Is Loan Interest Tax Deductible What Is Tax Deductible Interest Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income

Is student loan interest tax deductible Yes but within limits Learn more about how the student loan interest tax deduction works Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim interest you ve paid when you file your taxes if you take

Is Loan Interest Tax Deductible

Is Loan Interest Tax Deductible

https://images.prismic.io/pigeon-loans/731fa247-4f28-4040-9e77-d1f0909bc76a_leon-dewiwje-ldDmTgf89gU-unsplash.jpg?auto=compress,format&rect=0,0,4365,2912&w=820&h=547

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

Mortgage Minute Making Mortgage Interest Tax Deductible YouTube

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

As a general rule you cannot deduct the interest that you pay on a personal or family loan The IRS considers these standard lending products with the same rules whether you borrow from a family member or the bank However there are The interest paid on personal loans is generally not tax deductible If however you used a personal loan to fund college expenses or business expenses you may be able to deduct the

In most cases personal loans do not have tax deductible interest This is because you can t deduct personal expenses on your income taxes Babener says So if you use the personal Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

Download Is Loan Interest Tax Deductible

More picture related to Is Loan Interest Tax Deductible

Is Personal Loan Interest Tax Deductible Capital One

https://ecm.capitalone.com/WCM/learn-grow/card/lgc987_hero_is-personal-loan-interest-tax-deductible_v1.jpg

Is Home Loan Interest Tax Deductible RateCity

https://production-content-assets.ratecity.com.au/20210121/can-i-get-a-tax-deduction-for-interest-on-a-home-loan-0hWt_-VCO.jpg

HELOC Is The Interest Tax Deductible YouTube

https://i.ytimg.com/vi/SKMnUEmDjlU/maxresdefault.jpg

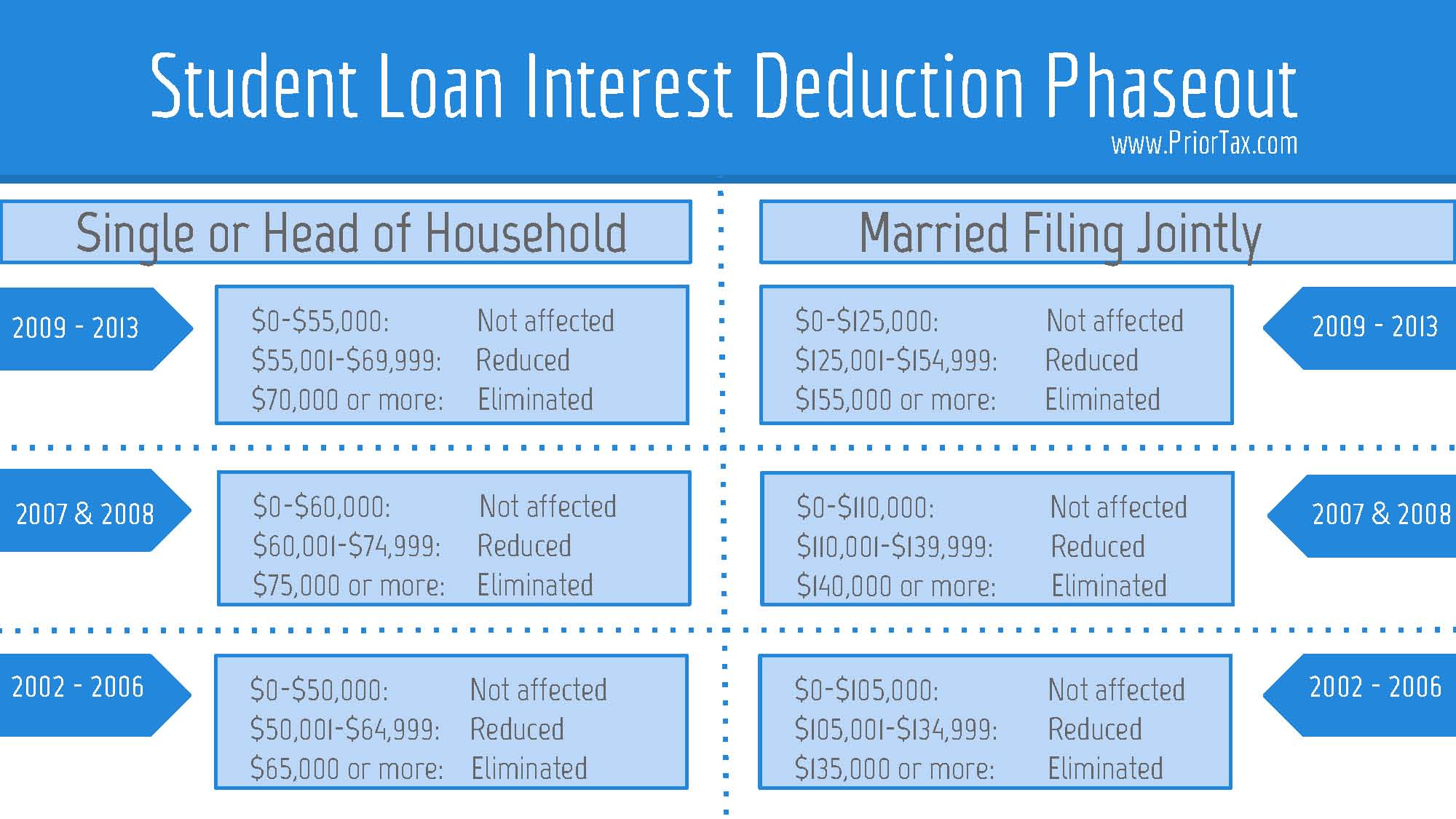

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status The interest you pay on a mortgage on a home other than your main or second home may be deductible if the proceeds of the loan were used for business investment or other deductible purposes Otherwise it is considered personal interest and isn t deductible

[desc-10] [desc-11]

Is Personal Loan Interest Tax Deductible

https://www.usatoday.com/money/blueprint/images/uploads/2023/02/13094155/credit-SerhiiBobyk-e1676281383122.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

What Is Tax Deductible Interest Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income

https://www.forbes.com/advisor/taxes/student-loan...

Is student loan interest tax deductible Yes but within limits Learn more about how the student loan interest tax deduction works

Is Car Loan Interest Tax Deductible In Canada

Is Personal Loan Interest Tax Deductible

Is Business Loan Interest Tax Deductible Limitations In 2023

Is Home Equity Loan Interest Tax Deductible For Rental Property

Student Loan Interest Deduction 2013 PriorTax Blog

Is Personal Loan Interest Tax Deductible

Is Personal Loan Interest Tax Deductible

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

Tax Benefits On Home Loan Know More At Taxhelpdesk

Is Car Loan Interest Tax Deductible Understanding Auto Loan Taxation

Is Loan Interest Tax Deductible - As a general rule you cannot deduct the interest that you pay on a personal or family loan The IRS considers these standard lending products with the same rules whether you borrow from a family member or the bank However there are