Is House Rent Tax Free Rental income is income received from allowing another person use your property vehicle or other assets in return for money or other benefits of monetary value

Suppose Adam owns a house and rents a room to Bill for 300 a month and pays Bill 300 a month to mow the lawn clean the rooms and do other maintenance Assume Tax on property You have to pay tax to the Finnish Tax Administration on inheritance valuable gifts rent income sales profits investment income and real estate

Is House Rent Tax Free

Is House Rent Tax Free

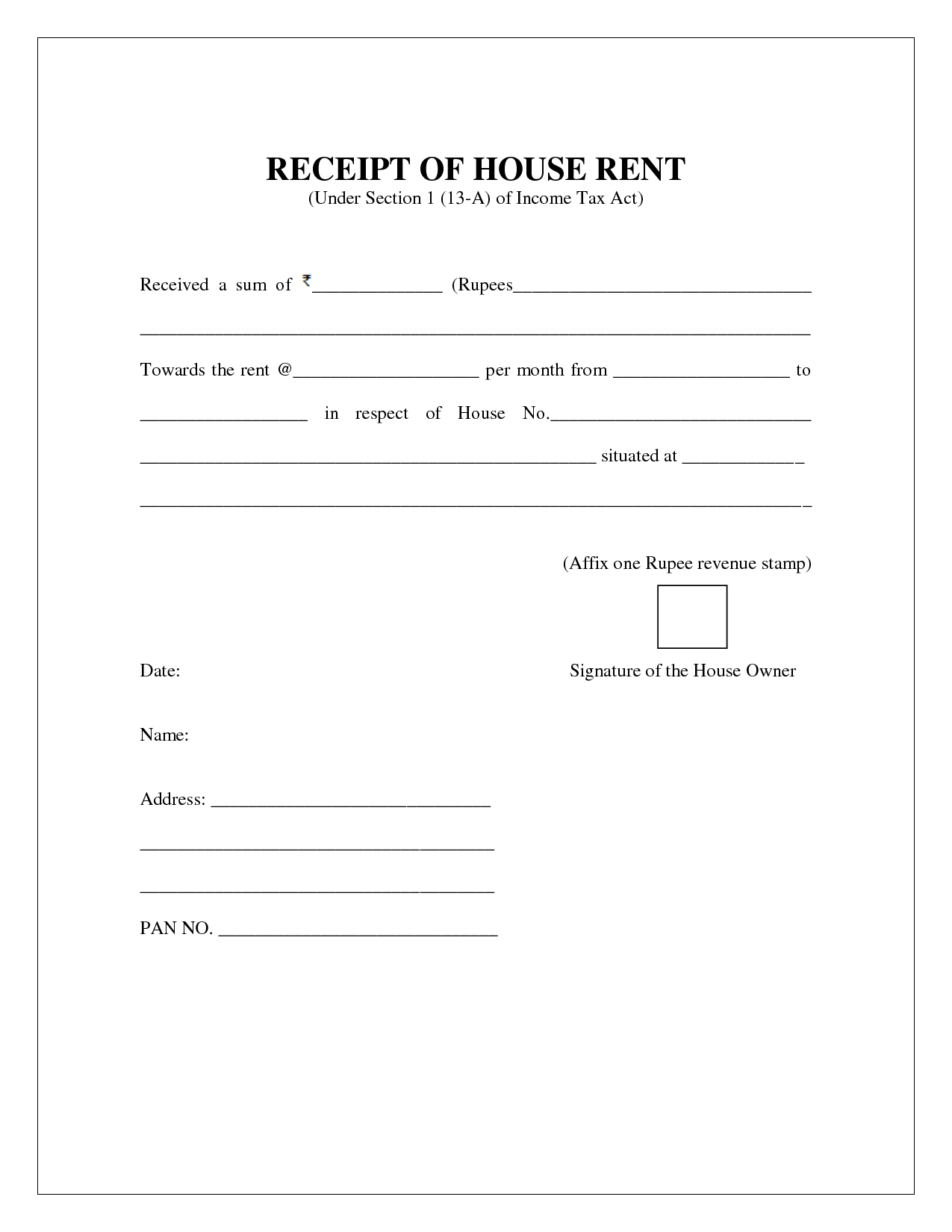

https://1.bp.blogspot.com/-yJv0YDTZblA/YDC13TQ5SII/AAAAAAAE-ZU/YkD4-Dswfw8PzDkiQRXBvQr3tthg0zYzQCLcBGAsYHQ/s16000/free-house-rental-invoice-house-rent-receipt-https-75maingroup-com-rent-agreement-format-receipt-template-invoice-template-word-invoice-template.png

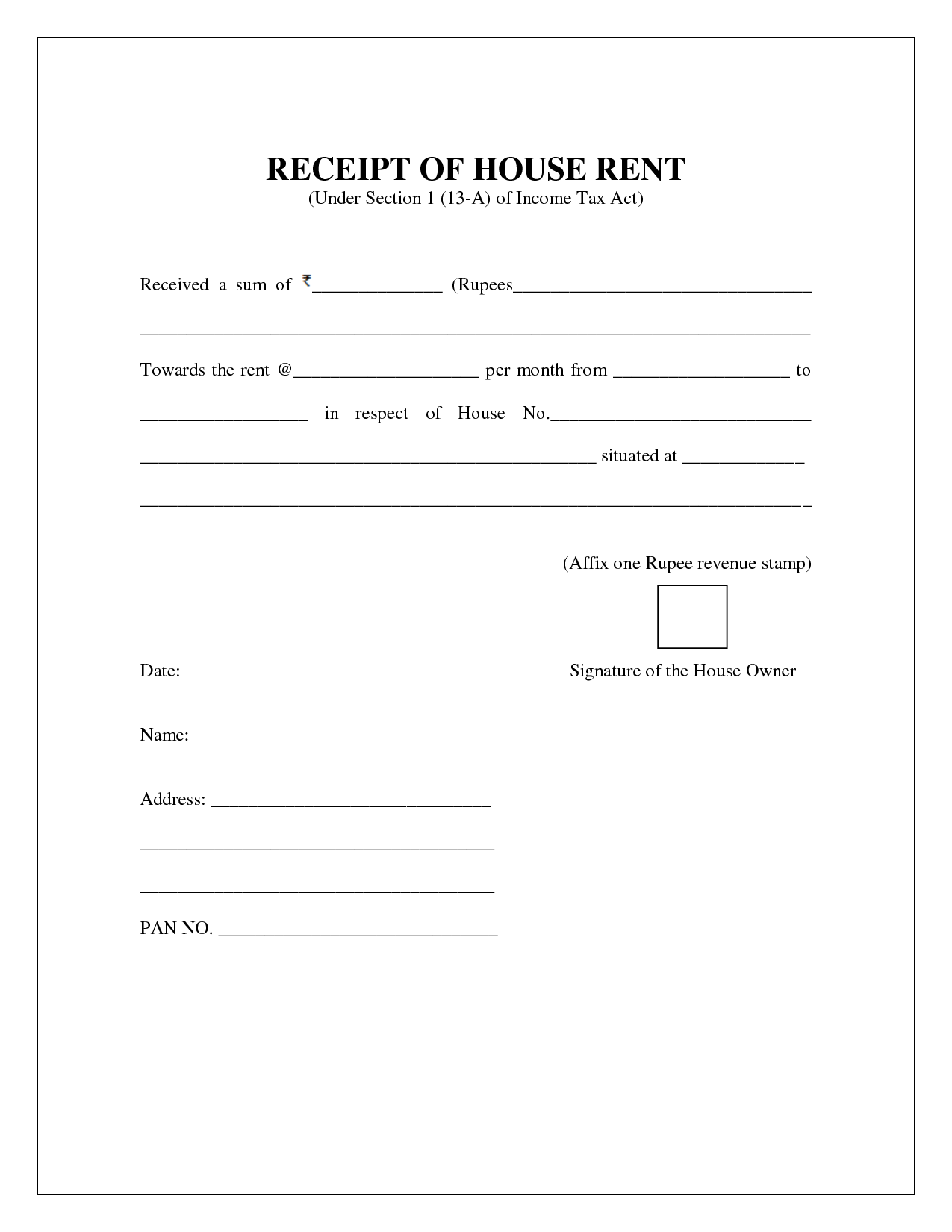

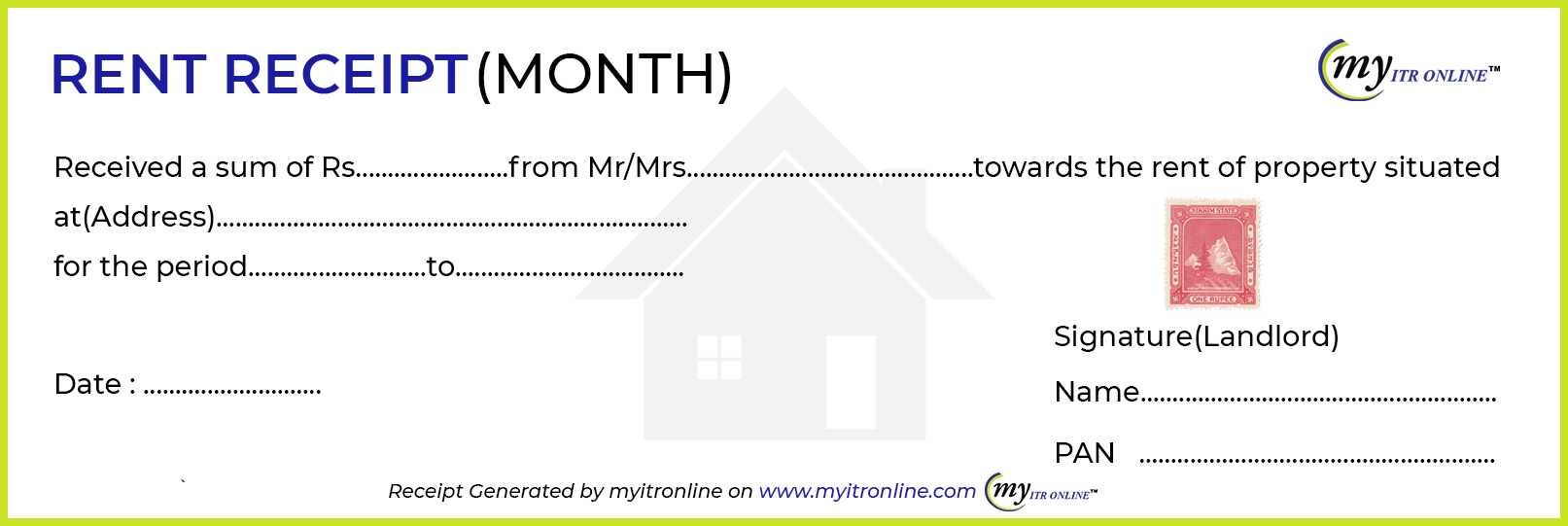

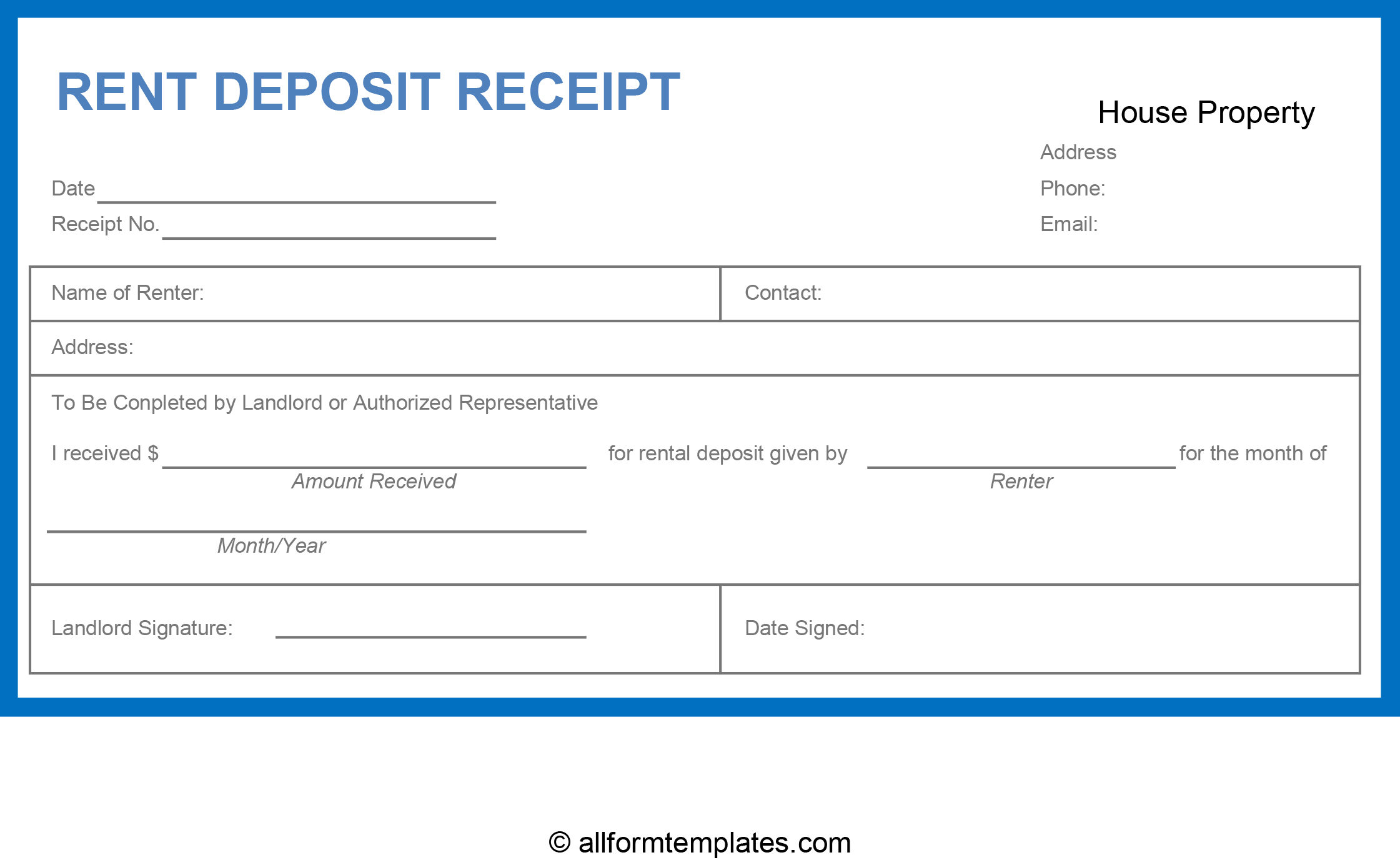

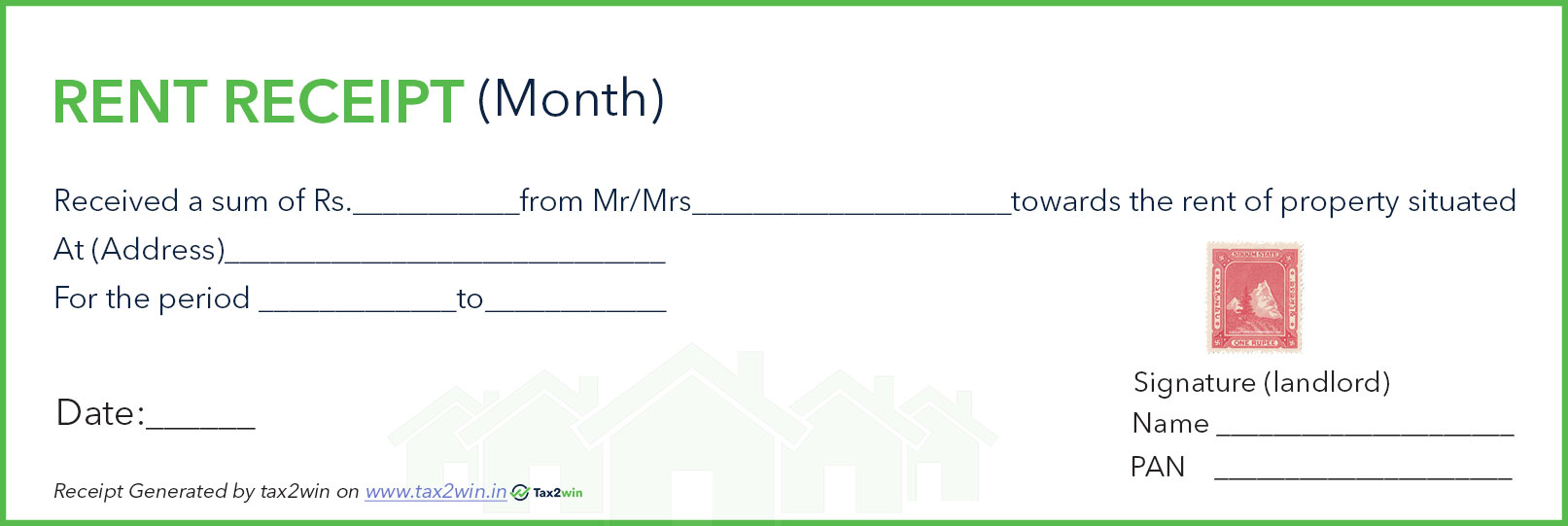

Free Rent Receipt Generator Online House Rent Receipt Generator With

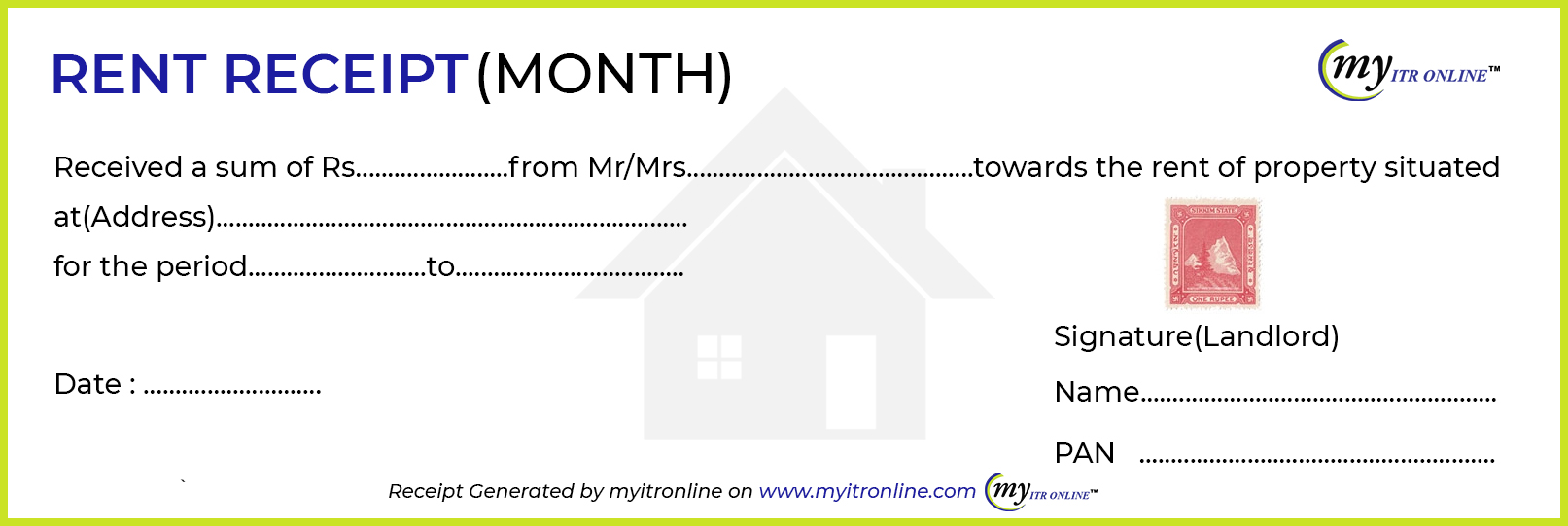

https://admin.myitronline.com/assets/tax-tools/Rent-recept-format.jpg

Free Printable Rent Receipt Free Printable 49 Printable Rent Receipts

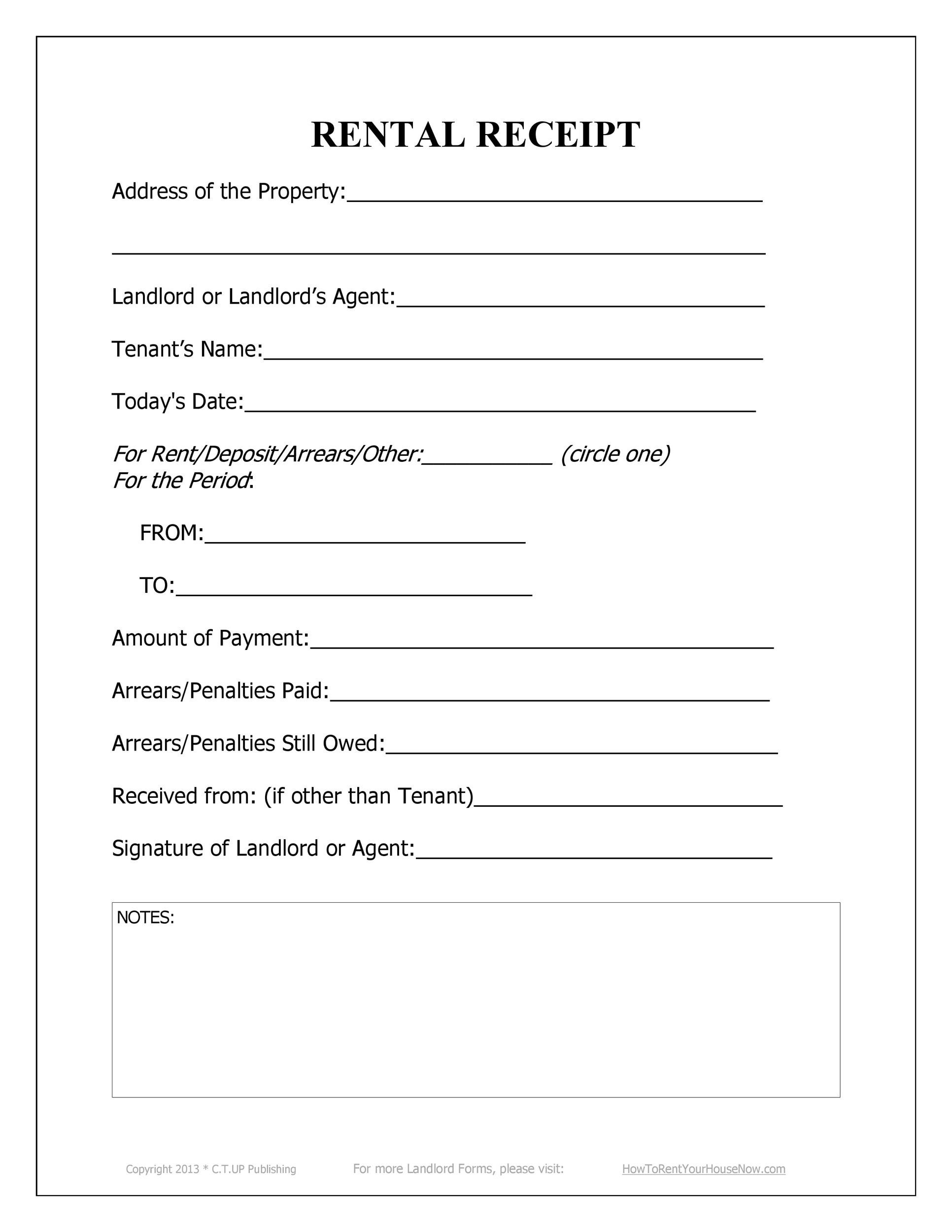

https://templatelab.com/wp-content/uploads/2019/03/rent-receipt-25.jpg?w=790

The provision allowing homeowners to exclude rental income earned from renting their personal residence for less than 15 days is in Section 280 A of the Rental income earned by NRIs and Indian citizens is taxable So if you are an NRI earning rental income by renting out your property in India you are liable to

Rental income Rental income is the rent you get from your tenants This includes any payments for the use of furniture charges for additional services you Know how and when rental income up to Rs 10 lakh becomes tax free under New Tax Regime Rental income up to Rs 10 lakh can be tax free under New

Download Is House Rent Tax Free

More picture related to Is House Rent Tax Free

The Best How To Calculate House Rent Allowance In Excel References

https://i2.wp.com/i.ytimg.com/vi/6CS3qlrCF5Q/maxresdefault.jpg

How Tax On Rental Income Is Calculated Step by step Guide Income Tax

https://www.financialexpress.com/wp-content/uploads/2022/11/tax-on-rent.jpg

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

https://www.signnow.com/preview/101/125/101125610/large.png

The ability to deduct qualified expenses is one of the many tax benefits that come with owning rental properties But after the deductions are accounted for your It s a longstanding provision allowing people to rent out their homes for two weeks or less and pocket the rental income free of federal taxes This benefit is often

What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental As a landlord you must normally pay income tax on any profit you receive from any rental properties you own Put simply your profit is the sum left once you ve added together

Houses For Rent Oxnard CA County Property Management

https://lirp-cdn.multiscreensite.com/4409b412/dms3rep/multi/opt/c-p-m_for_rent-1920w.jpg

Rent Receipt Template With Logo Premium Printable Receipt Templates

https://dp5zphk8udxg9.cloudfront.net/wp-content/uploads/2019/01/6.jpg

https://www.vero.fi/en/individuals/property/rental...

Rental income is income received from allowing another person use your property vehicle or other assets in return for money or other benefits of monetary value

https://money.stackexchange.com/questions/3899

Suppose Adam owns a house and rents a room to Bill for 300 a month and pays Bill 300 a month to mow the lawn clean the rooms and do other maintenance Assume

Free Rental Monthly Rent Invoice Template PDF Word EForms

Houses For Rent Oxnard CA County Property Management

Rent Invoice Template Free Download

How To Lower Taxes On The Sale Of Inherited Rental Property Finance

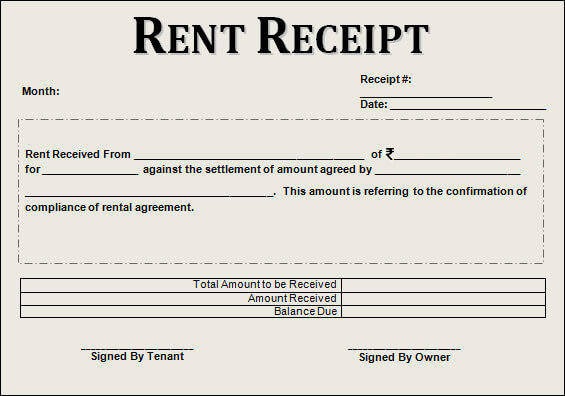

Get Our Image Of Online Rental Receipt Template Receipt Template

Can You Claim Rent On Your Income Tax Tadordesign

Can You Claim Rent On Your Income Tax Tadordesign

Monthly Rent Receipt Templates Glamorous Receipt Forms

Rent Receipt Template Ontario Schoolsupernal

Rent Tax TDS On House Rent Notice From The Office Of Kathmandu

Is House Rent Tax Free - Rental income earned by NRIs and Indian citizens is taxable So if you are an NRI earning rental income by renting out your property in India you are liable to