Is Principal And Interest Tax Deductible Web Annual net interest expense the excess of interest paid over that received is only deductible at up to 30 of EBITDA for corporation and trade tax purposes The 30

Web 15 Dez 2017 nbsp 0183 32 Your mortgage payments that go toward the principal reduce the loan balance These payments are not tax deductible Can I write off mortgage interest In Web There is no technical definition of interest Interest is generally taken to be passive investment income being payment for the use of money or for indebtedness by

Is Principal And Interest Tax Deductible

Is Principal And Interest Tax Deductible

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

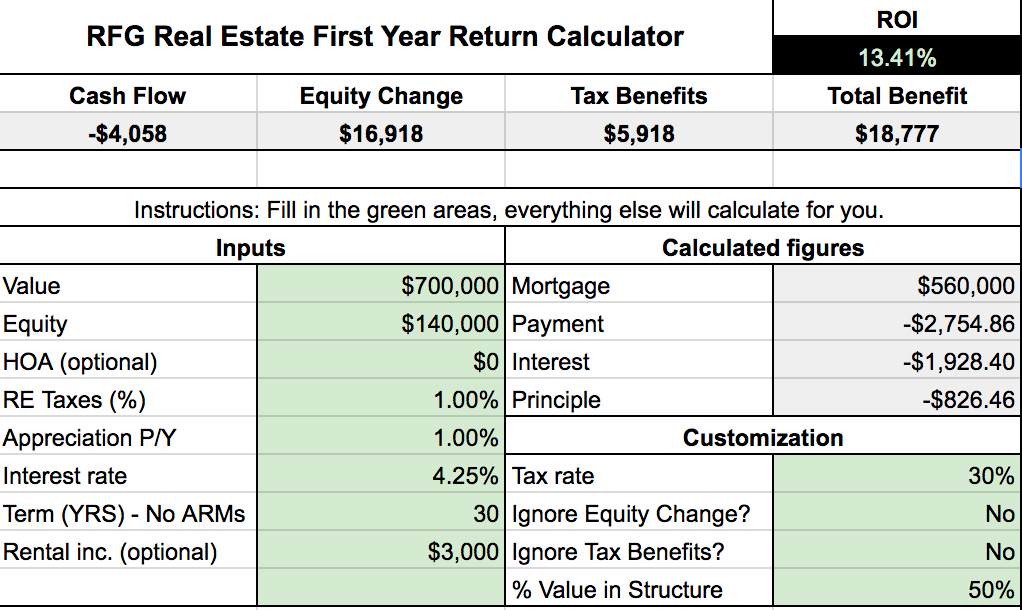

How Much Real Estate Interest Is Tax Deductible Real Estate Spots

http://static1.squarespace.com/static/58967c71c534a5fc6eaac8c9/5896812cb3db2ba7b8ccc3ab/5915e068579fb3ad10cce1a3/1568674637897/2017-05-12_0921.png?format=1500w

Are Health Insurance Premiums Tax Deductible Insurance Deductible

https://i.pinimg.com/736x/41/18/66/4118660dcdfb923da8f29f18391f22df.jpg

Web Updated 08 03 2023 Fact Checked Principal and interest are some of the most basic terms you ll hear used in lending but it s not always obvious what each one means More Web 28 Feb 2013 nbsp 0183 32 If PE is a cash basis taxpayer and the interest is properly determined to be QSI the accrued interest would not be taxable and section 267 would in fact defer the

Web 9 Nov 2020 nbsp 0183 32 Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject to tax Some examples of Web 8 Apr 2022 nbsp 0183 32 Principal interest taxes insurance PITI are the sum components of a mortgage payment Specifically they consist of the principal amount loan interest property tax and the homeowners

Download Is Principal And Interest Tax Deductible

More picture related to Is Principal And Interest Tax Deductible

Is Interest Rate Tax deductible Jan 04 2022 Johor Bahru JB

https://cdn1.npcdn.net/image/1641275540016693861db27c663ebda4095db98fe2.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Five Types Of Interest Expense Three Sets Of New Rules

https://www.thetaxadviser.com/content/dam/tta/issues/2018/oct/witner-exhibit.JPG

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

Web 17 Jan 2023 nbsp 0183 32 Tax deductible interest is the interest you ve paid for various purposes that can be used to reduce your taxable income Not all interest is tax deductible In general tax deductible interest is Web Principal No The principal is the total amount you borrow from the lender It s not deductible The portion of your house payment that goes toward the principal is generally smaller during the first years of the

Web 1 Okt 2018 nbsp 0183 32 If the loan is to purchase a principal residence the points represent prepaid interest and the conditions of Sec 462 g are satisfied the full 6 000 paid for the points is deductible as qualified residence Web 24 Juni 2020 nbsp 0183 32 If the funds from your business loan are just sitting in your business bank account the interest isn t tax deductible Even if you re paying off the principal and

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

https://www.investopedia.com/thmb/5m0mI7c0y7v4NIj1i56LUS3-JLU=/3959x3917/filters:no_upscale():max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png

Are Insurance Payments Tax Deductible Infographics Article

https://www.budgetdirect.com.au/blog/wp-content/uploads/2018/06/Is-home-insurance-tax-deductible-1.jpg

https://taxsummaries.pwc.com/germany/corporate/deductions

Web Annual net interest expense the excess of interest paid over that received is only deductible at up to 30 of EBITDA for corporation and trade tax purposes The 30

https://www.penfed.org/mortgage-knowledge-center/how-do-principal-and...

Web 15 Dez 2017 nbsp 0183 32 Your mortgage payments that go toward the principal reduce the loan balance These payments are not tax deductible Can I write off mortgage interest In

Mortgage Interest Tax Deductible 2023

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

What Is Interest Tax Shield Formula Calculator

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage

Home Equity Main Line Real Estate Blog

Home Equity Main Line Real Estate Blog

The Mortgage Interest Tax Deduction Is One Of The Most Popular Parts Of

Investment Expenses What s Tax Deductible Charles Schwab

Conceptual Photo About Tax Deductible Interest With Handwritten Text

Is Principal And Interest Tax Deductible - Web 13 Nov 2018 nbsp 0183 32 Over time the interest portion of your monthly payment will decrease as you pay down the loan The Tax Benefits of Mortgage Interest As of 2018 mortgage