Is My Retirement Plan Tax Deductible Web 28 Aug 2018 nbsp 0183 32 In the year 2005 only 50 of the payment was subject to German income tax This percentage increases up to 2020 by 2 per year and from then on by 1 In the year 2040 the percentage will be 100 Example A receives in the year 2018 his US social security pension for the first time

Web 2 Dez 2023 nbsp 0183 32 That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Having a 401 k account at work doesn t Web 10 Dez 2019 nbsp 0183 32 If you re wondering Is my retirement plan tax deductible the answer is yes You can save for retirement using pre tax dollars or after tax dollars When you use pre tax dollars to fund your retirement account the IRS allows you to reduce your taxable income by that amount

Is My Retirement Plan Tax Deductible

Is My Retirement Plan Tax Deductible

https://aktassociates.com/blog/wp-content/uploads/2019/06/retirement-plan-Tax-efficient_-1.jpg

Blog Best Retirement Plan For Self Employed Gold Standard Tax

http://www.goldstandardtax.com/wp-content/uploads/2021/01/Retirement-Chart.png

How To Create A Retirement Plan For Your Employees Hilb Group Of Florida

https://hilbgroupfl.com/wp-content/uploads/2021/01/retirement-plan.jpg

Web 29 Aug 2023 nbsp 0183 32 Traditional IRAs Retirement plan at work Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income exceeds certain levels No retirement plan at work Your deduction is allowed in full if you and your spouse if you are married aren t covered by a retirement plan at work Web 27 Nov 2023 nbsp 0183 32 Withdrawals from traditional IRA and 401 k accounts are taxable Withdrawals from Roth IRAs and Roth 401 k s are generally not taxable Retirement account withdrawals can bump you into a higher

Web 1 Dez 2023 nbsp 0183 32 Contributions to qualified retirement plans such as traditional 401 k s tax deductible However you don t have to report them on your tax return as your employer will have already Web By Rachel Curry Mar 5 2021 Published 1 45 p m ET Source Getty Saving for retirement involves a lot more than just stockpiling cash under your mattress Finding the right account to maximize

Download Is My Retirement Plan Tax Deductible

More picture related to Is My Retirement Plan Tax Deductible

More Time To File Taxes And Review Your Retirement Plan SouthPark

https://southparkcapital.com/wp-content/uploads/2021/04/More-Time-to-File-Taxes-and-Review-Your-Retirement-Plan-scaled.jpg

How To Do Retirement Planning Step By Step Guide Infographic

https://www.edelweissmf.com/images/EDL/insights/infograph/Edelweiss MF- Infographics-revised-03.jpg

What Retirement Contributions Are Tax Deductible Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/what-retirement-contributions-are-tax-deductible-PUDE.jpg

Web In 2023 you can deduct contributions of up to 6 500 to a traditional IRA 7 500 if you are age 50 or older by the end of the tax year This is up from 6 000 in 2022 Other plans have different limits which vary based on your age and type of plan They may also be limited based on your income level Web 30 Apr 2022 nbsp 0183 32 Choosing a retirement plan that offers the best tax benefit depends upon several factors including your income and the tax benefits unique to each type of plan Before investing your hard earned money in a retirement plan see which one will benefit you and your unique financial situation

Web Contributions made during the tax year are not tax deductible as they are paid pre tax Tax Benefits Now Contributions may be made with tax free salary deferrals and any earnings are tax free until distributions are made Web 23 Aug 2022 nbsp 0183 32 However not all retirement plan contributions are tax deductible The type of retirement plan you have will determine whether you can reduce your taxable income with your contributions Learn how tax advantages vary and when your contributions to retirement savings are tax deductible

Plan Your 2022 Retirement Contributions

https://irp.cdn-website.com/d6207150/dms3rep/multi/retirement-plans-benefits-2022.png

39 Modern Retirement Income Planning Techniques

https://blogs-images.forbes.com/wadepfau/files/2016/04/Retirement-Optimization-Plan2.png

https://scheller-international.com/blog-beitraege/german-income...

Web 28 Aug 2018 nbsp 0183 32 In the year 2005 only 50 of the payment was subject to German income tax This percentage increases up to 2020 by 2 per year and from then on by 1 In the year 2040 the percentage will be 100 Example A receives in the year 2018 his US social security pension for the first time

https://www.investopedia.com/ask/answers/081414/can-i-deduct-my...

Web 2 Dez 2023 nbsp 0183 32 That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Having a 401 k account at work doesn t

Your Guide To Choosing The Best Retirement Plan For Your Employees

Plan Your 2022 Retirement Contributions

Retirement Planning For Employees Crossroads Insurance Investments

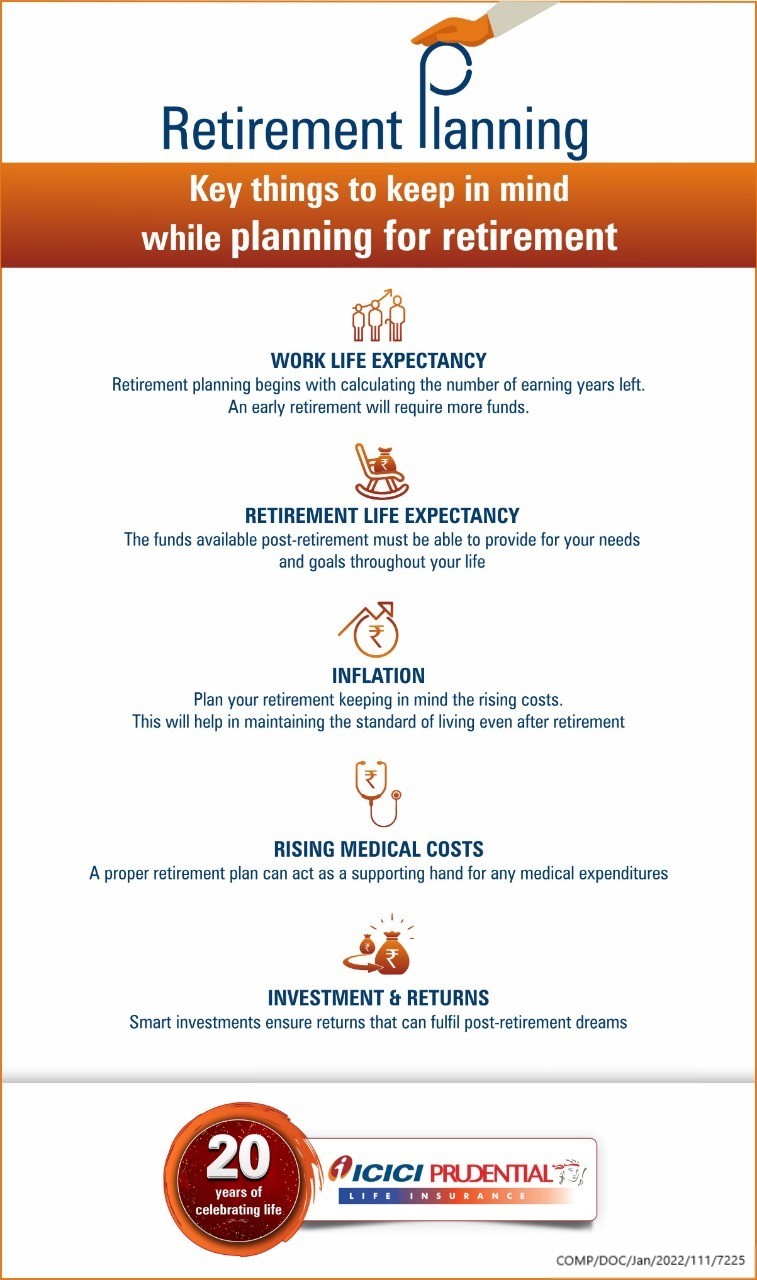

Retirement Planning Steps To Plan Retirement ICICI Pru Life

Retirement Plan Basics Memo Everhart Advisors

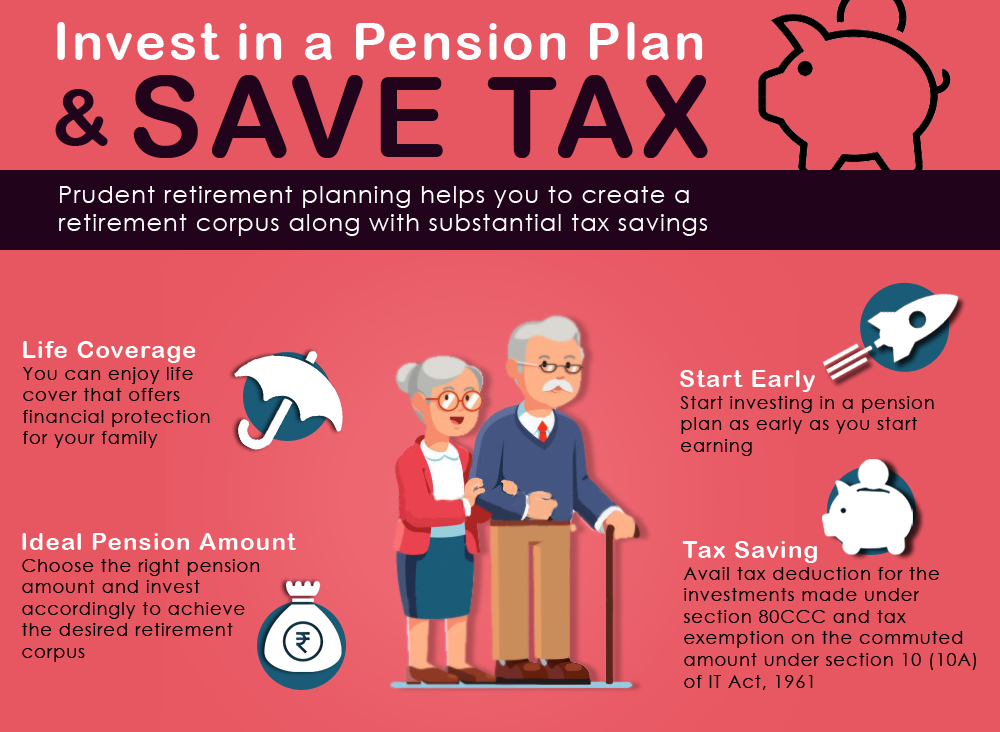

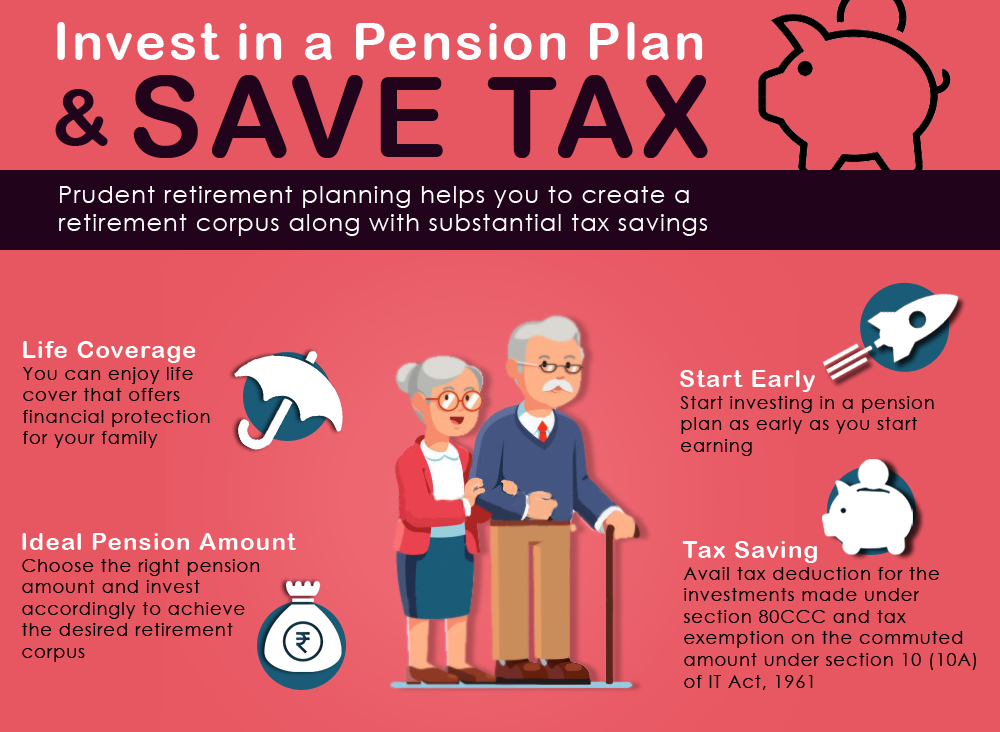

How Pension Plans Help To Save Taxes Comparepolicy

How Pension Plans Help To Save Taxes Comparepolicy

Retirement Plan Lookup Early Retirement

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

House Bill Would Further Skew Benefits Of Tax Favored Retirement

Is My Retirement Plan Tax Deductible - Web 1 Juli 2020 nbsp 0183 32 With that as context we will describe how Defined Benefit Plans are taxed for both the employer and employee First all permissible employer contributions are tax deductible to the employer Additionally contributions made on behalf of employees to pay their future benefits are not taxable to the employee at that time