Is Mileage Paid By Employer Taxable You re not required to reimburse employees using the IRS s mileage reimbursement rate you can choose a higher or lower amount if you prefer But if you

If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal Rules for tax If you make payments to employees above a certain amount you ll have to report them to HM Revenue and Customs HMRC and deduct and pay tax Mileage

Is Mileage Paid By Employer Taxable

Is Mileage Paid By Employer Taxable

https://calbudgetcenter.org/app/uploads/2021/08/Taxable-wage-base-as-ave-annual-earnings-01.png

Is Mileage Reimbursement Taxable

https://www.moneytaskforce.com/wp-content/uploads/2022/06/Is-Mileage-Reimbursement-Taxable.webp

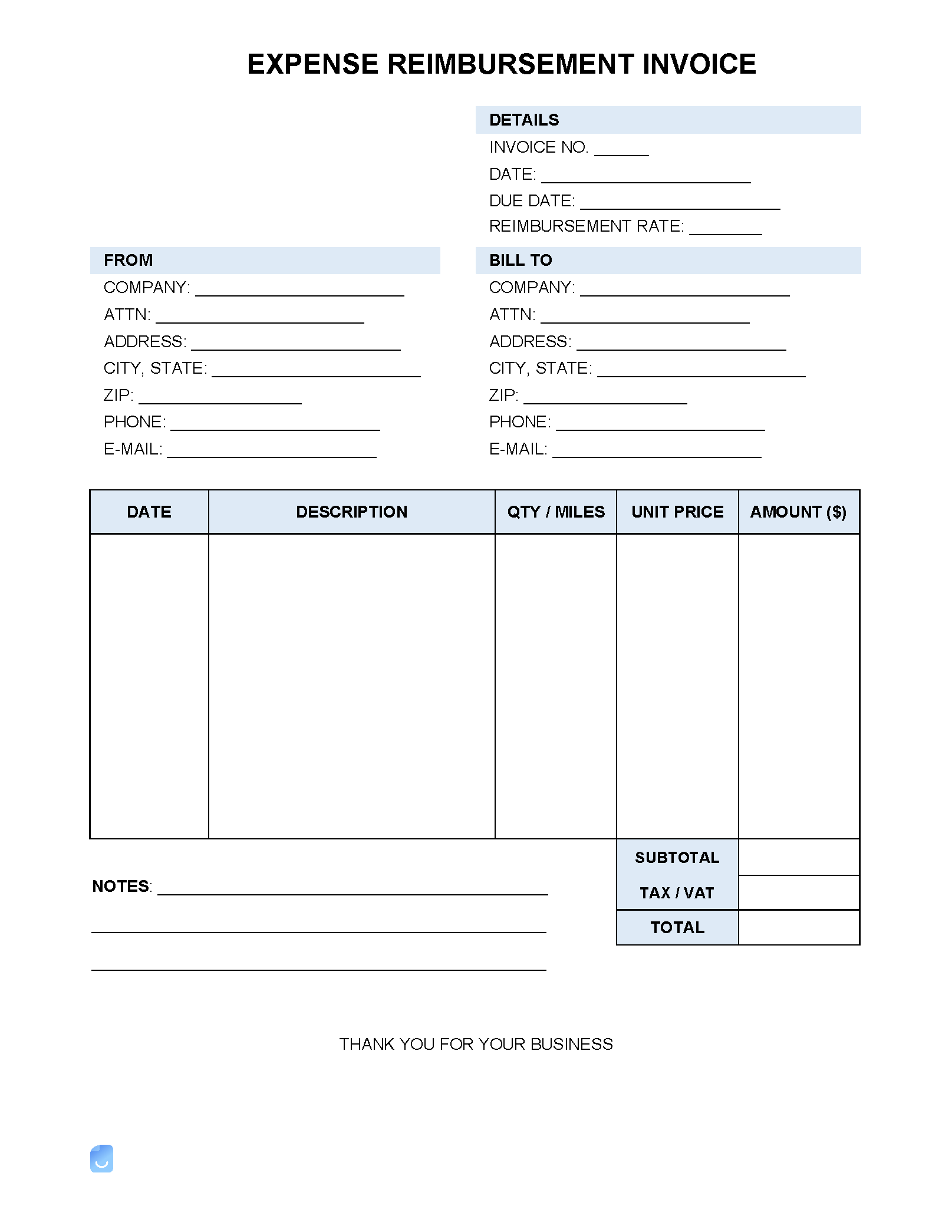

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

For example if an employer reimburses an employee for mileage at more than the standard mileage rate then the excess is taxable income Comply with IRS Rules Employees Learn the ins and outs of employee mileage reimbursement IRS tax deduction rates and how an organization can adopt its own mileage policies

While the Fair Labor Standards Act FLSA doesn t require employers to reimburse workers for mileage organizations of all sizes must reimburse their Is mileage reimbursement taxable In general mileage reimbursements are not taxable if they follow IRS rules which we will get to in a bit But if the employer

Download Is Mileage Paid By Employer Taxable

More picture related to Is Mileage Paid By Employer Taxable

Vehicle Programs Is Mileage Reimbursement Taxable Motus

https://www.motus.com/wp-content/uploads/2022/02/Is-Mileage-Reimbursement-Taxable.jpg

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01-923x1024.png

MUKESH PATEL ON TAX PLANNING FOR SALARIED Insurance Premium Paid By

https://i.ytimg.com/vi/ERuka7bsW8A/maxresdefault.jpg

Tax Tip 2022 104 July 11 2022 Business travel can be costly Hotel bills airfare or train tickets cab fare public transportation it can all add up fast The good news is business If your mileage reimbursement exceeds the IRS rate the difference is considered taxable income Comparably if your employer uses the IRS rate but does

Mileage deductions can add up to significant savings for taxpayers Self employed workers and business owners are eligible for the largest tax deductible If the allowance or reimbursement paid to your employee for the use of their own vehicle is taxable the value of the benefit is equal to the amount paid to your employee in the

High Mileage Vehicle Maintenance

https://wrench.com/blog/content/images/2019/10/high-mileage-car.jpg

How Do I Claim For Mileage Travelled For Work Purposes Shoebox

https://shoebox.co.uk/wp-content/uploads/2021/05/shutterstock_1054690775-1-scaled.jpg

https://www.uschamber.com/co/run/finance/employee...

You re not required to reimburse employees using the IRS s mileage reimbursement rate you can choose a higher or lower amount if you prefer But if you

https://www.mburse.com/blog/is-a-mileage-reimbursement-taxable

If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal

Mileage Reimbursement Allowance In Canada CRA 2024 PiggyBank

High Mileage Vehicle Maintenance

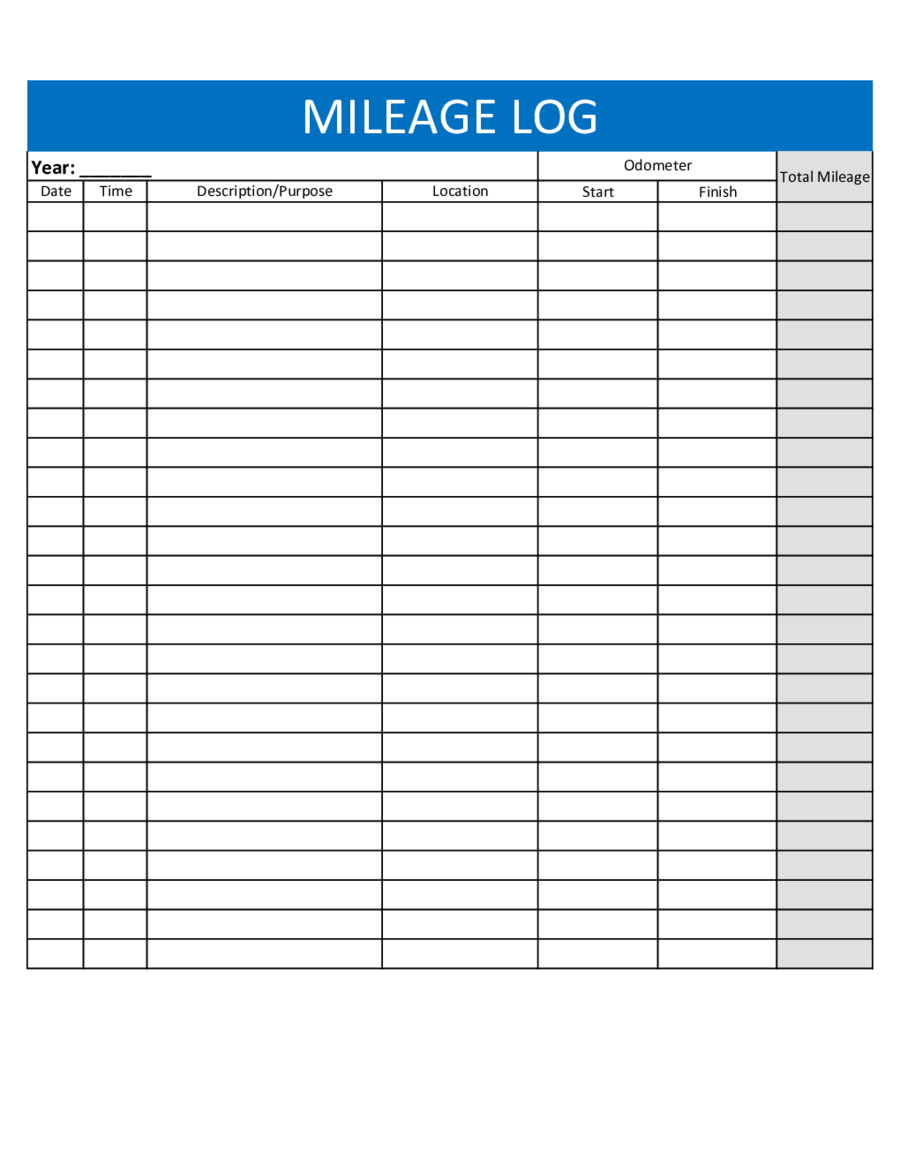

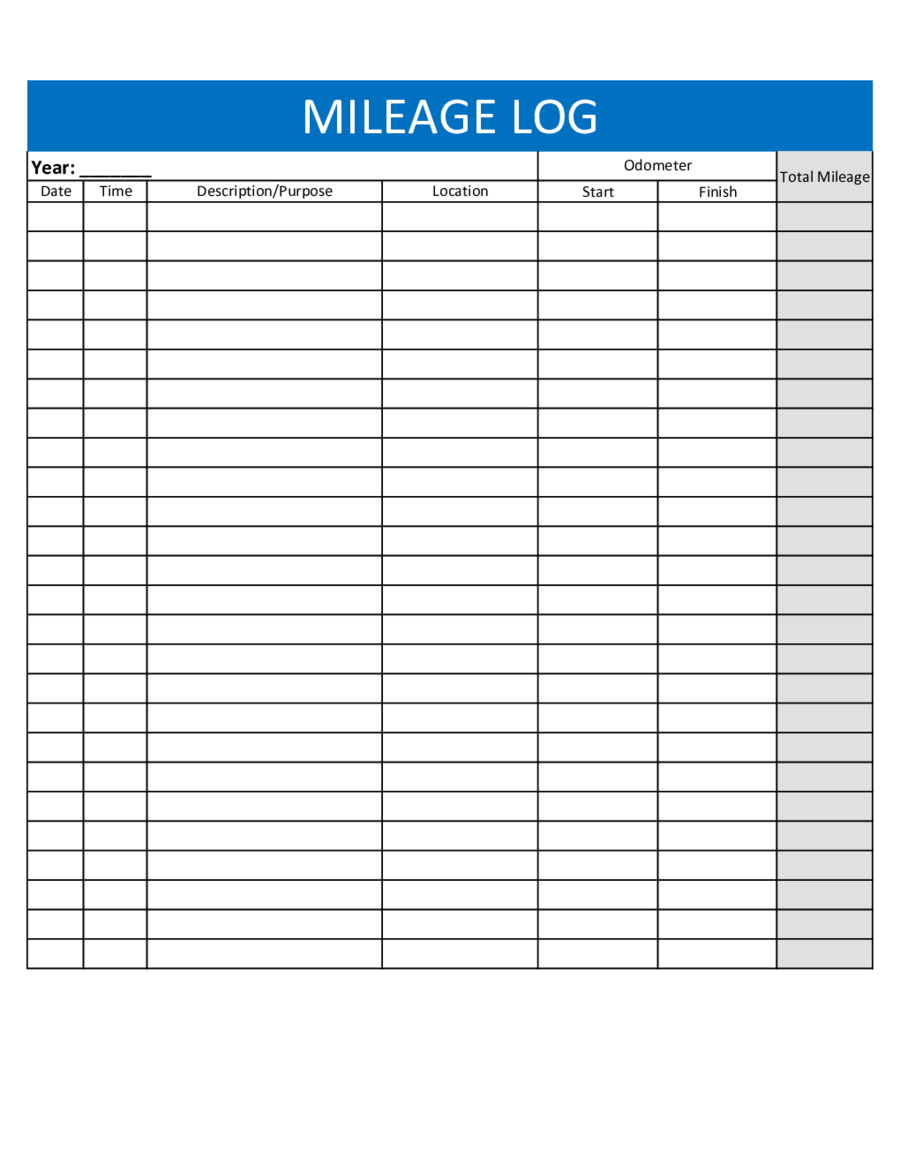

Mileage Report Template

Printable Mileage Reimbursement Form Printable Forms Free Online

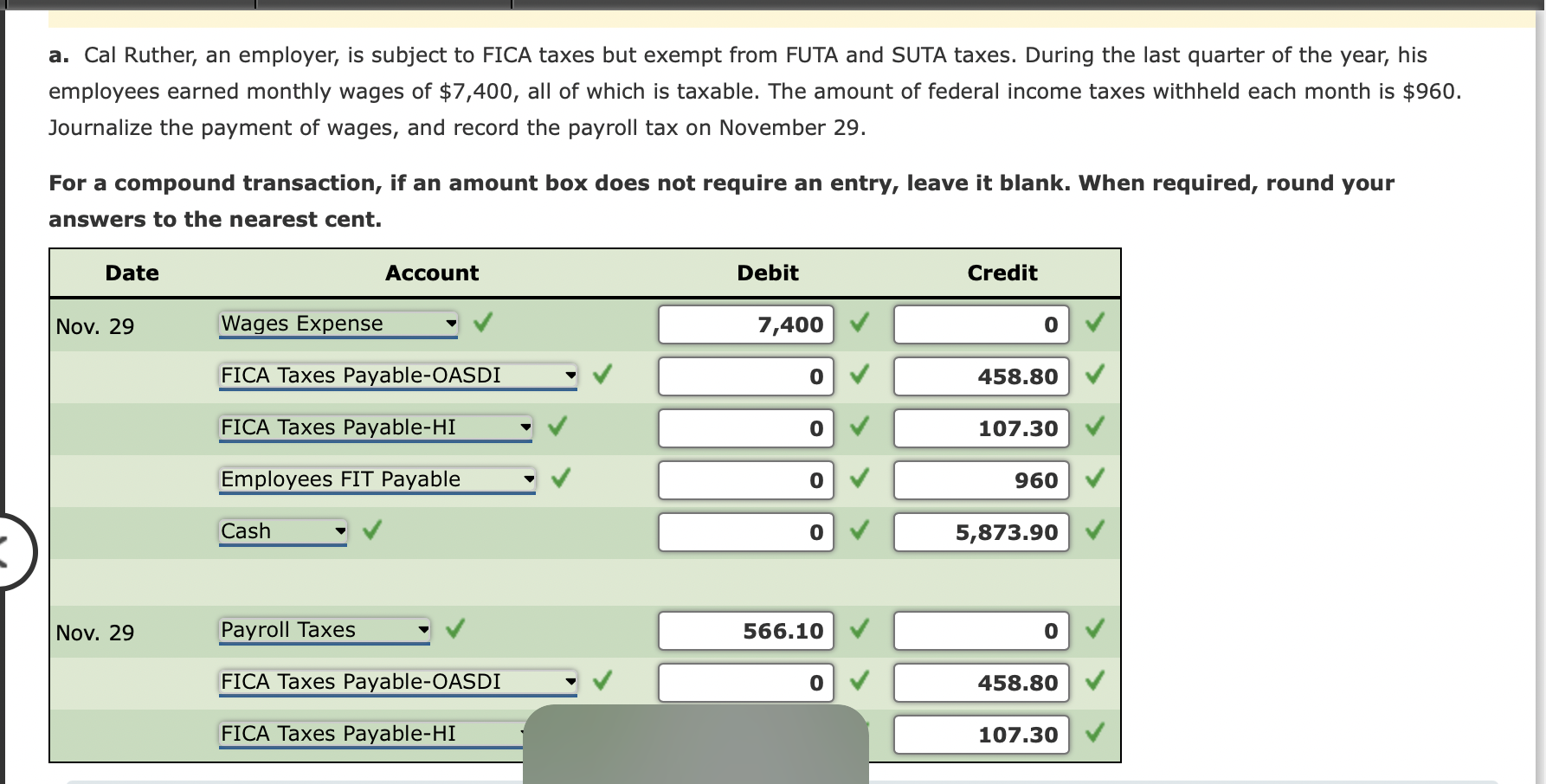

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

Mileage Sheets Free Excel Templates

Mileage Sheets Free Excel Templates

What Is Mileage Reimbursement 2021

How To Calculate Mileage Reimbursement Remember If You Don t

New Mileage Rate Method Announced Generate Accounting

Is Mileage Paid By Employer Taxable - While the Fair Labor Standards Act FLSA doesn t require employers to reimburse workers for mileage organizations of all sizes must reimburse their