Is Hsa Seed Money Taxable An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for

In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs No tax is levied on

Is Hsa Seed Money Taxable

Is Hsa Seed Money Taxable

https://img.saplingcdn.com/640/photos.demandstudios.com/12/94/fotolia_4398116_XS.jpg

Our 2020 Taxable Investment Income On9Income

https://www.maxoutofpocket.com/wp-content/uploads/2021/04/Seed-scaled.jpg

Calculating Taxable Income Example YouTube

https://i.ytimg.com/vi/E6Nr61_Wfhw/maxresdefault.jpg

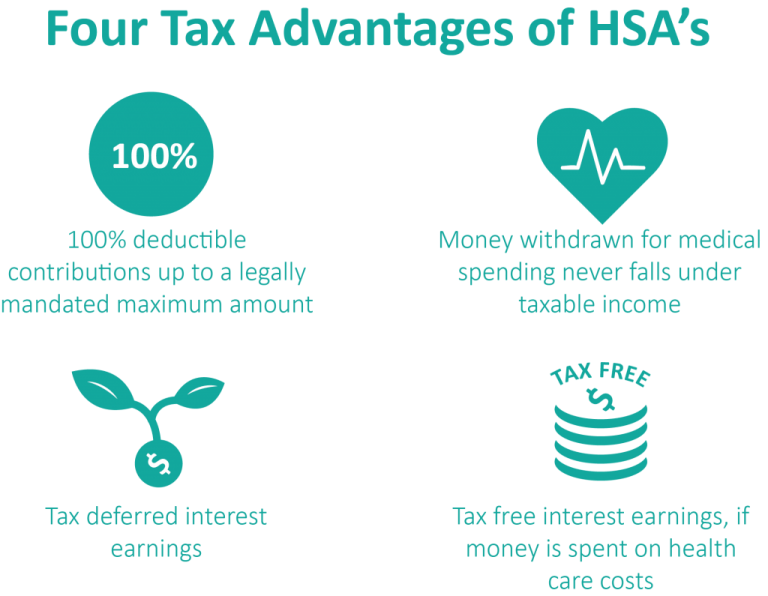

Contributions to HSAs aren t subject to federal income tax and earnings in the account grow tax free Unspent money in an HSA rolls over at the end of the year Any contributions you or your employer may make to your HSA are federal tax free and could help you pay for the HSA eligible health plan s deductible or other qualified

Withdrawals from an HSA can be made on a tax free basis as long as they are used to pay for qualified medical expenses Unlike many employer sponsored In general HSA contributions can be made for employees in only one coverage category or the other without violating the comparability rules More generous

Download Is Hsa Seed Money Taxable

More picture related to Is Hsa Seed Money Taxable

Can I Invest The Money In My HSA FSA Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

HSA Explained 2022 HSA Max Contribution Limits What Is An HSA

https://content.pureequity.us/wp-content/uploads/2022/01/hsa5.jpg

Health Savings Accounts How HSAs Work And The Tax Advantages

http://www.ilhealthagents.com/wp-content/uploads/2018/04/Tax-Advantages-of-an-HSA-1024x795-1024x795-768x596.png

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses The maximum amount you can Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

What Are the Rules Affecting Employer Contributions to HSAs and HRAs For both Health Savings Accounts and Health Reimbursement Arrangements caps are Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

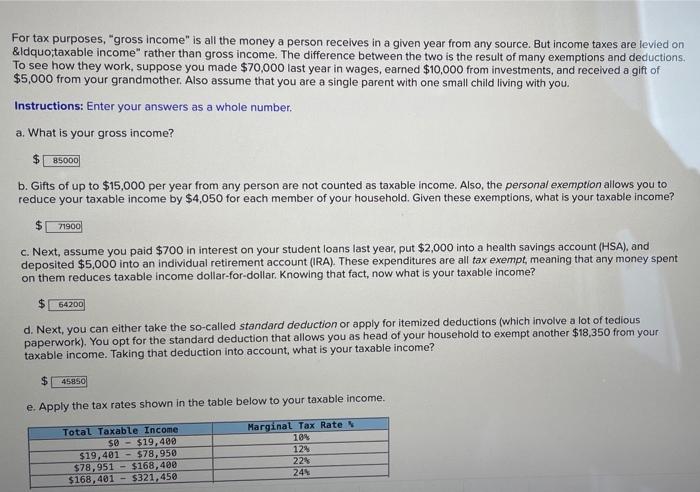

Seed Data SQLPad

https://getsqlpad.com/images/screenshot.png

https://ttlc.intuit.com › ... › hsa-distribution-taxable

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for

https://www.fidelity.com › learning-center › personal-finance › hsa-tax-form

In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute

HSA Bank To Present At Baird Global Healthcare Conference

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

How To Use An HSA As A Retirement Account Money And Markets

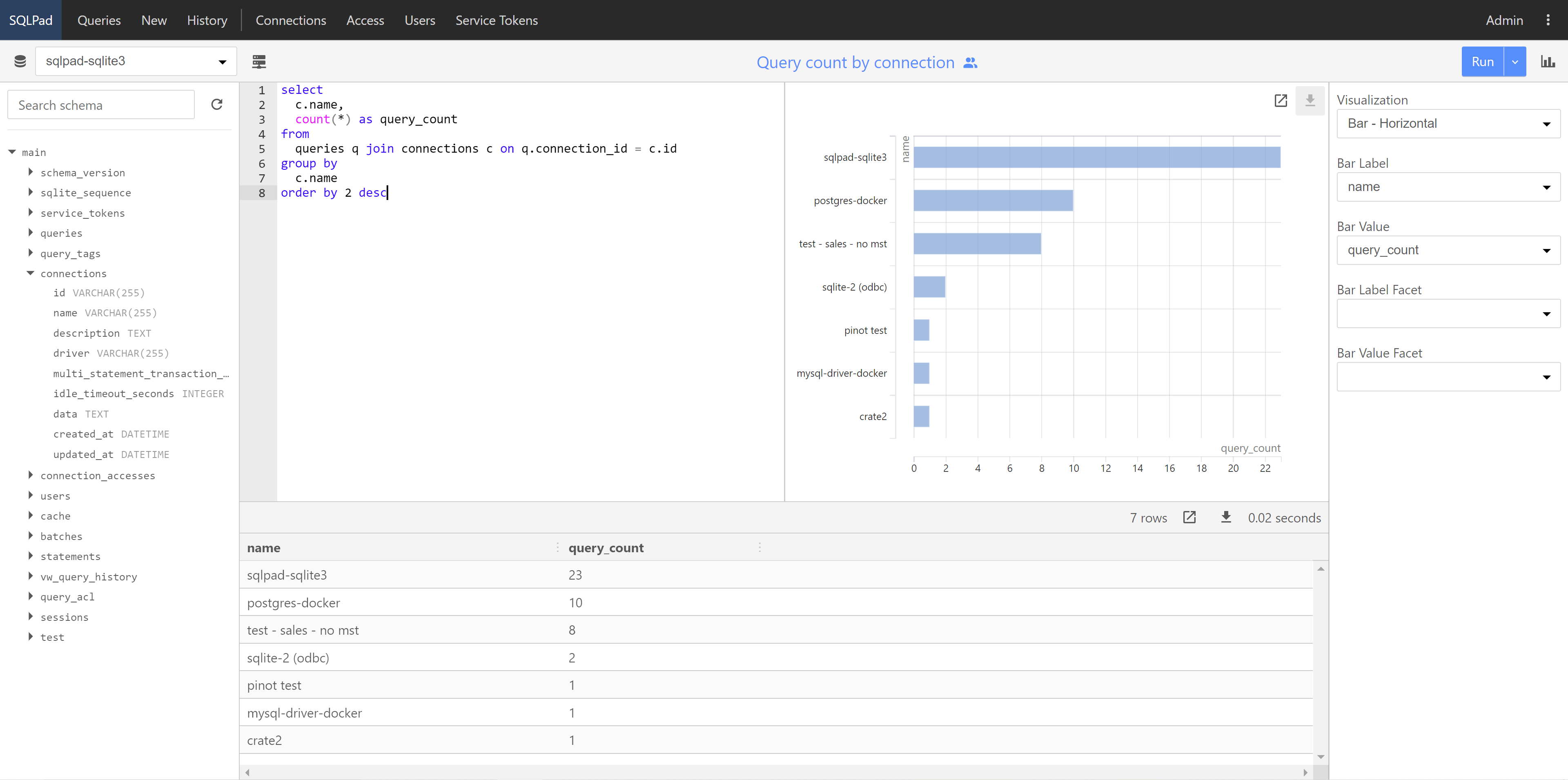

Solved For Tax Purposes gross Income Is All The Money A Chegg

JNTUACEP Seed Money Guidelines PDF Government Business

Contact Us Seed For CVD

Contact Us Seed For CVD

What s The Difference Between An HSA FSA And HRA Medical Health

SEED Money Eghygu7y ANNEXURE I SEED GRANT PROPOSAL FORMAT to Be

Hometown Feed Seed Ider AL

Is Hsa Seed Money Taxable - In general HSA contributions can be made for employees in only one coverage category or the other without violating the comparability rules More generous