Is It Better To Claim Mileage Or Gas On Taxes Note that what s considered a pro or con depends on your circumstances when filing your taxes Which is better the standard

September 25 2015 Your Guide to Deducting Mileage versus Gas Receipts If you use Claiming a deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to

Is It Better To Claim Mileage Or Gas On Taxes

Is It Better To Claim Mileage Or Gas On Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabad516a1f1ceea16e1_60d8c67933840b4f5f836616_claim-mileage-deduction-canada.jpeg

Gas Mileage Calculator Taxes LeighannBelle

https://uploads-ssl.webflow.com/60882c80d0ef9737f2ee0911/6183a909e9214c4375f1a5d6_irs rates 5.png

How To Claim Mileage Allowance When You re Self employed IPSE

https://www.ipse.co.uk/static/4db9b86a-25f4-4013-8a7bb18629e14019/freelancer-driving-mileage.jpg

Accounting Bookkeeping Business Expenses By Fraser Sherman Is It Better to Claim Mileage or Gas for Taxes Claiming mileage or

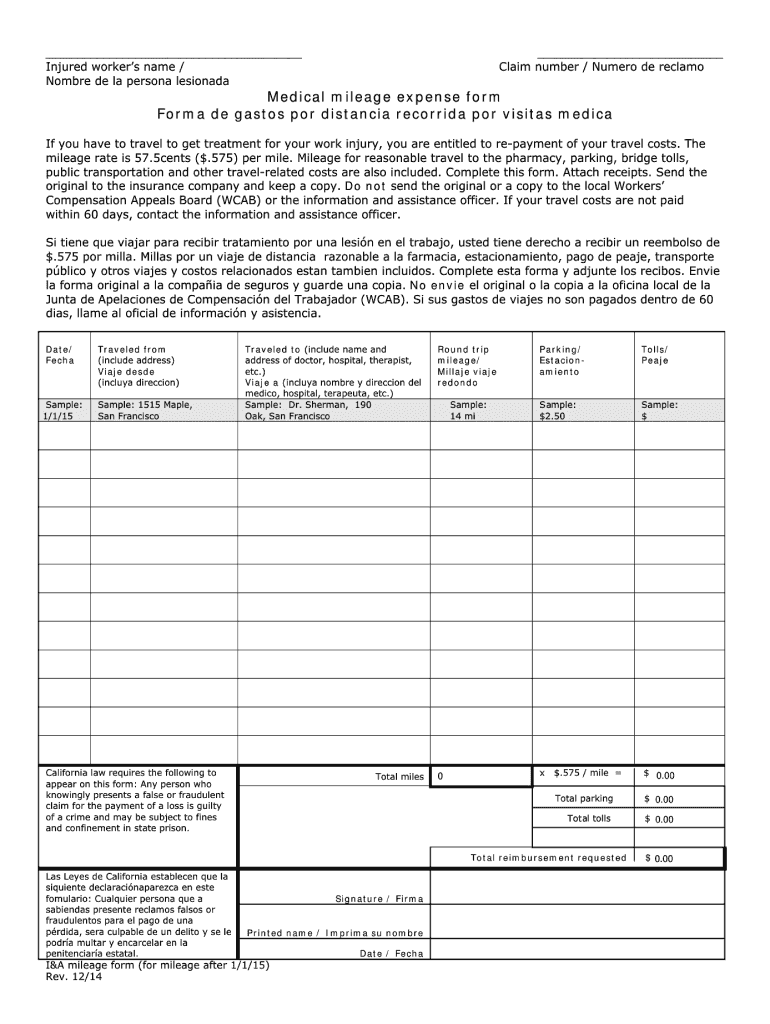

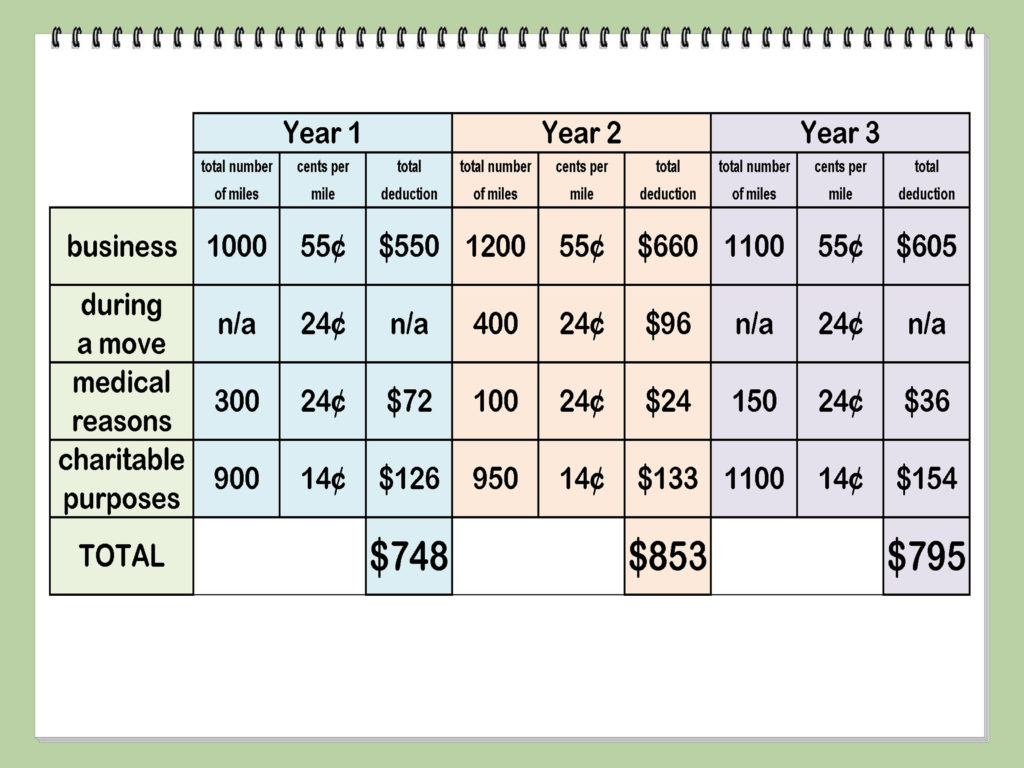

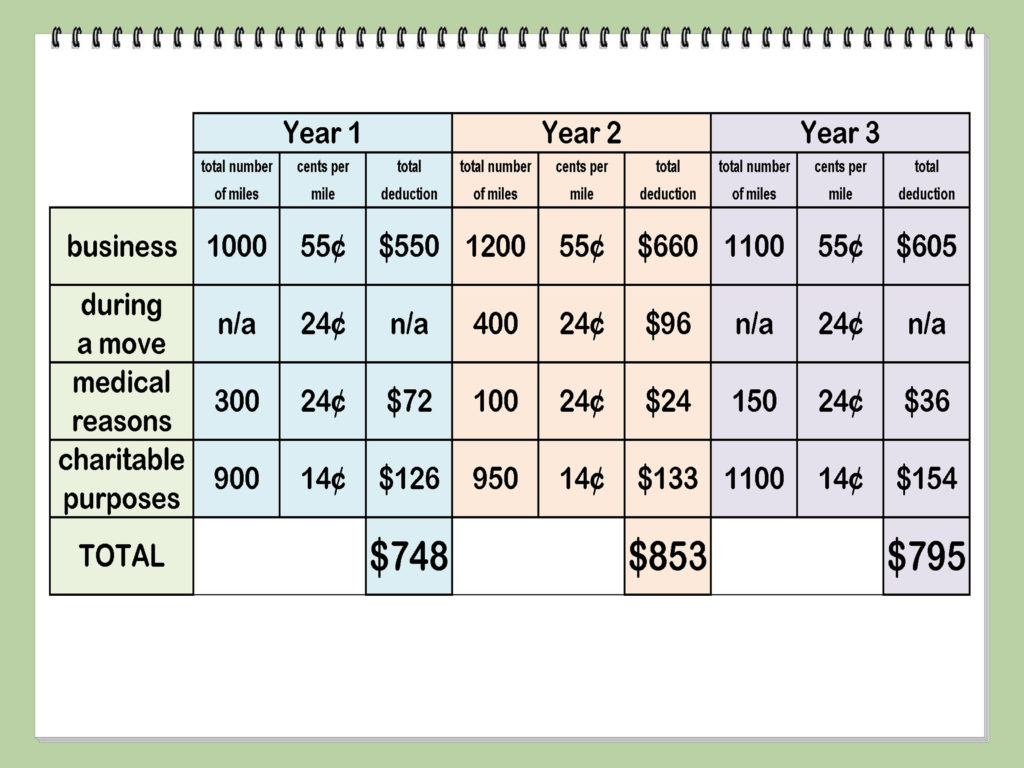

Comparison Mileage reimbursements are worth more to you than deducting a mileage allowance on your tax return A reimbursement for mileage pays you 100 percent of the mileage The mileage tax deduction rules generally allow you to claim 0 655 per mile in 2023 if you are self employed You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if

Download Is It Better To Claim Mileage Or Gas On Taxes

More picture related to Is It Better To Claim Mileage Or Gas On Taxes

Can You Deduct Gas On Taxes

https://taxsaversonline.com/wp-content/uploads/2022/07/Can-You-Deduct-Gas-On-Taxes-1-850x567.jpg

Is It Better To Claim 1 Or 0 On Your W 4 Form YouTube

https://i.ytimg.com/vi/rCr8n9xZpsA/maxresdefault.jpg

Mileage Form 2021 IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/tax-forms-for-mileage-claims-fill-out-and-sign-printable-5.png

Key Takeaways For business driving you can choose between using the You can generally either deduct a flat rate based on your miles traveled

As a limited company you have the choice to use either method however when using the mileage method VAT can only be claimed back on the fuel element of the mileage It can get technical If you drive a personal vehicle for business use you can choose to take

How Much Fuel Can I Claim On Taxes Leia Aqui Is It Better To Claim

https://cdn.mos.cms.futurecdn.net/W6XdppKMYTgYXVCSJeQb3X.jpg

Example Of 25 Printable Irs Mileage Tracking Templates Gofar Mileage

https://i.pinimg.com/originals/5b/93/c0/5b93c0ebe22d3e39de585887378000ba.jpg

https://turbotax.intuit.com/tax-tips/self...

Note that what s considered a pro or con depends on your circumstances when filing your taxes Which is better the standard

https://myclearpathadvisors.com/tax-planning/your...

September 25 2015 Your Guide to Deducting Mileage versus Gas Receipts If you use

How To Claim Mileage On 2018 Taxes GOFAR

How Much Fuel Can I Claim On Taxes Leia Aqui Is It Better To Claim

Mileage Claim Form Template

How To Claim Mileage Allowance Expenses Explained In Under 60 Seconds

You ll Never Forget To Use This Simple Mileage Log Money Saving Tips

Government Mileage Calculator IRS Mileage Rate 2021

Government Mileage Calculator IRS Mileage Rate 2021

Can I Claim Mileage On My Taxes

A Friendly Guide To Schedule C Tax Forms U S FreshBooks Blog

Getting Terrible Gas Mileage Any Tips And Or What To Do Get Better Mpg

Is It Better To Claim Mileage Or Gas On Taxes - Accounting Bookkeeping Business Expenses By Fraser Sherman