Is Hra Taxable Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated by

Is Hra Taxable

Is Hra Taxable

https://i.ytimg.com/vi/OxsfmamwlCY/maxresdefault.jpg

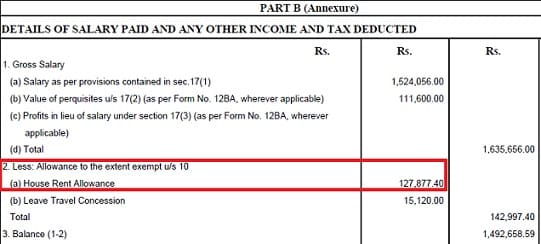

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

Can I Claim HRA For Rent That Parents Pay Mint

https://www.livemint.com/lm-img/img/2023/06/04/1600x900/HRA-exemption-is-not-available-from-your-taxable-i_1685902165159.jpg

Is House Rent Allowance HRA Taxable Tax Exemption on House Rent Allowance HRA Documents to Avail of HRA Taxation Rules For Tax Exemption on HRA How to Claim an HRA Tax Exemption How to Calculate House Rent Allowance HRA Example 1 Example 2 HRA Tax Deduction Under Section 80GG Claiming Deduction House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in rental premises can claim exemption of House Rent Allowance u s 10 13A Employees are required to submit the rent receipts to their employers to claim the tax benefit

House Rent Allowance is an allowance given by an employer to an employee to cover the cost of living in rented housing HRA is not entirely taxable even though it is a part of your salary A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will

Download Is Hra Taxable

More picture related to Is Hra Taxable

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

How To Calculate HRA Exemption For Income Tax Step by Step

https://i.ytimg.com/vi/CUHATMJX7Io/maxresdefault.jpg

The HRA House Rent Allowance allowance you receive from your employer is not always fully tax exempt It may be fully or partially exempt from tax depending on certain condtions Out of the HRA received the least of the following three amounts is taken to be exempt from tax HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

[desc-10] [desc-11]

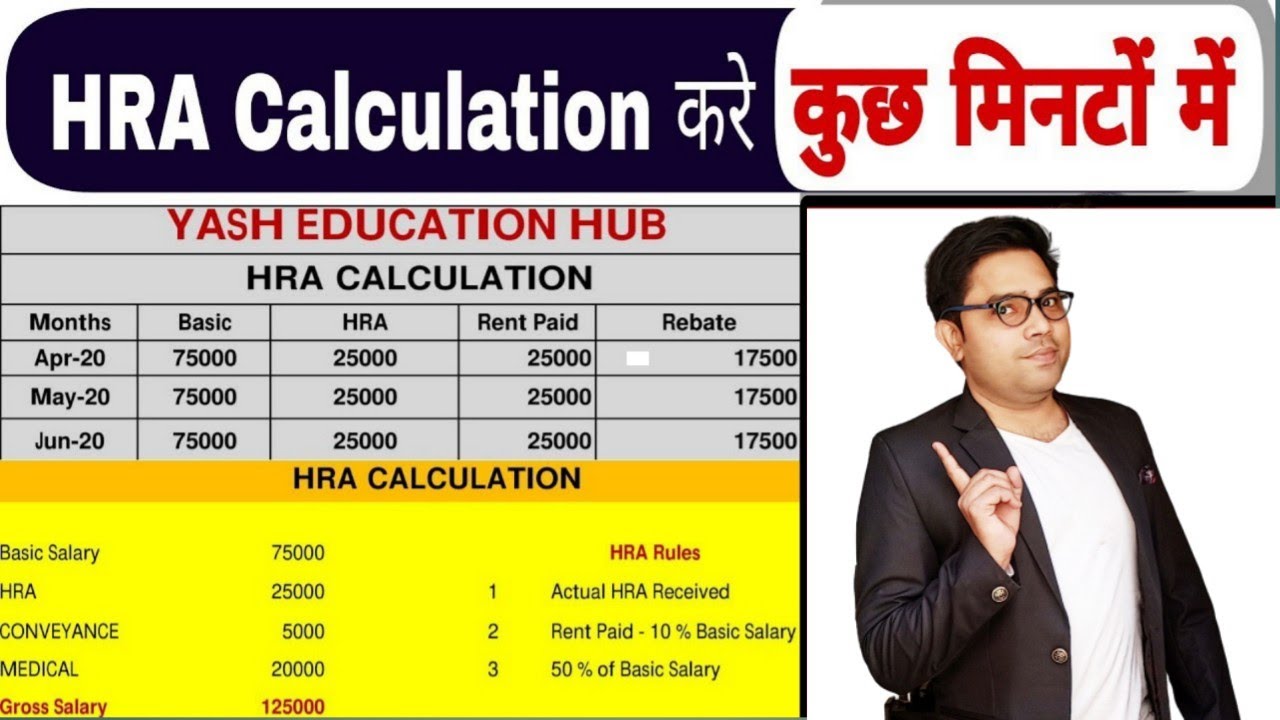

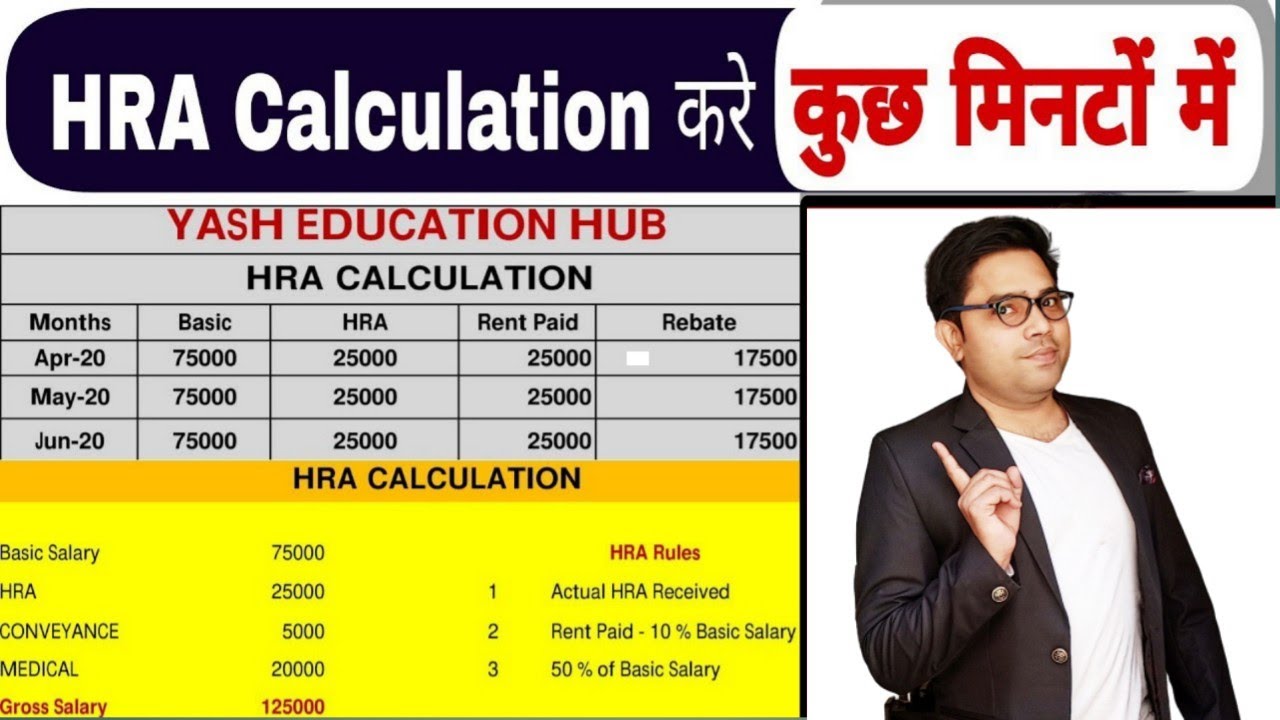

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

https://i.ytimg.com/vi/zUhWp9Wwy9g/maxresdefault.jpg

HRA Overview Captain Contributor Explains HRAs

https://captaincontributor.com/wp-content/uploads/2019/09/HRA-Thumb.jpg

https://tax2win.in/guide/hra-house-rent-allowance

Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Material Requirement Form Hra Exemption Calculator 201920

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

What Is A Retiree HRA Account ABBS

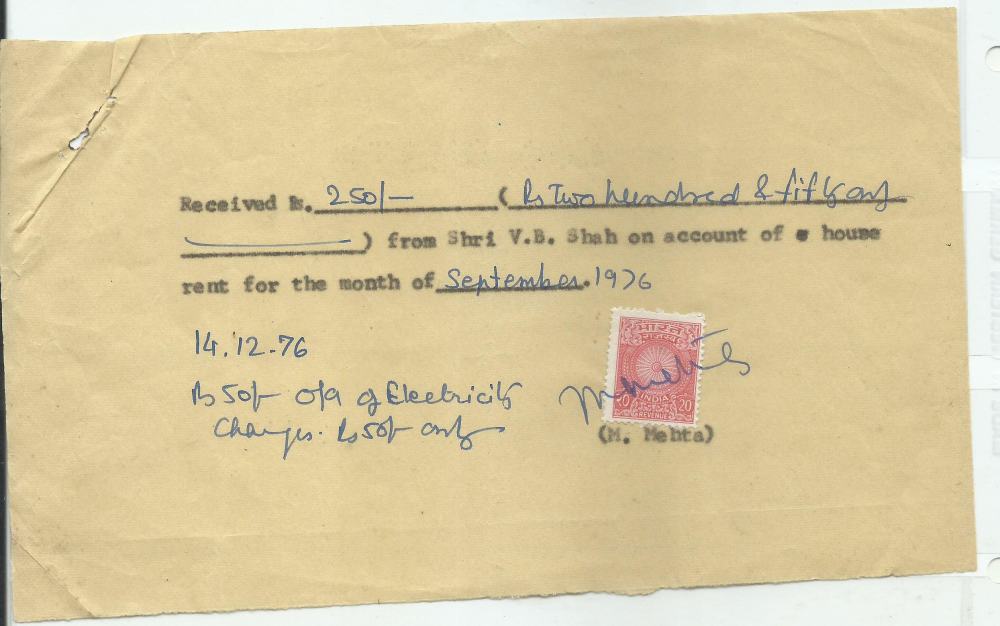

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

HRA Is A Key Component Of The Salary And Is Taxable Under The Income

What Is HRA House Rent Allowance And How To Calculate HRA

What Is HRA House Rent Allowance And How To Calculate HRA

Schedule HRA

House Rent Allowance In India HRA Exemption And Tax Deduction Jar

HRA Calculator To Determine House Rent Allowance Scripbox

Is Hra Taxable - [desc-12]