Is Interest On A Home Equity Loan Tax Deductible In 2020 Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially improve

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be You can only deduct the portion of the loan or line of credit you used to buy build or substantially improve the home that is used to secure the loan or line of credit This requirement began with

Is Interest On A Home Equity Loan Tax Deductible In 2020

Is Interest On A Home Equity Loan Tax Deductible In 2020

https://www.cobaltcu.com/sites/default/files/2022-01/Home-Equity-Loan-VS-Line-of-Credit.png

Is Interest On A Home Equity Line Of Credit HELOC Tax Deductible

https://mte-media.s3.amazonaws.com/wp-content/uploads/2022/02/11133159/is-interest-on-a-home-equity-line-of-credit-heloc-tax-deductible.jpg

Home Equity OAHE FCU

https://images.squarespace-cdn.com/content/v1/5dc1ff2526a33c5d20a47454/1579271969696-HVMDSNDIV7A1XBPJ8VWA/shutterstock_135658307.jpg

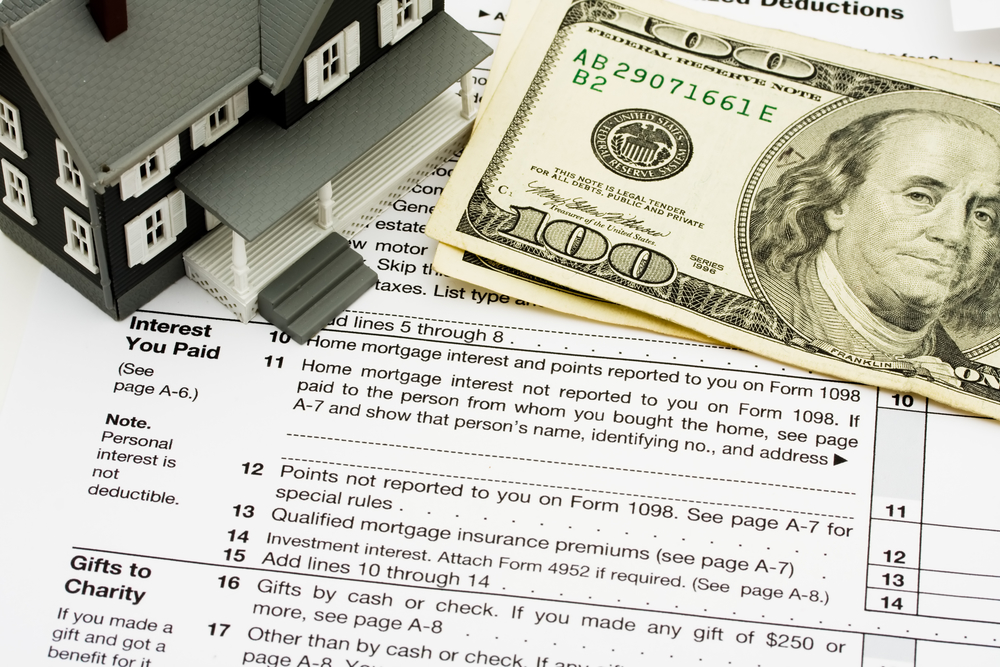

Due to recent tax law changes the interest on a home equity loan can be tax deductible including interest paid on your second home In this article we ll cover everything you should know about claiming a home equity loan tax deduction Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan The loan must be secured by the taxpayer s main

Is it possible to get a tax deduction on your home equity loan in 2024 and 2025 The answer is you can still deduct home equity loan interest Interest on home equity loans When you borrow against your home s equity the interest you pay every year is tax deductible up to a government imposed limit as long as the borrowed money goes toward improving your home

Download Is Interest On A Home Equity Loan Tax Deductible In 2020

More picture related to Is Interest On A Home Equity Loan Tax Deductible In 2020

What Is Home Equity And How To Use It For Cash Out Refinance Trident

https://prudentfinancialsolutions.com/wp-content/uploads/2021/05/shutterstock_1219076071-1024x684.jpeg

Home Equity Loan Interest Can Still Be Deducted in Certain Instances

https://bcocpa.com/wp-content/uploads/2018/02/Home-Equity-Loan-Dos-and-Donts.jpg

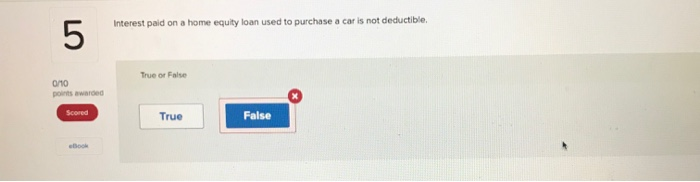

Solved 5 Interest Paid On A Home Equity Loan Used To Chegg

https://media.cheggcdn.com/media/3a7/3a7b7ca4-7636-4d12-91e5-4907f1f8308c/image.png

As a result homeowners are collectively sitting on close to 33 trillion in home equity and many are taking advantage of this windfall through equity backed loans This Despite provisions in the Tax Cut and Jobs Act TCJA home equity loan interest still may be deductible for some homeowners along with interest on home equity lines of credit HELOCs and

Interest paid on a HELOC loan might be tax deductible The deduction is similar to mortgage interest deduction The amount you can deduct depends on whether you itemize your deductions how you use the funds and According to the IRS home equity loan interest can be tax deductible as long as you use the funds to buy build or substantially improve your home However you won t

Is Home Equity Loan Interest Tax Deductible LendingTree

https://www.lendingtree.com/content/uploads/2015/03/img_7-1.jpg

Interest On Home Equity Loans Is No Longer Tax Deductible Main Line

https://mainlinehomesales.files.wordpress.com/2018/01/home-equity-interest-no-longer-tax-deductible.png?w=1200

https://www.investopedia.com › ... › heloc …

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially improve

https://www.irs.gov › faqs › itemized-deductions...

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be

How A Home Equity Loan Helps You Achieve Your Financial Dreams

Is Home Equity Loan Interest Tax Deductible LendingTree

Is There Closing Costs On A Home Equity Loan

Interest On Your Home Loan Could Be Tax Deductible Smith Feutrill

Home Equity Loan To Avoid A Consumer Proposal Mortgage Brokers Network

All You Need To Know About Home Equity Loan Home Equity Loan In 2020

All You Need To Know About Home Equity Loan Home Equity Loan In 2020

Home Equity Loans Lower Bucks County PA Spirit Financial CU

Here s What Happens When You Build Equity In Your Home

Is Interest On Your Home Equity Loan Tax Deductible Details Explained

Is Interest On A Home Equity Loan Tax Deductible In 2020 - The short answer is yes the interest you pay on home equity loans can be tax deductible But it depends on how you use your loan