Is Interest On Post Office Monthly Income Scheme Taxable Post Office Monthly Income Scheme Account MIS Interest earned is taxable and no deduction under Sec 80C for deposits made TDS to be deducted on

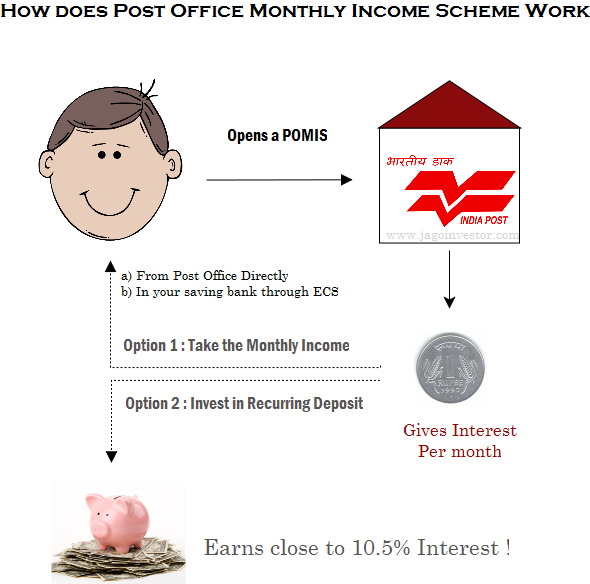

Investors in the post office s monthly income scheme can earn up to 6 6 percent annual interest each month A POMIS account can be formed individually or Currently the interest rate is 7 40 for April June 2024 payable monthly The minimum investment in this scheme is Rs 1000 and an additional deposit in

Is Interest On Post Office Monthly Income Scheme Taxable

Is Interest On Post Office Monthly Income Scheme Taxable

https://www.jagoinvestor.com/wp-content/uploads/files/img/ji/post-office-monthly-income-scheme.png

Post Office Monthly Income Scheme E filing Of Income Tax Return

https://etaxadvisor.com/wp-content/uploads/2020/05/Post-Office-Monthly-Income-Scheme-600x339.jpg

Post Office Monthly Income Scheme Calculator Check MIS Returns In 3

https://www.moneycontain.com/wp-content/uploads/2020/12/fixed.jpg

Understanding Taxation on Post Office Monthly Income Schemes While POMIS offers several tax benefits it s crucial to understand the taxation rules TDS and Section Can Monthly Income Scheme MIS interest be credited to Recurring Deposit RD account MIS interest cannot be credited to post office RD account It can be

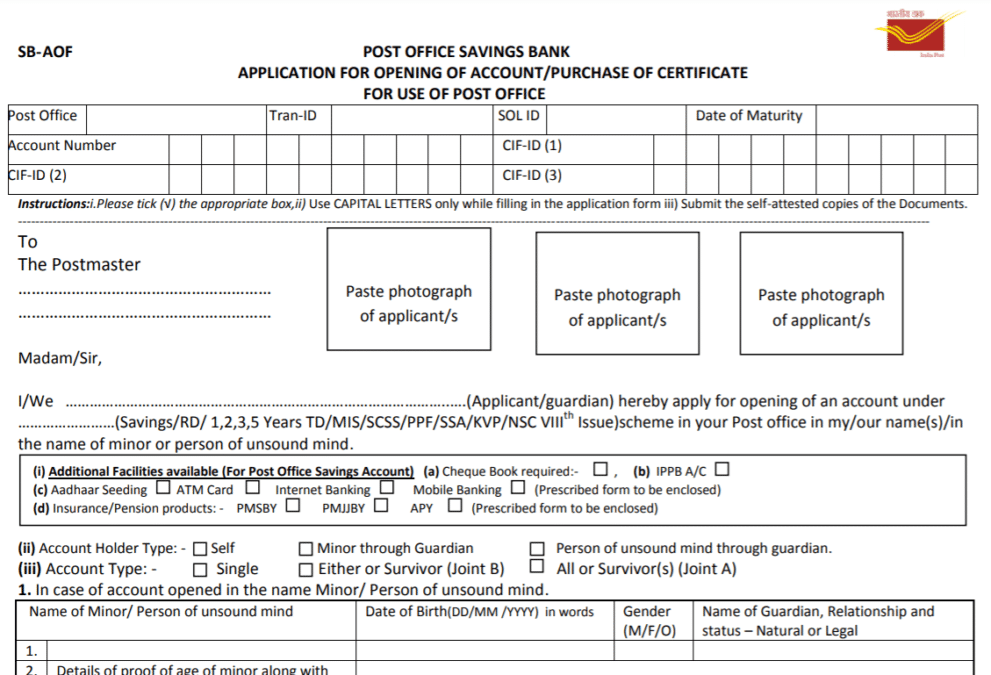

From 01 January 2024 interest rates for Post Office Monthly Income Scheme will be 7 4 per annum payable monthly The following table includes the current and previous The Post Office Monthly Income Scheme interest is taxable into the hands of depositor 2 Deposits As per the India Post website Post Office MIS account can be opened with minimum of

Download Is Interest On Post Office Monthly Income Scheme Taxable

More picture related to Is Interest On Post Office Monthly Income Scheme Taxable

Post Office Monthly Income Scheme Calculator POMIS

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/04/post-office-monthly-income-scheme-calculator-1.jpg

Post Office Monthly Income Scheme 2023

https://i0.wp.com/narega.net/wp-content/uploads/2022/08/Post-Office-Monthly-Income-Scheme.webp?fit=1200%2C675&ssl=1

Post Office Monthly Income Scheme POMIS Features Benefits Interest

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/post-office-monthly-income-scheme.jpg

POMIS is an investment scheme recognized and validated by the Ministry of Finance It is one of the highest earning schemes with an interest rate of 6 6 The interest in this How to open Post office monthly income scheme Interested individual can open Post office MIS by submitting the following documents Artificial Intelligence AI Interest is

Interest rate offered is 8 4 percent annually which will be paid out every month The maturity tenure for POMIS is five years There will be no bonus upon maturity The least Interest Rate The POMIS calculator next takes in as input the interest rate offered by the post office at the time of your investment in the post office s monthly income scheme

Post Office Monthly Income Scheme POMIS How It Works And Rules

https://www.jagoinvestor.com/wp-content/uploads/files/img/ji/post-office-investment-schemes.jpg

Post Office Monthly Income Scheme MIS Detailed Explaination YouTube

https://i.ytimg.com/vi/N0bpgrQ_Ww0/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/on...

Post Office Monthly Income Scheme Account MIS Interest earned is taxable and no deduction under Sec 80C for deposits made TDS to be deducted on

https://economictimes.indiatimes.com/wealth/invest/...

Investors in the post office s monthly income scheme can earn up to 6 6 percent annual interest each month A POMIS account can be formed individually or

Post Office Monthly Income Scheme Details And Interest Rate 2022 Post

Post Office Monthly Income Scheme POMIS How It Works And Rules

Reasons To Invest In Post Office Monthly Income Scheme TomorrowMakers

Post Office Monthly Income Scheme Interest Rate Features

Post Office Monthly Income Scheme 2022 MIS Calculator Interest Rate

Post Office Monthly Income Scheme How To Apply Online Benefits

Post Office Monthly Income Scheme How To Apply Online Benefits

Post Office Monthly Income Scheme MIS Full Details YouTube

Post Office Monthly Income Scheme Calculator Scripbox

Post Office Schemes Interest Rates April 2020 Yadnya Investment Academy

Is Interest On Post Office Monthly Income Scheme Taxable - For MIS accounts at CBS Post offices monthly interest can be credited to savings accounts at any CBS Post Offices Is the interest rate earned taxable