Is Home Loan Interest Tax Deductible For Under Construction Property No you can t deduct interest on land that you keep and intend to build a home on However some interest may be deductible once construction begins You can

If the home loan taken is not for self occupation purpose then whole interest amount can be claimed as tax deductions under Section 24 There is no maximum limit Typically interest paid on a loan is immediately expensed and is tax deductible but that isn t always the case For example construction interest expense that is incurred during the

Is Home Loan Interest Tax Deductible For Under Construction Property

Is Home Loan Interest Tax Deductible For Under Construction Property

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/tWByqgLRT/0x0/gettyimages-85644473-1645659085162.jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/DIZm9nweS/1280x670/gettyimages-461479730-1645646485129.jpg

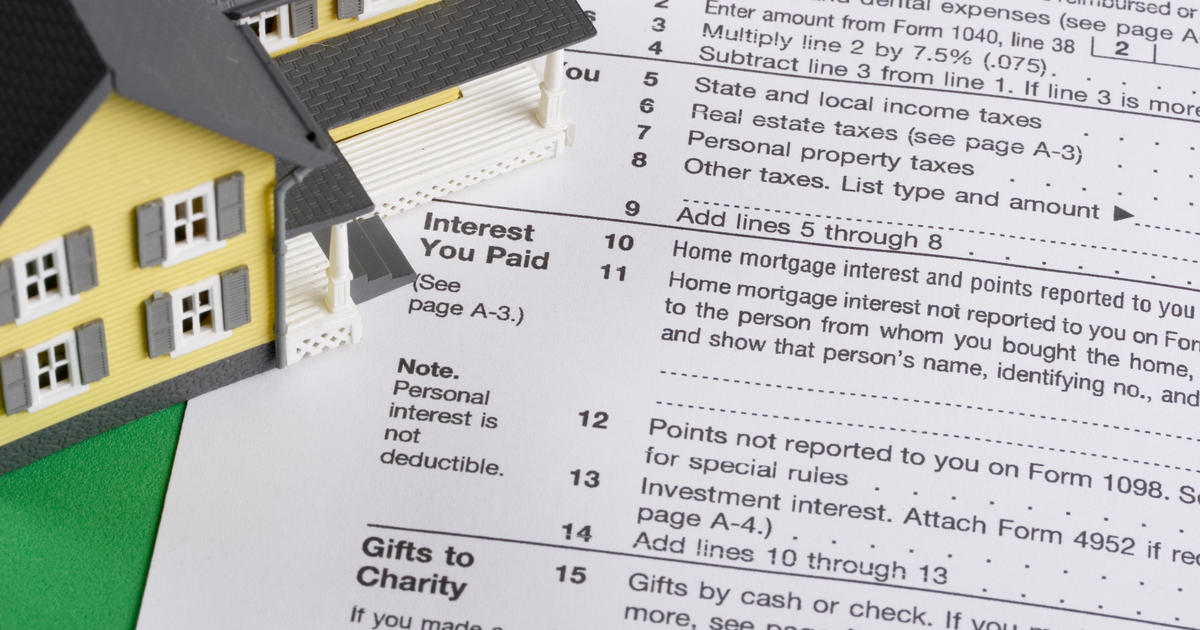

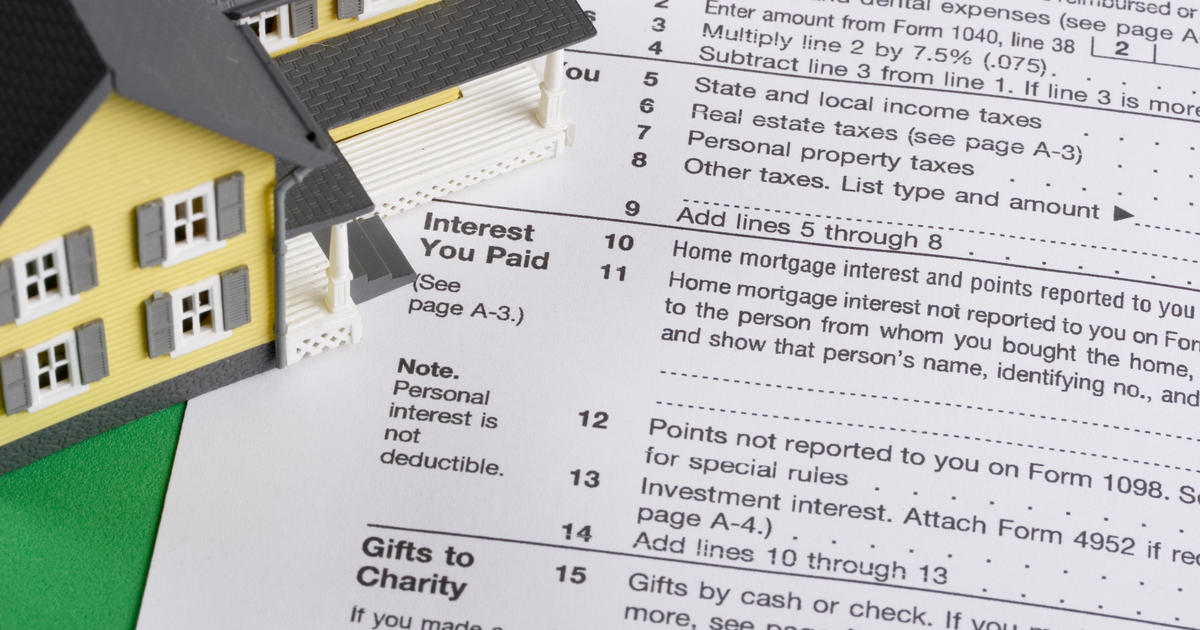

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan The loan must be secured by the Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as

A loan must be taken for the purchase or construction of a house property to claim a tax deduction If it is taken for the construction of a house then For tax years 2018 through 2025 no Interest paid on a loan secured by your main home or second home may be deductible subject to certain dollar limitations only

Download Is Home Loan Interest Tax Deductible For Under Construction Property

More picture related to Is Home Loan Interest Tax Deductible For Under Construction Property

Is Home Loan Interest Tax Deductible RateCity

https://production-content-assets.ratecity.com.au/20210121/can-i-get-a-tax-deduction-for-interest-on-a-home-loan-0hWt_-VCO.jpg

Pin On Finances

https://i.pinimg.com/originals/8b/8c/39/8b8c3967ac759c21d52eb6712c7b0617.jpg

Is Car Loan Interest Tax Tax Deductible Only For Business Vehicles

https://media.marketrealist.com/brand-img/qsB1dLdpQ/640x335/is-car-loan-interest-tax-deductible-1645731550732.jpg?position=top

It permits you to deduct the interest on up to 750 000 you borrow to buy or build a new main home and or second non rental home so long as the loan is secured by the home You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are

Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the Yes you can You can deduct the interest on your construction loan if the loan was secured by the property you moved into You can treat a home under

The Deduction Of Interest On Mortgages Is More Delicate With The New

https://cbsnews2.cbsistatic.com/hub/i/r/2018/05/11/544003b6-8a03-4bfe-bf80-9925d8c0616a/thumbnail/1200x630/a6a32c86c1c42ea9dfe5c87ce10ddfb2/istock-121277713.jpg

Is Personal Loan Interest Tax Deductible Where Is My US Tax Refund

https://whereismyustaxrefund.com/wp-content/uploads/2022/08/piggy-bank-970340_1280-scaled.jpg

https://www.irs.gov/faqs/itemized-deductions...

No you can t deduct interest on land that you keep and intend to build a home on However some interest may be deductible once construction begins You can

https://taxguru.in/income-tax/claim-deduction...

If the home loan taken is not for self occupation purpose then whole interest amount can be claimed as tax deductions under Section 24 There is no maximum limit

Is Home Equity Loan Interest Tax Deductible For Rental Property

The Deduction Of Interest On Mortgages Is More Delicate With The New

Is Reverse Mortgage Interest Tax Deductible REVERSE MORTGAGE LOAN

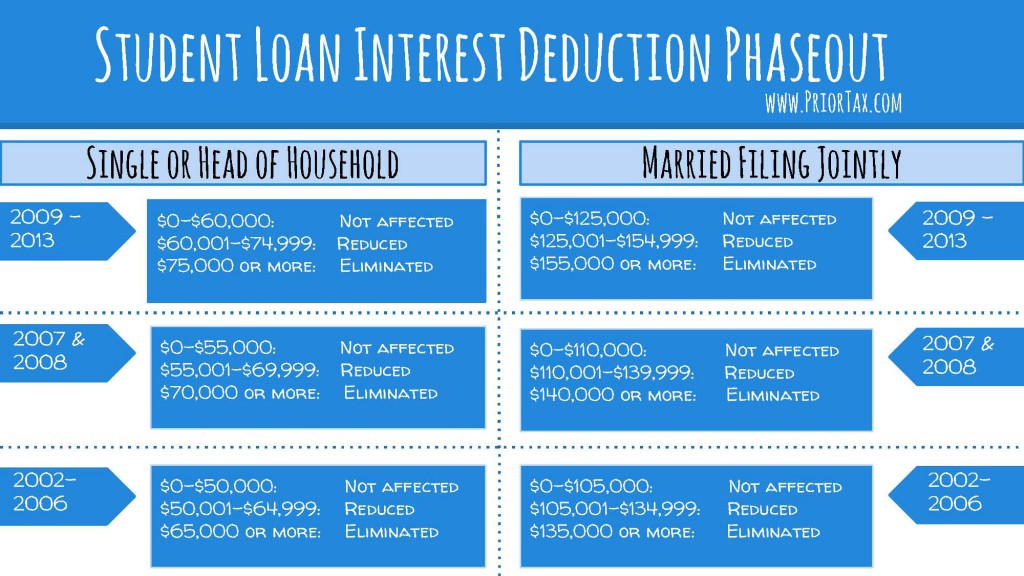

Student Loan Interest Deduction 2013 PriorTax Blog

Is Business Loan Interest Tax Deductible Limitations In 2023

Is Margin Loan Interest Tax Deductible Marotta On Money

Is Margin Loan Interest Tax Deductible Marotta On Money

How To Calculate Percentage Loan Emi Haiper

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Home Loan Interest Tax Deductible For Under Construction Property - According to the Income Tax Act of 1961 a taxpayer is entitled to a deduction of Rs 2 lakhs for the interest paid on the housing loan used to purchase the