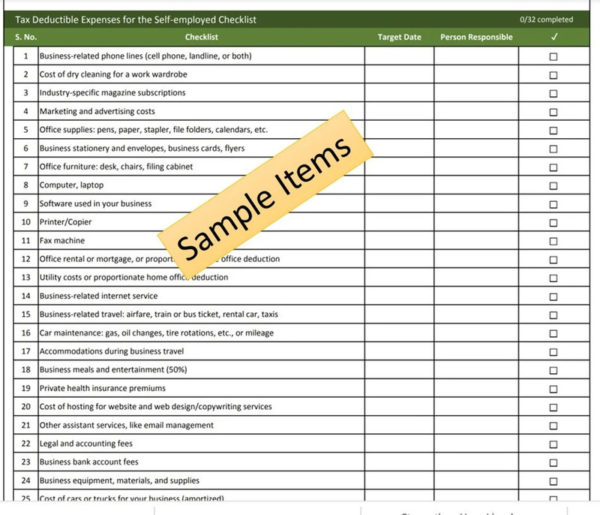

Is Income Protection Insurance Tax Deductible For Self Employed Web 12 Aug 2019 nbsp 0183 32 Personal insurance for the self employed is tax free just as it is for standard employee income insurance so that 70 should come very close to covering your entire take home amount Can I claim income

Web 10 Okt 2003 nbsp 0183 32 13th Oct 2003 14 00 Tax position on Income Protection An income protection insurance permanent health insurance scheme can be established so that Web Published 26 Apr 2023 When you re self employed or a contractor you get the sweet perk of being your own boss but you wave goodbye to traditional employee benefits like

Is Income Protection Insurance Tax Deductible For Self Employed

Is Income Protection Insurance Tax Deductible For Self Employed

https://smartbrokers.co.nz/wp-content/uploads/2017/03/Income-Protection-Insurance.jpg

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Is Health Insurance Tax Deductible For Self Employed International

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

Web For the purposes of the tax exemption the period of the policy is not relevant but it does have relevance for the way in which the insurer is taxed on the business For more Web Guides Self employed income protection insurance A guide to life insurance when you re self employed Can you get income protection if you are self employed If you

Web 9 Juni 2020 nbsp 0183 32 That s because as far as HMRC is concerned you are paying your premium using money that has already been taxed either through your employer or through Self Assessment if you are self Web 11 Dez 2023 nbsp 0183 32 IRS Publication 587 Business Use of Your Home Including Use by Day Care Providers A document published by the Internal Revenue Service IRS that provides information on how taxpayers who

Download Is Income Protection Insurance Tax Deductible For Self Employed

More picture related to Is Income Protection Insurance Tax Deductible For Self Employed

The Importance Of Income Protection Insurance Brookfield Finance

https://brookfieldfinance.com/wp-content/uploads/2022/10/Untitled-design-1.jpg

How Does Income Protection Insurance Help You

https://www.reginaldchan.net/wp-content/uploads/2021/11/Income-Protection-Insurance.jpg

Is Income Protection Tax Deductible LifeCovered

https://www.lifecovered.nz/wp-content/uploads/2022/04/income-protection-tax-deductible-1024x538.jpg

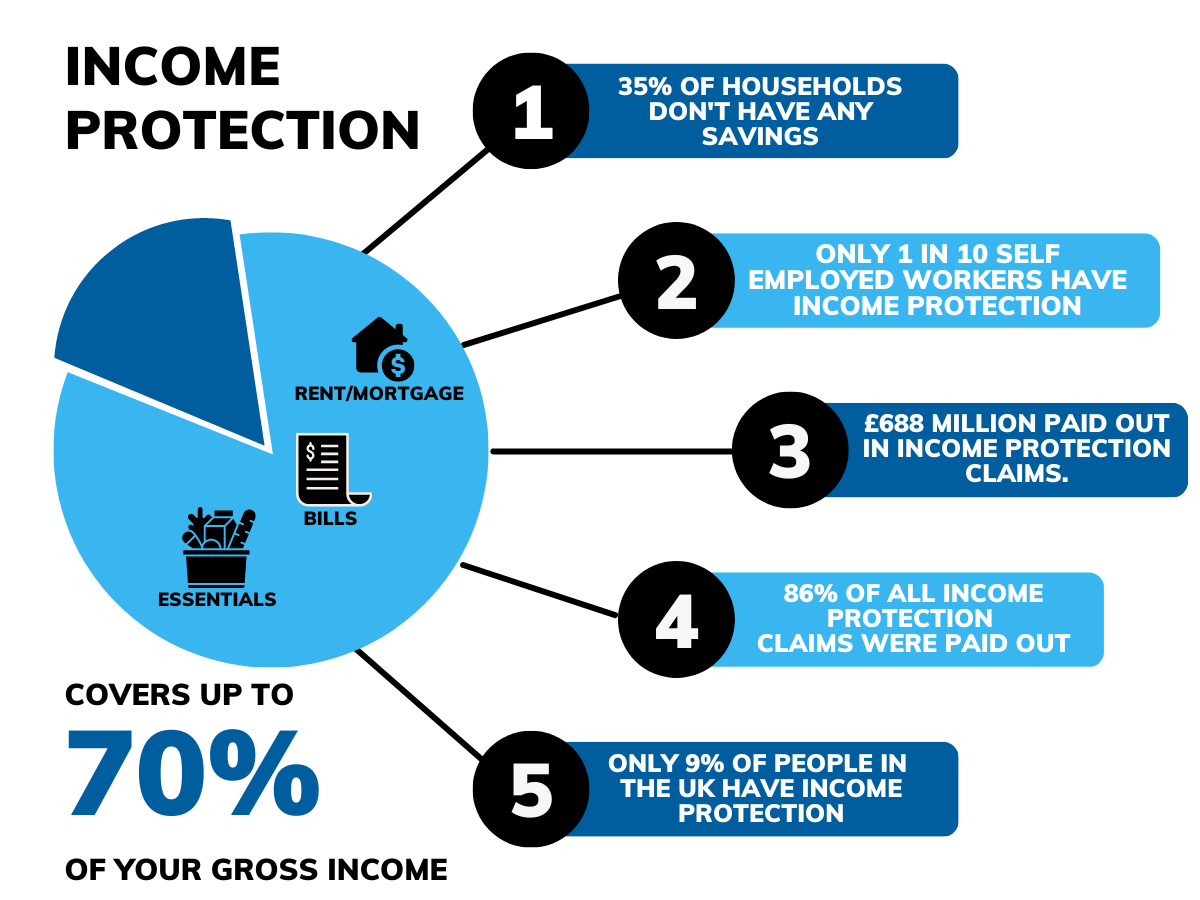

Web 21 Dez 2023 nbsp 0183 32 Andrew Burton December 21 2023 5 min read What is income protection for self employed people Income protection for self employed people is an insurance Web 31 Mai 2019 nbsp 0183 32 Are Income Protection Premiums Tax Deductible and Can I Offset Them as a Business Expense I want to take out income protection but as a company

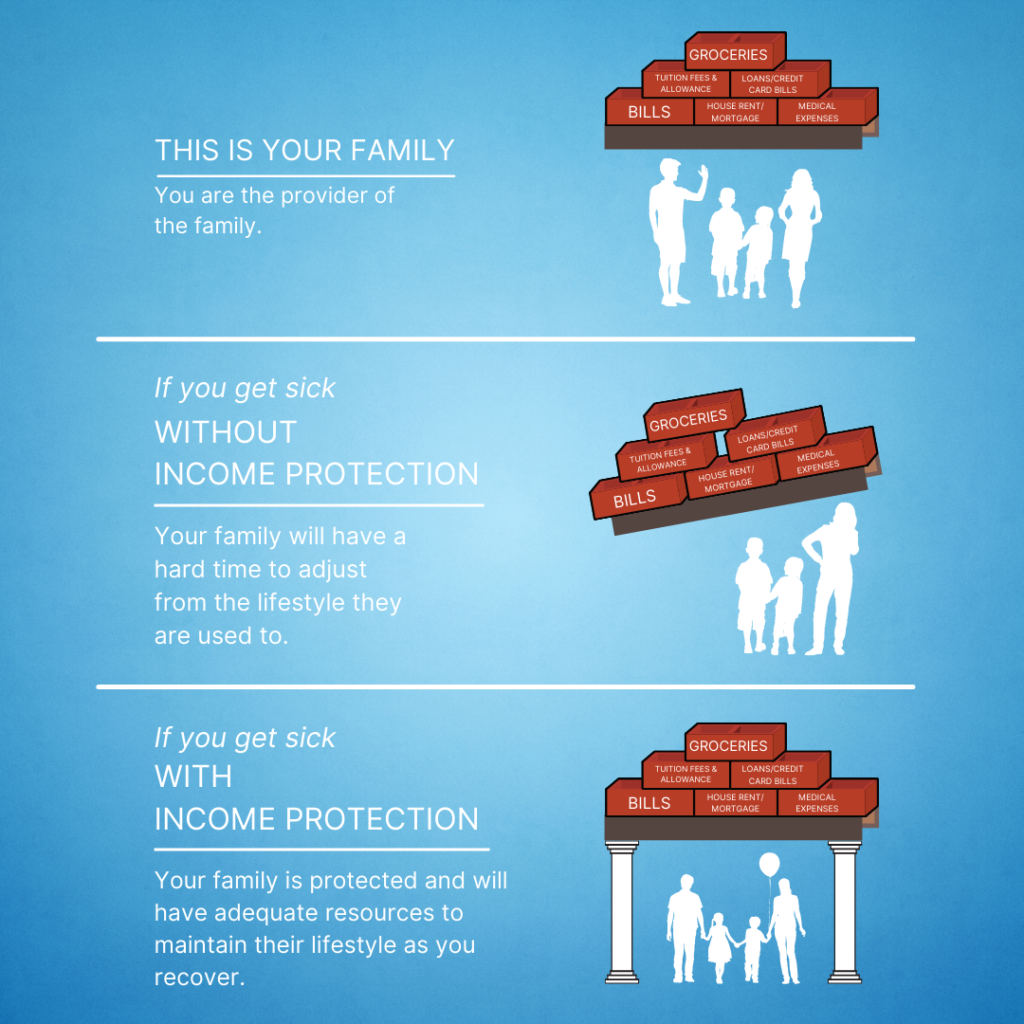

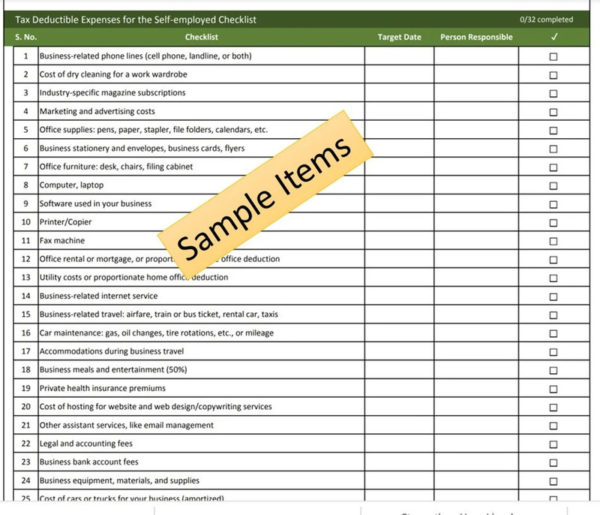

Web Also one of the most important factors especially for self employed individuals is the ability to earn assessable income As a result taking out disability insurance against Web 12 Okt 2022 nbsp 0183 32 You can deduct some of these as part of your annual tax return to work out your taxable profit as long as they re allowable expense The list of tax deductible

Tax Deductible Expenses For The Self employed Checklist

https://www.checklisted.us/wp-content/uploads/2022/05/Tax-Deductible-Expenses-for-the-Self-employed-Checklist-1-600x515.jpg

Income Protection Insurance Carew Co Solutions

https://www.carewco.co.uk/wp-content/uploads/2023/03/Income-Protection-1.png

https://www.unitelife.org/resources/self-empl…

Web 12 Aug 2019 nbsp 0183 32 Personal insurance for the self employed is tax free just as it is for standard employee income insurance so that 70 should come very close to covering your entire take home amount Can I claim income

https://www.accountingweb.co.uk/.../tax-deduction-for-income-protection

Web 10 Okt 2003 nbsp 0183 32 13th Oct 2003 14 00 Tax position on Income Protection An income protection insurance permanent health insurance scheme can be established so that

Income Protection Insurance Do You Really Need It

Tax Deductible Expenses For The Self employed Checklist

Qualified Business Income Deduction And The Self Employed The CPA Journal

Is Income Protection Tax Deductible News Week Me

Pin By Heather La Bash On AU Medicine Money Taxes Income

Income Protection Insurance Australia Is Income Protection Insurance

Income Protection Insurance Australia Is Income Protection Insurance

Is Life Insurance Tax Deductible For Self Employed Protection Matters

When Is Income Protection Tax Deductible

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Is Income Protection Insurance Tax Deductible For Self Employed - Web 9 Juni 2020 nbsp 0183 32 That s because as far as HMRC is concerned you are paying your premium using money that has already been taxed either through your employer or through Self Assessment if you are self