Is Interest On Underpayment Of Tax Deductible The IRS typically assesses penalties along with interest on the balance owed by a taxpayer and this interest is not tax deductible Key Takeaways Taxpayers cannot deduct IRS penalties on

In accordance with IRC 6601 the payment of interest is required on underpayments of tax unless otherwise specified by law IRC 6621 provides the interest rates on overpayments and underpayments of tax which are tied to the Federal short term interest rate Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of

Is Interest On Underpayment Of Tax Deductible

Is Interest On Underpayment Of Tax Deductible

https://silvertaxgroup.com/wp-content/uploads/2020/11/owe-taxes-underpayment-penalties.jpg

/31844337457_bc187b1e6e_k-6335cb7fd1104606b62f5194903cd89b.jpg)

Underpayment Penalty Definition

https://www.investopedia.com/thmb/V4cvC5wyaeJjUsVwJiQ73Jl2SkE=/2048x1415/filters:fill(auto,1)/31844337457_bc187b1e6e_k-6335cb7fd1104606b62f5194903cd89b.jpg

Irs Underpayment Penalty Calculator MacRuvarashe

https://2020taxresolution.com/wp-content/uploads/2022/01/tax-penalty-with-pen-calculator-tax-report-sign-1024x621.jpg

Temporary regulations section 1 163 9T b 2 i A specifies that personal interest includes interest paid on underpayments of individual federal state or local income taxes and on debt incurred to pay such taxes regardless of the source of No interest shall be payable for any period before April 16 1977 March 16 1977 in the case of a corporation on any underpayment of a tax imposed by the Internal Revenue Code of 1986 formerly I R C 1954 to the extent that such underpayment was created or increased by any provision of the Tax Reform Act of 1976 Pub L 94 455

The IRS charges underpayment interest when you don t pay your tax penalties additions to tax or interest by the due date The underpayment interest applies even if you file an extension If you pay more tax than you owe we pay interest on the overpayment amount Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Download Is Interest On Underpayment Of Tax Deductible

More picture related to Is Interest On Underpayment Of Tax Deductible

Penalty For The Underpayment Of Estimated Taxes YouTube

https://i.ytimg.com/vi/UXJGUbpcB-M/maxresdefault.jpg

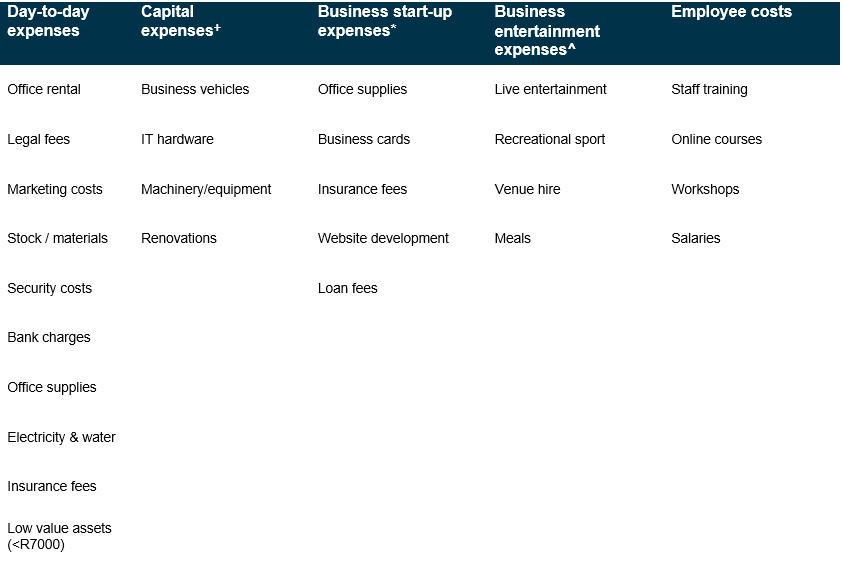

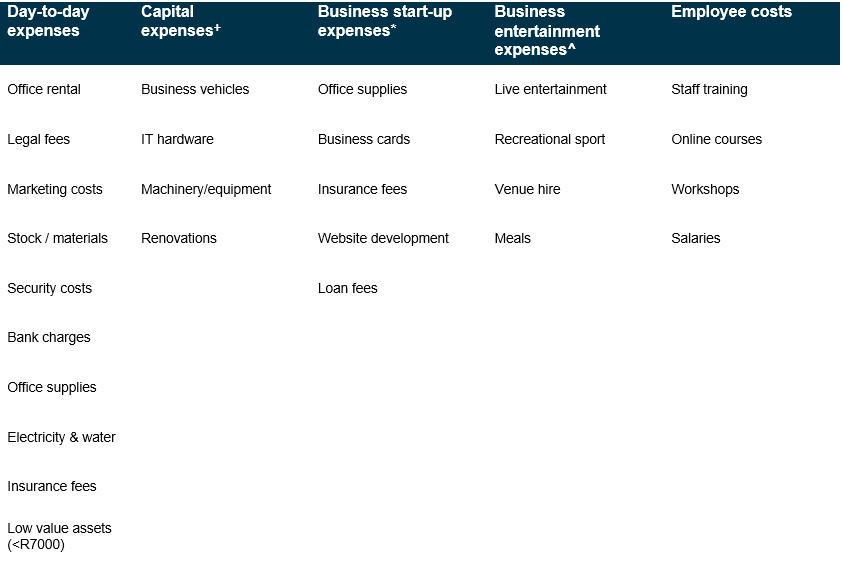

Understanding Nondeductible Expenses For Business Owners

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

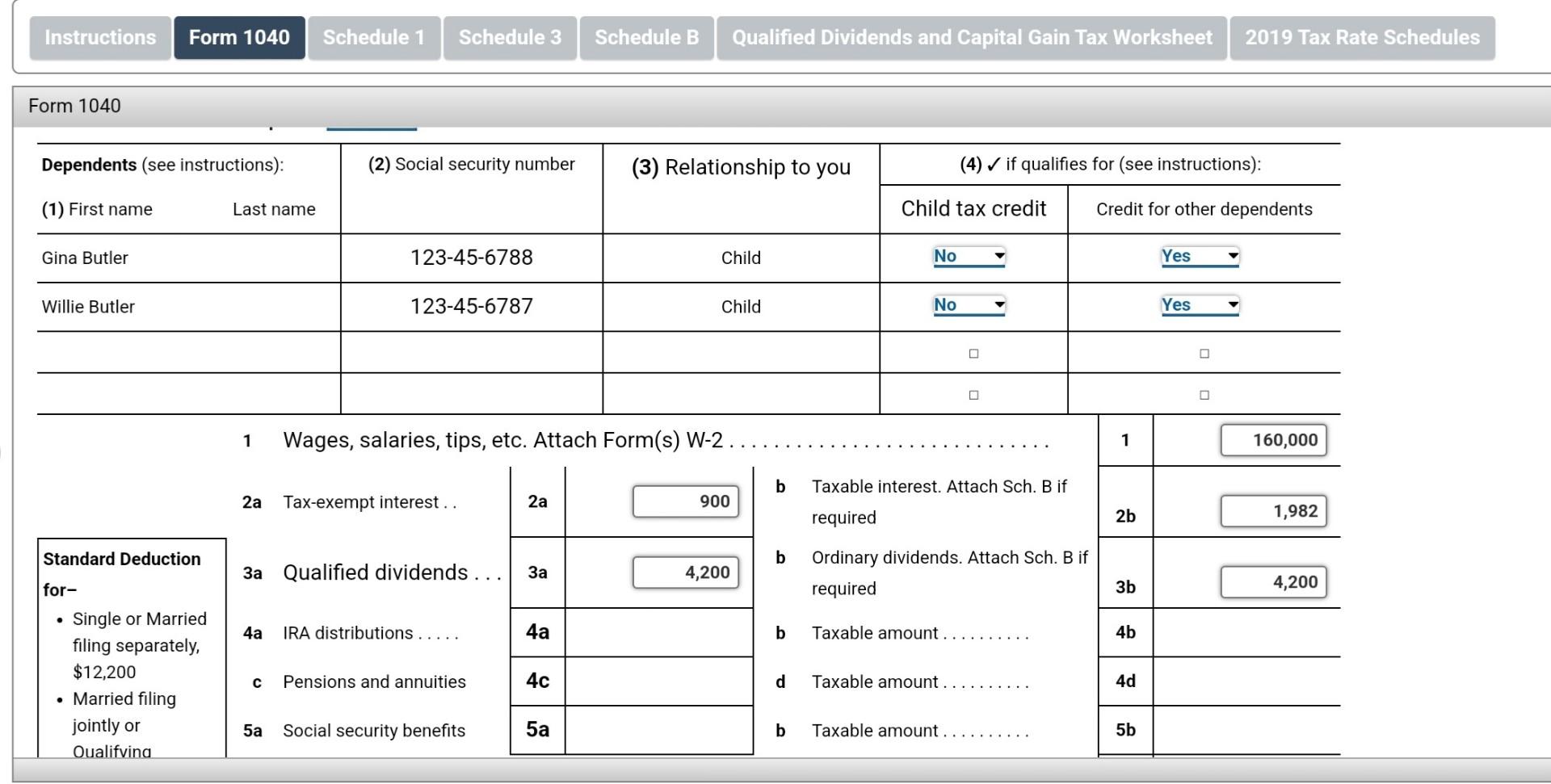

Solved Note This Problem Is For The 2019 Tax Year Daniel Chegg

https://media.cheggcdn.com/study/559/55971a09-1ae0-47d5-9c7e-e8effc372189/image.jpg

June 5 2022 The short answer is no Penalties and interests paid to the Internal Revenue Service IRS are not deductible on your next tax return Read further to learn more about the penalties and interests in question and what expenses are actually tax deductible Interest Payments Tax underpayments and overpayments accrue interest as well The IRS determines the interest rate every quarter generally basing it on the federal short term rate plus

Interest on late paid Class 1 Class 1A and Class 1B National Insurance Contributions is not deductible for tax purposes Contract settlements A valid contractual settlement displaces HMRC If you underpay tax we ll charge you interest We may also charge a penalty with interest This is often called use of money interest or UOMI If your ability to make a tax payment on time has been affected by COVID 19 we may be able to write off use of money interest COVID 19 Penalties and interest What interest is applied to

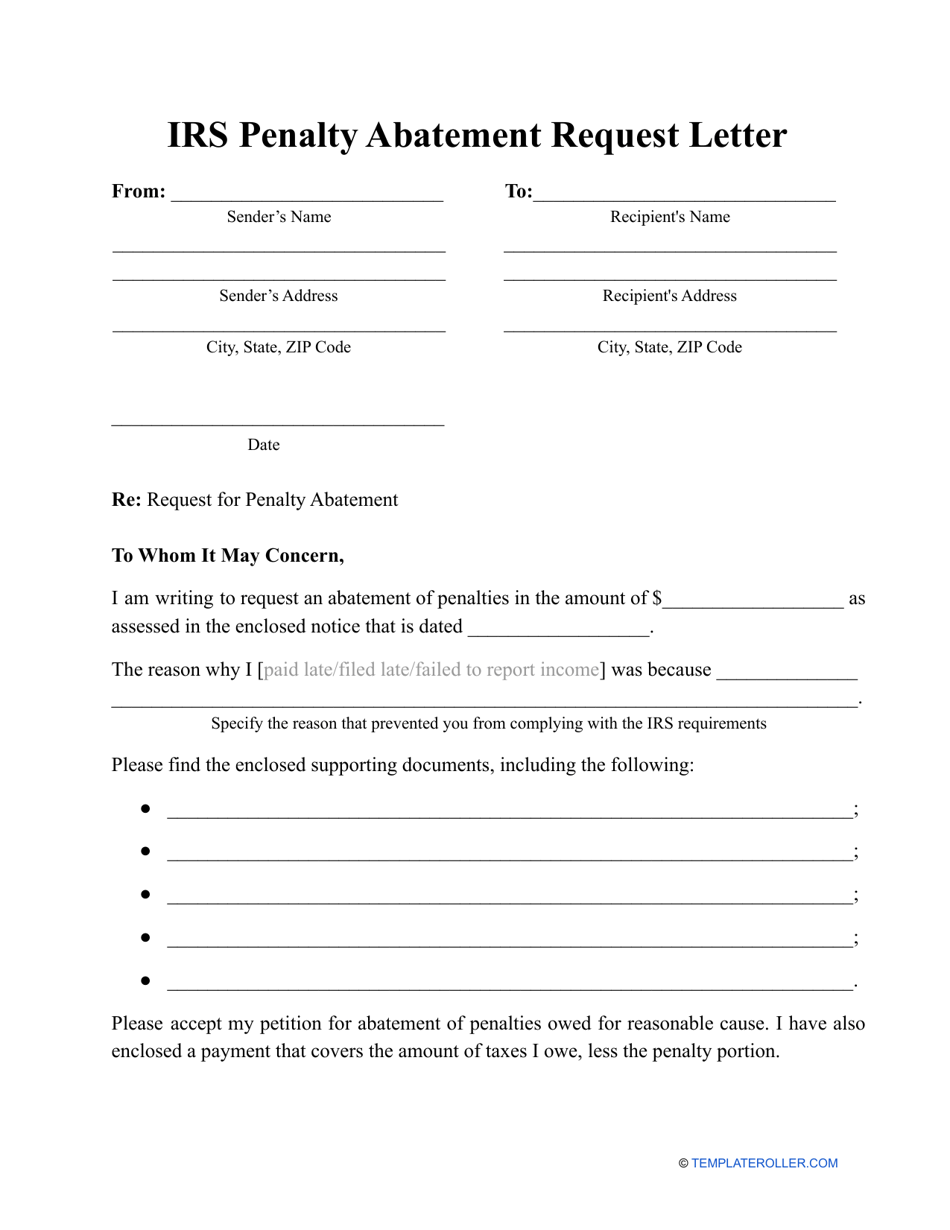

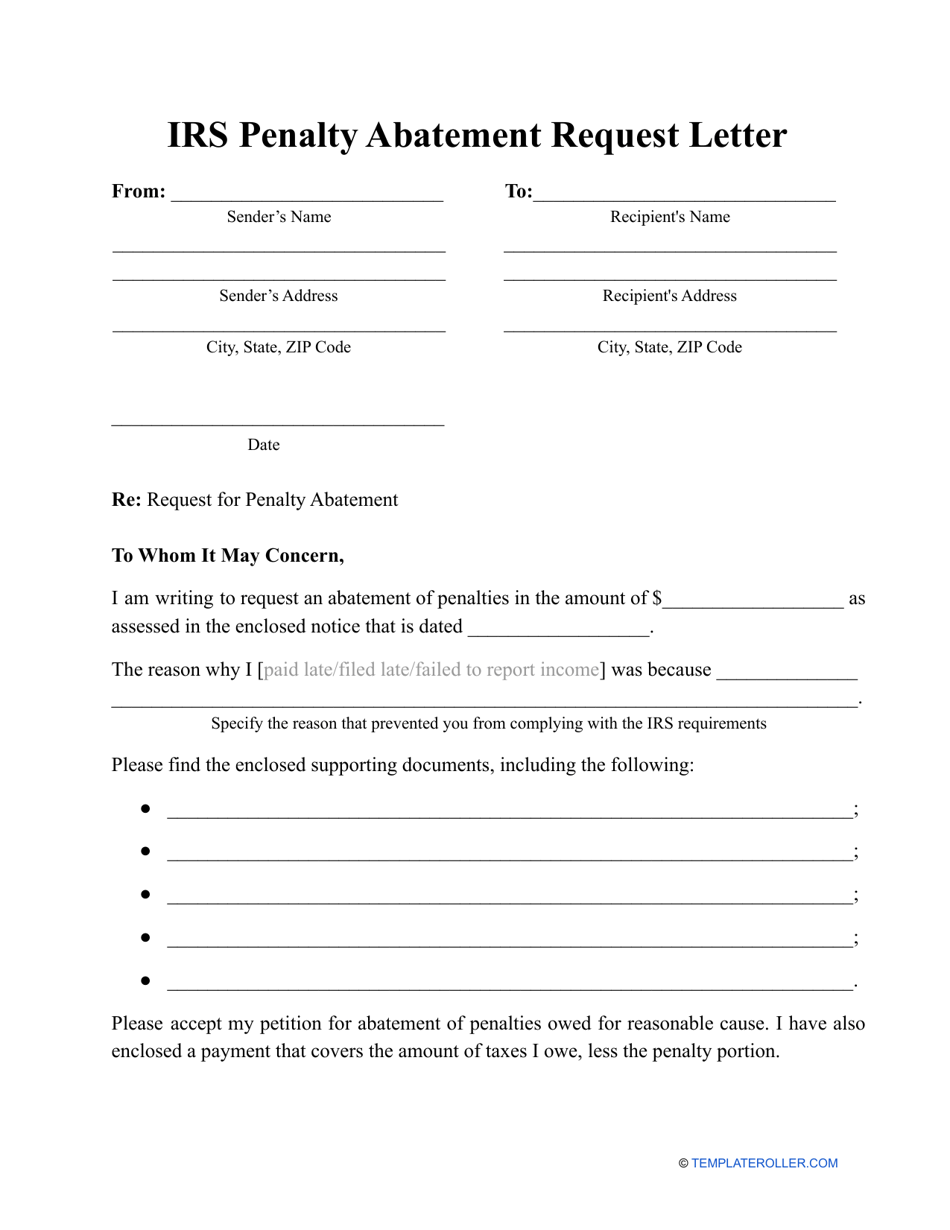

IRS Penalty Abatement Request Letter Template Download Printable PDF

https://data.templateroller.com/pdf_docs_html/2209/22095/2209532/irs-penalty-abatement-request-letter-template_print_big.png

Irs Interest Rates For Underpayment Of Taxes 2022 2023 Fill Online

https://www.pdffiller.com/preview/626/995/626995029/big.png

https://www. investopedia.com /ask/answers/102915/...

The IRS typically assesses penalties along with interest on the balance owed by a taxpayer and this interest is not tax deductible Key Takeaways Taxpayers cannot deduct IRS penalties on

/31844337457_bc187b1e6e_k-6335cb7fd1104606b62f5194903cd89b.jpg?w=186)

https://www. irs.gov /irm/part20/irm_20-002-005r

In accordance with IRC 6601 the payment of interest is required on underpayments of tax unless otherwise specified by law IRC 6621 provides the interest rates on overpayments and underpayments of tax which are tied to the Federal short term interest rate

How Much Is The IRS Tax Underpayment Penalty Landmark Tax Group

IRS Penalty Abatement Request Letter Template Download Printable PDF

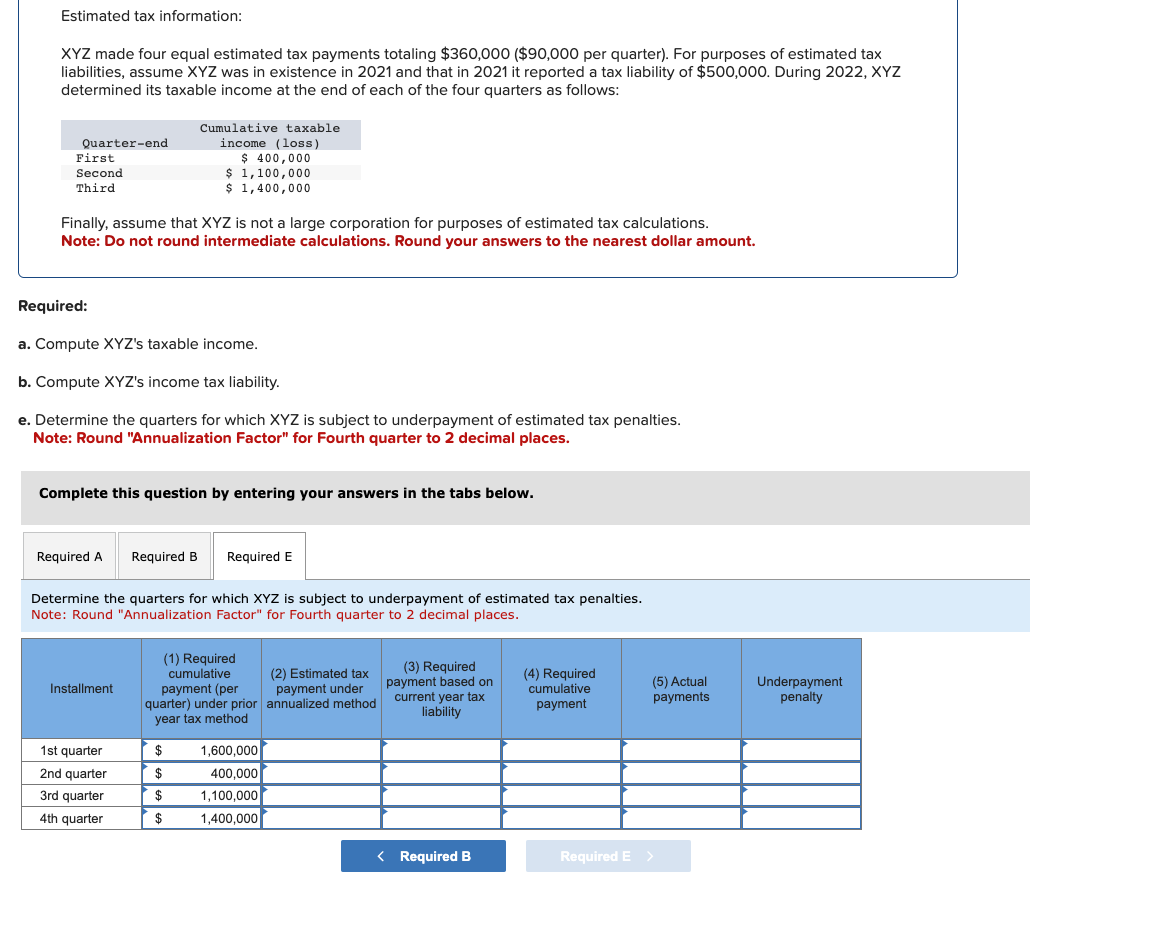

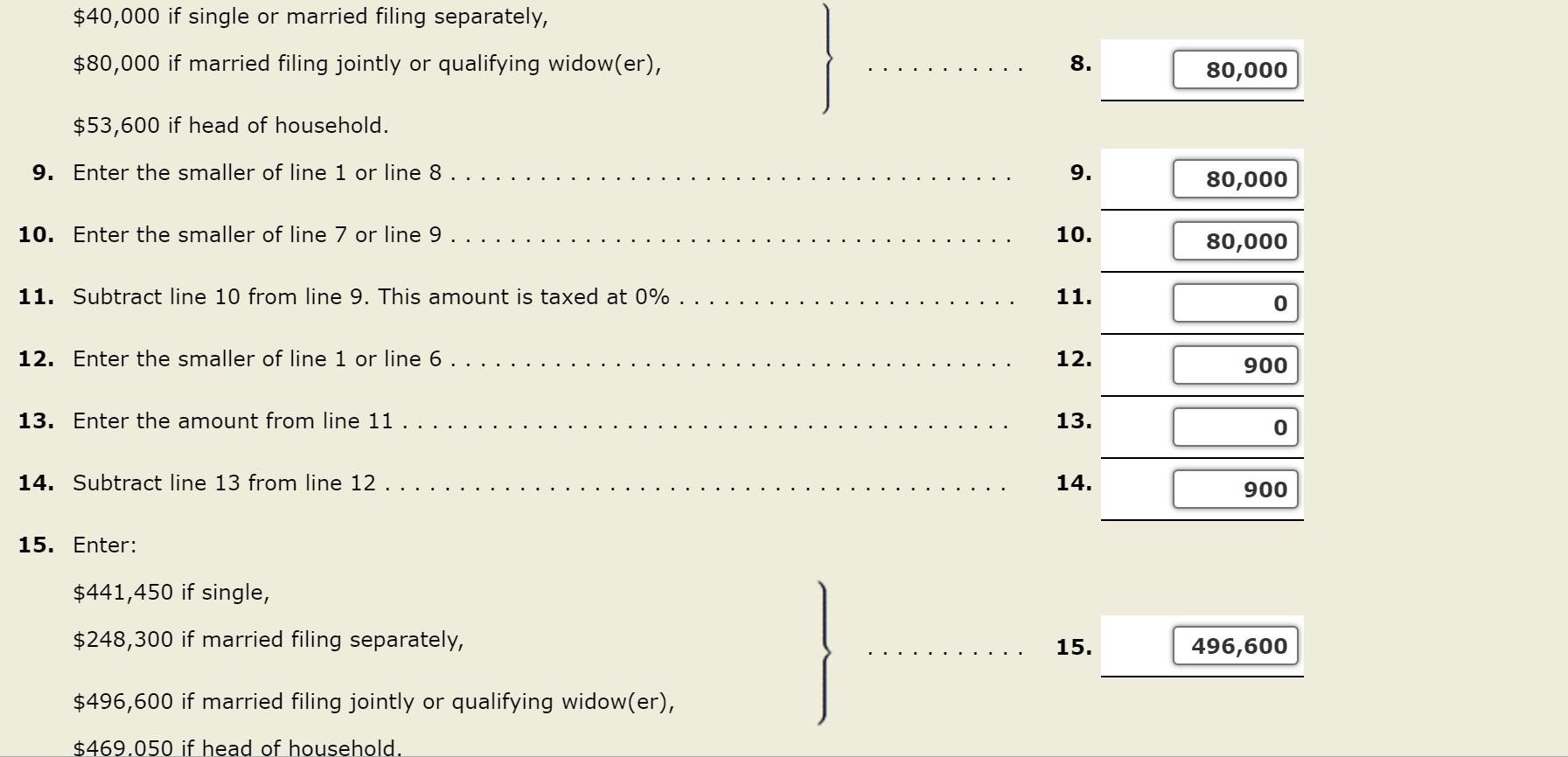

Solved Estimated Tax Information XYZ Made Four Equal Chegg

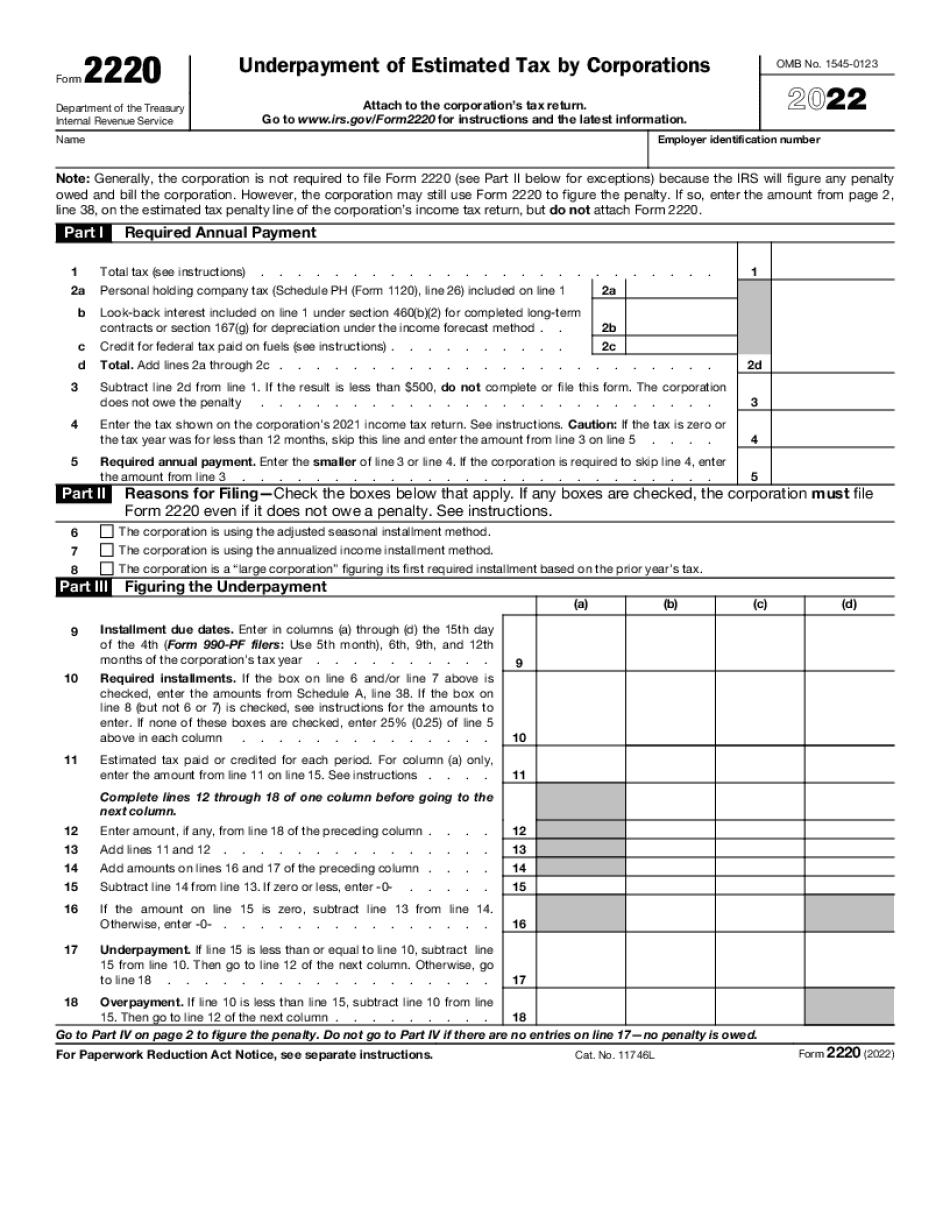

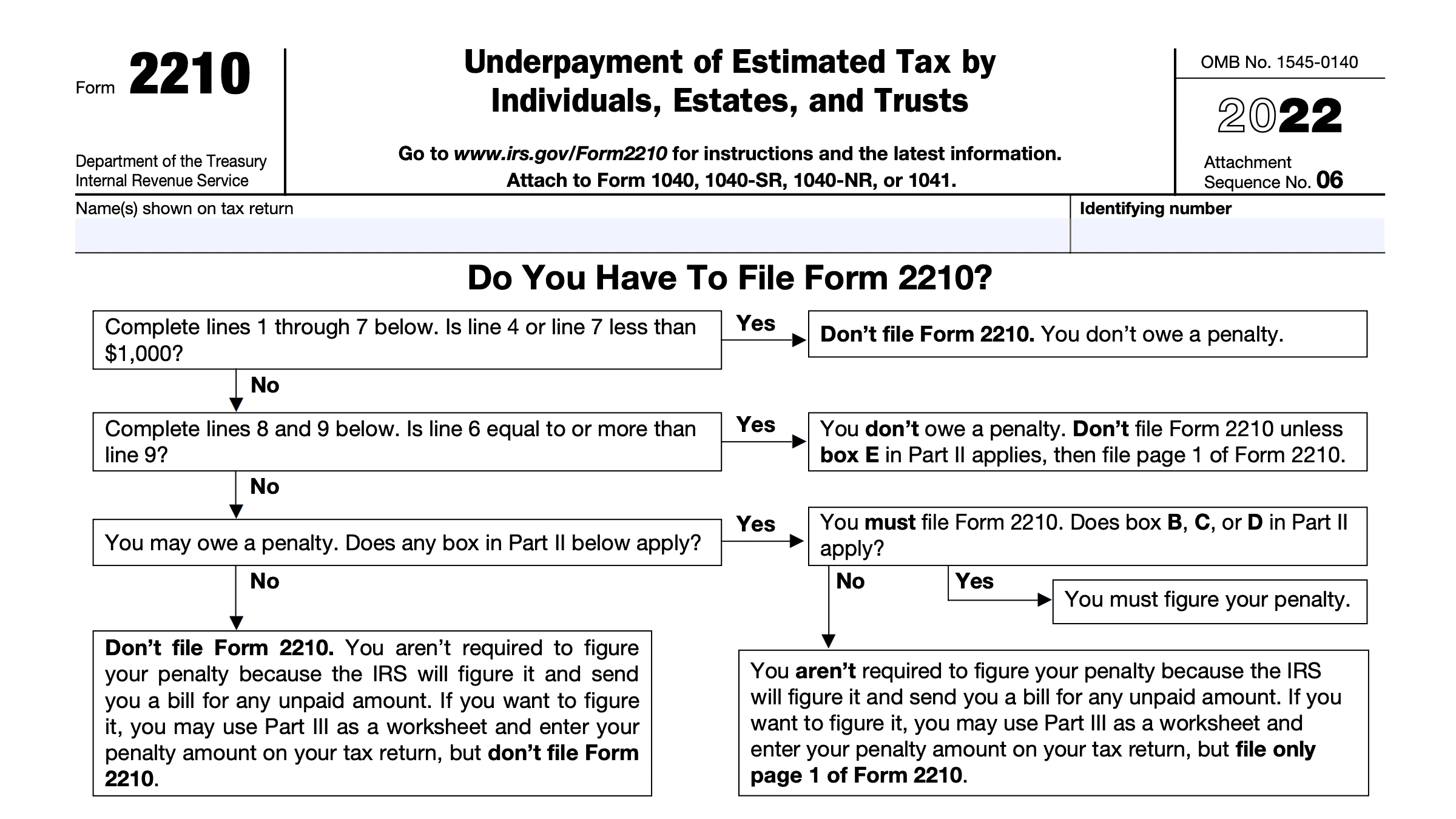

Estimated Tax Underpayment Penalty Waiver Rules Internal Revenue

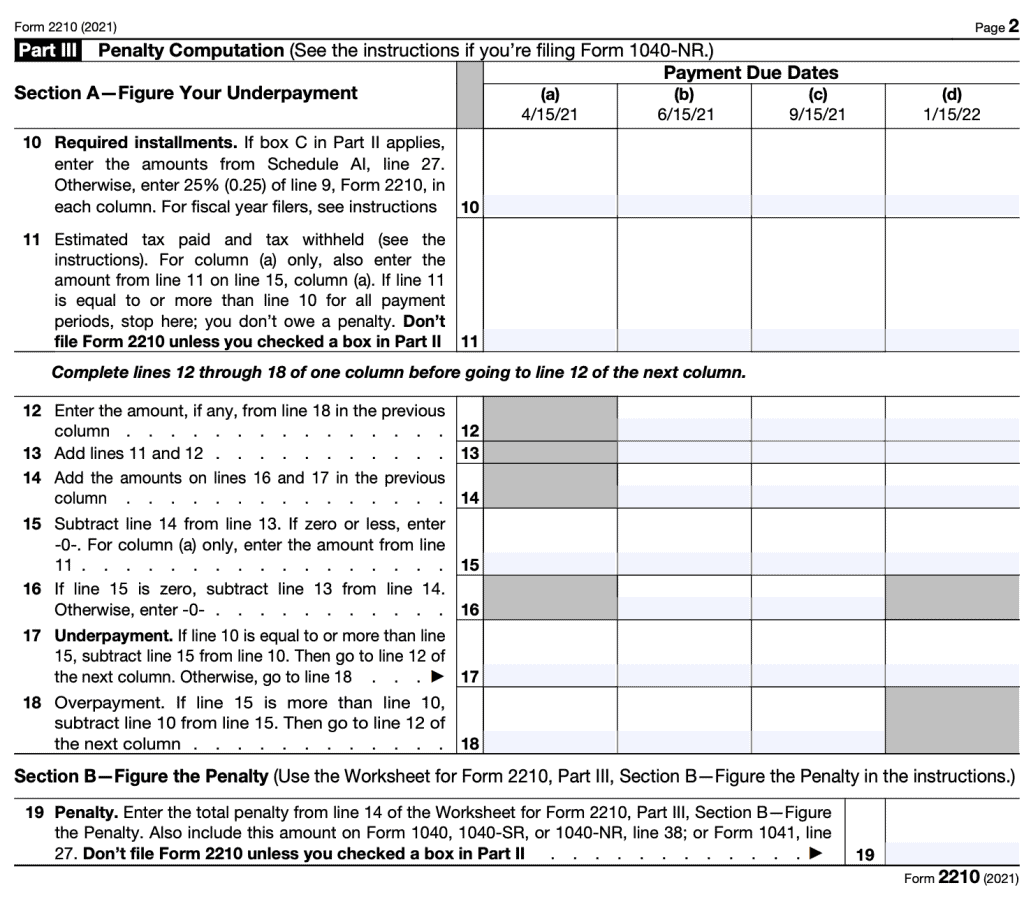

IRS Form 2210 Instructions Underpayment Of Estimated Tax

Tax deductible Expenses For Small Businesses On Accounting

Tax deductible Expenses For Small Businesses On Accounting

IRS Form 2210 A Guide To Underpayment Of Tax

Note This Problem Is For The 2020 Tax Year Daniel Chegg

:max_bytes(150000):strip_icc()/TermDefinitions_Underpaymentpenalty_finalv1-4dfc8b09facc4bd3a480917c81ec5b7c.png)

Tax Underpayment Penalty What It Is Examples And How To Avoid One

Is Interest On Underpayment Of Tax Deductible - No interest shall be payable for any period before April 16 1977 March 16 1977 in the case of a corporation on any underpayment of a tax imposed by the Internal Revenue Code of 1986 formerly I R C 1954 to the extent that such underpayment was created or increased by any provision of the Tax Reform Act of 1976 Pub L 94 455