Is Mileage Reimbursement Taxable In Nz Mileage tools Reimbursing allowances are not taxable However if the payment is more than the employment related expenses the excess amount is taxable To calculate the

Self employed and close companies If you are a sole trader or qualifying close company and use the kilometre rate method to claim business If you pay your staff extra money for things that aren t part of their usual wages or salary like accommodation or travel costs these payments are known as employee allowances Some allowances are taxable and

Is Mileage Reimbursement Taxable In Nz

Is Mileage Reimbursement Taxable In Nz

https://hrwatchdog.calchamber.com/wp-content/uploads/EmployeeMileageReimburse.jpg

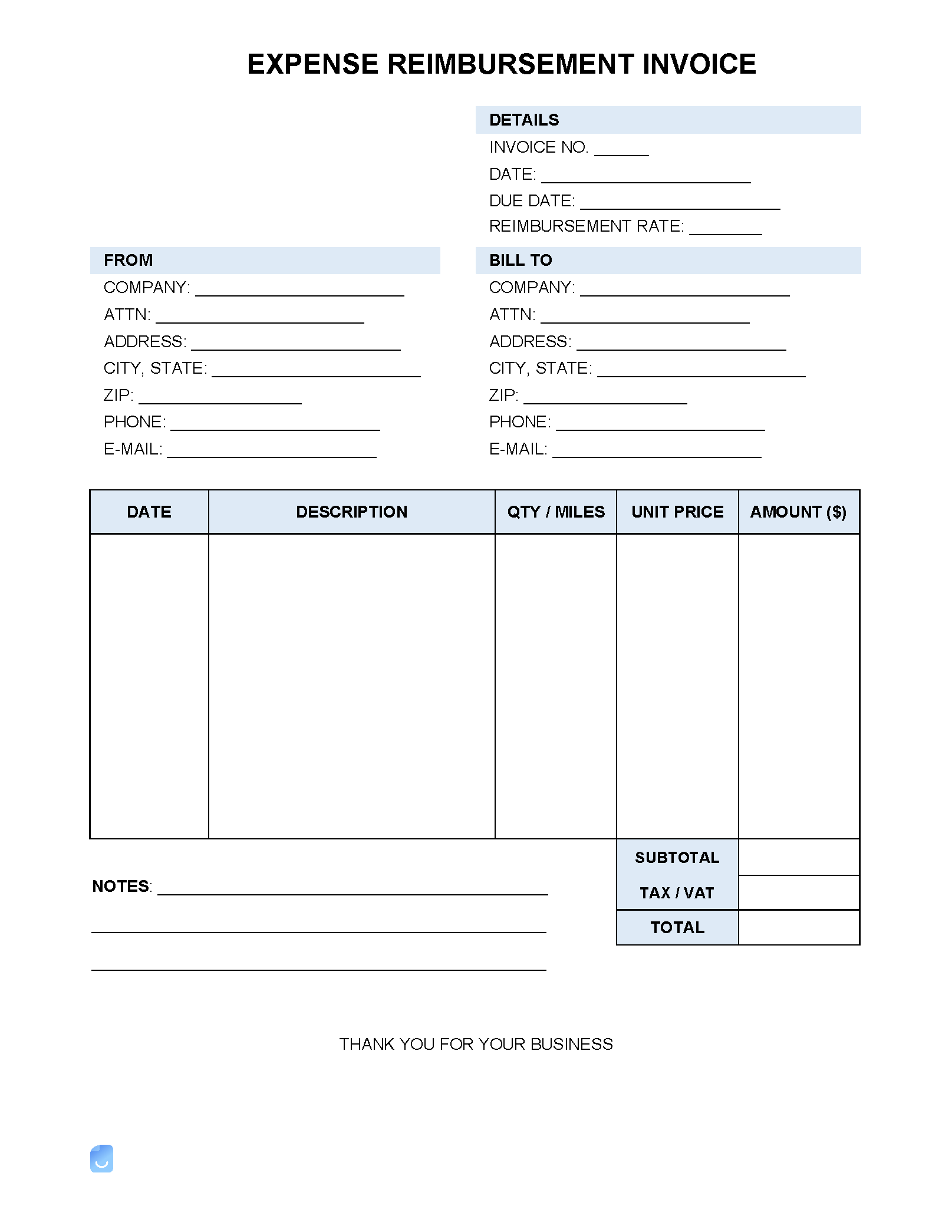

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

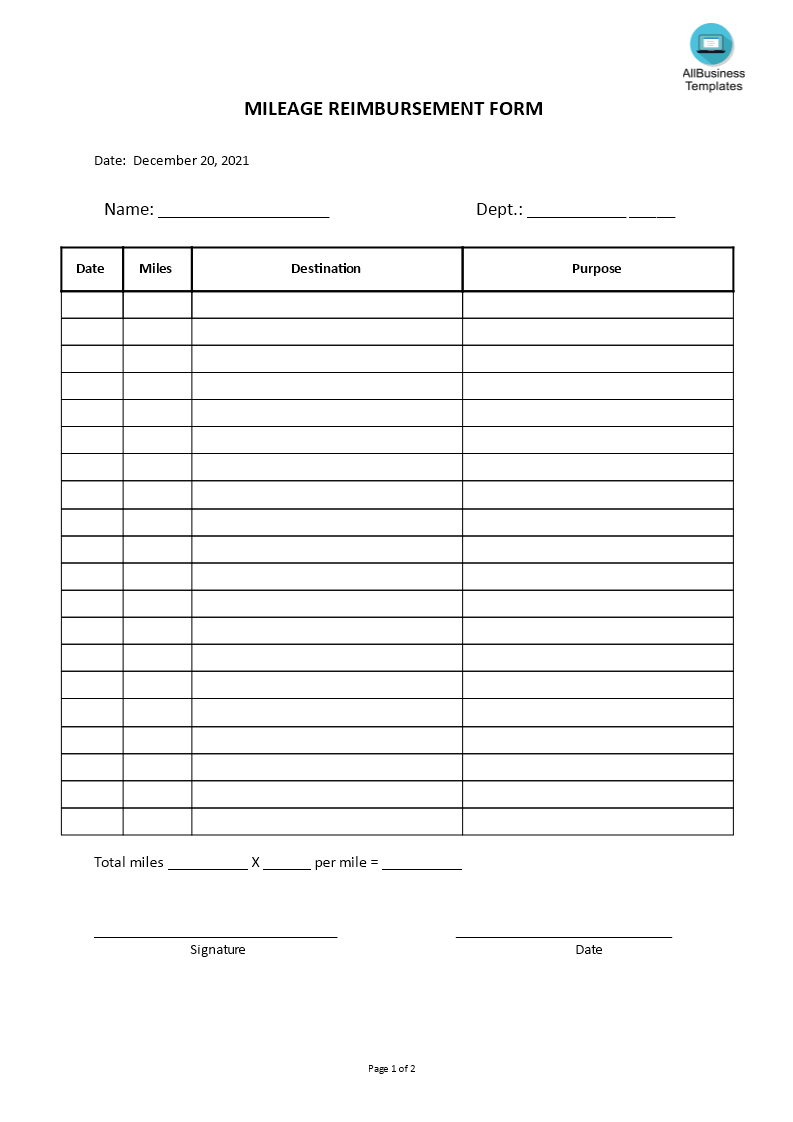

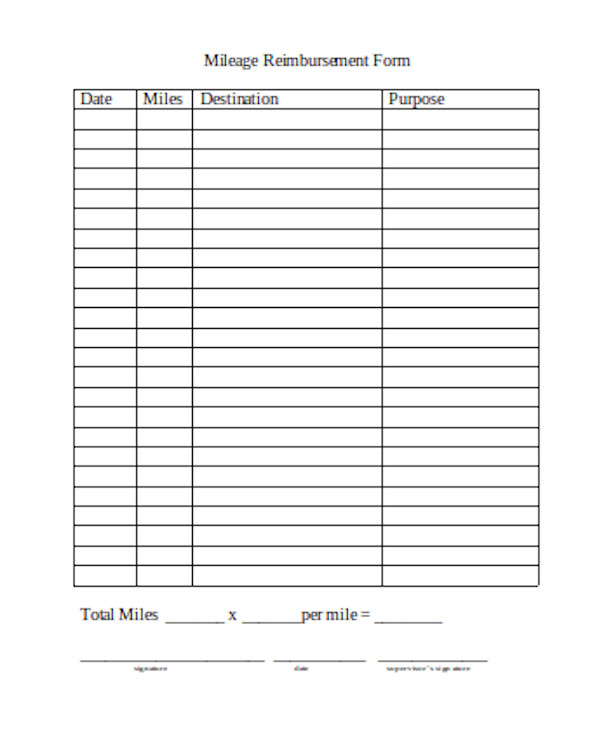

Mileage Form Gratis

https://www.allbusinesstemplates.com/thumbs/c892da8a-ddf7-4004-955a-c6aaec1445f4_1.png

If your reimbursement policy states a set rate at which you will reimburse work related mileage and this is lower than the new rate you do not need to do 2022 mileage reimbursement rates published Inland Revenue has published its most recent rates for tax free reimbursement of mileage While the rates

Inland Revenue has published its most recent rates for tax free reimbursement of mileage While the rates have increased many will be surprised the rate increase was not higher Where there is a taxable amount included in a particular reimbursement this will need to be fed into the payroll system for reporting purposes as many employers do not pay

Download Is Mileage Reimbursement Taxable In Nz

More picture related to Is Mileage Reimbursement Taxable In Nz

Is Mileage Reimbursement Taxable

https://www.moneytaskforce.com/wp-content/uploads/2022/06/Is-Mileage-Reimbursement-Taxable.webp

Federal Mileage Reimbursement IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-9-sample-mileage-reimbursement-forms-in-pdf-word.jpg

Vehicle Programs Is Mileage Reimbursement Taxable Motus

https://www.motus.com/wp-content/uploads/2022/02/Is-Mileage-Reimbursement-Taxable.jpg

IRD mileage reimbursement rates in New Zealand New Zealand s Inland Revenue IR has just released its vehicle kilometre km rates for the 2021 income year and it s not good 01 June 2021 New Zealand s Inland Revenue IR has just released its vehicle kilometre km rates for the 2021 income year and it s not good news particularly for employers

Petrol Hybrid 83 cents 18 cents Electric 83 cents 10 cents These operational statements provide further information on the use of the kilometre rates OS Ng utu t pui haerenga Travel allowances You can pay a cash allowance to an employee for travel between home and work This is tax free if it reimburses their additional

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2023/01/2023-mileage-reimbursement-calculator-1-1024x576.png

9 Free Mileage Reimbursement Forms To Download PerformFlow

https://performflow.com/wp-content/uploads/2023/01/Mileage-Reimbursement-by-FormVille.png

https://www.ird.govt.nz/.../reimbursing-allowances

Mileage tools Reimbursing allowances are not taxable However if the payment is more than the employment related expenses the excess amount is taxable To calculate the

https://www2.deloitte.com/nz/en/pages/tax-alerts/...

Self employed and close companies If you are a sole trader or qualifying close company and use the kilometre rate method to claim business

Example Mileage Reimbursement Form Printable Form Templates And Letter

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Mileage Reimbursement Considered Taxable Income TripLog

Mileage Reimbursement What Is It Rydoo

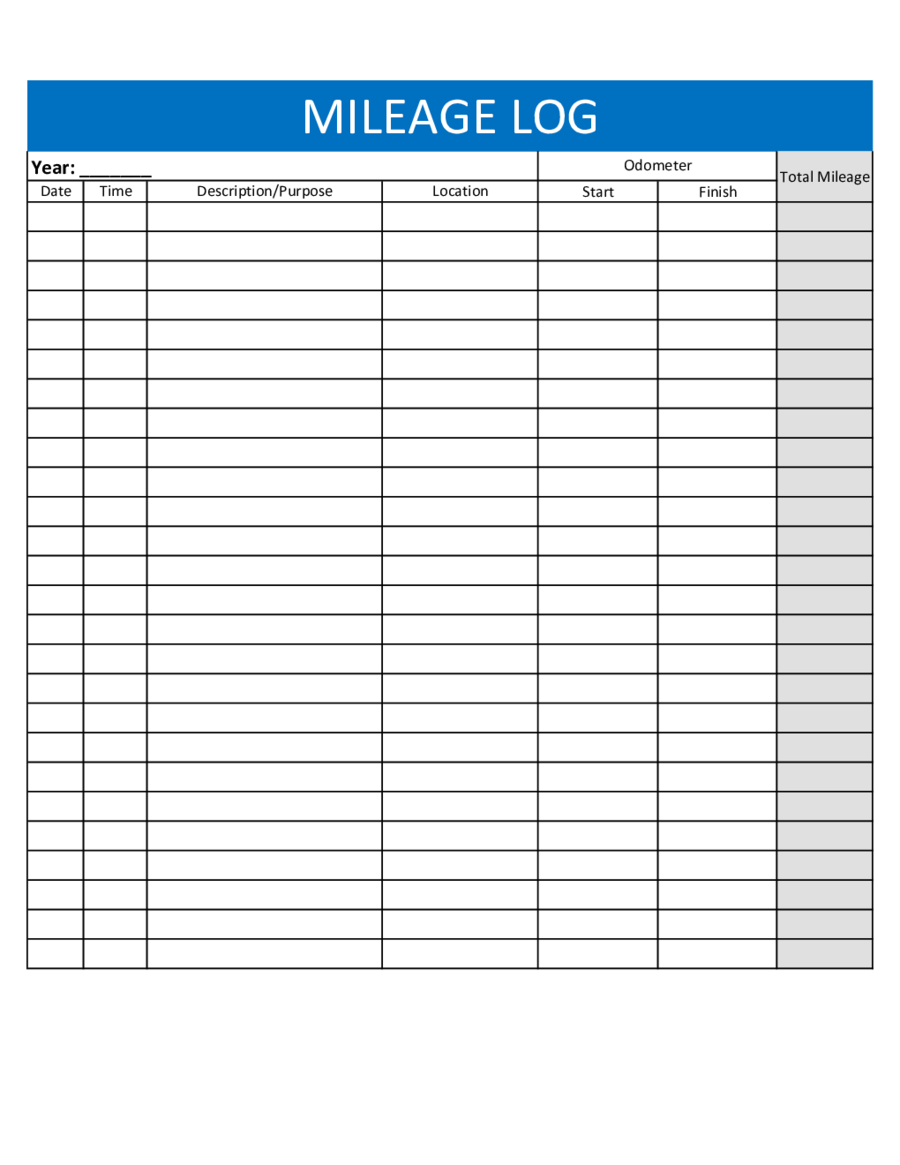

Mileage Reimbursement Form Excel Excel Templates

Is A Mileage Reimbursement Taxable

Is A Mileage Reimbursement Taxable

Mileage Reimbursement Form In PDF Basic Mileage Reimbursement Form

Printable Mileage Form Printable Form 2024

2023 Mileage Form Printable Forms Free Online

Is Mileage Reimbursement Taxable In Nz - Where there is a taxable amount included in a particular reimbursement this will need to be fed into the payroll system for reporting purposes as many employers do not pay