Is Redundancy Taxable In Ireland Web 25 Juli 2023 nbsp 0183 32 Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief from tax For further information please see Lump sum termination payments

Web Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each completed year of service The basic exemption may be Web 25 Apr 2023 nbsp 0183 32 An employee who has been made redundant may be entitled to a lump sum payment under the Redundancy Payments Act 1967 This is not to be included as pay for tax purposes Covid 19 Related Lay off Payments CRLP Employees unable to accrue reckonable service due to layoffs caused by the COVID 19 public health restrictions may

Is Redundancy Taxable In Ireland

Is Redundancy Taxable In Ireland

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

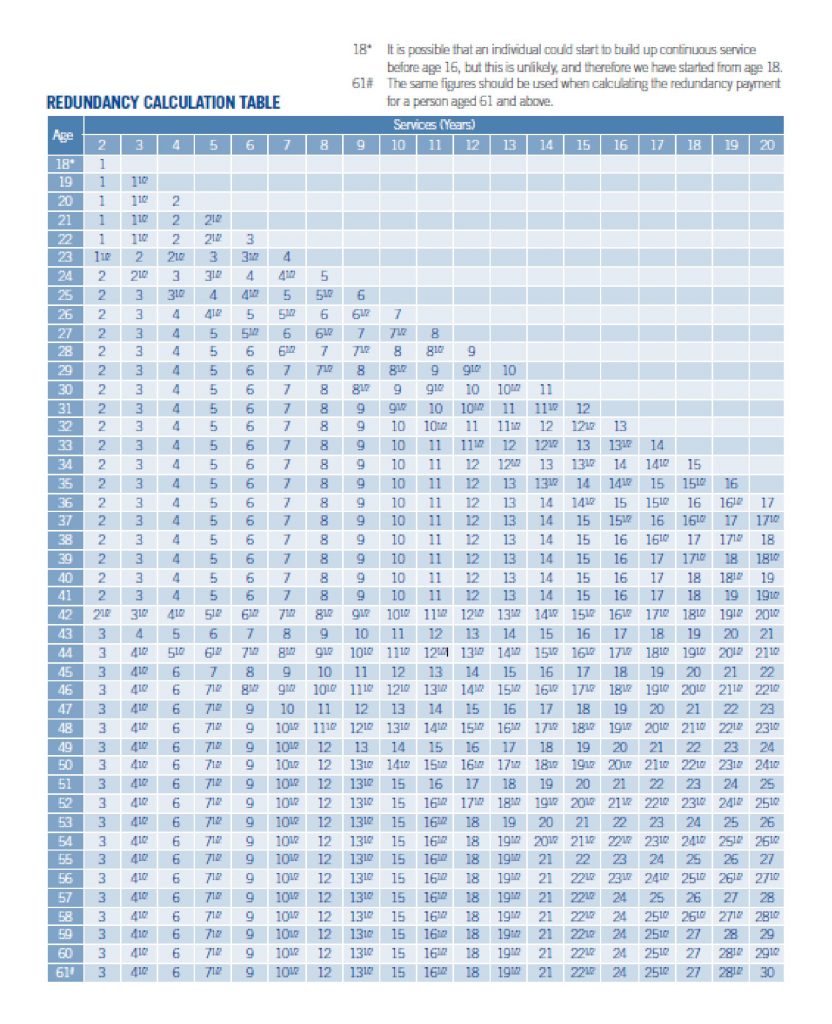

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

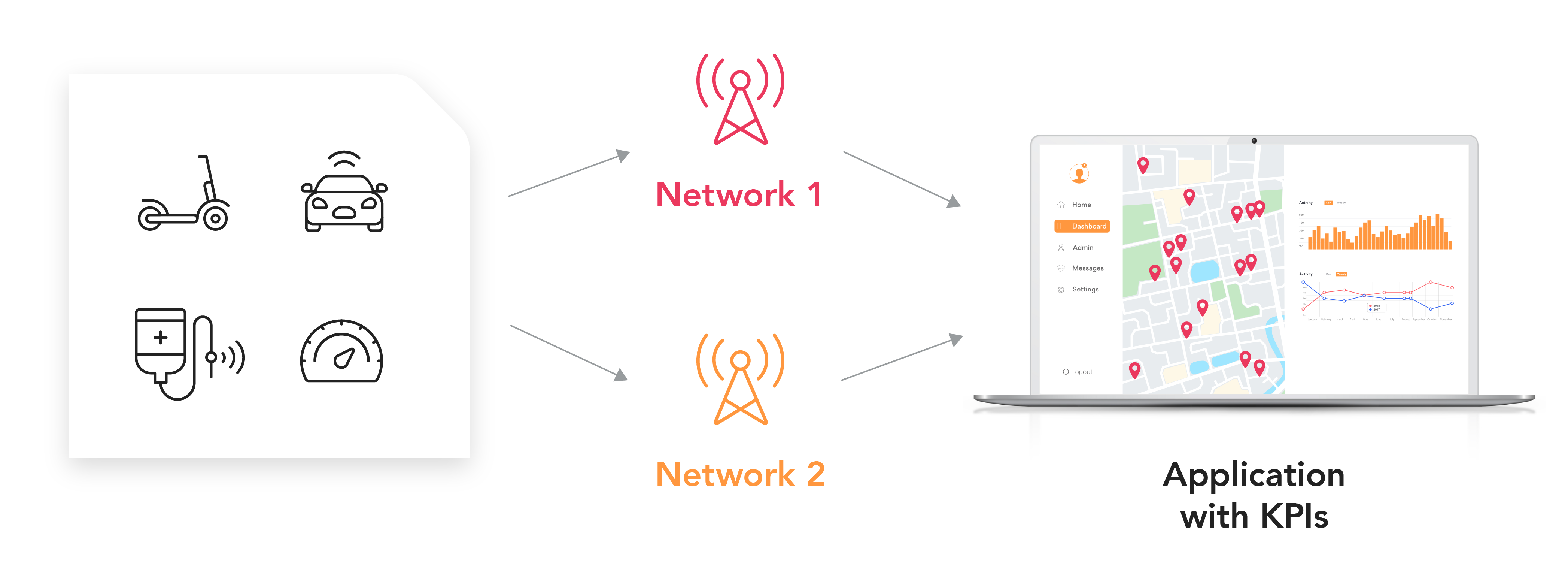

What Is Network Redundancy IoT Glossary 2022

https://www.emnify.com/hs-fs/hubfs/network-redundancy-model.png?width=4188&name=network-redundancy-model.png

Web The statutory redundancy payment is tax free If you get a lump sum as compensation for losing your job part of it may be tax free Read more about how lump sum payments on redundancy are taxed More information on whether elements of the payment such as pay in lieu of notice is taxable is available on the Revenue website Web 9 Juni 2022 nbsp 0183 32 How are are redundancy payments taxed in Ireland Statutory payments If you are just receiving the base amount of redundancy payment which is the statutory amount then this will be completely tax free

Web 6 Nov 2023 nbsp 0183 32 And under current legislation that can be up to 200k tax free severance payment separate from any pension lump sum Now this 200 000 is a lifetime limit and all previous exempt severance payments received are taken into account in determining this 200 000 limit For example if you received an exempt severance payment of 200 000 Web By law you are entitled to a minimum paid notice period Do I have a right to redundancy pay If you lose your job you may be eligible for redundancy pay This page summarises the rules on qualifying for a redundancy payment How much redundancy pay will I get Find out about redundancy pay and how your statutory redundancy is calculated

Download Is Redundancy Taxable In Ireland

More picture related to Is Redundancy Taxable In Ireland

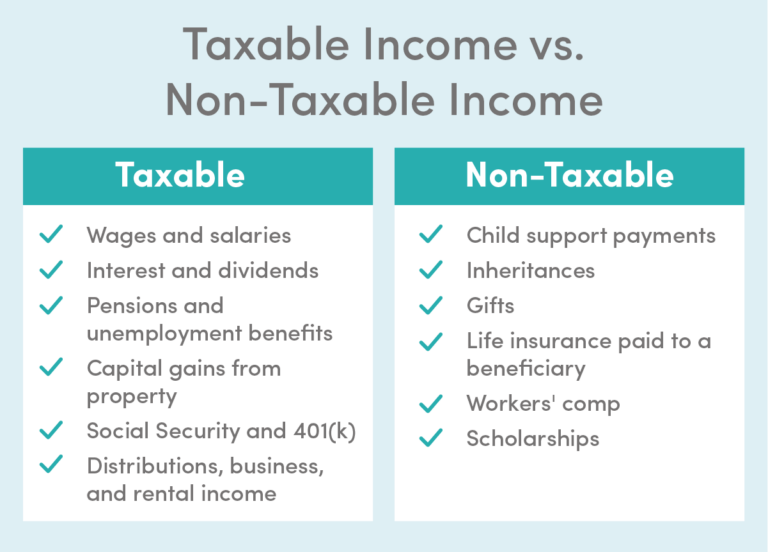

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

What Is Redundancy

https://www.breathehr.com/hs-fs/hubfs/man_20carring_20box_20full_20of_20stuff_20in_20mee-min.jpg?width=900&name=man_20carring_20box_20full_20of_20stuff_20in_20mee-min.jpg

Redundancy Process Explained Step By Step Guide For Employers

https://arielle.com.au/wp-content/uploads/2023/02/redundancy-process-australia.jpg

Web 13 Juli 2023 nbsp 0183 32 Tax On Redundancy in Ireland If you receive a statutory redundancy payment the amount you receive is not subject to taxation meaning it is completely tax free To be eligible for this payment you must have worked for the company for at least two years after turning 16 and have paid Irish PRSI at a qualifying class The statutory Web Statutory redundancy payments arising from the Redundancy Payments Acts 1967 to 2014 do not attract tax They are completely exempt from income tax under Schedule E Section 203 TCA 1997 They do not affect the reliefs and exemptions applicable to other redundancy payments How is statutory redundancy calculated

Web 13 Nov 2020 nbsp 0183 32 Basic Exemption The basic exemption exempts payments over and above statutory redundancy up to 10 160 plus 765 for each complete year of service from tax Increased Exemption The basic tax free exemption may be increased by 10 000 if the following two conditions are satisfied Web 13 Aug 2010 nbsp 0183 32 Taxable amount 40 000 23 200 16 800 This Taxable Lump Sum is treated as Income from employment and taxed in the normal way More About Redundancy Introduction to Redundancy and Tax Statutory Redundancy Top slicing Relief Click the links above to find out more about the different areas of redundancy and

Redundancy

https://static.wixstatic.com/media/f4ca34_3fb7f5b1b59d45d89d3ec41495353a16~mv2.png

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

https://www.revenue.ie/.../redundancy-lump-sum-payments.aspx

Web 25 Juli 2023 nbsp 0183 32 Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum payment on redundancy or retirement If you do it may be exempt from tax or may qualify for some relief from tax For further information please see Lump sum termination payments

https://kpmg.com/ie/en/home/insights/2019/09/are-severance-payme…

Web Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each completed year of service The basic exemption may be

IBM Launches Voluntary Redundancy Scheme In Latest Job Cuts The Register

Redundancy

Voluntary Redundancy And Unfair Dismissal

The Trials And Tribulations Of Surviving Redundancy

Redundancy Your Rights

The Importance Of Redundancy 123NET

The Importance Of Redundancy 123NET

What Is Redundancy Definition And Meaning Market Business News

Redundancy Advice For Employers DavidsonMorris

Is Director Redundancy Pay Taxable Redundancy Claims UK

Is Redundancy Taxable In Ireland - Web How are redundancy payments taxed in Ireland Taxation of redundancy payments in Ireland varies depending on whether the employee received a payment over and above the statutory entitlement However if the entire redundancy payment is a statutory redundancy payment the lump sum is tax free In the UK there is a 163 30 000 exemption to paying