Is Post Office Term Deposit Interest Taxable Credit rating As the POTD is offered by the Government of India it does not require any commercial rating Tax implications There

Currently the interest from post office saving bank account is 1 st taxable under income from other sources and then eligible for deduction u s 80TTA upto Rs Ans Yes the post office fixed deposits are taxable for the interest paid but the tax deduction at source is not done by the post office One can save the tax by

Is Post Office Term Deposit Interest Taxable

Is Post Office Term Deposit Interest Taxable

https://new-img.patrika.com/upload/2022/02/09/money_new45.jpg

Post Office Term Deposit Vs Bank FDs Highest Interest Rates For 2 year

https://i.pinimg.com/originals/c8/4c/73/c84c7364e4c42de1b8a24aad8f4f303b.png

Post Office Time Deposit Account POTD Interest Rate

https://www.moneymanch.com/wp-content/uploads/2020/06/Post-Office-Time-Deposit-Account.png

There are four possible tenures for post office time deposit accounts you can choose from i e 1 year 2 years 3 years and 5 years The minimum deposit allowed in this account is Rs 1 000 The interest is Facility of extending the deposit on maturity Interest income is taxable but there is no TDS certificate issued Maturity proceeds not drawn are eligible to saving account interest rate for a maximum period

He says post office does not calculate yearly interest for recurring deposits Is RD interest tax free Don t banks or post offices deduct tax on source TDS If it is taxable is there any tax 7 5 National Savings Monthly Income Account MIS Post Office Monthly Income Scheme Account MIS Interest payable Rates Periodicity etc Minimum

Download Is Post Office Term Deposit Interest Taxable

More picture related to Is Post Office Term Deposit Interest Taxable

Get Instant Help On Calculating Term Deposit Interest Rates Finserving

https://finserving.com/wp-content/uploads/2020/09/Get-Instant-Help-on-Calculating-Term-Deposit-Interest-Rates.png

Post Office Fixed Deposit Scheme 2022 Latest Interest Rate

https://i.ytimg.com/vi/oK4NrLt5t5c/maxresdefault.jpg

Post Office Time Deposit Scheme All Details Indiafilings

https://img.indiafilings.com/learn/wp-content/uploads/2019/03/12004533/Post-Office-Time-Deposit-Scheme.jpg

While both the schemes are eligible for deduction interest earned on both the schemes are taxable The interest payout under 5 year POTD is added to total income to calculate tax liability Unless 15G 15H Taxation on interest Under the Income Tax Act the interest earned on the deposit is taxable income and can be subject to a Tax Deducted at the Source TDS

Interest earned on this deposit is taxable under section 80C only if it is a five year time deposit Otherwise it is taxable Investors cannot en cash their TD before 6 months For However post office term deposit of 5 years is eligible for tax deduction under Section 80C of the Income Tax Act 1961 Hence one can claim tax benefits up to

Term Deposit Interest Rates On Climbing Up Telangana Today

https://cdn.telanganatoday.com/wp-content/uploads/2023/01/Money-3.jpg

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/03/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-April-2020_Featured.png?fit=1239%2C891&ssl=1

https://www.valueresearchonline.com/stories/…

Credit rating As the POTD is offered by the Government of India it does not require any commercial rating Tax implications There

https://taxguru.in/income-tax/taxation-interest...

Currently the interest from post office saving bank account is 1 st taxable under income from other sources and then eligible for deduction u s 80TTA upto Rs

Nab Term Deposit Rates Peatix

Term Deposit Interest Rates On Climbing Up Telangana Today

SBI FD Vs Post Office Deposit Rates 2021 Check Interest Rate And Other

Post Office Time Deposit Benefits Tax Deduction Account Opening

How To Get Duplicate KVP NSC Post Office Term Deposit Certificate Online

Difference Between Bank And Post Office Differbetween

Difference Between Bank And Post Office Differbetween

Post Office

Office Savings Schemes Interest Rate And Maturity Details Po Tools

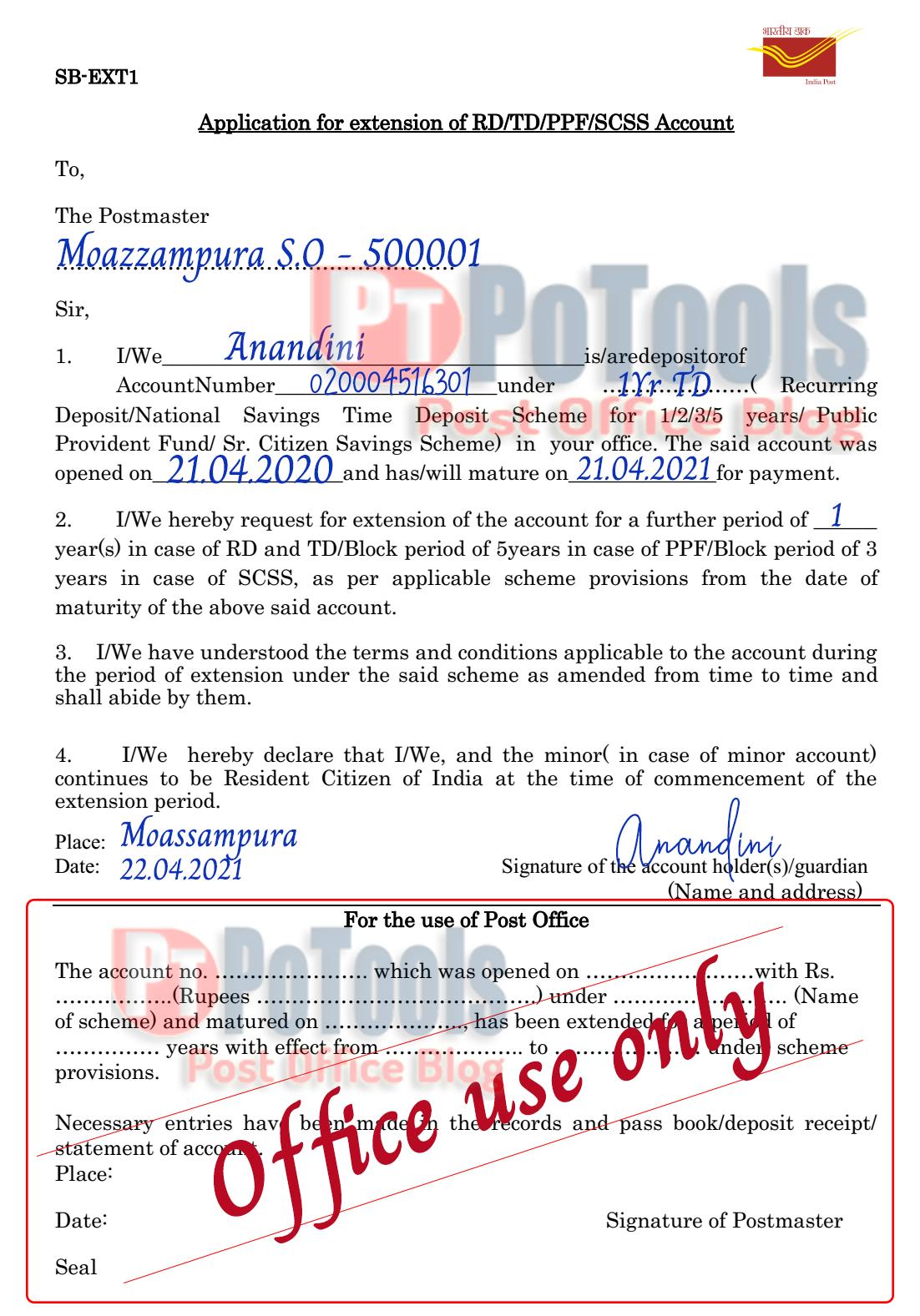

How To Fill Extension Form For Post Office Term Deposit

Is Post Office Term Deposit Interest Taxable - A fixed rate of interest remains the same and does not change for the duration of the term Tax free Tax free means that interest paid will be free from UK Income Tax and