Is Medical Reimbursement Amount Taxable Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in Health insurance reimbursement can be tax free for your business and your employees Explore the tax differences between HRAs and healthcare stipends

Is Medical Reimbursement Amount Taxable

Is Medical Reimbursement Amount Taxable

https://navi.com/blog/wp-content/uploads/2022/06/Medical-Reimbursement_1267w-e1662661707980.jpg

An Employers Guide To Reimbursement

https://w3ll.com/wp-content/uploads/2021/12/test-blog-4-scaled-2.jpg

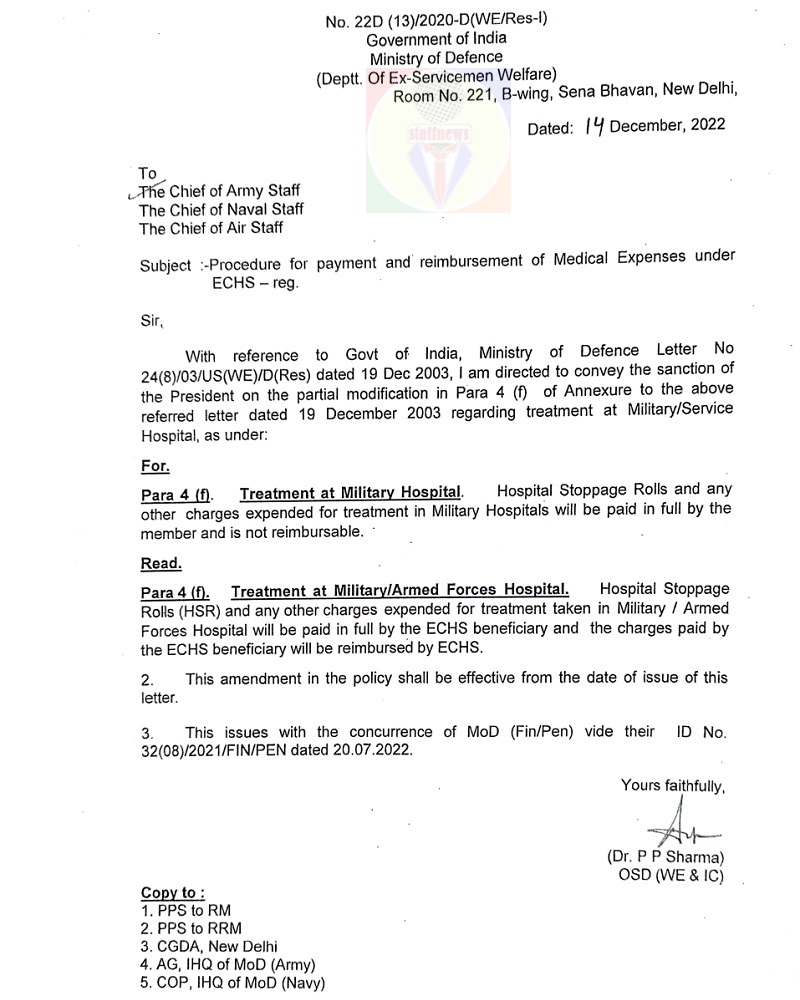

Procedure For Payment And Reimbursement Of Medical Expenses Under ECHS

https://www.staffnews.in/wp-content/uploads/2023/01/reimbursement-of-medical-expenses-under-echs.jpg

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible Qualified small employer health reimbursement arrangements QSEHRAs QSEHRAs allow eligible small employers to pay or reimburse medical care expenses including

With a health reimbursement arrangement HRA your employer may contribute funds that you can use tax free to reimburse certain medical expenses HRAs For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Download Is Medical Reimbursement Amount Taxable

More picture related to Is Medical Reimbursement Amount Taxable

Reimbursement Form Template IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/47-reimbursement-form-templates-mileage-expense-vsp-1.jpg

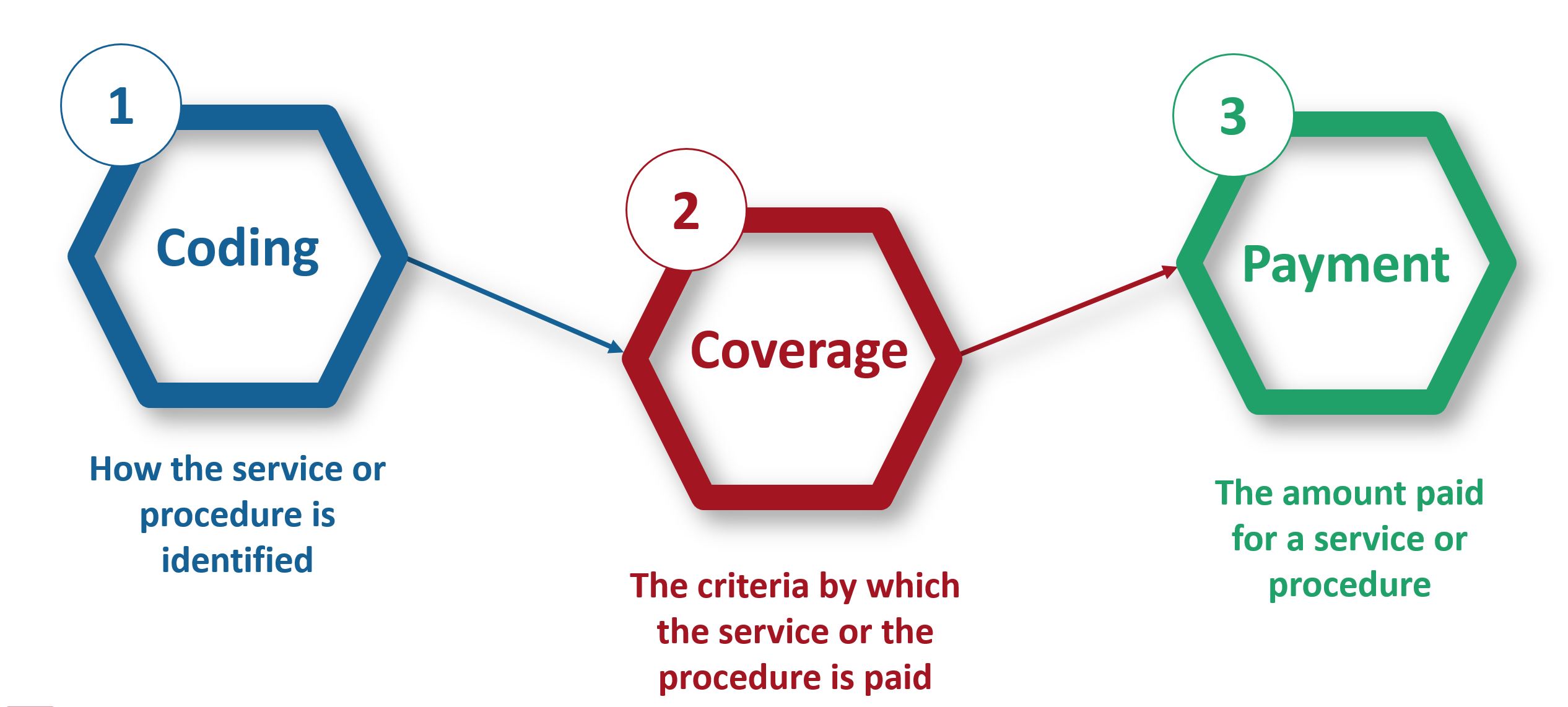

Understanding Reimbursement For Medical Devices Coding Coverage

https://www.theatticusgroup.net/wp-content/uploads/2017/01/Reimbursment.jpg

What Is Healthcare Reimbursement Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/08/What-Is-Healthcare-Reimbursement_-1.jpg

WASHINGTON The Internal Revenue Service reminds taxpayers today that the cost of home testing for COVID 19 is an eligible medical expense that can be Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has

Luckily there are options that allow you to reimburse employees for individual health insurance coverage such as a taxable stipend or a health Is medical allowance taxable Yes any amount received as a fixed medical allowance is fully taxable in the hands of employees even if they incur medical

Medical Reimbursement Form

https://www.bizzlibrary.com/Storage/Media/9c0f8178-0508-4ee3-adfe-9724d7f5b748.png

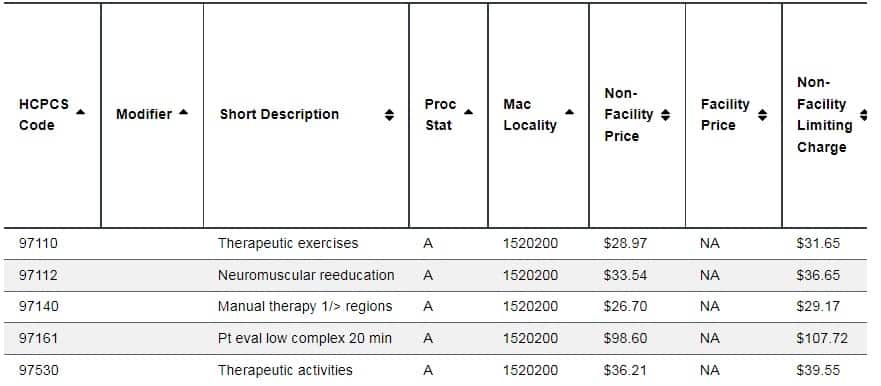

Common CPT Codes And Fee Schedules Reimbursement Rates

https://www.outsourcestrategies.com/wp-content/uploads/2022/02/reimbursement-rate.jpg

https://www.justworks.com/blog/expenses-1…

Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

https://www.irs.gov/publications/p525

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in

What To Know About Medical Reimbursement Plans

Medical Reimbursement Form

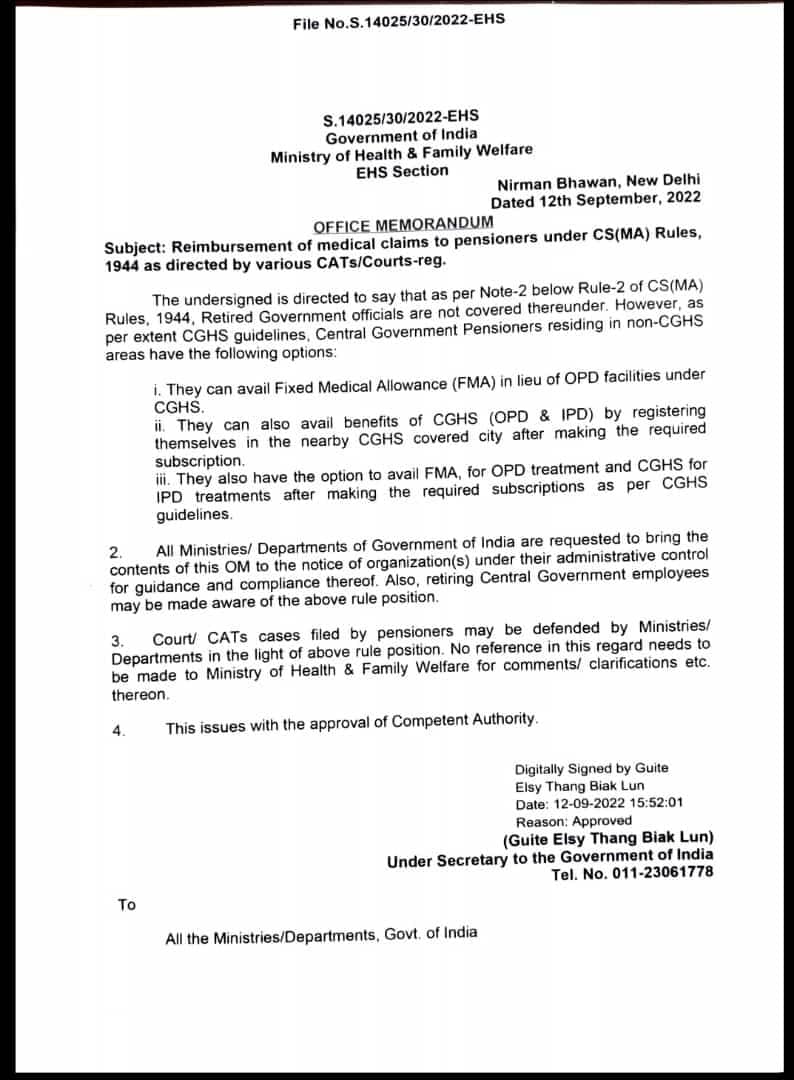

Reimbursement Of Medical Claims To Pensioners Under CS MA Rules 1944

4 Effective Methods To Collect Patient Payments For Maximizing

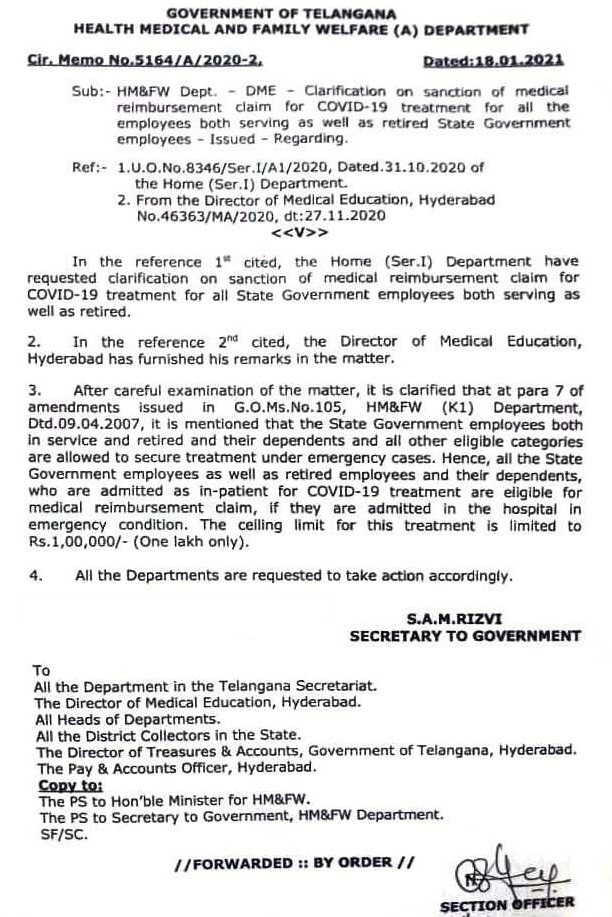

Medical Reimbursement Claim For COVID 19 Treatment Rs 1 Lakh Cir Memo

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

Application For Reimbursement Of Medical Treatment Expenses Due To

AB202019 Ch13 Workbook Principles Of Healthcare Reimbursement And

Is Medical Reimbursement Amount Taxable - You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible