Is Gst Refund Taxable Income Actually GST refund which we get is for the GST already paid same is not expensed out rather it forms part of the Duties and Taxes i e Balance Sheet item So now gst

Timely GST refunds for businesses understand the claim sanctioning procedure Learn more about the GST refund mechanism with this blog post Goods and Services Tax GST refund is now an open topic that is a challenge for almost all classes of taxpayers particularly exporters as it directly impacts their working capital Types

Is Gst Refund Taxable Income

Is Gst Refund Taxable Income

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

A Comprehensive Guide To GST Refund For Exports

https://mlhnytz51z83.i.optimole.com/w:auto/h:auto/q:mauto/f:avif/https://www.mygstrefund.com/wp-content/uploads/2022/06/1-1-scaled.webp

GST Refund Services At Rs 1500 month In New Delhi ID 23173592530

https://5.imimg.com/data5/SELLER/Default/2023/7/322720175/UA/UH/LO/46019100/gst-refund-services-1000x1000.png

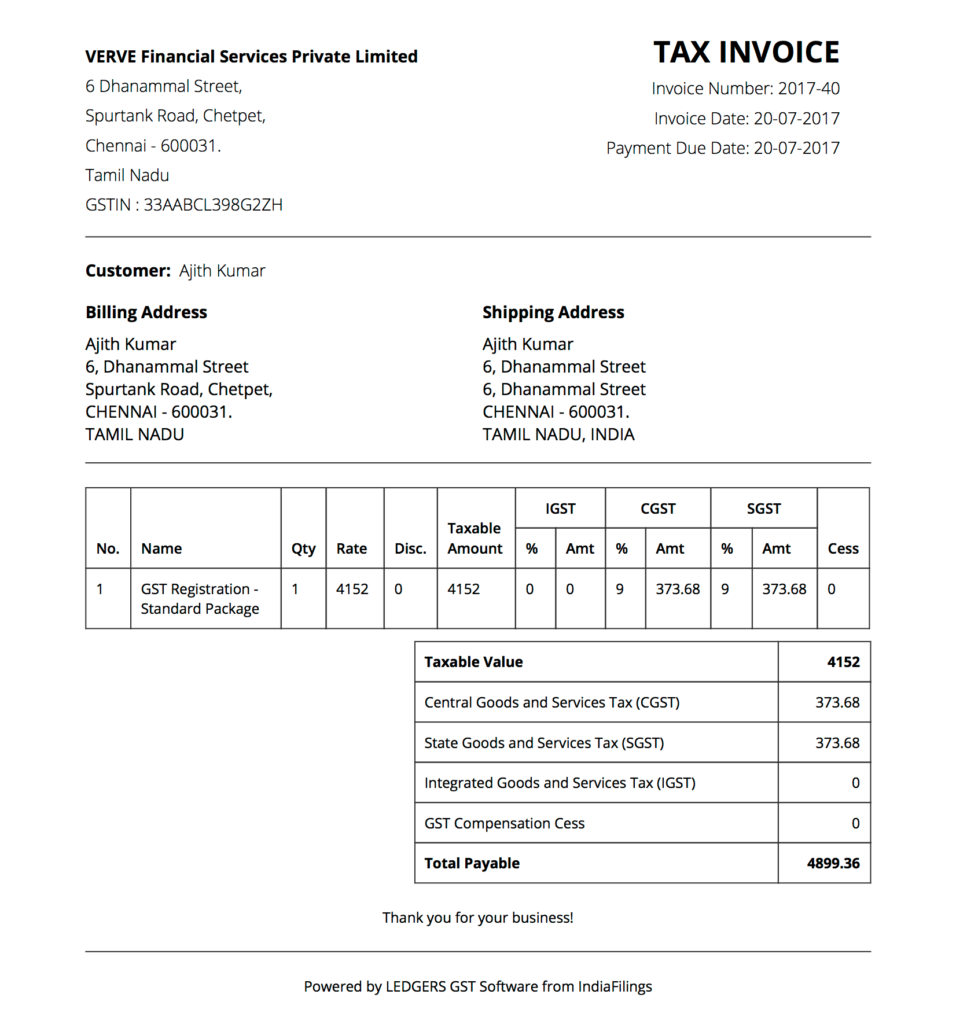

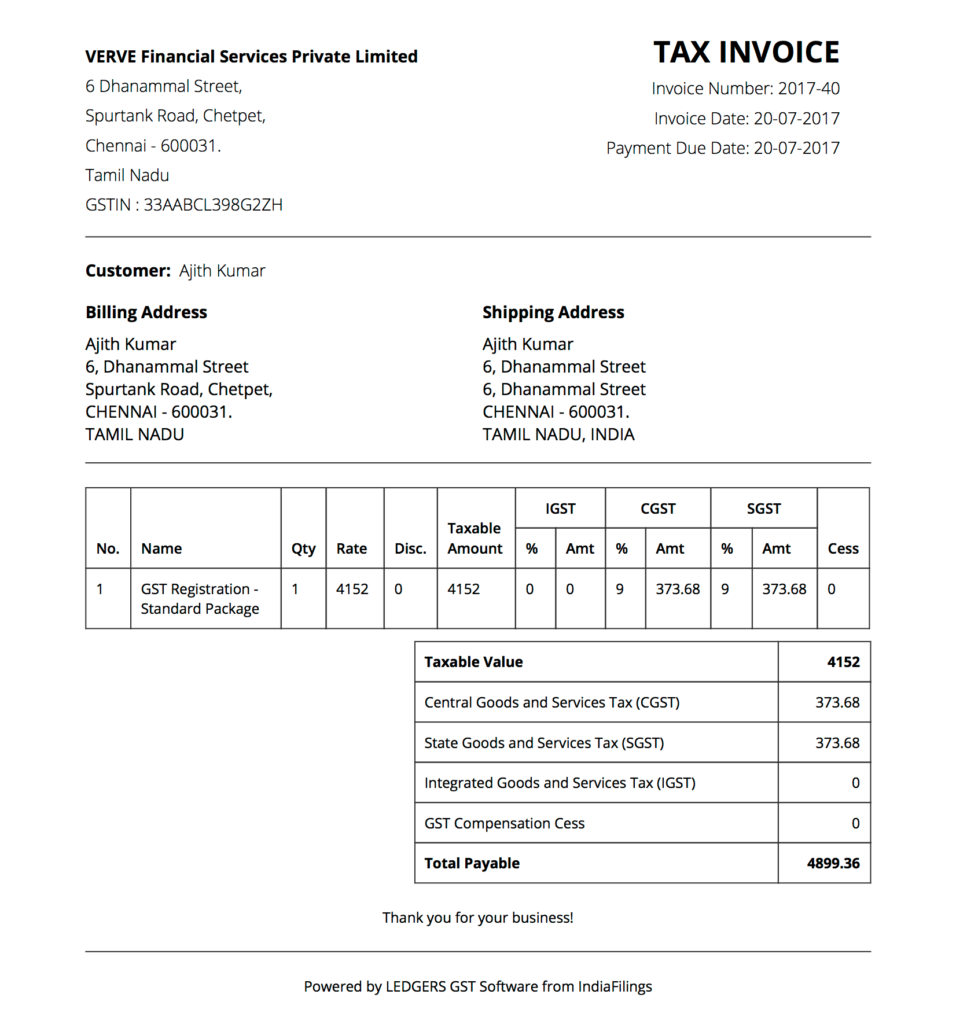

GST Refund is a process in which taxpayers can claim amount on eligible circumstances if any as refund from the GST authority They can claim after submitting a refund application with the necessary details in the Is a refund of GST taxable income The extra tax that you paid is what is referred to as the GST refund amount which is not regarded as income It is thus not taxed

Additionally it asserts that a notified registered taxable person may only claim a refund of up to 80 of the total amount claimed with the exception of input tax credit that hasn t been approved in cases where the Will this system continue in GST Ans Under the GST regime exports will be zero rated which means that the export goods would not suffer any actual tax liability although inputs for such

Download Is Gst Refund Taxable Income

More picture related to Is Gst Refund Taxable Income

Retirees Is Your Tax Refund Costing You Money Level Financial Advisors

https://levelfa.com/wp-content/uploads/2019/02/taxrefund.jpg

3 Ways To Use Your Tax Refund To Solve Your Debt Problem AZ Consumer

http://skibalaw.com/wp-content/uploads/2015/03/Dollarphotoclub_62162801.jpg

Power To Withhold adjust GST Refund With Effect From 01 10 2022

https://ttplimages.imgix.net/tax-practice-images/GSTRFDR3New000000000000_thumb.jpg?w=1200

GST Refund is a process through which registered entities under Goods and Services Tax Regime claim a payout from tax authorities if they have paid more GST than their actual tax liability Know details of how to apply for Refund Current GST return filing requires that every month once GSTR 1 is filed to report Sales one must file GSTR 3B to report the ITC and make necessary GST Payment Also if a

GST refunds are only taxable in current year if they are claimed as an expense capitalised to asset in any of the Previous year And hence if it is not taxable it is not Are GST rebates taxable If you mean refund of GST Input it is taxable under income tax

Gst Return Working Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/105/100105630/large.png

Assam Direct Recruitment Refund Application Fees Refund Date

https://assamjobz.com/wp-content/uploads/2022/11/ADR-Refund.jpg

https://www.caclubindia.com › forum

Actually GST refund which we get is for the GST already paid same is not expensed out rather it forms part of the Duties and Taxes i e Balance Sheet item So now gst

https://taxguru.in › goods-and-service-tax › …

Timely GST refunds for businesses understand the claim sanctioning procedure Learn more about the GST refund mechanism with this blog post

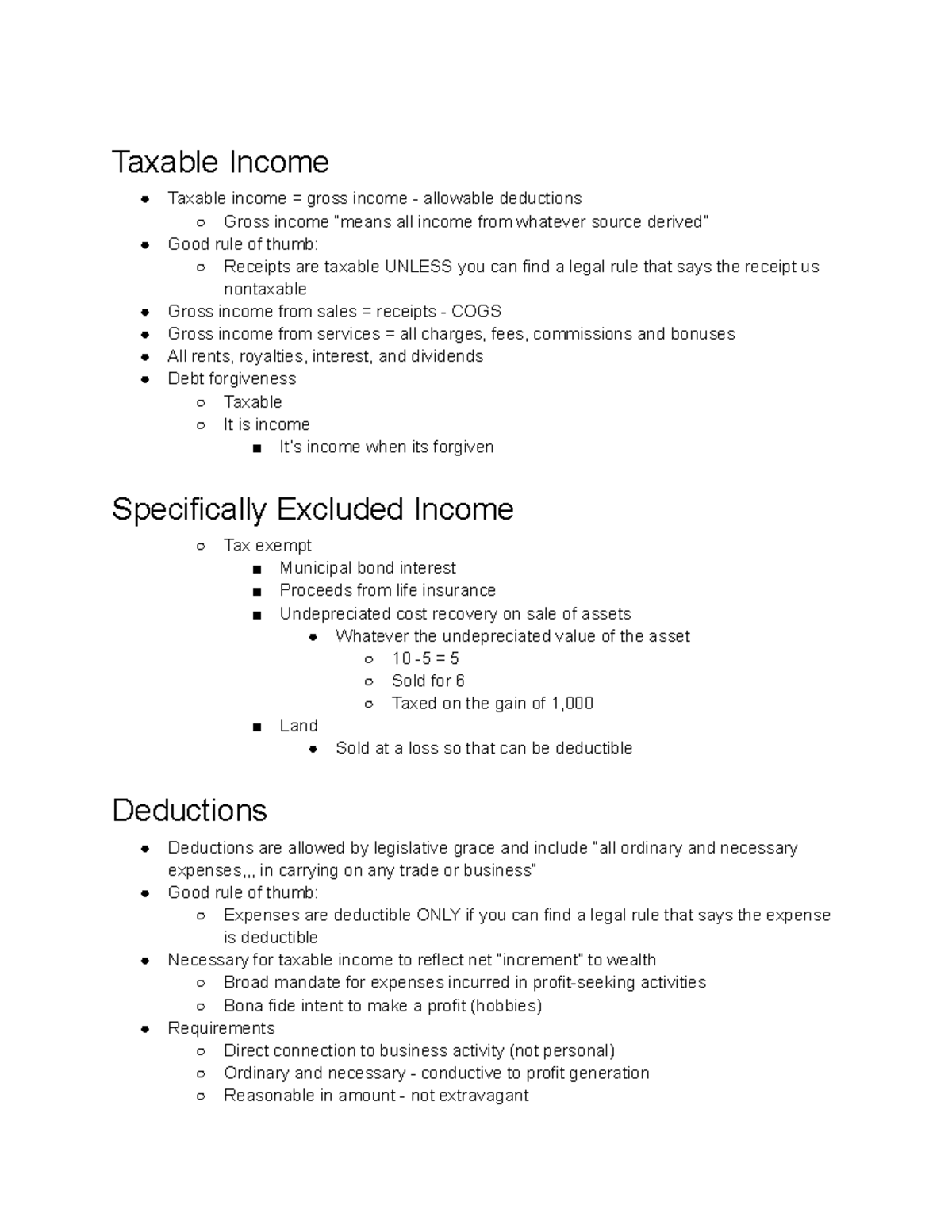

Chapter 6 Taxable Income From Business Operations Taxable Income

Gst Return Working Form Fill Out And Sign Printable PDF Template

Manage Attendees Tickets And Registrations

Gross Income Free Of Charge Creative Commons Handwriting Image

Tax Refund Tax Bind Consulting

What Is Gst Invoice Bill Types Gst Tax Invoice Rules Last Date Hot

What Is Gst Invoice Bill Types Gst Tax Invoice Rules Last Date Hot

GST Rate Structure

Dividend Income Tax Rate 2023 2024

Direct Deposit For Your Tax Refund YouTube

Is Gst Refund Taxable Income - Explore the comprehensive guide on GST refund process categories rules statutory provisions computation and procedures for timely refunds under different scenarios