Is Redundancy Pay Tax Free Nsw The amount of an ETP that is taxable for payroll tax is the total ETP amount you paid minus any Lump sum D components tax free components of genuine redundancy or early retirement

Redundancy and early retirement Find out about genuine redundancy early retirement scheme payments and reporting the tax free amounts Tax free component of ETPs Learn about when Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax free amount isn t part of the

Is Redundancy Pay Tax Free Nsw

Is Redundancy Pay Tax Free Nsw

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

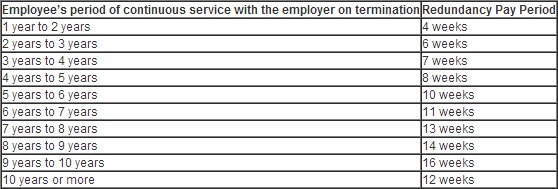

How Much Are You Entitled As Redundancy Pay Know Your Eligibility In UK

https://cdn.papershift.com/20221019210850/redundancy-pay-for-the-employees-in-UK-and-its-legal-obligations-explained-by-Papershift.jpeg

Redundancy Pay With Earlier Casual Service Workdynamic Australia

https://workdynamic.com.au/wp-content/uploads/redundancy-pay.jpg

Genuine redundancy payments are taxed at special rates and part of the redundancy payment can be paid tax free The tax free limit consists of two elements a base amount and an The tax free limit which changes every year is a base amount plus an amount for each complete year of service with your employer Any remaining genuine redundancy payment is

When an employee s job is made redundant their employer may need to pay them redundancy pay also known as severance pay On this page Redundancy pay When redundancy pay Tax free component of your payment If you re below the preservation age you ll pay tax at 30 plus the Medicare Levy on any excess above the free component up to

Download Is Redundancy Pay Tax Free Nsw

More picture related to Is Redundancy Pay Tax Free Nsw

Redundancy Pay Redundancy Entitlements Mini Guide Owen Hodge Lawyers

https://www.owenhodge.com.au/wp-content/uploads/2013/07/v.jpg

Director s Redundancy Concept Explained CMA

https://www.cma-quebec.org/wp-content/uploads/2022/02/redundancy-pay-768x467.jpg

Kelebihan Kekurangan Kad Kredit American Express Asas Asas 2023

https://img.cs-finance.com/img/money/how-to-calculate-redundancy-pay.jpg

The tax free component for genuine redundancies for the 2022 23FY is Base Limit 11 591 Service amount 5 797 You can read more about the Tax free part of genuine If you ve received a genuine redundancy payment part or all of it may be tax free As below So if your total genuine redundancy payment is less than this you won t pay any tax on the

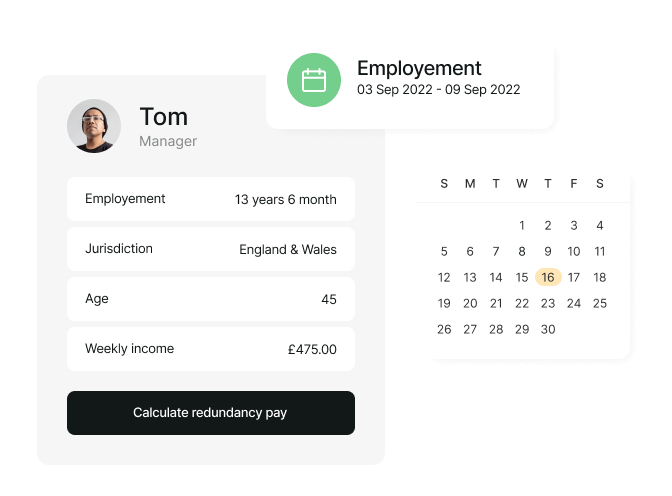

You can find out how much notice and redundancy pay is required when employment ends by using this calculator The calculator includes pay and redundancy If you are made redundant you may be entitled to redundancy pay Redundancy pay is a payment offered to an employee because their employer no longer needs anyone to do their

What Is Voluntary Redundancy Pay

https://dontdisappoint.me.uk/wp-content/uploads/2022/03/Webp.net-compress-image-2022-03-25T141940.767.jpg

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

https://slowfortune.com/wp-content/uploads/2020/01/How-Is-A-Redundancy-Payment-Taxed-In-Australia.jpg

https://www.revenue.nsw.gov.au/taxes-duties-levies...

The amount of an ETP that is taxable for payroll tax is the total ETP amount you paid minus any Lump sum D components tax free components of genuine redundancy or early retirement

https://www.ato.gov.au/businesses-and...

Redundancy and early retirement Find out about genuine redundancy early retirement scheme payments and reporting the tax free amounts Tax free component of ETPs Learn about when

Redundancy Pay UK Your Legal Rights Statutory Minimum And How To

What Is Voluntary Redundancy Pay

What Tax Do I Pay On Redundancy Payments CruseBurke

Statutory Redundancy Pay Calculator

Tax On Redundancy Payments Davis Grant

Is My Redundancy Payment Tax Free

Is My Redundancy Payment Tax Free

Determining Redundancy Pay Deputy

What Tax Do I Pay On Redundancy Payments Accounting Firms

Redundancy Pay DSC Chartered Accountants

Is Redundancy Pay Tax Free Nsw - Tax free component of your payment If you re below the preservation age you ll pay tax at 30 plus the Medicare Levy on any excess above the free component up to