Is Oil To Gas Conversion Tax Deductible Specifically the production of oil and gas is an extraction activity that qualifies for the deduction The deduction is limited to the lesser of 6 of qualified production

Contents hide 1 Are there tax deductions available for oil and gas companies 2 What type of Oil and Gas Tax Benefits are Out There and How Do They The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1

Is Oil To Gas Conversion Tax Deductible

Is Oil To Gas Conversion Tax Deductible

https://randlettpark.files.wordpress.com/2014/11/img_2875.jpg

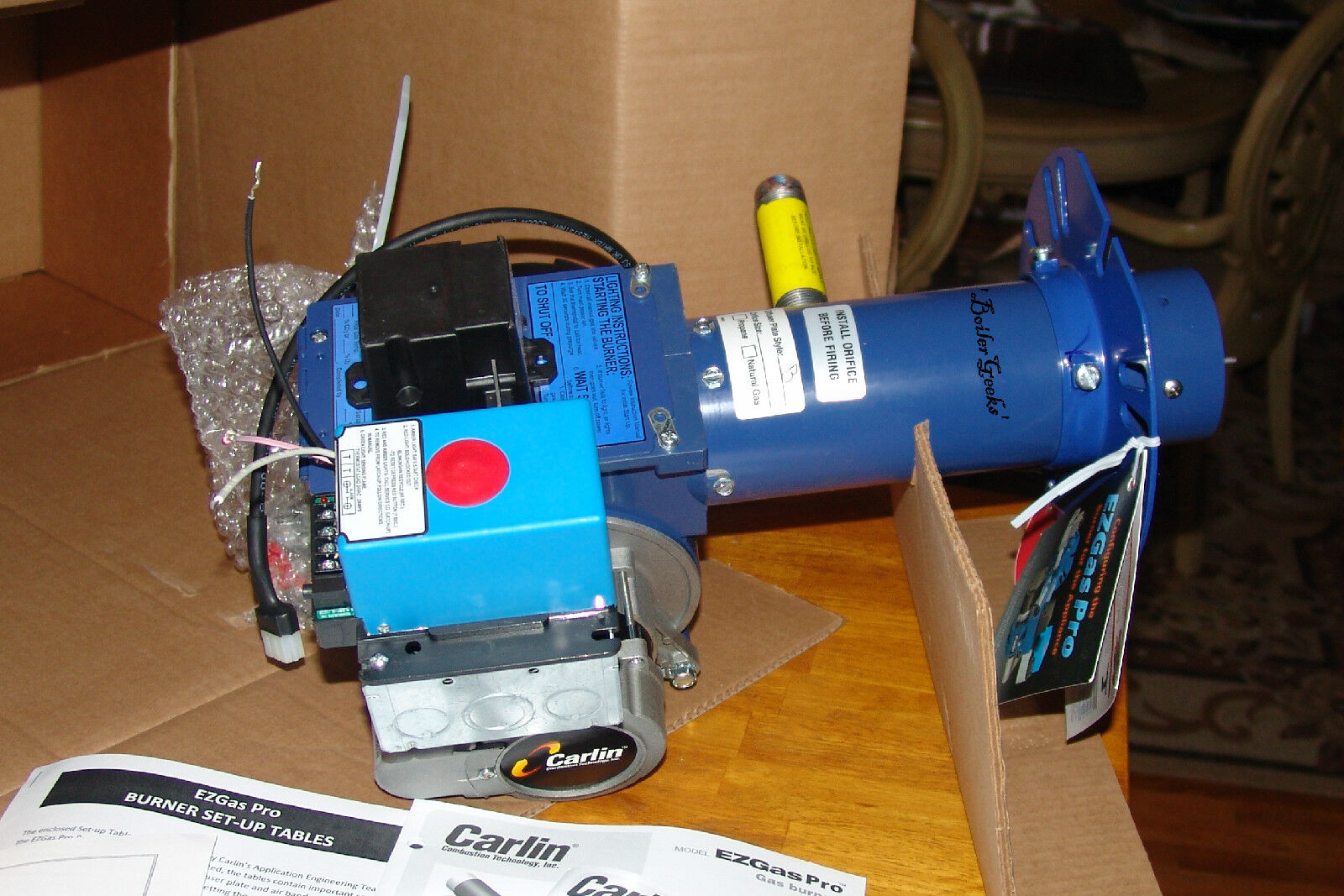

CARLIN EZ PRO OIL To GAS CONVERSION BURNER factory Sealed Box EBay

https://i.ebayimg.com/images/g/3WsAAOSwxH1T-B6t/s-l1600.jpg

Oil To Gas Conversion In The Portland Metro Area As Low As 4 500

https://comfortco.com/wp-content/uploads/2021/04/oil-gas-conversion.jpg

In addition to the general income tax of 28 a non deductible special petroleum tax of 50 applies to income from oil and gas production and from pipeline Capitalized improvements vs deductible repairs Taxpayers generally must capitalize amounts paid to improve a unit of property A unit of property is improved if the

Corporation tax is applied to oil and gas profits at a higher rate than applies to other activities The profit base for SC is the corporation tax profit base adjusted for The Inflation Reduction Act also extended the following fuel tax credits through December 31 2024 Biodiesel and renewable diesel credit Biodiesel and renewable diesel mixture

Download Is Oil To Gas Conversion Tax Deductible

More picture related to Is Oil To Gas Conversion Tax Deductible

Oil To Gas Conversions On Long Island NY All Island Mechanical

https://www.allislandmechanical.com/wp-content/uploads/2017/03/shutterstock_88841917.jpg

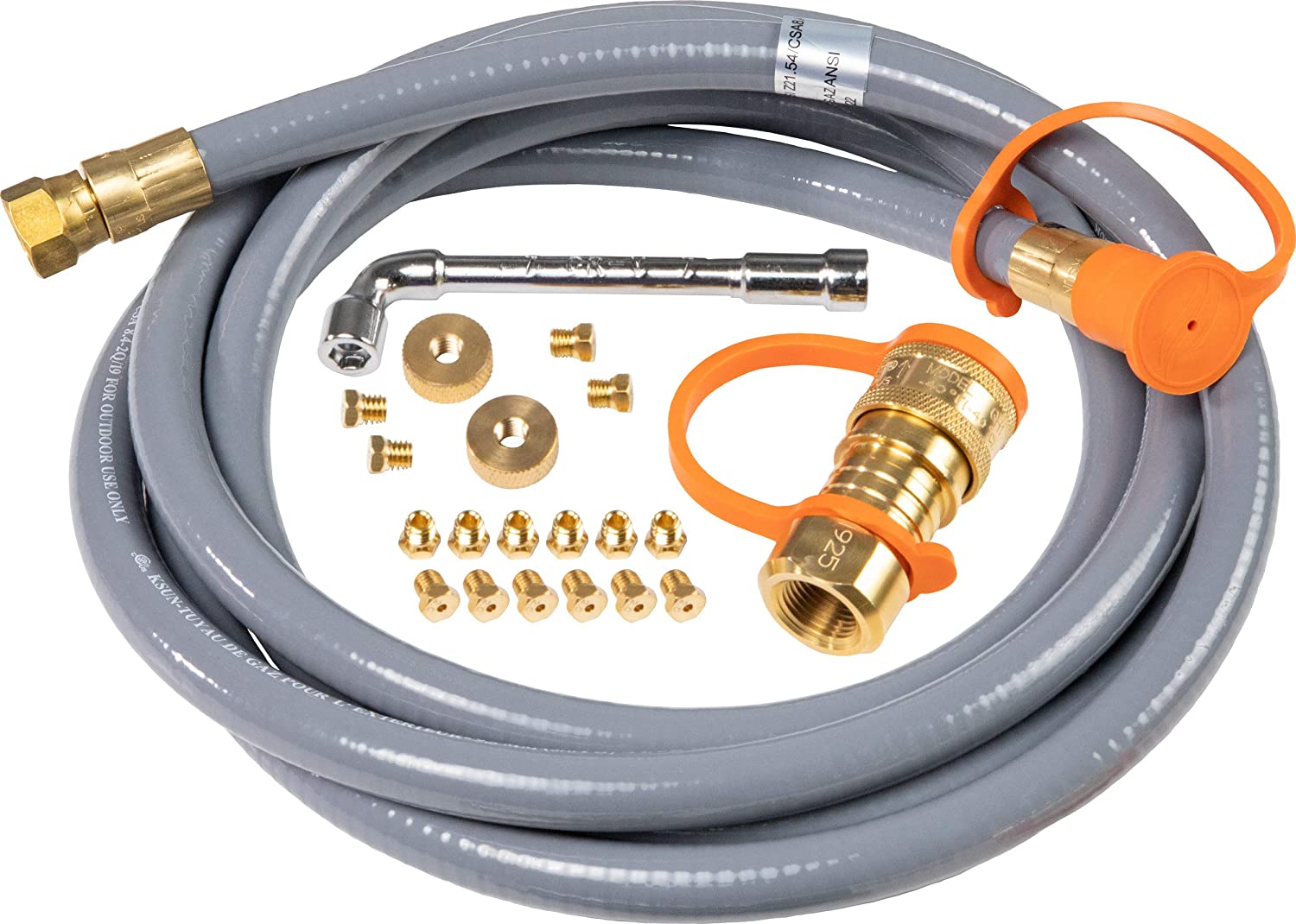

Natural Gas Conversion Kit KLH RV Parts Accessories

https://klhrv.ca/wp-content/uploads/2021/03/natural-gas-conversion-kit_6047cd58c4a2a.jpeg

Oil Price Plunge The LNG Market Timera Energy

https://timera-energy.com/wp-content/uploads/2020/01/shutterstock_1177101259-scaled.jpg

New legislation passed in 2022 will cover energy related tax credits and rebates starting in the 2023 tax year so we put together a list of some common home improvement and renewable energy tax credits that may A taxpayer s total percentage depletion deduction for the year from all oil and gas properties cannot exceed 65 percent of taxable income computed without

IRC Section 263 a provides an election to deduct IDCs when incurred for domestic oil and gas wells the deduction option is unavailable for foreign IDCs KPMG s Indirect Tax Practice and Thomson Reuters ONESOURCE Indirect Tax technology can help Oil Gas companies manage calculate and report global indirect taxes while

Is Early November Too Late For Oil to gas Conversion

https://flotechsplumbing.com/wp-content/uploads/2018/11/oil-to-gas-conversion.jpg

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

https://www2.deloitte.com/content/dam/Deloitte/...

Specifically the production of oil and gas is an extraction activity that qualifies for the deduction The deduction is limited to the lesser of 6 of qualified production

https://www.pheasantenergy.com/oil-and-gas-tax-deductions

Contents hide 1 Are there tax deductions available for oil and gas companies 2 What type of Oil and Gas Tax Benefits are Out There and How Do They

Better Buildings Blog RAND Engineering Architecture DPC

Is Early November Too Late For Oil to gas Conversion

Carlin EZ PRO GAS BURNER OIL To GAS Conversion Burner With TECHNICAL

Is An Oil To Gas Conversion Worth The Investment Oil To Gas

Oil To Gas Conversion NJ Heating Contractor Aladdin

11 15 2014 After Pics Of Oil To Gas Conversion RandlettPark

11 15 2014 After Pics Of Oil To Gas Conversion RandlettPark

Why Choose Natural Gas Refresh NI

All About Oil To Gas Conversion Is It Worth It Cost All A s Plumbing

Figure 1 From Integration Of Power to Gas Conversion Into Dutch

Is Oil To Gas Conversion Tax Deductible - Oil and gas investments may be tax deductible Many investors begin investing in oil and gas due to the returns they expect from this industry However there are more returns