Is Property Tax Deductible Property Taxes Guide What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income

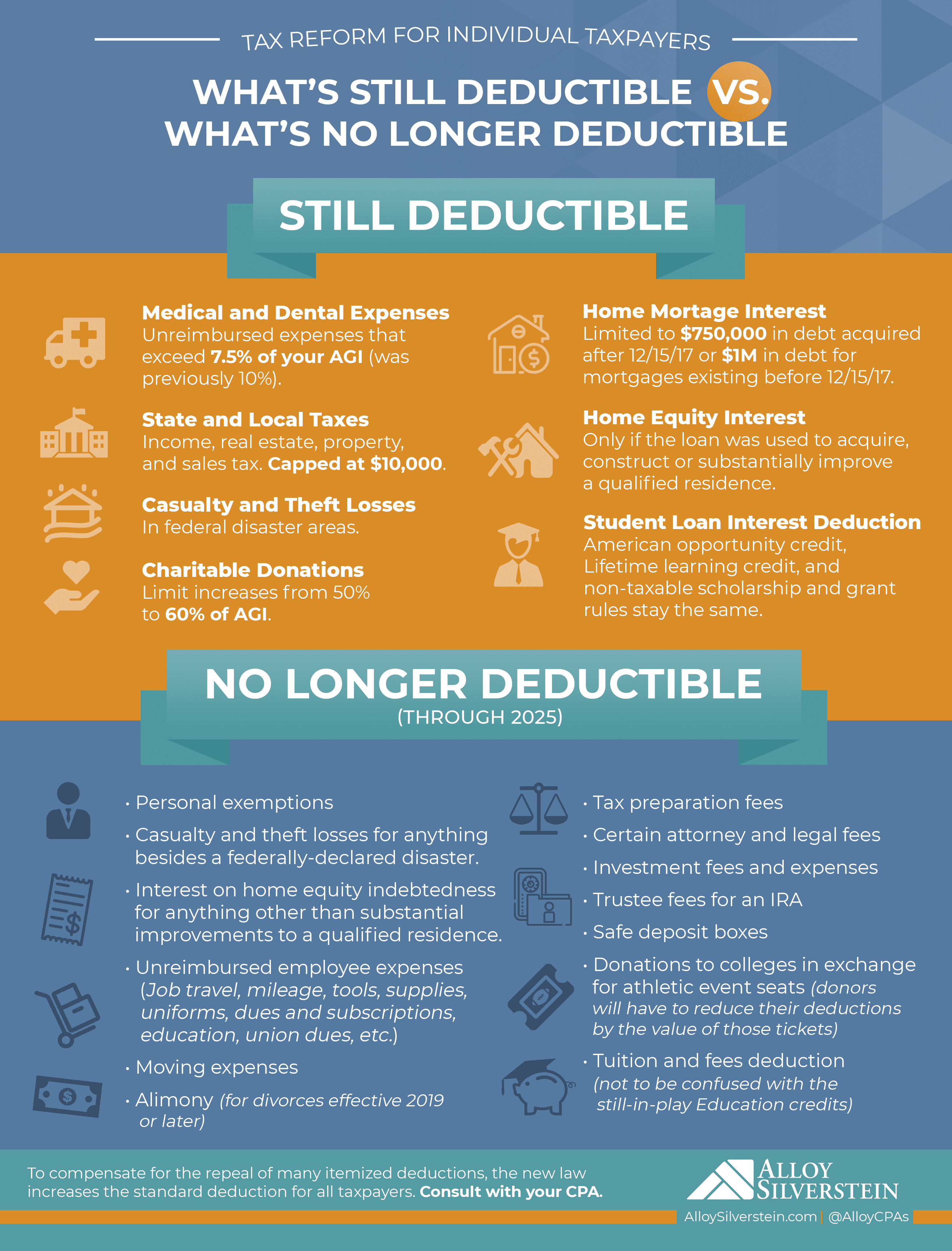

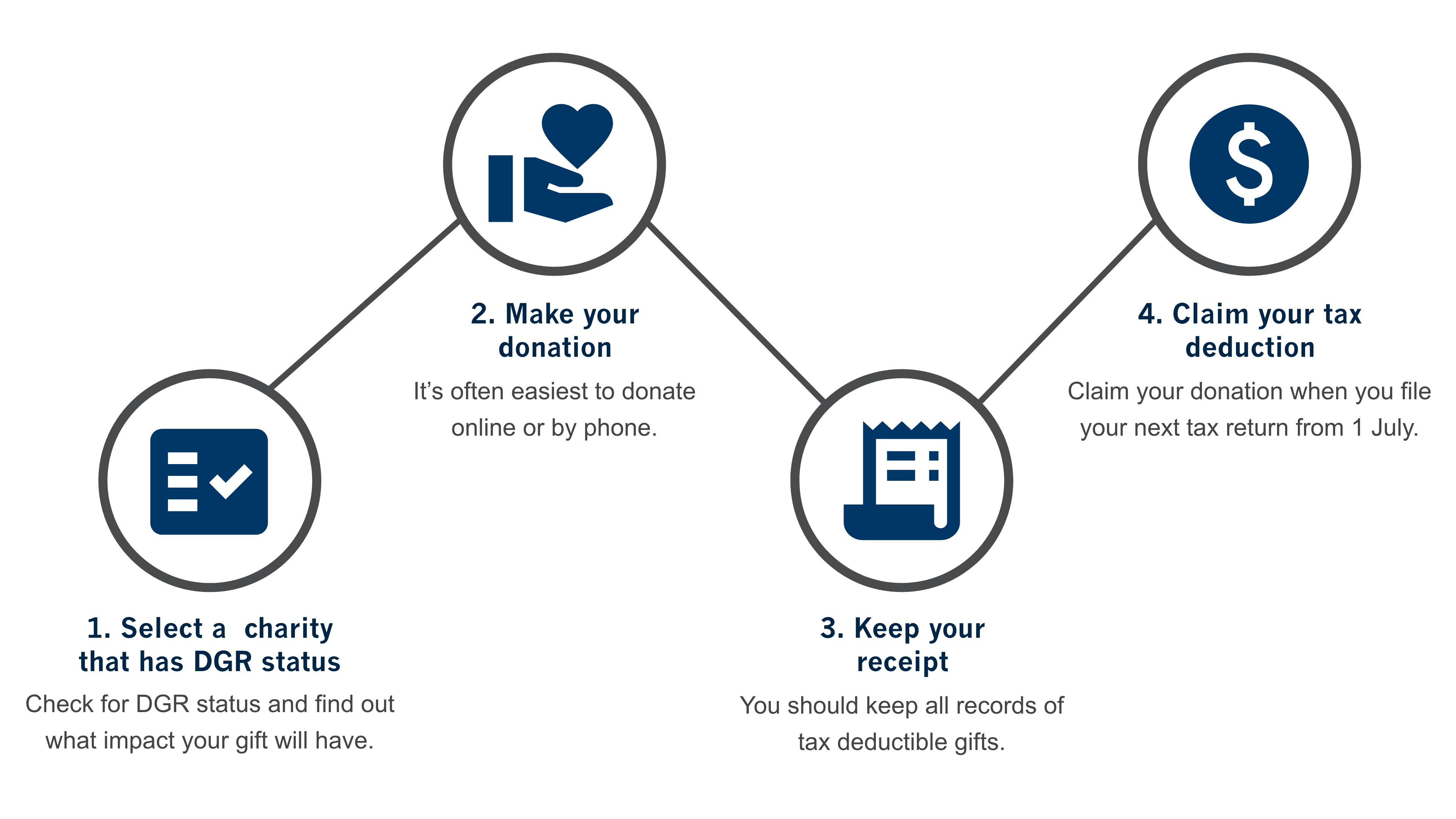

Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniform the same rate is applied to all real property in the tax jurisdiction The revenues raised must benefit the community as a whole or the government Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local income taxes including

Is Property Tax Deductible

Is Property Tax Deductible

https://www.mortgagerater.com/wp-content/uploads/2024/01/is-property-tax-deductible.png

Is Property Tax Deductible Griffin Funding

https://griffinfunding.com/wp-content/uploads/2023/08/image3-4.jpg

Is Property Tax Deductible In California YouTube

https://i.ytimg.com/vi/knm-zxuFFf8/maxresdefault.jpg

Deductible personal property taxes are those based only on the value of personal property such as a boat or car The tax must be charged to you on a yearly basis even if it s collected more than once a year or less than once a year State and local real property taxes are generally deductible Deductible real property taxes include any state or local taxes based on the value of the real property and levied for the general public welfare

Real estate taxes are generally divided so that you and the seller each pay taxes for the part of the property tax year you owned the home Your share of these taxes is deductible if you itemize your deductions Real estate taxes are deductible if Based on the value of the property Levied uniformly throughout your community Used for a governmental or general community purpose Assessed and paid before the end of the tax year You can deduct up to 10 000 or 5 000 if married filing separately of state and local taxes including property taxes

Download Is Property Tax Deductible

More picture related to Is Property Tax Deductible

Is Property Tax Deductible 5 Shocking Facts

https://www.mortgagerater.com/wp-content/uploads/2024/01/property-tax-deduction.png

Is Home Insurance Tax Deductible In Canada Surex

https://cdn-brochure.surex.com/cdn-brochure-prod/cdn-files/styles/blog_image_retina_1110x413/public/2022-12/pexels-andrea-piacquadio-3770194.jpg.webp?VersionId=OmGdd2ofhw898PDjE9T9zNlrPRScboW.&itok=0EMlg-8o

Is Property Tax Deductible Griffin Funding

https://griffinfunding.com/wp-content/uploads/2023/08/image2-2.jpg

Key Takeaways How is property tax calculated Property tax is determined by multiplying the assessed value of your property by the basic levy rate which is a percentage set by the municipal tax authority In some cases special assessments are also included in the total property taxes assessed Why do we have property taxes What is a property tax deduction Counties cities and states levy property taxes on various kinds of property Property may include owned real estate recreational vehicles

[desc-10] [desc-11]

Is Property Tax Deductible If You Don t Itemize PRORFETY

https://i.pinimg.com/originals/87/db/7a/87db7adb24644e9250c142cc920a8a8c.png

Plants Should Be Tax Deductible Good Earth Plants

https://www.goodearthplants.com/wp-content/uploads/2019/04/money-tree-geralt-Pixabay-2380158_1920-1.jpg

https://www.investopedia.com/terms/p/property_tax_deduction.asp

Property Taxes Guide What Is the Property Tax Deduction State and local property taxes are generally eligible to be deducted from the property owner s federal income

https://www.thebalancemoney.com/property-tax-deduction-3192847

Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniform the same rate is applied to all real property in the tax jurisdiction The revenues raised must benefit the community as a whole or the government

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Is Property Tax Deductible If You Don t Itemize PRORFETY

Ergeon How Your Fence Can Be Tax Deductible

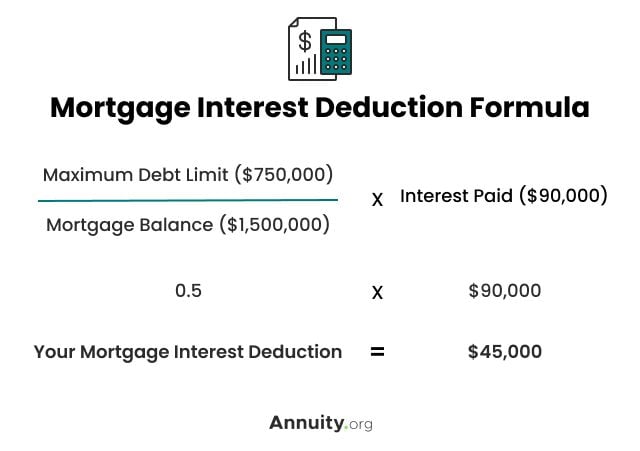

Tax Deductible Donations Reduce Your Income Tax Charity Tax Calculator

How Much Of Property Taxes Are Tax Deductible

Is Property Tax Deductible If You Don t Itemize PRORFETY

Is Property Tax Deductible If You Don t Itemize PRORFETY

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

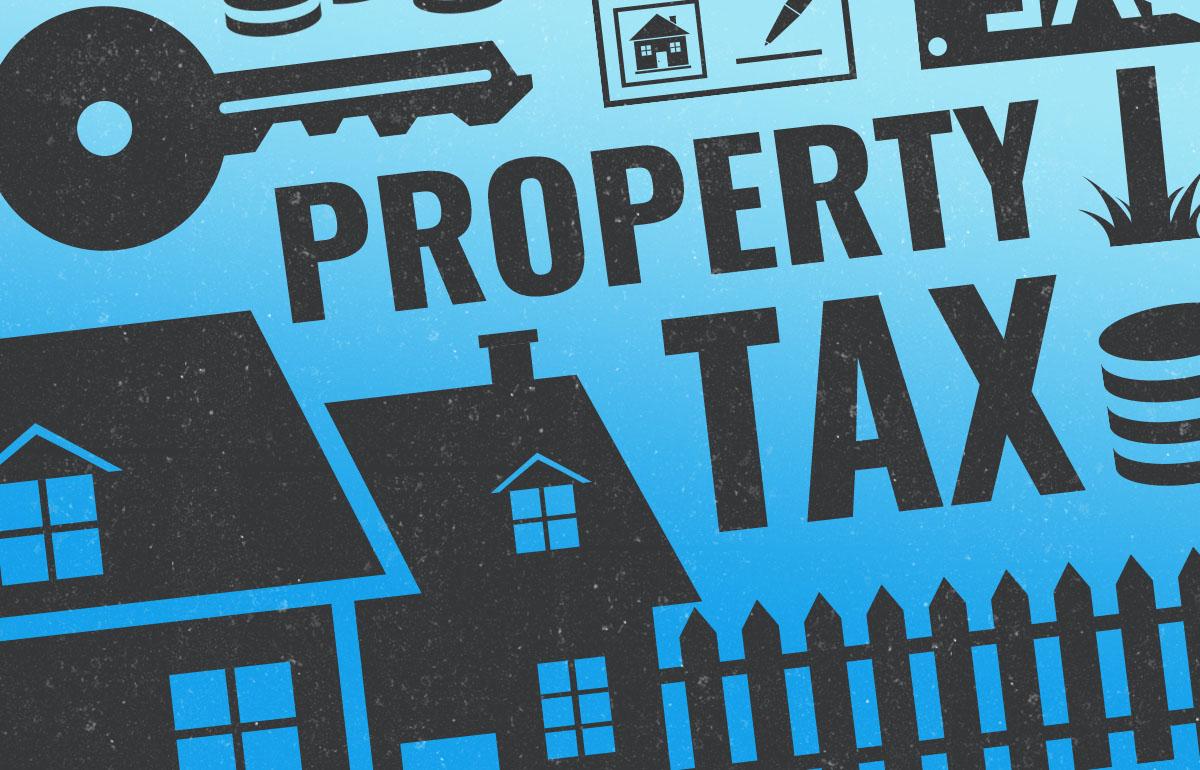

Mortgage Interest Tax Relief Calculator DermotHilary

Property Tax Definition Uses And How To Calculate TheStreet

Is Property Tax Deductible - [desc-12]