Is Medical Insurance Tax Deductible In Canada Tax deductible No for the employee Yes for the employer Example Jane works for Canada Life and receives health and dental benefits as part of her total compensation Because Jane doesn t pay for her benefits directly she cannot claim the premiums on her annual income tax filing

Fortunately Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax Credit on your income tax return Generally life health and disability insurance premiums aren t tax deductible for individuals or businesses So you can assume the answer is no until you find out whether your specific situation is an exception

Is Medical Insurance Tax Deductible In Canada

Is Medical Insurance Tax Deductible In Canada

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

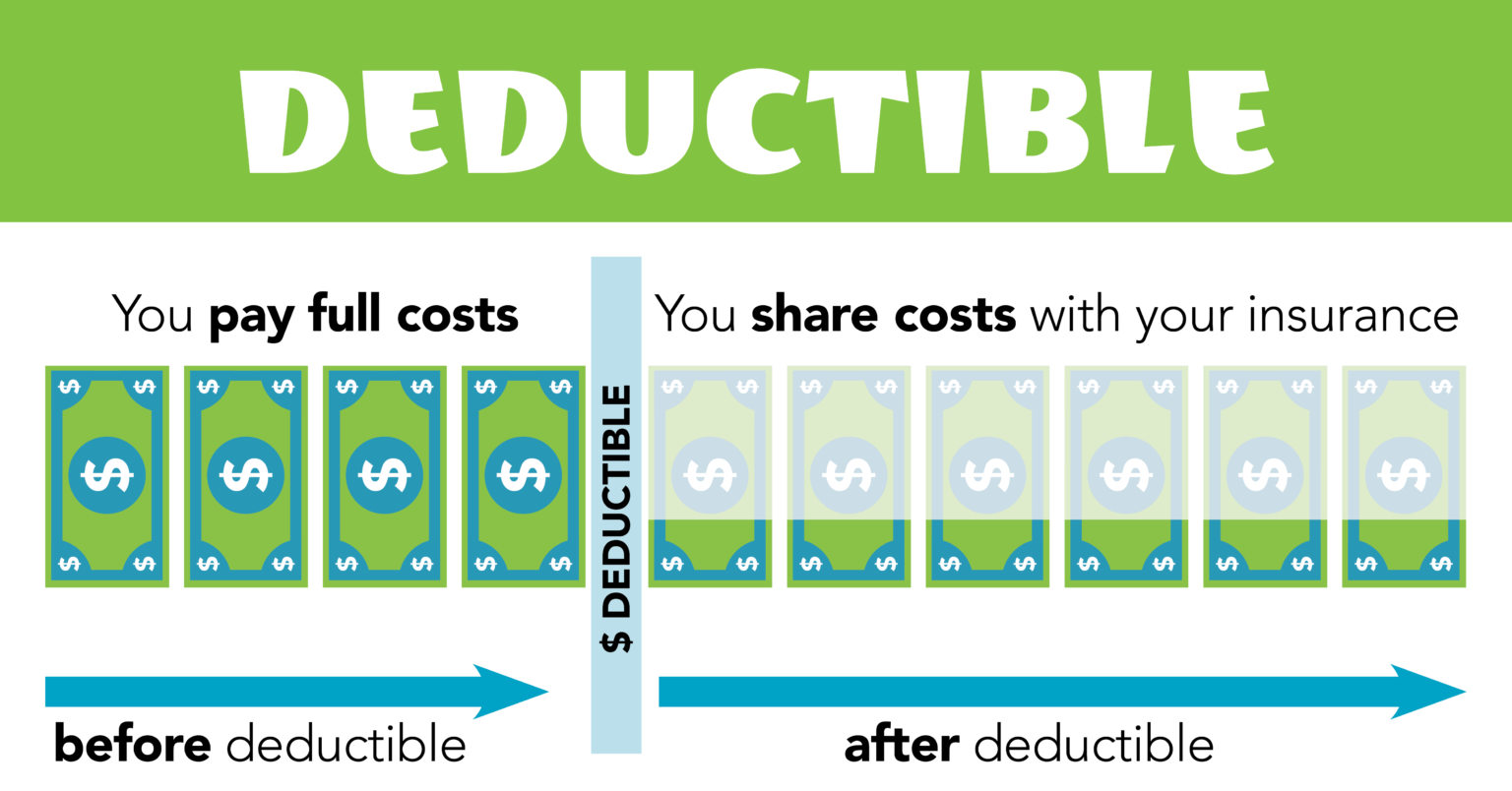

16 Things To Know About Car Insurance Deductibles

https://images.ctfassets.net/hxbzgg5l506g/5rRaYcbgIPsChS5hpDNlTN/1964fef31c5145ed8a86160b4d250207/Blog_Deductibles.png

The How Long Do You Have Health Insurance After Gunnerjxnk309

https://aeroflowinc.com/wp-content/uploads/2020/05/Insurance_Infographic_Web_Page.png

The Canada Revenue Agency CRA has approved 17 medical expenses as tax deductible including prescription medications medical services service animals medical devices and equipment vision care sexual reassignment When Medical Insurance Is Tax Deductible In Canada you can deduct some health expenses with the Medical Expense Tax Credit You can claim these deductions on your tax return for individual items but you may also be able to deduct your insurance costs

Medical expenses not covered by provincial or private health care plans may save you money on your tax return If you file your taxes jointly with a spouse or partner it s usually best to claim the medical expenses on the return with the lower net income Save your medical receipts in case the CRA asks to see them Missed the deadline Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels Your medical expenses must exceed a minimum threshold which for the 2022 income tax year is the lesser of 3 of your net income or 2 479

Download Is Medical Insurance Tax Deductible In Canada

More picture related to Is Medical Insurance Tax Deductible In Canada

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

https://goodtogoinsurance.org/wp-content/uploads/2018/01/Is-Your-Auto-Insurance-Tax-Deductible-768x576.jpg

What Is A Deductible Insurance Shark

https://myinsuranceshark.com/wp-content/uploads/2020/03/what-is-a-deductible.png

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/health-insurance-application-forms-banknote-stethoscope-is-health-insurance-tax-deductible-ss-Feature-1024x573.jpg

Are medical expenses tax deductible in Canada Did you know you can claim a portion of your family s health expenses and your health insurance premiums on your tax return Here s how it works Do you need health insurance to help cover your medical costs Can you get a credit for unreimbursed medical expenses Learn how to claim tax deductions for medical expenses in Canada including insights on eligibility insurance premiums travel expenses and more There are a range on tax deductible medical expenses available for Canadians These include payments for expenses like However not all medical expenses are eligible

[desc-10] [desc-11]

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

Premiums Deductibles Copay s How It All Works

https://static.wixstatic.com/media/7a2cc6_dfd9416089244ffa9cf2b23290eb98fd~mv2.png/v1/fill/w_640,h_640,al_c,q_90/7a2cc6_dfd9416089244ffa9cf2b23290eb98fd~mv2.png

https://www.canadalife.com › insurance › health-and...

Tax deductible No for the employee Yes for the employer Example Jane works for Canada Life and receives health and dental benefits as part of her total compensation Because Jane doesn t pay for her benefits directly she cannot claim the premiums on her annual income tax filing

https://www.snowbirdadvisorinsurance.ca › learning...

Fortunately Canadian travellers may be eligible to recoup some of the cost of your travel medical insurance premium by claiming it for a CRA Medical Expense Tax Credit on your income tax return

Tax Deductions You Can Deduct What Napkin Finance

School Supplies Are Tax Deductible Wfmynews2

Deductible In Insurance Insurance Deductible Explained

Deductibles Explained ETrustedAdvisor

Are Health Insurance Premiums Tax Deductions In Canada

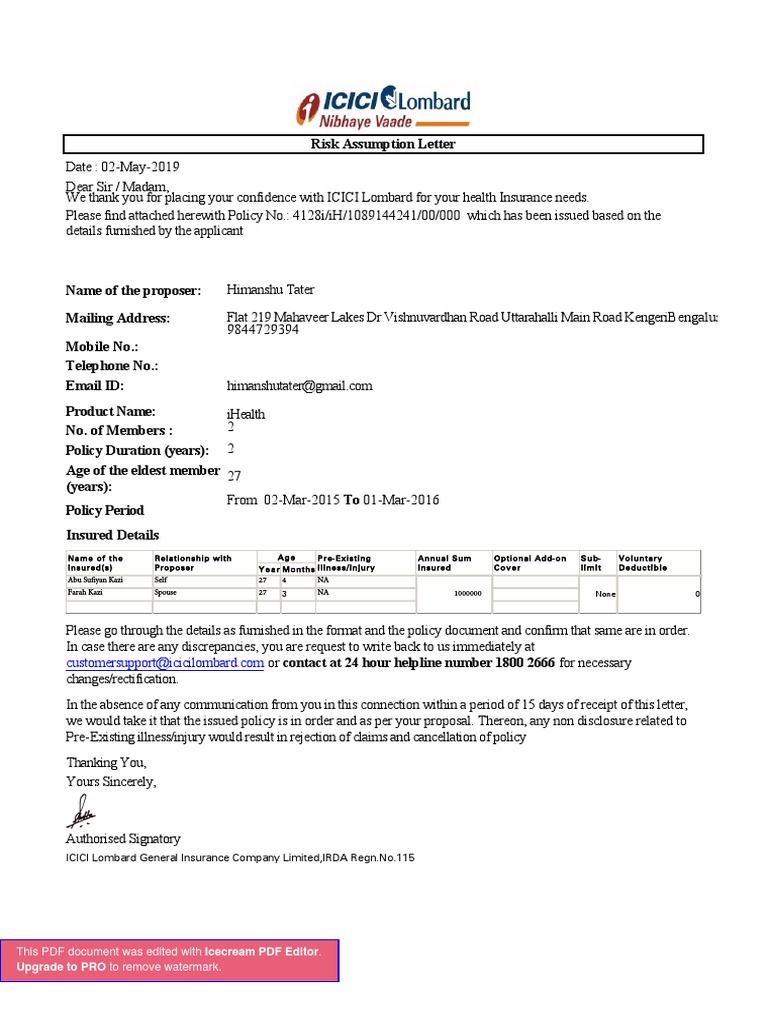

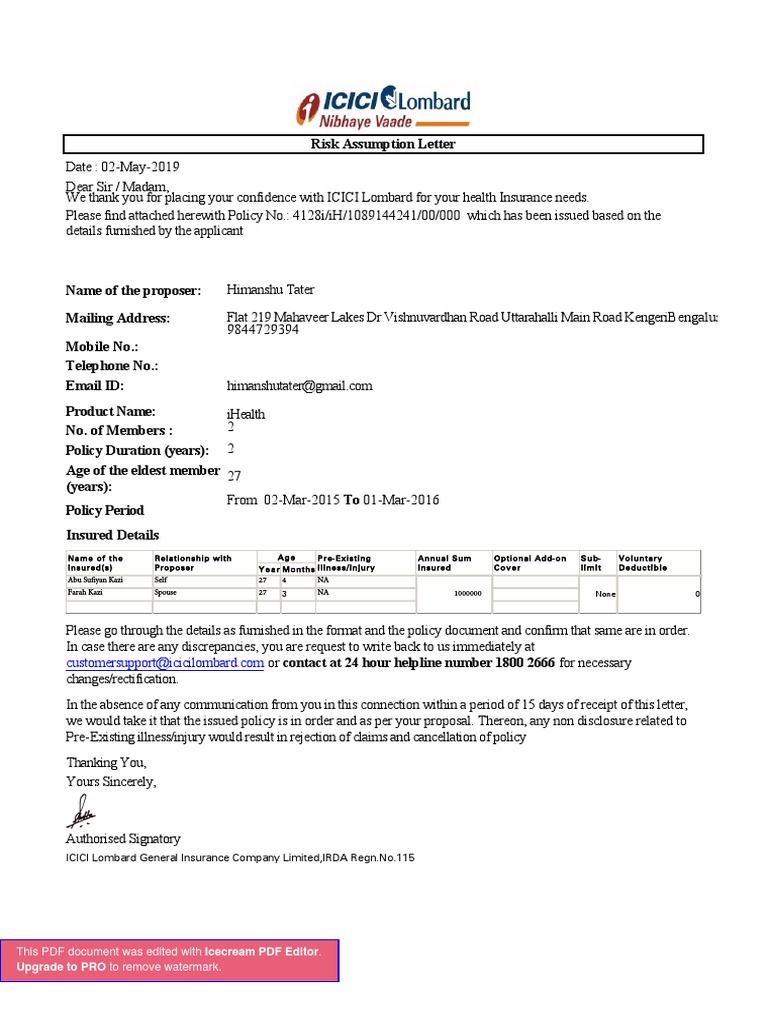

Medical Insurance Premium Receipt 2019 20 Deductible Insurance

Medical Insurance Premium Receipt 2019 20 Deductible Insurance

Definitions And Meanings Of Health Care And Health Insurance Terms

Is Homeowners Insurance Tax Deductible

.png/9025a687-d4ba-450f-fa19-12a92c3cb212?t=1637254391104&imagePreview=1)

What Are Insurance Premiums Insurance Deductibles And Policy Limits

Is Medical Insurance Tax Deductible In Canada - Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels Your medical expenses must exceed a minimum threshold which for the 2022 income tax year is the lesser of 3 of your net income or 2 479