Is Interest Earned On Senior Citizen Scheme Taxable The Senior Citizens Savings Scheme SCSS allows senior citizens in India to invest up to Rs 30 lakhs providing a safe and tax saving stream of income The

Do remember interest paid by the scheme is taxable in the hands of the investor based on the income tax slab In case the interest amount earned on the Whether the interest received on SCSS Account is exempt or taxable Interest receipt on such deposit is exempt to the extent of Rs 50 000

Is Interest Earned On Senior Citizen Scheme Taxable

Is Interest Earned On Senior Citizen Scheme Taxable

https://www.valueresearchonline.com/content-assets/images/50259_20220103-senior-citizen-savings-scheme__w1200__.jpg

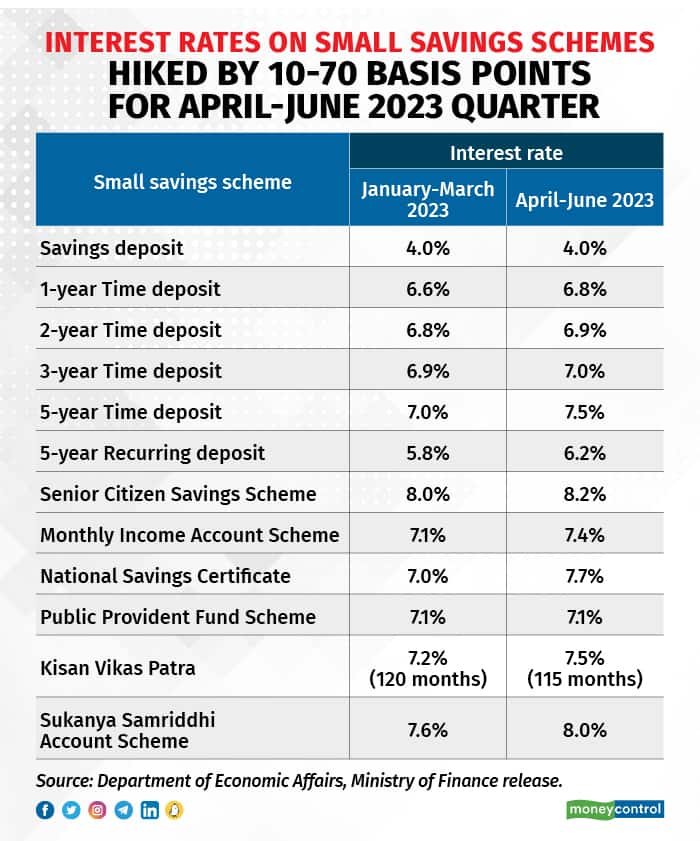

Rakesh Kumar Singhal Small Savings Schemes Interest

https://images.moneycontrol.com/static-mcnews/2023/03/Interest-rates-on-small-savings-schemes-hiked-by-10-70-basis-points-for-April-June.jpg

Senior Citizen Discount Requirement POSTER Lazada PH

https://filebroker-cdn.lazada.com.ph/kf/Sb05870109ae446a792a5645f491229972.jpg

Explore the Senior Citizen Savings Scheme SCSS for 2024 including current interest rates tax benefits and eligibility criteria Learn how SCSS can secure For senior citizens above the age of 60 years interest is taxable if the total interest paid in all SCSS accounts in a financial year exceeds Rs 50 000 for those

Yes the interest earned from the Senior Citizen Savings Scheme is taxable per the investor s income tax slab However investments made in the SCSS are eligible Investments made in Senior Citizen Saving Schemes are eligible for Section 80C deductions Interest earned under this scheme shall be taxable as follows 7 1 If an

Download Is Interest Earned On Senior Citizen Scheme Taxable

More picture related to Is Interest Earned On Senior Citizen Scheme Taxable

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Is SCSS Interest Taxable Is TDS Applicable For Senior Citizen Saving

https://i.ytimg.com/vi/_0F4Ln6qZOw/maxresdefault.jpg

Time Interest Earned Ratio Interpretation BrisakruwCherry

https://i.ytimg.com/vi/EBz-hV1f5Hg/sddefault.jpg

In case the interest amount earned is more than Rs 50 000 for a fiscal year Tax Deducted at Source TDS is applicable to the interest earned This limit for TDS So if the interest earned by you on SCSS exceeds Rs 50 000 the bank applies a 10 per cent deduction before transferring the interest to your account

However the interest rate is taxable Additionally if the interest amount is more than Rs 50 000 per annum TDS is deducted on interest Depositors can also Interest earned above Rs 50 000 is fully taxable and is also subject to TDS As per section 80TTB senior citizens are allowed to take deduction of interest earned from all types of

Senior Citizen Saving Scheme 2024 SCSS Interest Rate Benefits

https://yojanasarkari.in/wp-content/uploads/2022/09/SeniorCitizen-1024x392.jpg

Latest Post Office Interest Rates January March 2023

https://www.basunivesh.com/wp-content/uploads/2022/12/Latest-Post-Office-Interest-Rates-January-March-2023-scaled.jpg

https://cleartax.in/s/senior-citizen-savings-scheme

The Senior Citizens Savings Scheme SCSS allows senior citizens in India to invest up to Rs 30 lakhs providing a safe and tax saving stream of income The

https://economictimes.indiatimes.com/wealth/invest/...

Do remember interest paid by the scheme is taxable in the hands of the investor based on the income tax slab In case the interest amount earned on the

Interest Rate And Rule Of Senior Citizen Saving Scheme Your Guide To

Senior Citizen Saving Scheme 2024 SCSS Interest Rate Benefits

How Interest Rates Affect Businesses ILG

Senior Citizen Saving Scheme SCSS 2024 Forms New Rules Interest

Senior Citizens Savings Scheme SCSS Interest Rate Kuvera

Senior Citizen Saving Scheme Interest Rate Dollar Keg

Senior Citizen Saving Scheme Interest Rate Dollar Keg

Times Interest Earned Ratio TIE Formula Calculator

Senior Citizen Saving Scheme 2021 SCSS

The Impact Of Low Interest Rates

Is Interest Earned On Senior Citizen Scheme Taxable - As a senior citizen you are qualified to get a tax exemption of up to Rs 1 5 lakh in a year under Section 80C of the Income Tax Act 1961 The interest payments are taxable Tax