Is Gst Charged On Cash Discount In general businesses offer trade discounts to increase sales while cash discounts are given to recover payments quickly and promptly However Under GST

However such discounts shall be mentioned on the GST tax invoice GST sales invoice Lets understand the GST on discount with example Example 1 Mr X Discover the different types of post sale discounts and incentives offered in trade practices along with their implications and treatment for GST Learn how to differentiate between trade discounts

Is Gst Charged On Cash Discount

Is Gst Charged On Cash Discount

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202112/gst-graphic.jpg?itok=n1QrvzGi

Cash Discount Program Signage

https://lirp.cdn-website.com/499b3704/dms3rep/multi/opt/Cash+Discount+Signage-df206e01-1920w.png

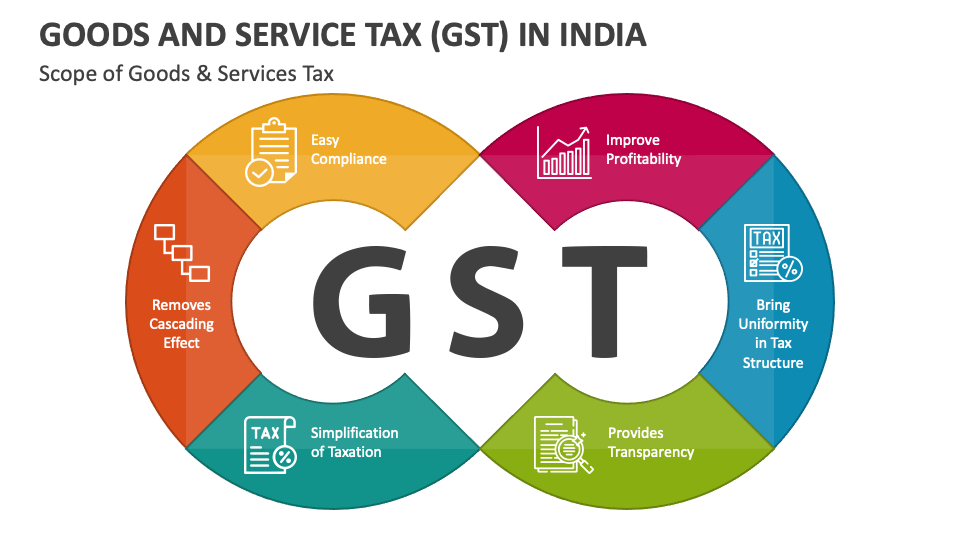

What Is GST

https://2.bp.blogspot.com/-3dc6MZXBWlU/WVX24dVN3dI/AAAAAAAAGvQ/N2rAaDUpNrsmeMAbV5jNHzfjgQLvjnNJQCLcBGAs/s1600/GST%2B_less%2Band%2Bmore_eng.jpg

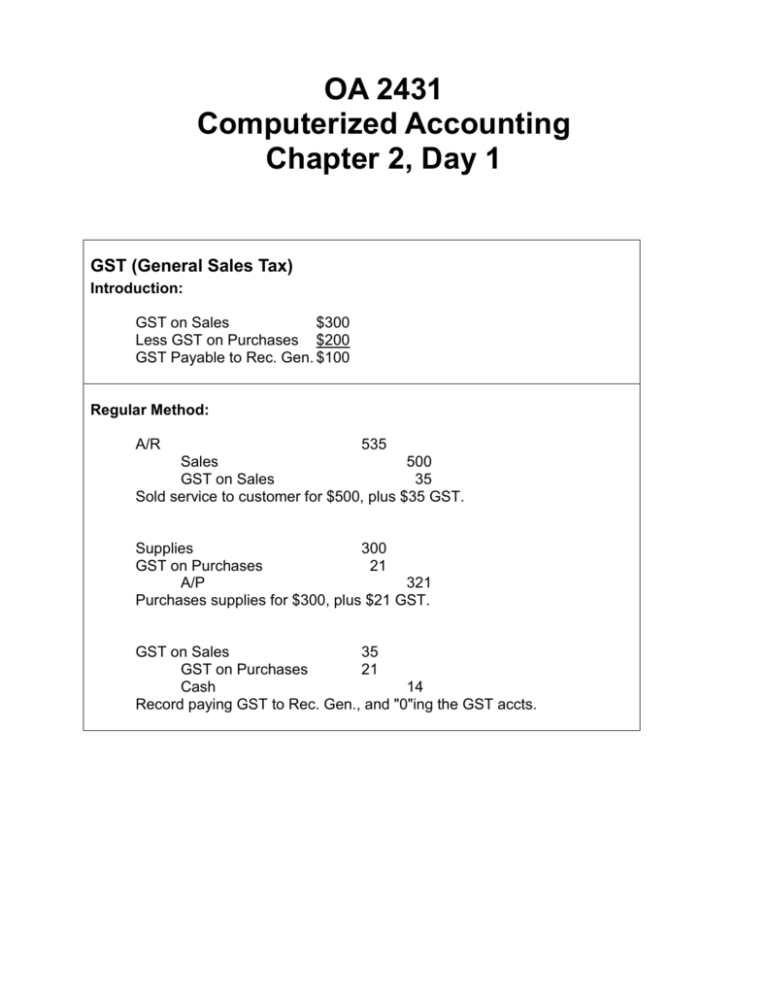

Whether GST is leviable on cash discount offered by the supplier to the applicant through credit note without adjustment of GST for making the early payment You have received a cash rebate of 100 on 2 Jan 2024 from your supplier GST should be accounted for on the full amount received Learn how to charge and account for GST

For volume discounts how you apply GST HST to the sale depends on whether you offer the discount at the time you make the sale or after you make the sale For a discount offered at the time of sale you If you offer an early payment discount on credit sales charge the GST HST on the full invoice amount even if your customer takes the discount When you invoice

Download Is Gst Charged On Cash Discount

More picture related to Is Gst Charged On Cash Discount

GST Return How To File GST Returns Online Duet Date Types Of GSTR

https://www.betterplace.co.in/blog/wp-content/uploads/2020/03/GST-Return-1.jpg

Gujarat Will Reverse Charge Mechanism Under GST Be Abolished

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2018/07/10/702870-gst-062918.jpg

Valuation Under GST

https://www.taxscan.in/wp-content/uploads/2023/03/Valuation-GST-Valuation-under-GST-Certificate-Course-online-certificate-course-certificate-course-2023-taxscan-taxscan-academy.jpg

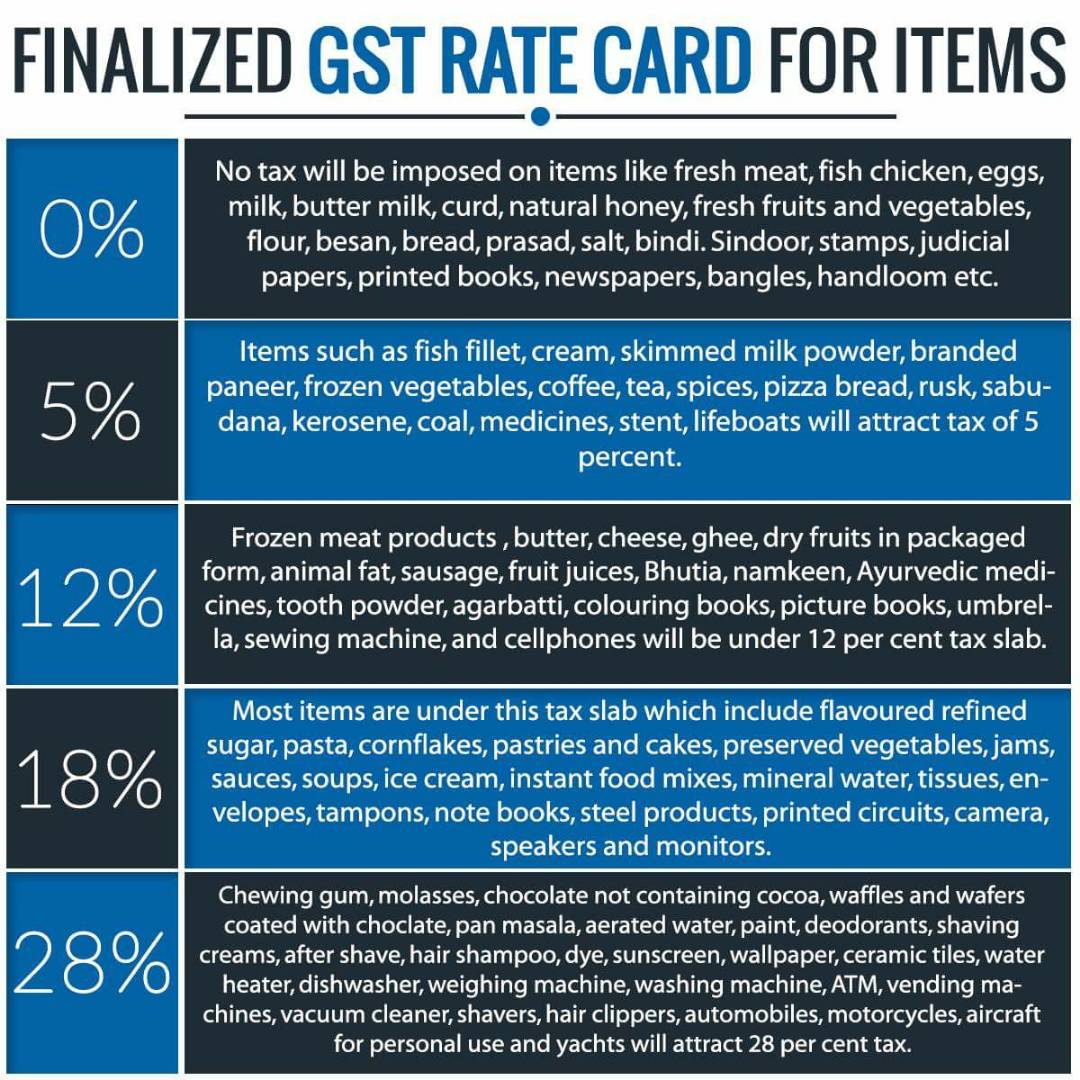

The treatment is simple the discounts given before or at the time of supply are simply deducted from the invoice value i e GST would be charges on discounted Is incentive taxable in GST Yes incentives are considered as services provided by dealers and are subject to tax under the Goods and Services Tax GST regime What is GST rate for incentive Incentives

It is clarified that discounts offered by the suppliers to customers including staggered discount under Buy more save more scheme and post supply volume discounts GST liability of the supplier would be reduced if both supplier and receiver of the goods or services are aware of the discount before supply i e GST would not be

Goods And Service Tax GST In India PowerPoint And Google Slides

https://www.collidu.com/media/catalog/product/img/c/9/c999eaa8536fae15aa976de0e6cb1596635e3833dcb4eae2bf73f00fbb1dd33d/goods-and-service-tax-gst-in-india-slide1.png

Gst Tax Rate Chart For Fy Ay Goods And Service Hot Sex Picture

https://taxdose.b-cdn.net/wp-content/uploads/2016/09/GST-Easy-Chart.jpg

https://tax2win.in/guide/treatment-discounts-gst

In general businesses offer trade discounts to increase sales while cash discounts are given to recover payments quickly and promptly However Under GST

https://gsthero.com/blog/gst-on-discounts-legal...

However such discounts shall be mentioned on the GST tax invoice GST sales invoice Lets understand the GST on discount with example Example 1 Mr X

A Complete Guide On GST Rate For Apparel Clothing And Textile Products

Goods And Service Tax GST In India PowerPoint And Google Slides

GST Its Effect And Impact 3 Years Of Implementation Was It Worth The

GST Return When To File GST Due Dates Other Important Dates

Types Of Gst Return Monthly Gst Return Filing YouTube

Implementation Of GST And Act Of GST Example TutorsTips

Implementation Of GST And Act Of GST Example TutorsTips

GST TO BE CHARGED ON REIMBURSEMENTS OR NOT YouTube

GST In Malaysia Explained

GST PST Journal Entries

Is Gst Charged On Cash Discount - Whether GST is leviable on cash discount offered by the supplier to the applicant through credit note without adjustment of GST for making the early payment