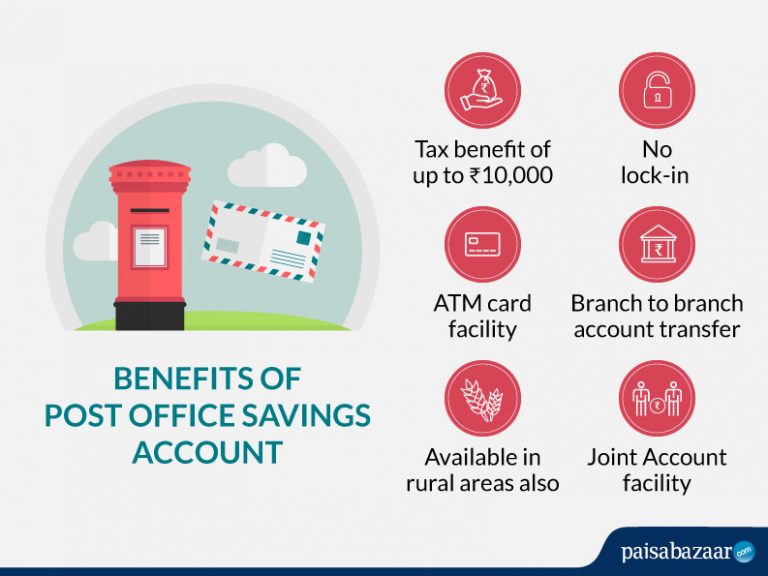

Is Post Office Savings Taxable Post office savings account 3 500 tax exemption for single post office savings account is an additional benefit that one can claim in one s ITR after claiming

Post office tax saving schemes are reliable and risk free investment tools that assure investors of a secure return Operated by post offices all over the country these However post office term deposit of 5 years is eligible for tax deduction under Section 80C of the Income Tax Act 1961 Hence one can claim tax benefits up to INR 1 5 lakhs by investing in post office

Is Post Office Savings Taxable

Is Post Office Savings Taxable

https://i.ytimg.com/vi/qXU8UFyzSDc/maxresdefault.jpg

Post Office Scheme Check Latest Interest Rates Of Kisan Vikas Patra

https://kj1bcdn.b-cdn.net/media/63727/ghgn.jpg?width=1200

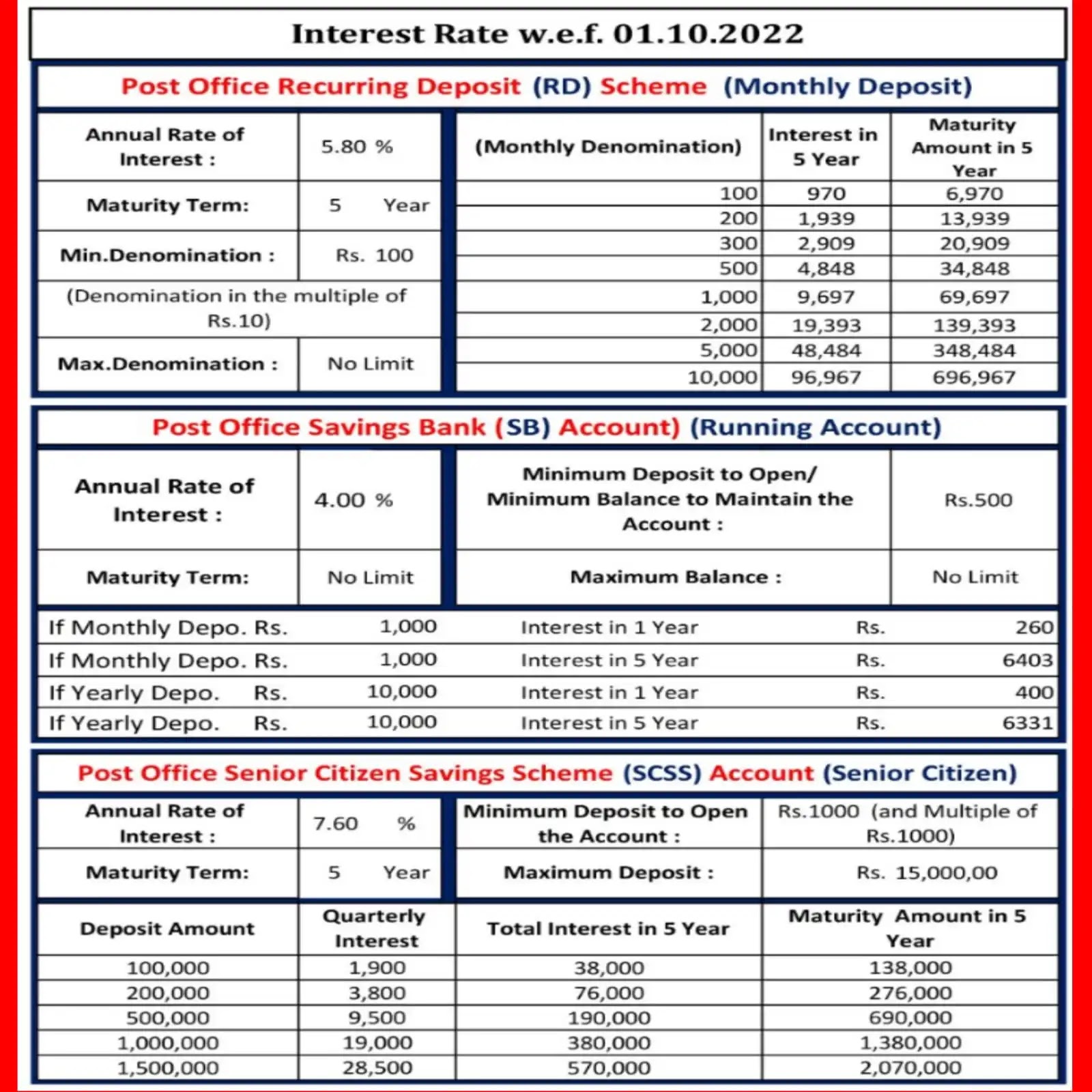

Post Office Interest Rate Chart 2022 Post Office Savings Schemes

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg7uYryhc1JxG0Uc3L92KV-3JKmceqOZ_FYMtGqK_XOmxYEo5RWKUak5mvb-7RDltJ2ymodKxqym1yYyQMMn6v469kH_2gbmnqnnP5-MwBtJmau5tVWr7dw6nzr51pbwd5CSUsgFFU7FcYAssJo-n4HEcsBhR5BHDt_8w_LwEkLO1_M76CE1jU_IhD-DQ/s16000/posb.webp

Post office offers many long term and short term investment plans but note that not all investment avenues are tax free as some Post office schemes interest Under Section 10 15 i of the Income Tax Act interest received from the post office savings account is exempt from tax for up to Rs 3 500 for individual

Portability of the account between post offices is possible Facility of extending the deposit on maturity is available Interest income is taxable Maturity proceeds not drawn are eligible to savings account Post office offers a variety of savings schemes that offer income tax benefits Post office savings schemes The interest rate on Sukanya Samriddhi account

Download Is Post Office Savings Taxable

More picture related to Is Post Office Savings Taxable

Post Office Savings Account 8 Must know Charges The Economic Times

https://img.etimg.com/thumb/msid-97801986,width-1070,height-580,imgsize-307793,overlay-etwealth/photo.jpg

POSB Post Office Savings Bank Schemes Short Notes Postal SB

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgaosLmTLxZkb-XDXLaG4CwekJ-crnYoN0ZMxa-CHHm3EJKMjRYRG2NK-eJW9HI5oCLF-77e3Q1-n0KDl9qKy9Go_kju-8aPVqBnE9agsX2lTJ-XiplUtOwpdLq3rhNCqH3i9QWUy7_1DTEpMZ6ro89vFvSZW-PjdcuXN93pWm03RKqWgxnRgW1EgTDCA/s16000/sb.webp

Post Office Savings Scheme 2021 Sukanya Samriddhi YojanaNewinr

http://newinr.com/wp-content/uploads/2020/12/Post-Office-Savings-Scheme-1068x601.jpg

As a result Section 10 15 i of the Income Tax Act allows you to claim interest from a post office savings account as tax free income According to a Apart from banking services the Post Office offers postal services insurance travel money government services money transfers and much more It also provides tax

The first thing to note is that An Post savings are tax free It is one of the major attractions of saving with the post office and explains why the headline rate of 7 1 5yr A c 7 5 National Savings Monthly Income Account MIS Post Office Monthly Income Scheme Account MIS Interest payable Rates Periodicity etc

Post Office Savings Bank Likely To Be Interconnected With Other Banks

https://www.dailyexcelsior.com/wp-content/uploads/2020/12/POST-OFFICE.jpg

Office Investment Through These Postal Investments You Can Also Savings

https://asset5.scripbox.com/wp-content/uploads/2021/05/post-office-savings.jpg

https://www.livemint.com/money/personal-finance/...

Post office savings account 3 500 tax exemption for single post office savings account is an additional benefit that one can claim in one s ITR after claiming

https://groww.in/p/savings-schemes/post-office-tax-saving-scheme

Post office tax saving schemes are reliable and risk free investment tools that assure investors of a secure return Operated by post offices all over the country these

Post Office Savings Account 2024 Interest Rate Eligibility

Post Office Savings Bank Likely To Be Interconnected With Other Banks

Post Office Savings Schemes Investors Eye Postal Saving Schemes The

Post Office Savings Account Opening Account In Post Office Is More

Post Office Savings Account Now Need Minimum Balance Of Rs 500

Post Office Savings Account Interest Rates Features

Post Office Savings Account Interest Rates Features

Post Office Superhit Plan Deposit 5 Lakhs And You Will Get 7 25 Lakhs

Post Office Savings Account Requirements Process Tax Benefit Etc

Post Office Savings 70

Is Post Office Savings Taxable - Portability of the account between post offices is possible Facility of extending the deposit on maturity is available Interest income is taxable Maturity proceeds not drawn are eligible to savings account