Is Medical Equipment Exempt From Sales Tax Durable medical equipment is considered taxable in Alabama even if prescribed by a medical professional but the state provides a sales tax exemption for prescribed durable medical

For those in the healthcare industry it s easy to assume that all medical related purchases are exempt from sales tax Although there are broad sales tax The Federal Board of Revenue FBR has granted sales tax exemption on the import of essential medical equipment The FBR issued SRO 1007 I 2021 on

Is Medical Equipment Exempt From Sales Tax

Is Medical Equipment Exempt From Sales Tax

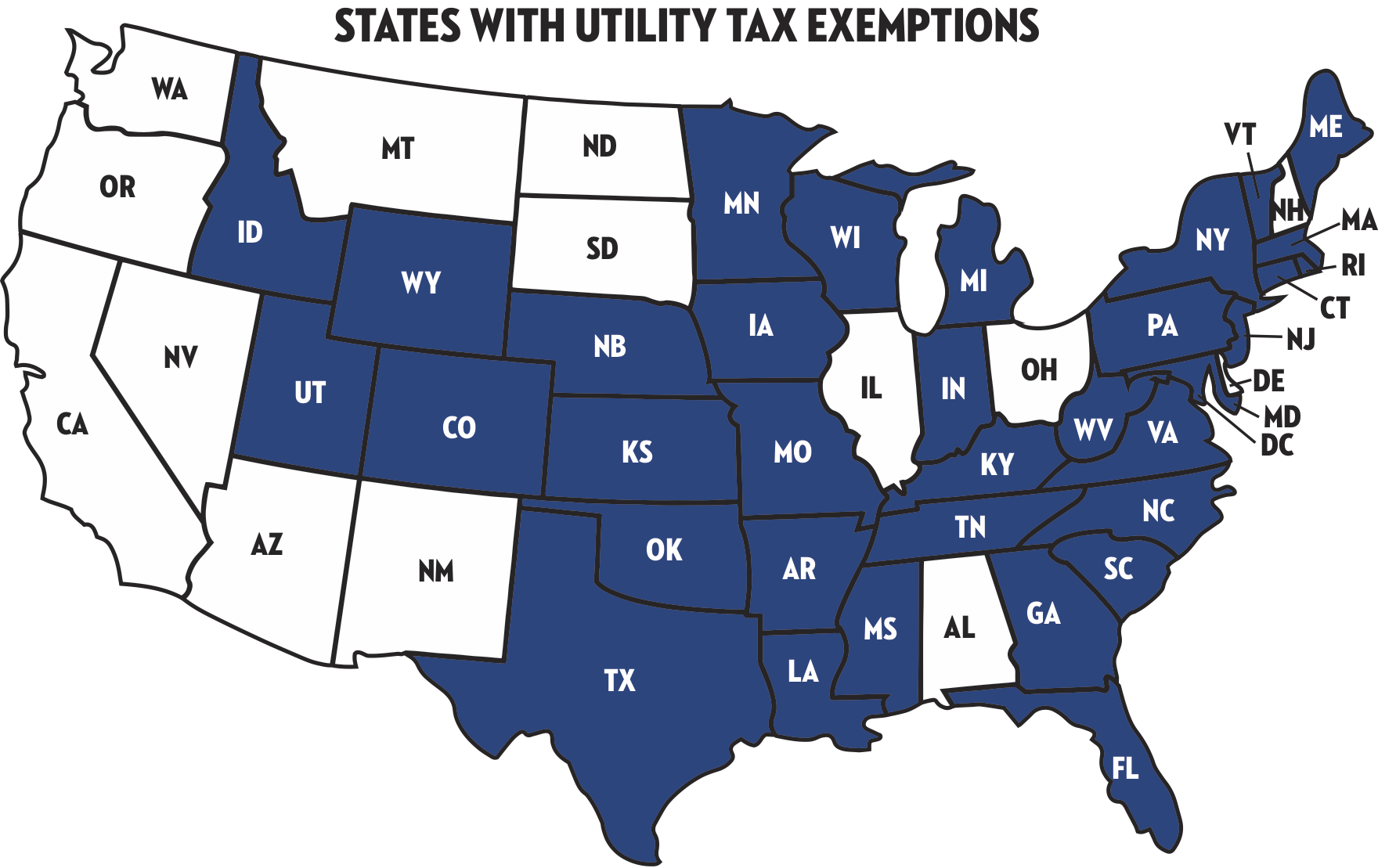

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

Texas Sales Tax Exemption Certificate From The Texas Human Rights

https://digital.library.unt.edu/ark:/67531/metadc967514/m1/1/high_res/

Tx Form Sales Tax Exemption Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/29/382/29382322/large.png

Georgia exemptions apply to the sale or use of any durable medical equipment or prosthetic device sold or used pursuant to a prescription and to the sale Sales of medical equipment component parts and medical supplies are exempt from New York State and local sales and use taxes unless sold for use in providing medical

Because home accessibility is so important to healthy living many states provide a sales tax exemption for durable medical equipment including stair lifts wheelchair ramps wheelchair lifts overhead ceiling All prescription drugs and most nonprescription drugs are exempt from the Connecticut Sales and Use Tax Any patient cosmetics personal hygiene products

Download Is Medical Equipment Exempt From Sales Tax

More picture related to Is Medical Equipment Exempt From Sales Tax

California Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/76/457/76457885/large.png

Missouri Sales Tax Exemption Ebenezer Lutheran Church

https://unite-production.s3.amazonaws.com/tenants/ebenezer/pictures/225443/Ebenezer_Tax_Exemption_Certificate.png

Texas Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/15/184/15184121/large.png

Most states exempt at least some medical devices from sales tax 22 states and D C exempt all medical devices from state sales tax when they are prescribed by a licensed medical provider Figure 1 Steven D Moore Esq is a partner in the Austin Texas office of Jackson Walker a multi office full line law firm based in Texas He represents companies on

The medical device tax is a 2 3 excise tax on sales of specific medical devices generally not sold for individual use and is paid and remitted by importers The following oral hygiene products are exempt from sales tax Electric and manual toothbrushes Toothpaste Dental floss and dental picks Oral irrigators Mouthwash

Georgia Sales Tax Exemption Form St 5 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

Taxact Online Fillable Tax Forms Printable Forms Free Online

https://www.signnow.com/preview/100/313/100313563/large.png

https://www.taxjar.com/blog/medical/0521-m…

Durable medical equipment is considered taxable in Alabama even if prescribed by a medical professional but the state provides a sales tax exemption for prescribed durable medical

https://kaufmanrossin.com/blog/which-healthcare...

For those in the healthcare industry it s easy to assume that all medical related purchases are exempt from sales tax Although there are broad sales tax

2009 Form SD Streamlined Sales And Use Tax Certificate Of Exemption

Georgia Sales Tax Exemption Form St 5 ExemptForm

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

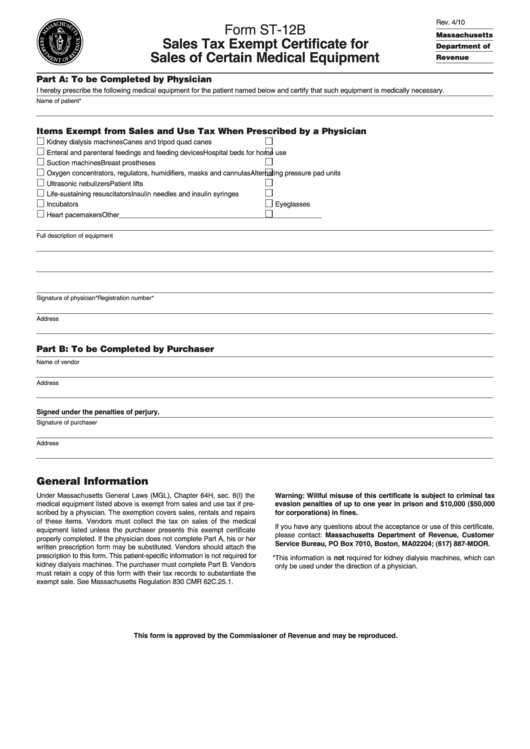

Form St 12b Sales Tax Exempt Certificate For Sales Of Certain Medical

Sales Exemption Certificate TUTORE ORG Master Of Documents

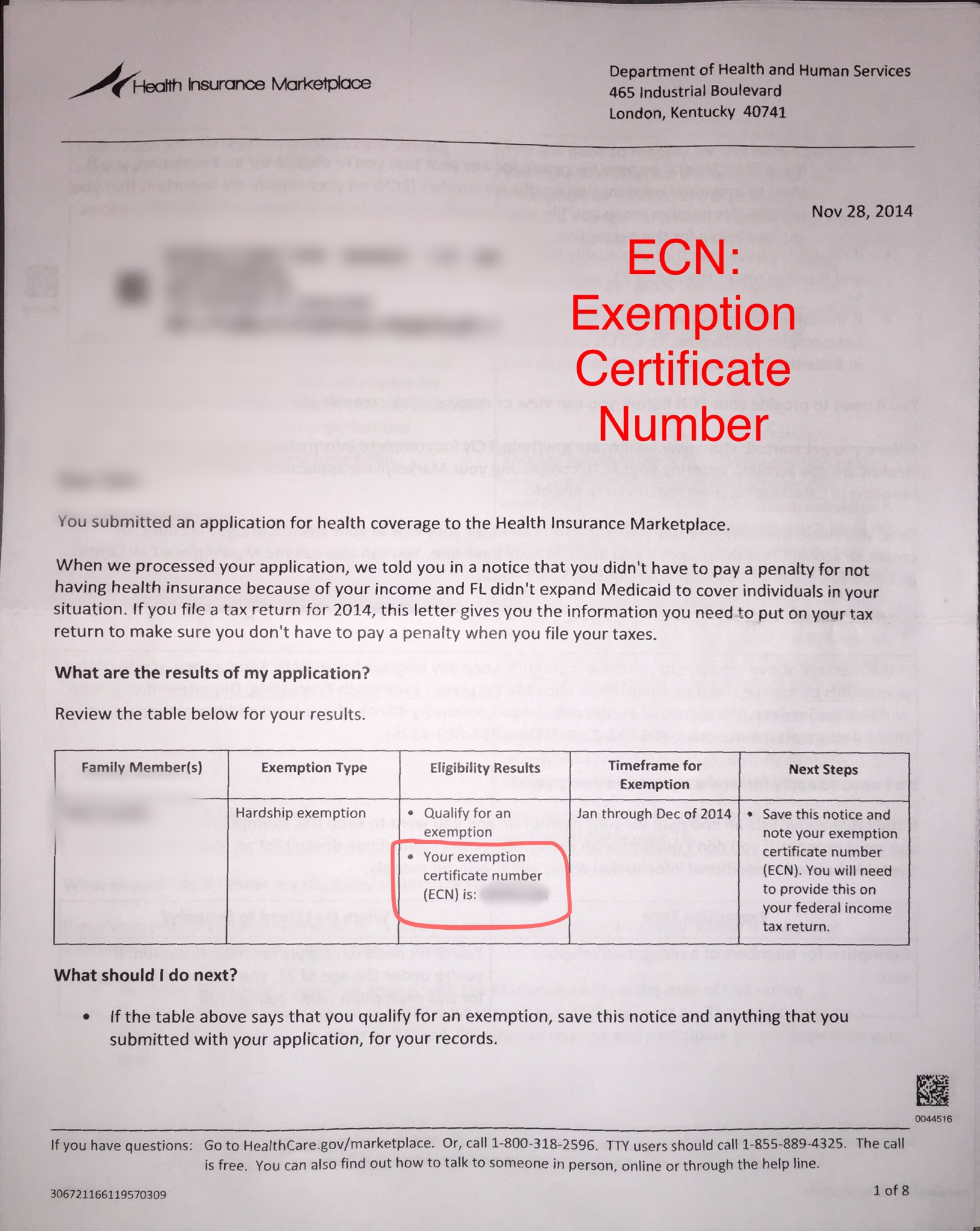

Exemption Certificate Number ECN

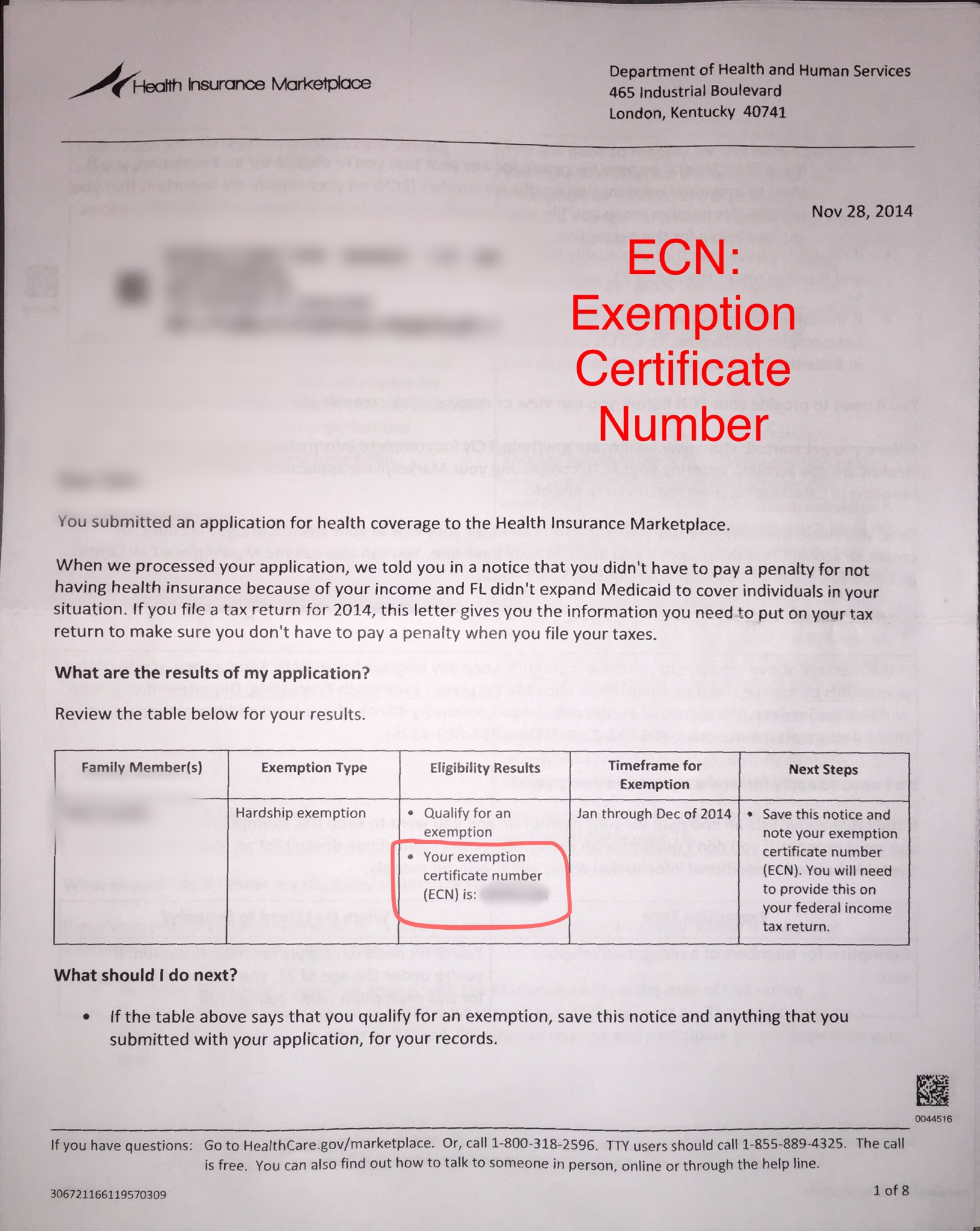

Exemption Certificate Number ECN

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

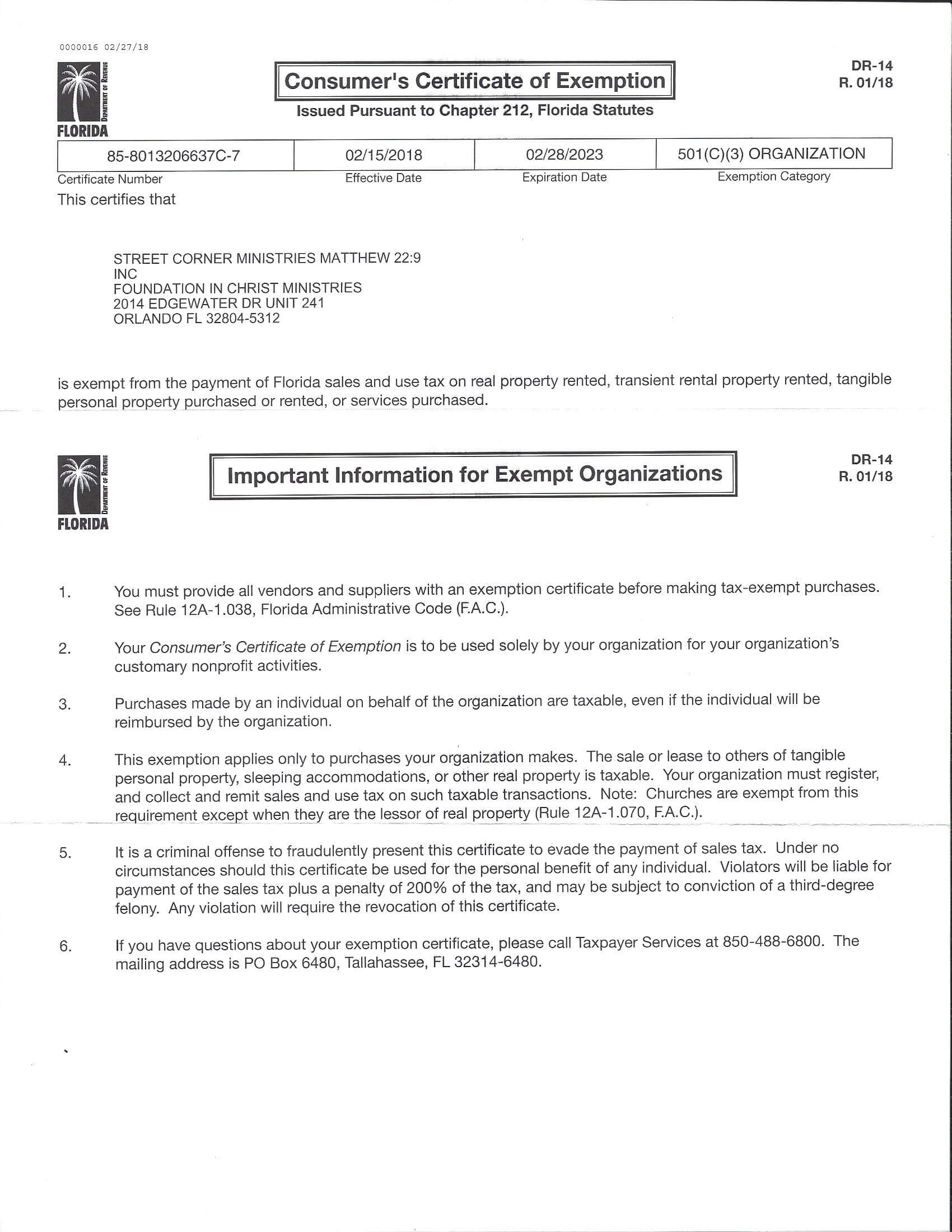

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Is Medical Equipment Exempt From Sales Tax - Because home accessibility is so important to healthy living many states provide a sales tax exemption for durable medical equipment including stair lifts wheelchair ramps wheelchair lifts overhead ceiling