Is Kvp Taxable On Withdrawal Web 21 Mai 2023 nbsp 0183 32 A reader asks how to avoid double taxation on the interest earned from a Kisan Vikas Patra KVP investment KPMG India advises on tax implications and

Web 31 Mai 2022 nbsp 0183 32 While withdrawing the amount do I need to pay income tax if returns are more than 1 lakh after 10 years especially if I don t have any other income Name Web 19 Dez 2023 nbsp 0183 32 Is KVP taxable KVP doesn t come under the 80C deductions thus the returns are completely taxable However withdrawals made after the maturity of the

Is Kvp Taxable On Withdrawal

Is Kvp Taxable On Withdrawal

https://paytm.com/blog/wp-content/uploads/2022/09/kisan-vikas-patra-scheme.png

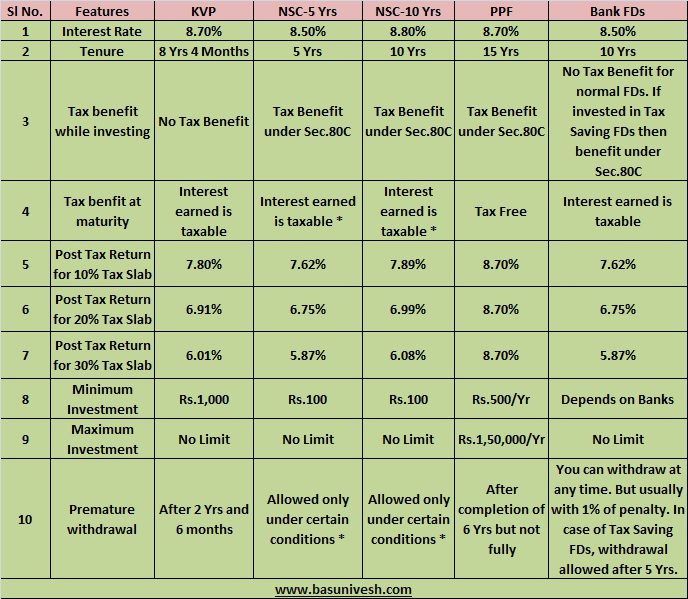

Comparison Of KVP NSC PPF And Bank FDs

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2014/11/Comparison-of-KVP-NSC-PPF-and-FDs.jpg?lossy=1&strip=1&webp=1

KVP Premature Withdrawal Calculations Pre Maturity

https://i.ytimg.com/vi/0AjaOozJ4N8/maxresdefault.jpg

Web 25 Apr 2022 nbsp 0183 32 What will be the tax benefits for investing in Kisan Vikas Patra The returns received from the Kisan Vikas Patra are not eligible for any tax deductions under Section Web Is Kisan Vikas Patra interest taxable Yes KVP s interests are taxable on accrual basis every financial year and the tax is applied on the same as Income from other sources How to encash KVP You can encash KVP

Web 3 Feb 2015 nbsp 0183 32 Taxation There is no incentive for investment in KVP and Interest on KVP is taxable on accrual basis and will be taxed as Income from Other Sources deduction under section 80C is not allowed on this Web 13 Juli 2023 nbsp 0183 32 It s important to note that the returns provided by KVP are taxable since it doesn t fall under the Section 80C tax deduction However when the maturity period is

Download Is Kvp Taxable On Withdrawal

More picture related to Is Kvp Taxable On Withdrawal

KVP Premature Withdrawal Table 2023 Kvp Premature Closure Kvp

https://i.ytimg.com/vi/-74u4dysubc/maxresdefault.jpg

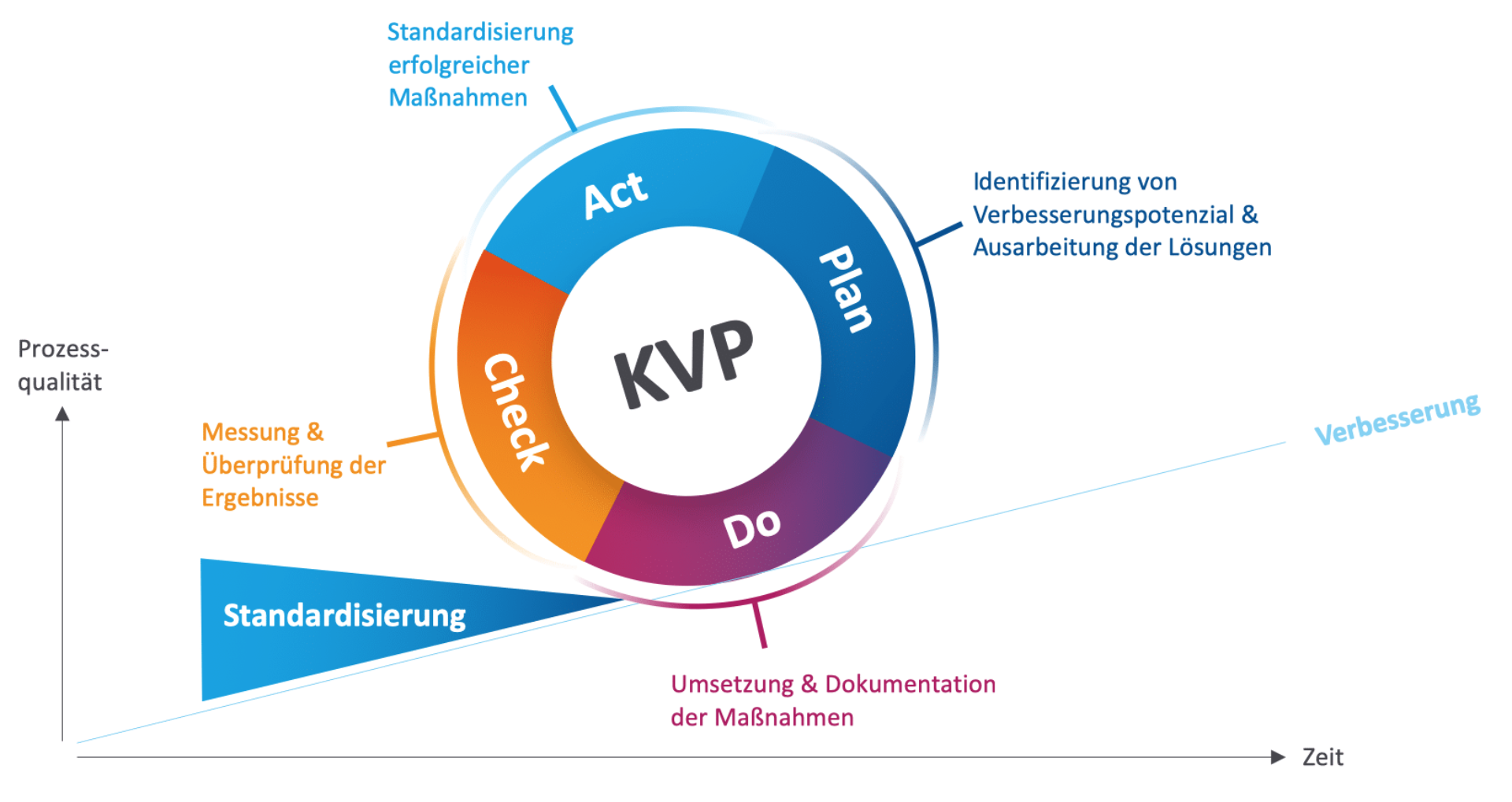

KVP Und Kaizen Kontinuierlich Den Prozess Verbessern

https://forcam.com/app/uploads/2021/04/kvp-kontinuierlicher_verbesserungsprozess-forcam-1920x0-c-default.png

Bank Withdrawal Rules

https://krushiinformation.com/wp-content/uploads/2024/01/Bank-Withdrawal-Rules.webp

Web 30 Okt 2022 nbsp 0183 32 Any Indian resident aged 18 years and above can purchase a KVP certificate individually or jointly with an eligible person One can operate the KVP for 123 months Premature closure of the account is Web 12 Juli 2023 nbsp 0183 32 Can I prematurely withdraw my investment from KVP Kisan Vikas Patra Yes premature withdrawal is allowed after completing 2 5 years from the date of

Web 28 Dez 2023 nbsp 0183 32 KVP is taxable upon maturity There is no tax benefit under this scheme However withdrawals made after the maturity of the scheme are exempt from Tax Web 23 Nov 2022 nbsp 0183 32 Introduction KVP Interest Rates Interest Applicability on Premature Withdrawal of KVP Benefits of KVP Eligibility Criteria and Document Requirements for

Full Form Of KVP KVP Full Form KVP Mean KVP Stands For KVP

https://i.ytimg.com/vi/RI-ZVkTPVlA/maxresdefault.jpg

Notice Withdrawal Counsel Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/312/497312497/large.png

https://www.livemint.com/money/personal-finance/avoiding-double...

Web 21 Mai 2023 nbsp 0183 32 A reader asks how to avoid double taxation on the interest earned from a Kisan Vikas Patra KVP investment KPMG India advises on tax implications and

https://www.livemint.com/money/personal-finance/how-income-tax-o…

Web 31 Mai 2022 nbsp 0183 32 While withdrawing the amount do I need to pay income tax if returns are more than 1 lakh after 10 years especially if I don t have any other income Name

FD Vs NSC KVP

Full Form Of KVP KVP Full Form KVP Mean KVP Stands For KVP

Kisan Vikas Patra Interest Rate Wint Wealth

Cash Withdrawal Loop By Nayna Yadav On Dribbble

How To Withdraw Funds From Zerodha

Benefits And Withdrawal Rules Of 401 k Plans InsightMania

Benefits And Withdrawal Rules Of 401 k Plans InsightMania

2023 24 Tax Brackets And Federal Income Tax Rates What They Mean For

Do I Have To Report A Loan From My 401k Leia Aqui Do I Have To Report

Tax Calculator 2022 23 India Latest News Update

Is Kvp Taxable On Withdrawal - Web 1 Feb 2023 nbsp 0183 32 The income tax will depend on the slab that you are part of However the corpus is exempt from Tax Deducted at Source or TDS Premature Withdrawal The