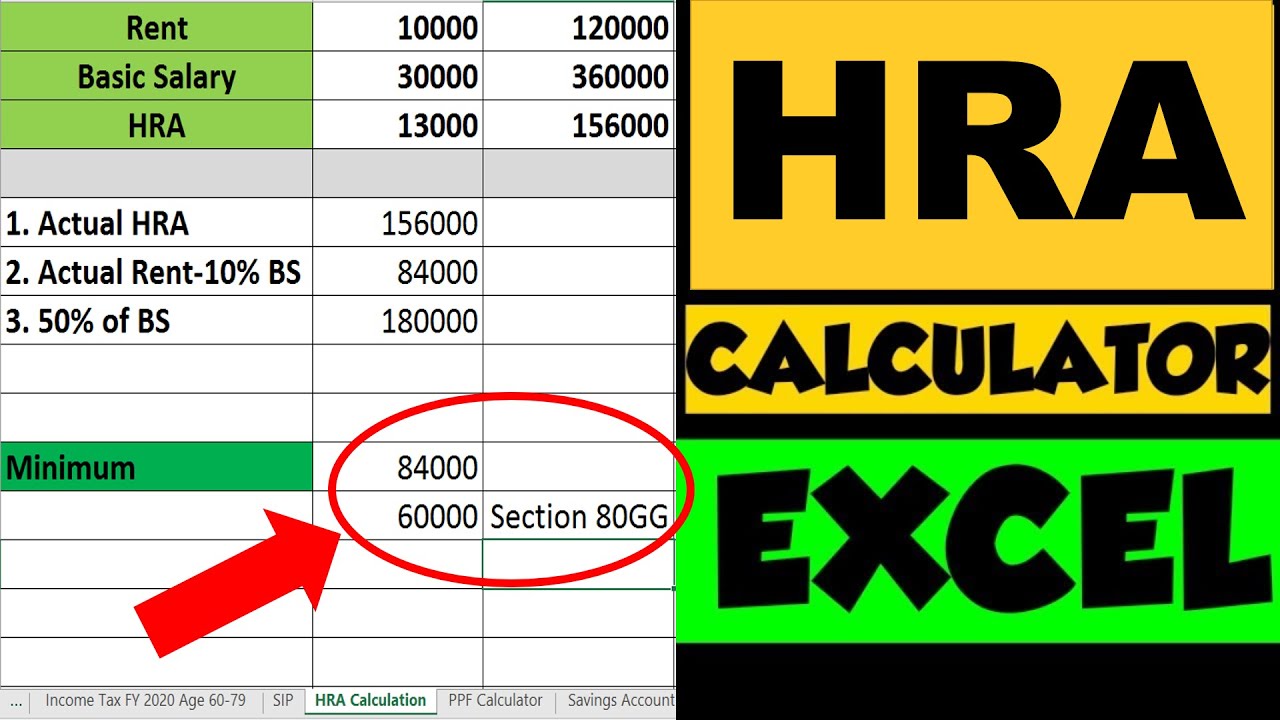

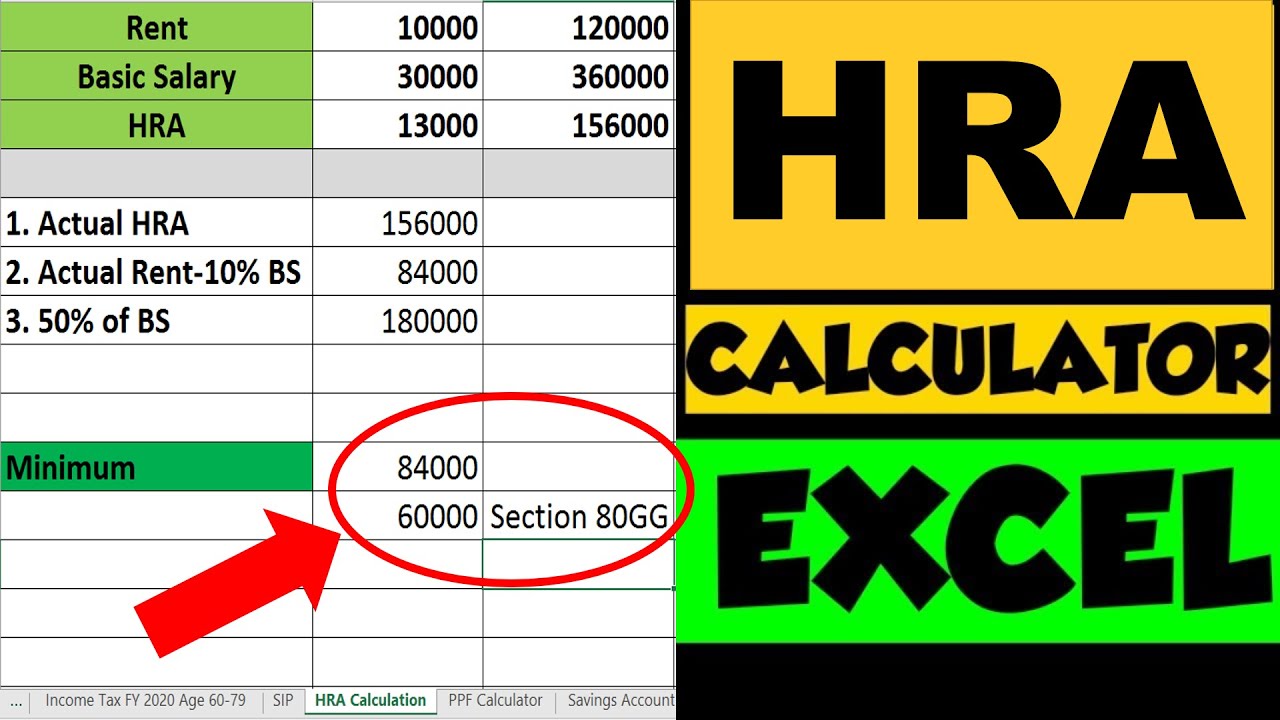

Hra Rebate In Income Tax Return Web 28 juil 2019 nbsp 0183 32 Here s how to calculate the tax exempt part of HRA Basic annual salary 30 000 x 12 3 6 lakh Total HRA received 10 000 x

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your Web HRA tax exemption will be available to you if you opt for the old income tax regime for purpose of TDS on salary Once the proof is submitted the employer will calculate the

Hra Rebate In Income Tax Return

Hra Rebate In Income Tax Return

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

HRA Exemption Excel Calculator For Salaried Employees House Rent

https://i.ytimg.com/vi/8nnBiRzYQzI/maxresdefault.jpg

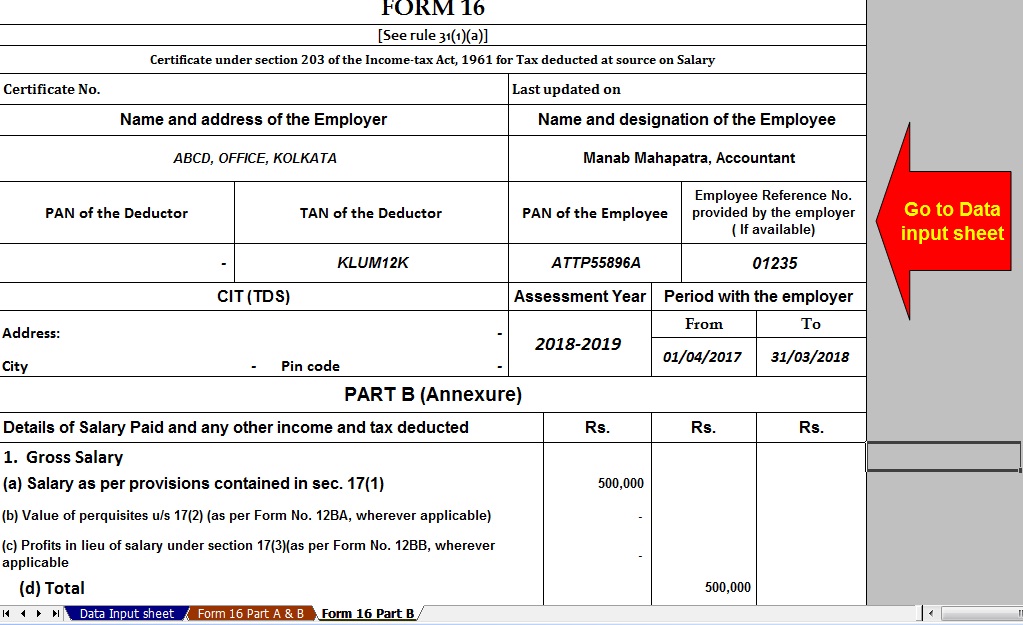

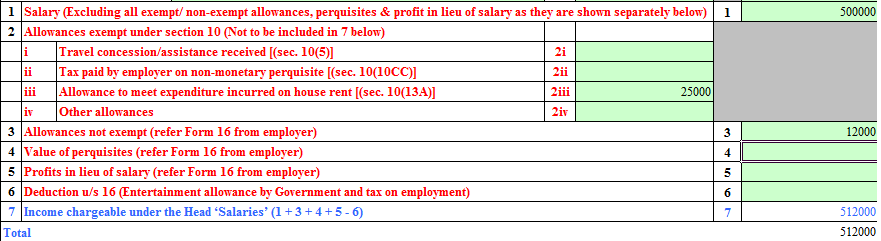

Download Automated Tax Computed Sheet HRA Calculation Arrears

https://4.bp.blogspot.com/-jcXR46JGbOw/WhOAD1L3J8I/AAAAAAAAF4A/ISuIxQnFWx4USLckHZYtmPvfE-NtuKIlwCLcBGAs/s1600/Form%2B16%2BPart%2BB.jpg

Web How to claim the HRA exemption when filing the Income Tax Returns Once the taxpayer has calculated the amount of HRA exemption which he she is eligible to claim from Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in

Web 30 d 233 c 2020 nbsp 0183 32 From the assessment year 2019 20 the income tax department has synced the ITR 1 with Form 16 With the help of this it now becomes easier for salaried Web 23 d 233 c 2022 nbsp 0183 32 You don t have to report your participation in an HRA on your tax return The amount your employer is willing to reimburse you for If you do great that s even more untaxed income you

Download Hra Rebate In Income Tax Return

More picture related to Hra Rebate In Income Tax Return

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

http://1.bp.blogspot.com/-A4xTxMi1MRk/TwR-tA5SwlI/AAAAAAAAAww/odnb2pSJxmo/s1600/HRA.JPG

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

How To Get MORE Out Of Your HRA Rediff Getahead

http://im.rediff.com/getahead/2011/jun/21table3.gif

Web A deduction from such HRA is allowed under section 10 13A which is least of the following Actual HRA received 40 of salary 50 of the salary if the rented property Web Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid amount After entering all the information the calculator will show you

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer

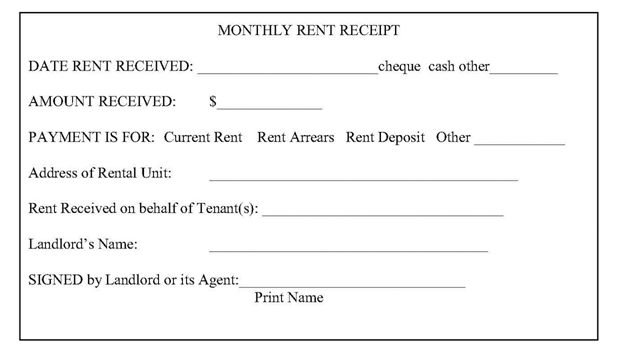

House Rent Allowance HRA Receipt Format For Income Tax Teacher

https://1.bp.blogspot.com/-ewd4gmFZDiM/Vr60xpZ2a2I/AAAAAAAARCw/IgWwp8ctHws/s640/IMG-20160213-WA0009-788169.jpg

How To Claim HRA In Income Tax Return TaxReturnWala

https://www.taxreturnwala.com/wp-content/uploads/2020/01/How-to-Claim-HRA-in-Income-Tax-Return-_.png

https://blog.saginfotech.com/claim-hra-filing-i…

Web 28 juil 2019 nbsp 0183 32 Here s how to calculate the tax exempt part of HRA Basic annual salary 30 000 x 12 3 6 lakh Total HRA received 10 000 x

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Income Tax Proof Submission HRA And Rent Receipt Joblagao

House Rent Allowance HRA Receipt Format For Income Tax Teacher

Understanding HRA And Why You Should Not Submit Fake Rent Receipts

How To Claim HRA With Rent Receipts E filing Of Income Tax Return

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

HRA Calculation Everything You Need To Know

Best Guide On HRA Exemption Section 10 13A TaxAdda

Documents Required To Claim HRA CommonFloor Groups Invoice Template

Hra Rebate In Income Tax Return - Web 31 janv 2022 nbsp 0183 32 There is no restriction on you claiming HRA while claiming tax benefits in respect of home loan provided some conditions are satisfied The income tax laws