Is Pf Deduction Allowed In New Tax Regime What does deduction mean in the new tax regime A standard deduction implies a flat rebate from taxpayers gross salary Taxpayers do not need to apply through a form to claim the deduction They can directly discount it on their income However the beneficiaries have to confirm if said deductions are accurately calculated The taxes for

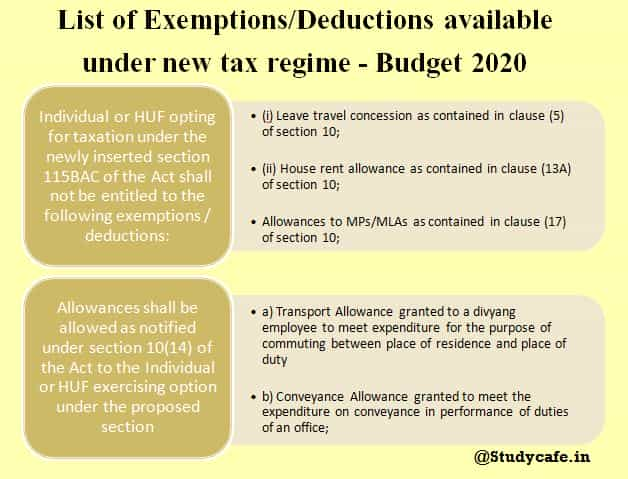

Following is a list of key tax deductions that can be claimed under the current tax regime but cannot be claimed under the new income tax regime Deductions under Chapter VI A such as those under Sections 80C 80CCC employee contribution u s 80CCD 80D 80DD 80DDB 80E 80EEA except those under 80CCD 2 and 80JJAA The employer contributions to EPF will continue to be tax free in the new tax regime current and revised in budget 2023 provided such contributions are less than or equal to Rs 7 5 lakhs in a financial year This limit

Is Pf Deduction Allowed In New Tax Regime

Is Pf Deduction Allowed In New Tax Regime

https://i.ytimg.com/vi/xGksEn4t4rI/maxresdefault.jpg

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

17 New Tax Deduction Allowed In New Tax Slab Regime In ITR Filing AY

https://i.ytimg.com/vi/tdu-ne4QFGQ/maxresdefault.jpg

However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Similarly family pensioners can claim deduction of If you are planning to opt for the new tax regime in current financial year then there are two deductions that are allowed under the new tax regime These deductions are available to salaried individuals Read on to know more about these two deductions and how it can be claimed while filing income tax return iStock

The standard deduction of Rs 50 000 has been extended to the new tax regime as well The highest surcharge rate of 37 has been reduced to 25 under the new tax regime This move impacts taxpayers earning more than Rs 5 crore As a result their overall tax rate will decrease from 42 74 to 39 Under the new regime which will be the default regime from FY23 24 deductions will not be allowed under chapter VIA of the income tax act 1961 such as deduction for donations made to

Download Is Pf Deduction Allowed In New Tax Regime

More picture related to Is Pf Deduction Allowed In New Tax Regime

Tax Deductions Allowed In New Tax Regime

https://i.ytimg.com/vi/DYbmYbMAmjY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLD2RWVjUR5RBAJ3FAvF9-s3EtvAYQ

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://blog.quicko.com/wp-content/uploads/2020/02/New-Tax-Regime-coverage-scaled-1-1024x512.jpg

Deductions NOT ALLOWED In New Tax Regime Salary

https://i.ytimg.com/vi/MOC5EFb_6oE/maxresdefault.jpg

In the new income tax regime as announced in Budget 2020 there are seven tax slabs Contribution by the employer towards the EPF account of an employee of up to 12 remains tax free If In addition family pensioners opting for the new tax regime can claim a standard deduction of Rs 15 000 from their pension income Soni highlighted that the rebate under section 87A has been hiked to Rs 7 lakh from Rs 5 lakh under the new tax regime The rebate benefit will be up to Rs 25 000 provided income doesn t exceed the

In the new tax regime the tax benefit available on employee s own contribution to EPF account is impacted In the existing tax regime an employer s contribution up to 12 per cent of an employee s salary is exempted from tax Any contribution exceeding 12 percent in a financial year will be taxable in the hands of the Standard Deduction and Family Pension Deduction Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

https://fi.money/blog/posts/understand-deductions-in-the-new-tax-regime

What does deduction mean in the new tax regime A standard deduction implies a flat rebate from taxpayers gross salary Taxpayers do not need to apply through a form to claim the deduction They can directly discount it on their income However the beneficiaries have to confirm if said deductions are accurately calculated The taxes for

https://www.paisabazaar.com/tax/deductions-allowed...

Following is a list of key tax deductions that can be claimed under the current tax regime but cannot be claimed under the new income tax regime Deductions under Chapter VI A such as those under Sections 80C 80CCC employee contribution u s 80CCD 80D 80DD 80DDB 80E 80EEA except those under 80CCD 2 and 80JJAA

Tax Deductions For Job Seekers

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Rebate Limit New Income Slabs Standard Deduction Understanding What

Deduction Allowed In 2023 Income Tax Slab New Regime

Exemption In New Tax Regime List Of All The New Tax Regime

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

Late Payment Of PF EPF ESI Allowed As Deduction If Paid Before Filing

New Rules For PF Deduction And Contribution Union Budget 2022

Budget 2023 Deduction Allowed In New Tax Regime YouTube

Is Pf Deduction Allowed In New Tax Regime - Under the new regime which will be the default regime from FY23 24 deductions will not be allowed under chapter VIA of the income tax act 1961 such as deduction for donations made to