Is Post Office Senior Citizen Scheme Interest Taxable This article provides a comprehensive understanding of the latest SCSS rules covering eligibility criteria investment options extension of tenure and income tax benefits

The section provides for exemption of interest received on deposits in banks cooperative societies engaged in banking business or a post office Investment in Senior Citizens Interest shall be payable annually No additional interest shall be payable on the amount of interest that has become due for payment but not withdrawn by the account holder

Is Post Office Senior Citizen Scheme Interest Taxable

Is Post Office Senior Citizen Scheme Interest Taxable

https://i.ytimg.com/vi/ACMVb7AGJkQ/maxresdefault.jpg

Rakesh Kumar Singhal Small Savings Schemes Interest

https://images.moneycontrol.com/static-mcnews/2023/03/Interest-rates-on-small-savings-schemes-hiked-by-10-70-basis-points-for-April-June.jpg

Post Office Interest Rates Table July To September 2022 FinCalC

https://fincalc-blog.in/wp-content/uploads/2022/06/post-office-interest-rates-table-2022-july-to-september-2022-video.webp

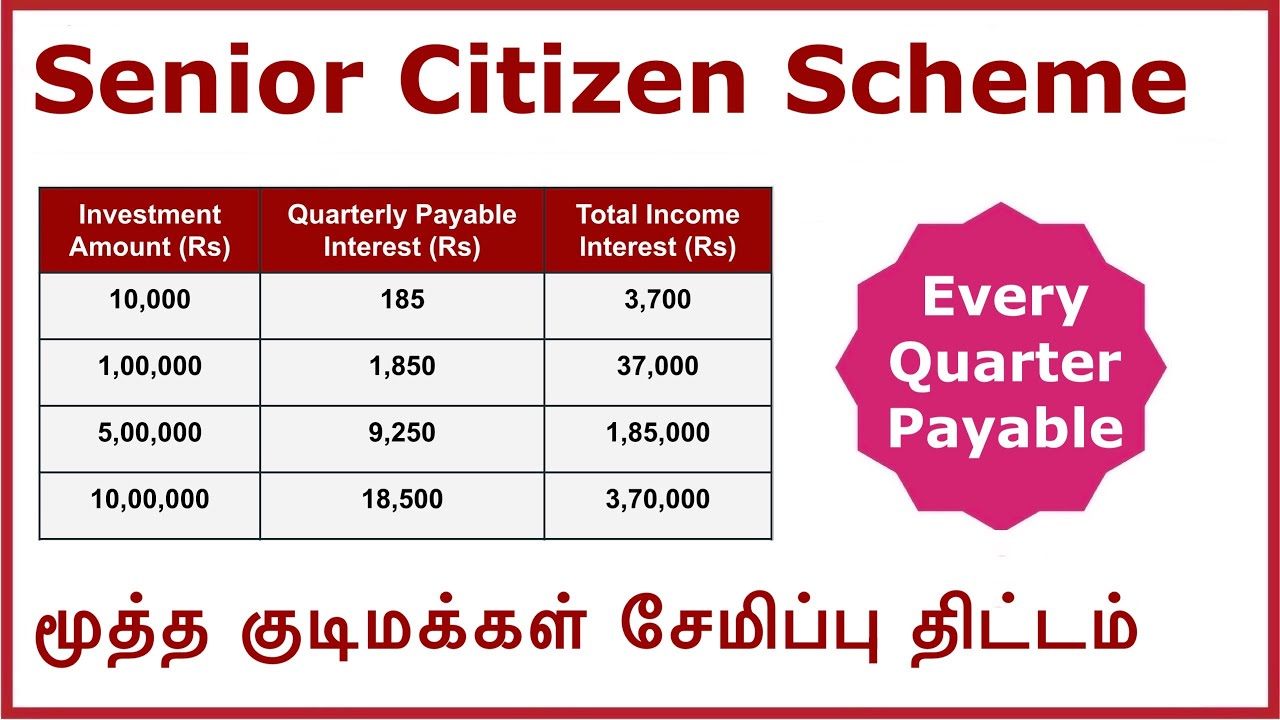

Senior Citizen Savings Scheme offers an interest rate of 8 percent with quarterly payout Senior citizens can claim a tax deduction of up to Rs 1 5 lakh for investments in SCSS Post Office provides Senior Citizens Savings Scheme SCSS provides stable retirement benefit while availing tax benefits under section 80C the interest paid on SCSS is at 8 2 per annum and the minimum deposit is Rs 1 000

Do note that with effect from 1 April 2018 any interest received by senior citizens from deposits in Post Office would be tax exempt up to Rs 50 000 under Section 80TTB Furthermore interest earned on SCSS is taxable according to an individual s tax slab However if the amount exceeds 50 000 for a fiscal TDS Tax Deducted at Source is

Download Is Post Office Senior Citizen Scheme Interest Taxable

More picture related to Is Post Office Senior Citizen Scheme Interest Taxable

Senior Citizen Savings Scheme Senior Citizen Savings Scheme Detail

https://i.ytimg.com/vi/qTpQUFUzdZU/maxresdefault.jpg

Latest Post Office Interest Rates January March 2023

https://www.basunivesh.com/wp-content/uploads/2022/12/Latest-Post-Office-Interest-Rates-January-March-2023-scaled.jpg

Post Office Senior Citizen Scheme Interest Calculator Interest

https://www.digitalindiagov.in/wp-content/uploads/2023/12/0000.jpg

Under Section 10 15 i of the Income Tax Act interest received from the post office savings account is exempt from tax for up to Rs 3 500 for individual accounts and Rs Senior Citizen Saving Scheme SCSS is a government backed initiative for senior citizens with tax benefits under Section 80C offering interest rates up to 8 2 and a tenure of

The Senior Citizen Savings Scheme is a government backed retirement benefits scheme offered by the Post Office It offers senior citizens an attractive investment option with higher Post Office Senior Citizen Savings Scheme Eligibility Interest Rates Income Tax Benefits Explained Here

Post Office Senior Citizen Scheme Interest Rates Eligibility 2023

https://i.ytimg.com/vi/5C5AL_KkGHE/maxresdefault.jpg

Post Office Senior Citizen Scheme Interest Rates Interest Upto 10

https://i.ytimg.com/vi/Pqw1ksfhRLs/maxresdefault.jpg

https://taxguru.in/income-tax/senior-citizen...

This article provides a comprehensive understanding of the latest SCSS rules covering eligibility criteria investment options extension of tenure and income tax benefits

https://economictimes.indiatimes.com/wealth/tax/...

The section provides for exemption of interest received on deposits in banks cooperative societies engaged in banking business or a post office Investment in Senior Citizens

Post Office Senior Citizen Scheme 2022 1 85 5

Post Office Senior Citizen Scheme Interest Rates Eligibility 2023

Post Office Senior Citizen Scheme In Hindi Know All Details About This

Is SCSS Interest Taxable Is TDS Applicable For Senior Citizen Saving

Latest Post Office Interest Rates January March 2022

Post Office Senior Citizen Saving Scheme

Post Office Senior Citizen Saving Scheme

Senior Citizen Savings Scheme SCSS

Senior Citizen Saving Scheme SCSS 2024 Forms New Rules Interest

Tenure

Is Post Office Senior Citizen Scheme Interest Taxable - Post Office provides Senior Citizens Savings Scheme SCSS provides stable retirement benefit while availing tax benefits under section 80C the interest paid on SCSS is at 8 2 per annum and the minimum deposit is Rs 1 000