Is Reimbursement Considered Revenue Revenues are typically recorded as an increase in cash or a receivable typically a debit to cash or a receivable and a credit to revenue On the other hand a reimbursement is

Revenue recognized from reimbursed expenses is typically subject to income tax which can increase the company s tax liability This necessitates careful planning to ensure Reimbursements while considered revenue technically don t qualify as income as they are nothing more than a repayment for an expense incurred While most people use

Is Reimbursement Considered Revenue

Is Reimbursement Considered Revenue

https://www.agmaretirement-health.org/wp-content/uploads/2022/10/reimbursement-768x512.jpg

Is Travel Reimbursement Considered Income A Comprehensive Guide The

https://www.lihpao.com/images/illustration/is-travel-reimbursement-considered-income-2.jpg

DOORDASH HITS RECORD FOR ORDERS REVENUE IN SECOND QUARTER

https://cdn.magzter.com/1406567956/1691018384/articles/-piJod2tZ1691150892331/DOORDASH-HITS-RECORD-FOR-ORDERS-REVENUE-IN-SECOND-QUARTER.jpg

Out of pocket expenses often relate to activities that do not transfer a good or service to the customer For example a service provider that is entitled to reimbursement for employee In these situations the funds received from the other party should be recorded as a reimbursement of expenses and not as revenue Revenue should only be recorded as the

Typically reimbursed expenses are not recorded as revenue because they are not earnings generated from the core business operations Instead they are amounts that the company has spent on behalf of a client or another party Current GAAP includes explicit presentation guidance on the accounting for reimbursements of out of pocket expenses That guidance is included in Subtopic 605 45

Download Is Reimbursement Considered Revenue

More picture related to Is Reimbursement Considered Revenue

Reimbursement PDF

https://imgv2-1-f.scribdassets.com/img/document/626110960/original/b0ca8e9160/1703588738?v=1

Revenue PDF

https://imgv2-2-f.scribdassets.com/img/document/602826332/original/1f68cbc5f4/1711348863?v=1

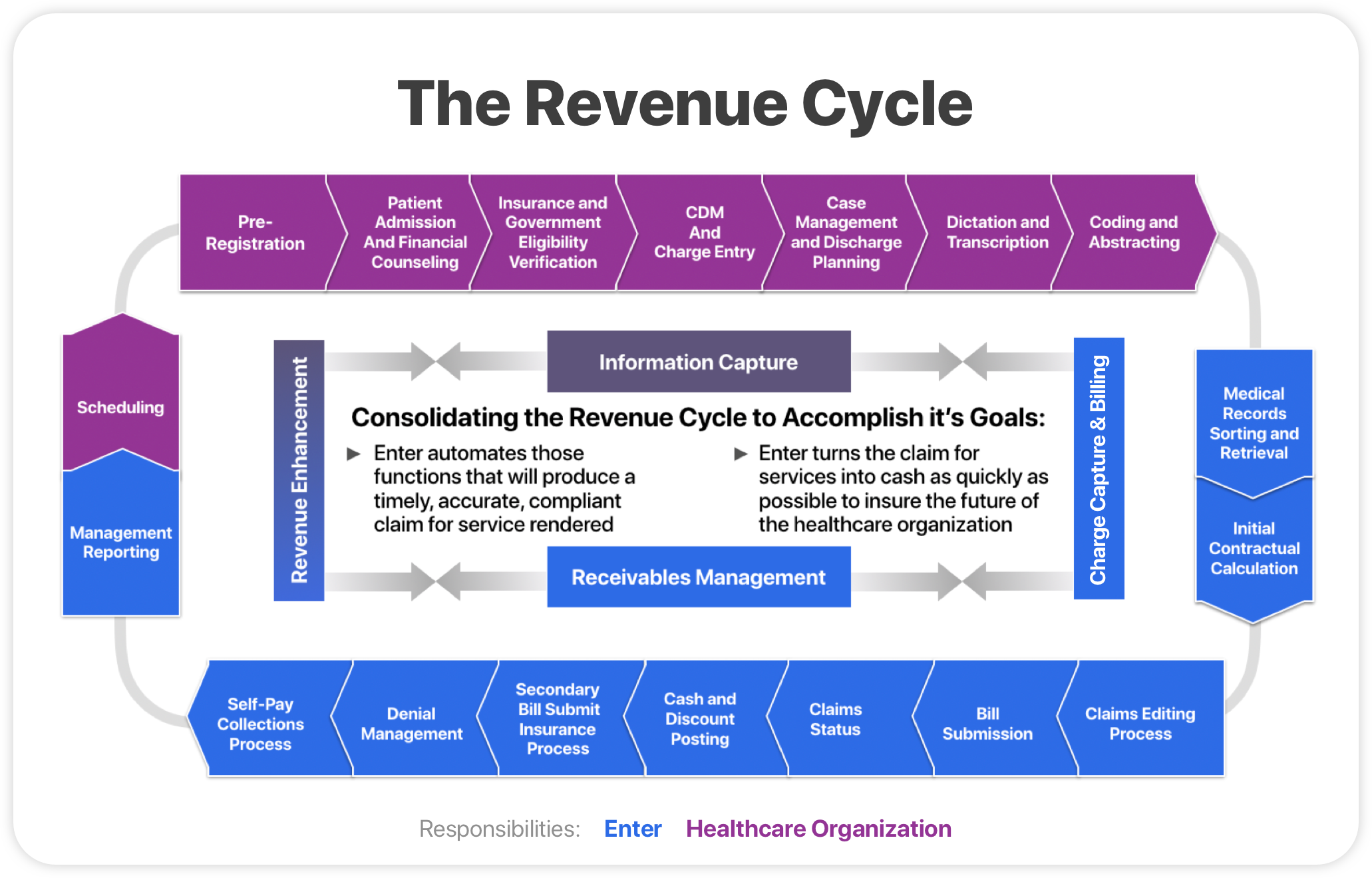

The Comprehensive Revenue Cycle Flowchart Steps Enter

https://assets.website-files.com/5f4713fe26e5e56d65759544/6179adf9c99e1c64ae64e733_RCM.png

According to these dictionary meanings reimbursement can be considered repayment of what has already been spent or incurred Therefore it should not be considered a reward or Being reimbursed for out of pocket expenses is not a revenue generating activity It simply means that either entity could have paid for the expense up front and it happens to

Reimbursement is money paid to an employee or customer or another party as repayment for a business expense insurance taxes or other costs Business expense reimbursements include If a reimbursable expense is initially paid by an employee a billable expense is a revenue generating purchase for a client or customer equivalent to the cost of goods sold

Revenue PDF

https://imgv2-1-f.scribdassets.com/img/document/690768780/original/0938a921dc/1705191059?v=1

Form Reimbursement PDF

https://imgv2-2-f.scribdassets.com/img/document/622377760/original/773234e79f/1704971505?v=1

https://hm.cpa/revenue-reimbursement

Revenues are typically recorded as an increase in cash or a receivable typically a debit to cash or a receivable and a credit to revenue On the other hand a reimbursement is

https://accountinginsights.org/gaap-accounting-and...

Revenue recognized from reimbursed expenses is typically subject to income tax which can increase the company s tax liability This necessitates careful planning to ensure

Reimbursement Form PDF

Revenue PDF

Reimbursement Nextherapy

Supercharging Revenue With Video YouTube

Abja On Twitter Men Are Paid 5 87 Of The Revenue Generated Women

Reimbursement Receipt PDF

Reimbursement Receipt PDF

Image Illustrating Revenue Generation Methods On Craiyon

Reimbursement Form PDF

Reimbursement Invoice Format Under Gst Prosecution2012

Is Reimbursement Considered Revenue - Out of pocket expenses often relate to activities that do not transfer a good or service to the customer For example a service provider that is entitled to reimbursement for employee