Is My Hsa Contribution Tax Deductible An HSA may receive contributions from an eligible individual or any other person including an employer or a family member on behalf of an eligible individual Contributions other

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute

Is My Hsa Contribution Tax Deductible

Is My Hsa Contribution Tax Deductible

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

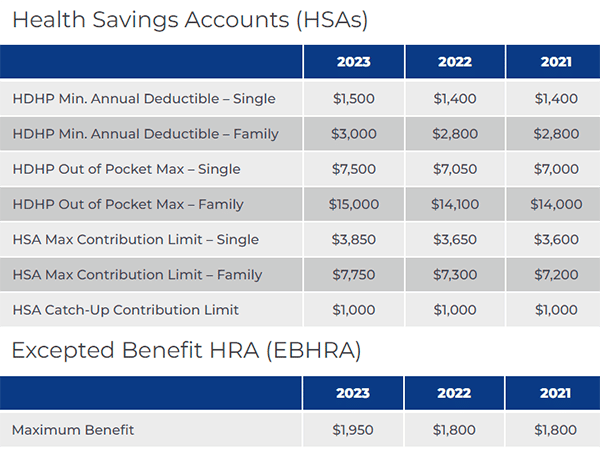

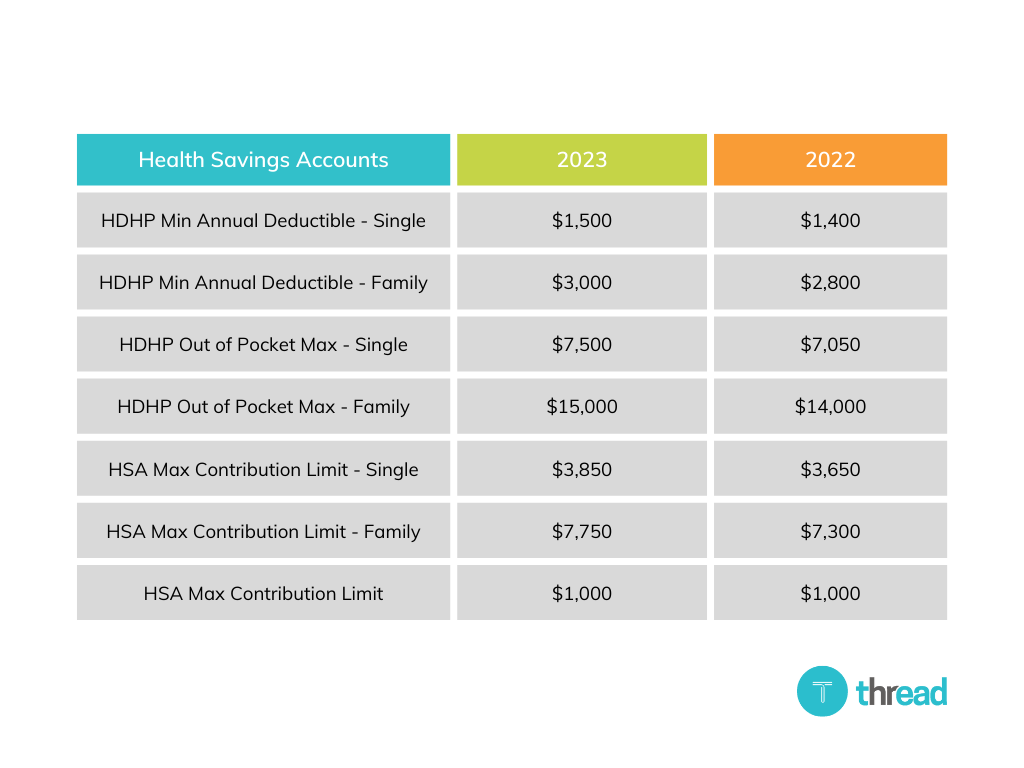

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

When you make your own HSA contributions you contribute during the year with after tax money before to deducting them on your tax return line 25 on Form 1040 regardless The minimum deductible required to open an HSA is 1 600 for an individual or 3 200 for a family for the 2024 tax year 1 650 and 3 300 respectively for 2025

Any contributions you or your employer may make to your HSA are federal tax free and could help you pay for the HSA eligible health plan s deductible or other qualified Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck

Download Is My Hsa Contribution Tax Deductible

More picture related to Is My Hsa Contribution Tax Deductible

2023 HSA Contribution Limits

https://www.peoplekeep.com/hubfs/All Images/Featured Images/2023 HSA contribution limits_featured.jpg#keepProtocol

Hsa Contribution Limits Released For 2022 Gambaran

https://static.fmgsuite.com/media/images/19180385-8bcc-4693-9b4a-a811d1f99879.png

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040

A health savings account is a tax advantaged savings account combined with a high deductible health insurance policy to provide an investment and health Short answer Yes your contributions to a Health Savings Account HSA are tax deductible under certain circumstances But that s just the beginning of the tax breaks

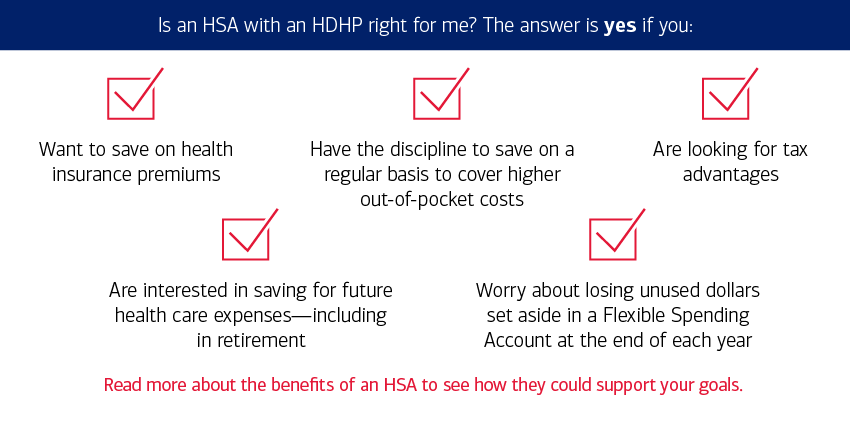

Is An HSA Right For Me

https://healthaccounts.bankofamerica.com/images/isanHSArightforyou_illus_HDHP-HSA_850x421.png

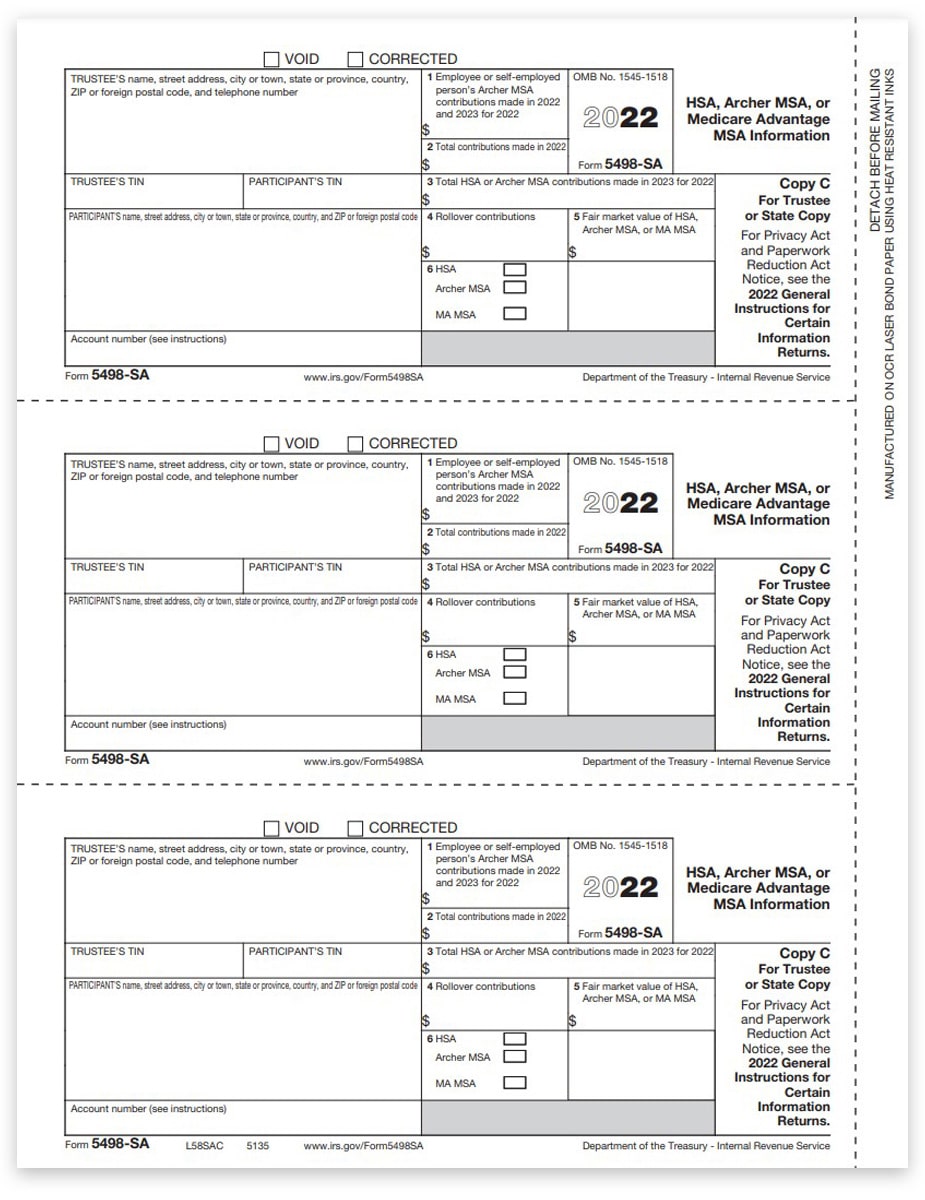

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

https://www.irs.gov/publications/p969

An HSA may receive contributions from an eligible individual or any other person including an employer or a family member on behalf of an eligible individual Contributions other

https://www.hrblock.com/tax-center/filing/...

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

2023 Hsa Form Printable Forms Free Online

Is An HSA Right For Me

Hsa Contribution Limits For 2023 And 2024 Image To U

FAQs_featured.jpg)

Health Savings Account HSA FAQs

Hsa 2024 Contribution Limits Tonye Gwenneth

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement HRA Vs Health Savings Account HSA

Health Savings Plan Accounts Paris Insurance Services

Hsa Max Contribution 2025 Family Ulla Alexina

Is My Hsa Contribution Tax Deductible - The minimum deductible required to open an HSA is 1 600 for an individual or 3 200 for a family for the 2024 tax year 1 650 and 3 300 respectively for 2025