Is Interest Tax Deductible Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Not all interest is tax deductible In general tax deductible interest is interest you pay on your mortgage student loans and some investments Tax deductible interest might be an adjustment to income or it can be an itemized deduction depending on the type of loan Taxation of interest Interest income from Treasury bills notes and bonds is subject to federal income tax but is exempt from all state and local income taxes You should receive Form 1099 INT showing the interest in box 3 paid to you for the year

Is Interest Tax Deductible

Is Interest Tax Deductible

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/pre-commencement-expense-diagram__.png?sfvrsn=fa5ce7e_2

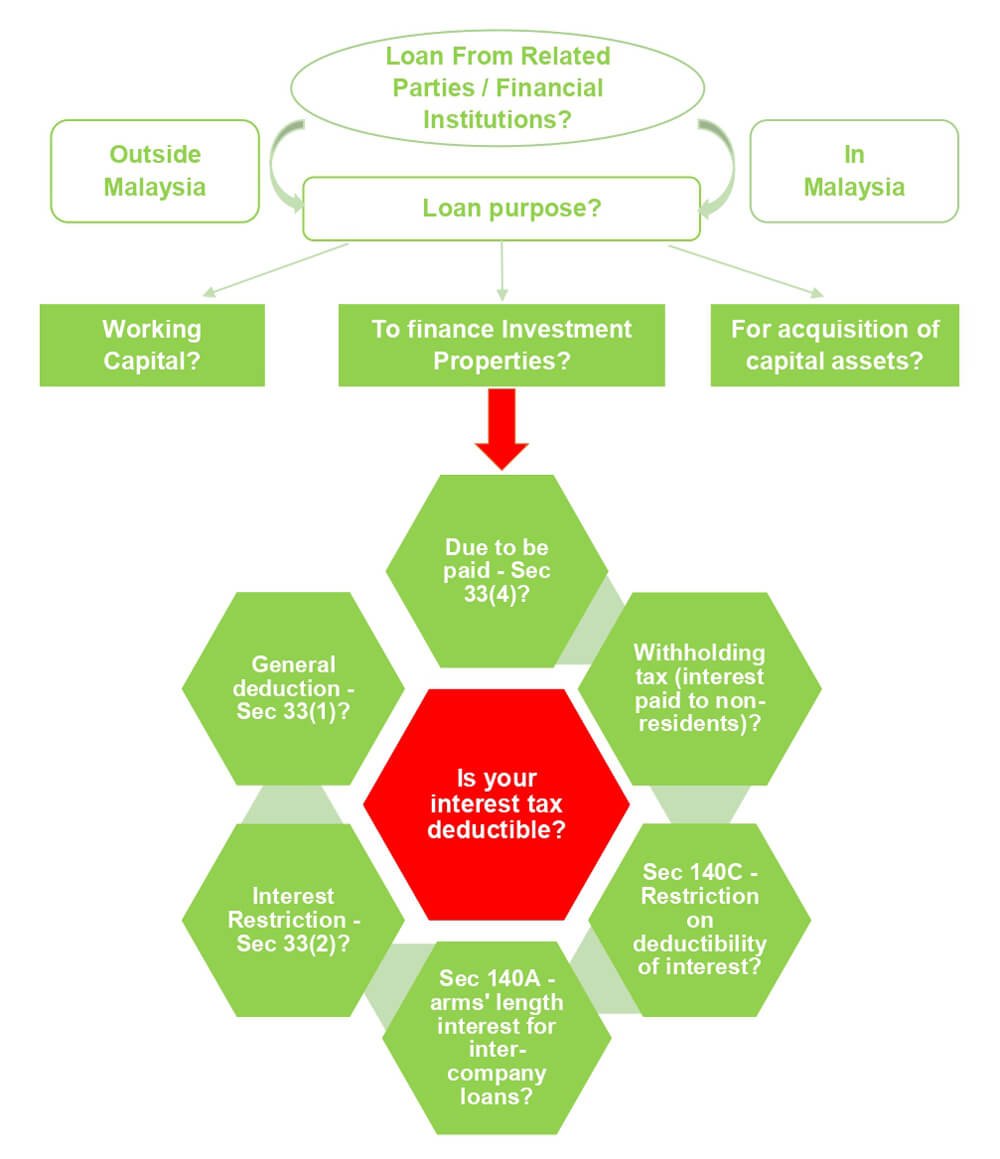

Is Your Interest Tax Deductible ShineWing TY TEOH

https://shinewingtyteoh.com/wp-content/uploads/2021/11/Interest-Tax-Graph.jpg

What Does tax Liability Mean Is That The Amount Business Accounting

https://business-accounting.net/wp-content/uploads/2021/07/image-EfOTbCYQMszwaXR9.png

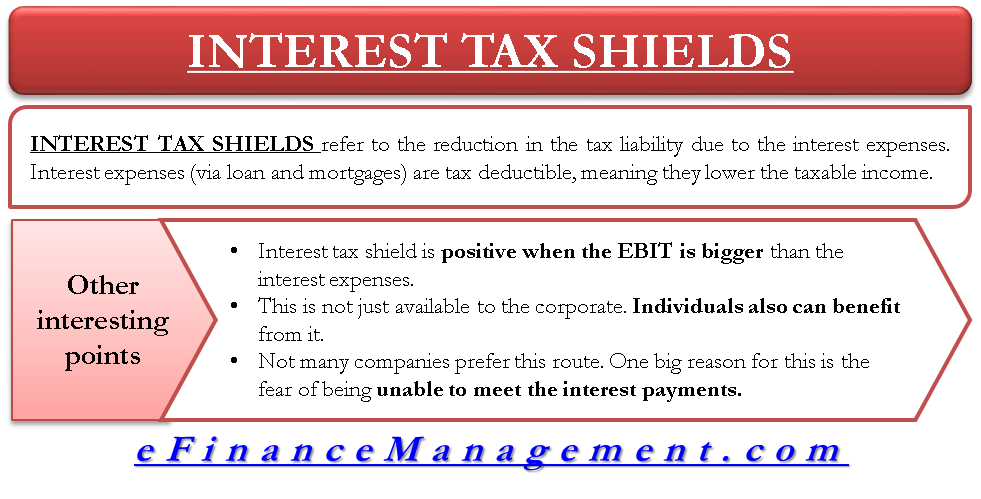

Tax deductible interest is a borrowing expense that taxpayers can claim on federal and state tax returns to reduce their taxable income and save money Qualified student loan interest and business interest are deductible befor e adjusted gross income AGI above the line qualified residence interest and investment interest are deductible from AGI below the line and personal interest is not deductible

You can t claim a deduction for interest you incur on a personal tax debt For example you can t claim the interest on a loan you take to pay your personal tax debt Investment seminars Deductible investment interest expenses refer to the interest paid on money borrowed to invest in assets that produce taxable investment income or appreciate in value allowing you to sell at a future gain

Download Is Interest Tax Deductible

More picture related to Is Interest Tax Deductible

Is Interest Tax Deductible On A Reverse Mortgage YouTube

https://i.ytimg.com/vi/wt9vp6kbnrw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgXyhUMA8=&rs=AOn4CLD4cjpQKr09a6s1q4TTmoeZoLrOVg

Five Types Of Interest Expense Three Sets Of New Rules

https://www.thetaxadviser.com/content/dam/tta/issues/2018/oct/witner-exhibit.JPG

Is Savings Account Interest Tax Deductible

https://s.yimg.com/uu/api/res/1.2/evO7M0dUmFwjNGktKceIXQ--~B/aD0xNDYzO3c9MjA0OTtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/motleyfool.com/cbdf5e307d50f0dbe4cdc22816aa633e

Taxable interest income is any money you earn on your investments or savings accounts When an account pays you interest for the money you have in that account or you earn an annual percentage yield APY on the money you have in the account then that earned interest is taxable Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim interest you ve paid when you file your taxes if you take

[desc-10] [desc-11]

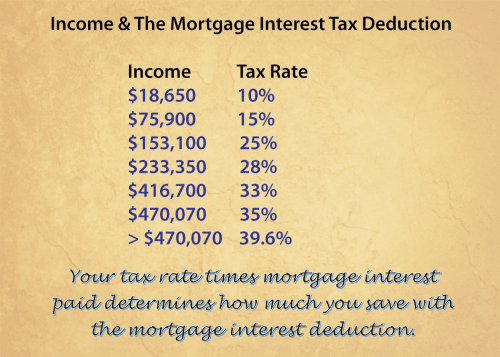

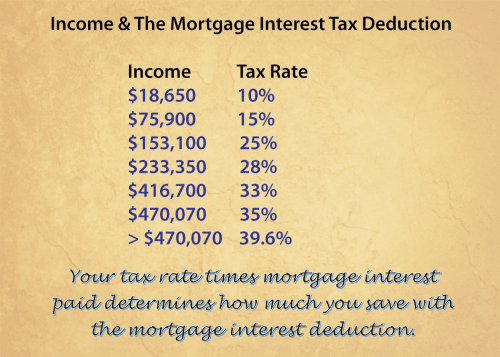

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage

https://assets.themortgagereports.com/wp-content/uploads/2017/07/tax-brackets-500x357.png

Mortgage Minute Making Mortgage Interest Tax Deductible YouTube

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

https://www.irs.gov/taxtopics/tc505

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

https://www.thebalancemoney.com/what-is-tax-deductible-interest...

Not all interest is tax deductible In general tax deductible interest is interest you pay on your mortgage student loans and some investments Tax deductible interest might be an adjustment to income or it can be an itemized deduction depending on the type of loan

HELOC Is The Interest Tax Deductible YouTube

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage

The Ultimate Refinance Guide For The Financially Savvy Backpocket CPA

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

Is Credit Card Interest Deductible Tax Hive Strategic Tax Planning

Lower Your Taxes 10 Deductible Expenses In The Philippines

Lower Your Taxes 10 Deductible Expenses In The Philippines

Are Interest Payments Tax Deductible MoneySense

Is Credit Card Interest Tax Deductible 2023

Is Interest Rate Tax deductible Jan 04 2022 Johor Bahru JB

Is Interest Tax Deductible - You can t claim a deduction for interest you incur on a personal tax debt For example you can t claim the interest on a loan you take to pay your personal tax debt Investment seminars