Accounting For Rebates Received Gaap Web 31 d 233 c 2021 nbsp 0183 32 If the consideration received has these characteristics it would be characterized as revenue or other income as appropriate and accounted for in

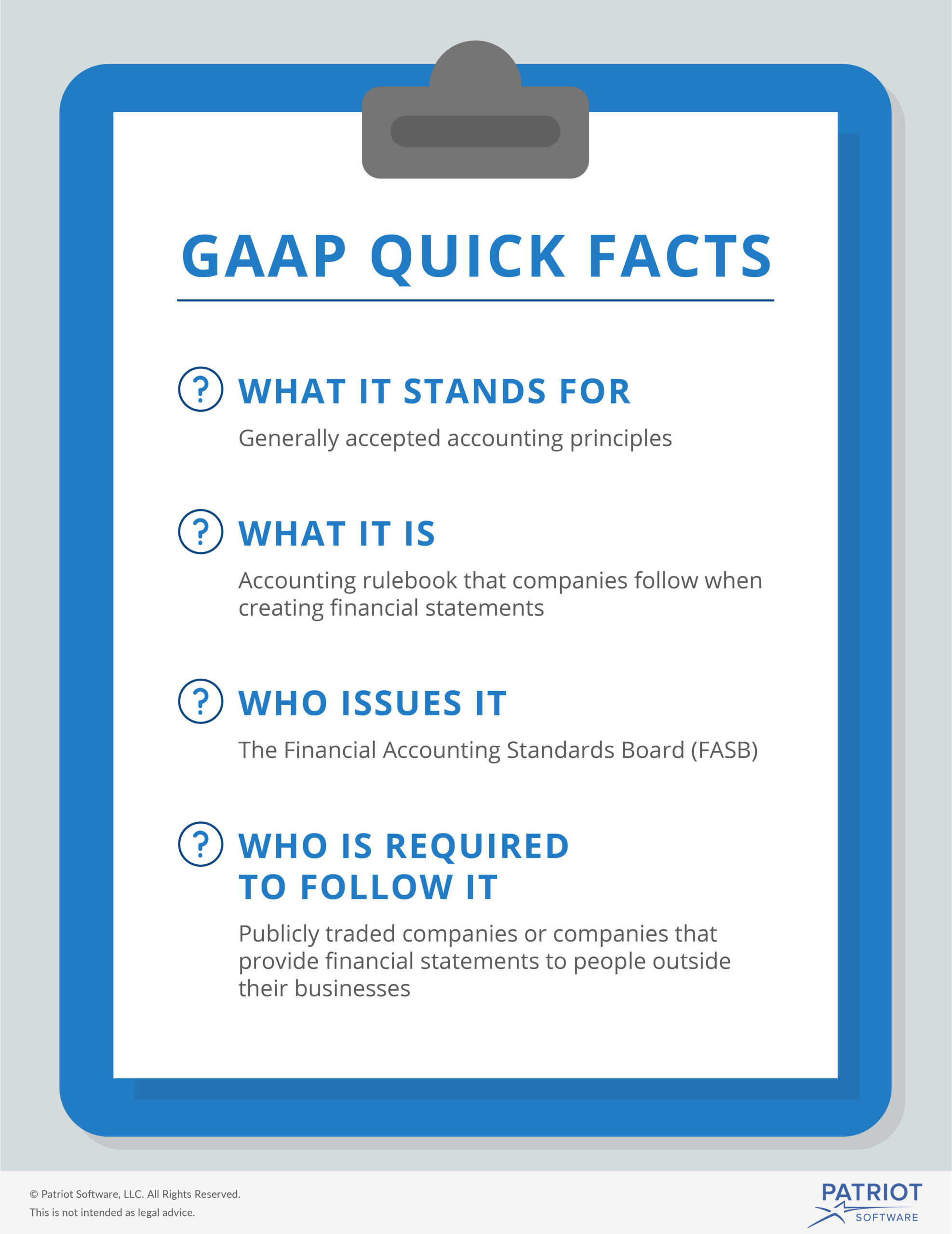

Web 30 nov 2022 nbsp 0183 32 There is no specific guidance in US GAAP that addresses the recognition and measurement of government assistance received by a business entity Thus Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

Accounting For Rebates Received Gaap

Accounting For Rebates Received Gaap

https://www.wallstreetmojo.com/wp-content/uploads/2019/02/GAAP-Generally-Accepted-Accounting-Principles.jpg

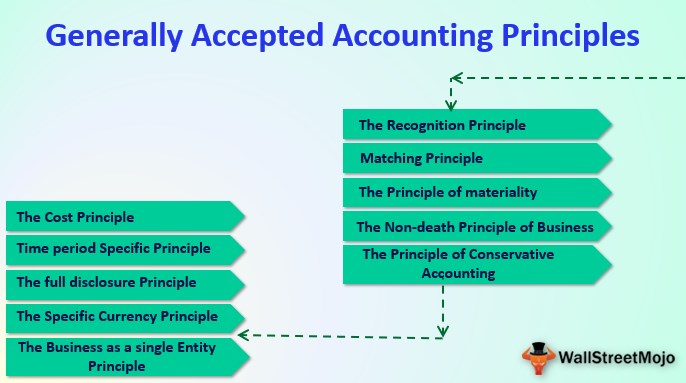

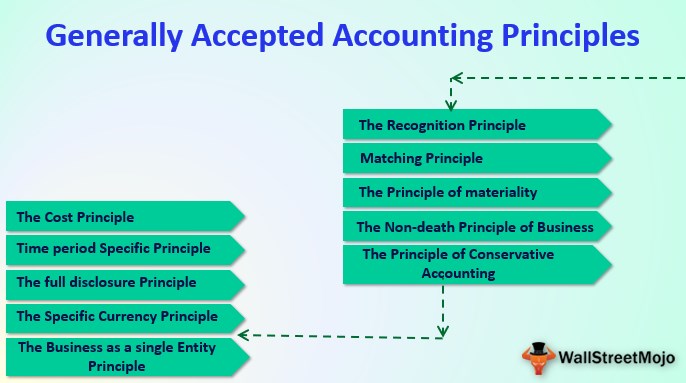

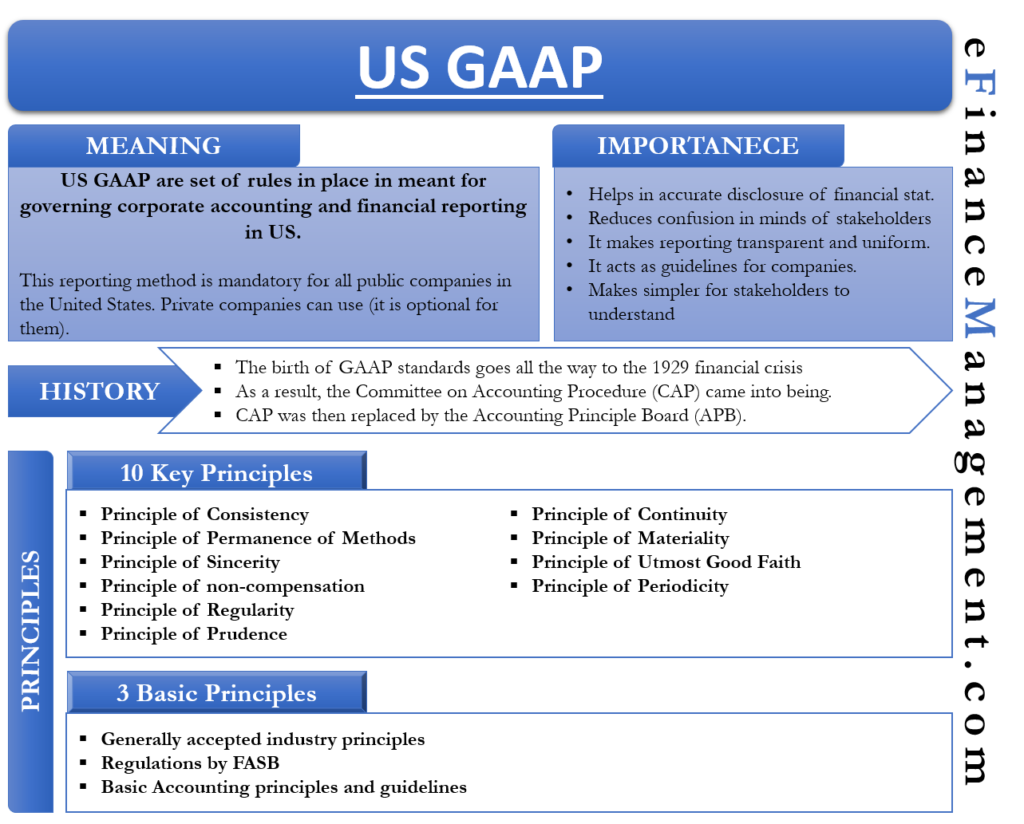

Your Guide To GAAP Generally Accepted Accounting Principles

https://www.patriotsoftware.com/wp-content/uploads/2020/01/GAAP-visual-scaled.jpg

Direct Vs Indirect Cash Flow Gaap Blimp Microblog Custom Image Library

https://www.accounting-basics-for-students.com/images/Indirect_cash_flow_statement_operating_activities_631.jpg

Web Accounting for vendor rebates can either be complex or easy To make it easy many organisations leverage the aid of financial automation tools Whether you choose to handle rebates accounting manually or Web Although this comes for rebate account there s a lot of nuances you need to know located on one type of rebate Here s a guide to help filled with solutions Here s a guide to help

Web When i comes to rebated accounting there s a lot by nuances you need until how on on the type of rebate Here s an guide go help filled with solutions Web Rebates also known as volume discounts bonus discounts are financial incentives or advantages given by a manufacturer supplier in order to motivate the customers or the

Download Accounting For Rebates Received Gaap

More picture related to Accounting For Rebates Received Gaap

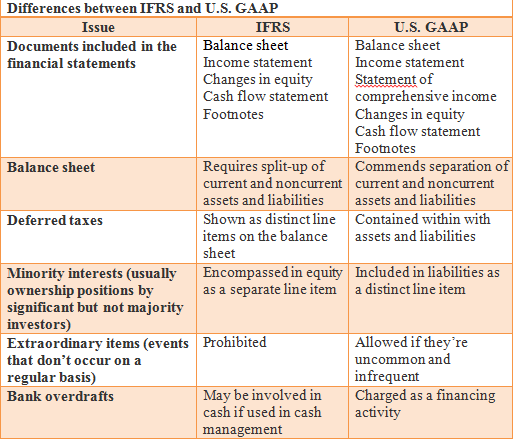

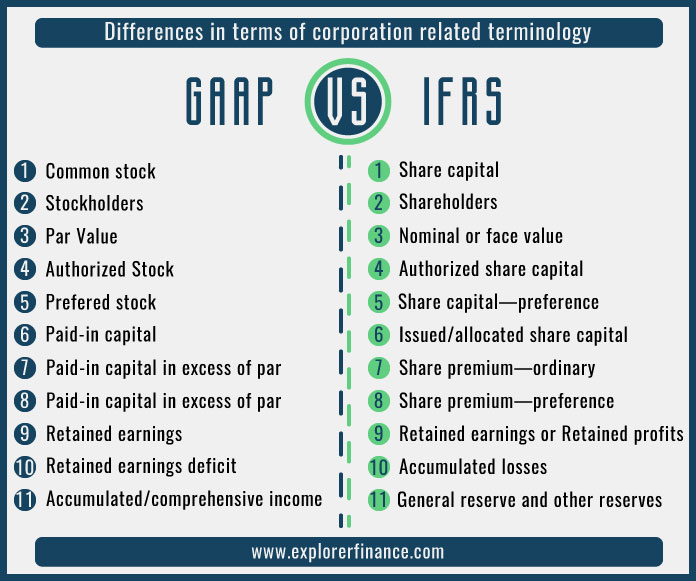

IFRS Vs US GAAP 6 Major Differences You Should Know

https://www.educba.com/ifrs/wp-content/uploads/2014/05/IMG1.png

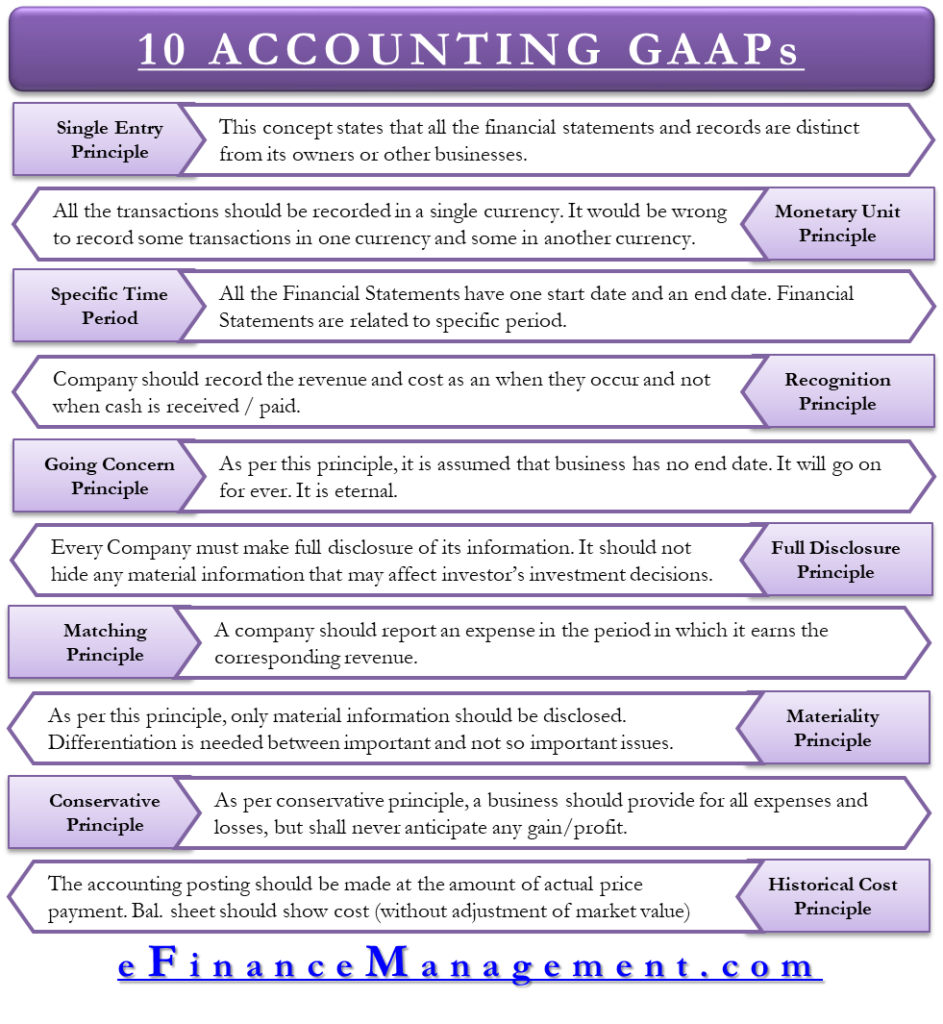

Gaap Principles Examples My XXX Hot Girl

https://efinancemanagement.com/wp-content/uploads/2019/10/10-Accounting-GAAPs-943x1024.png

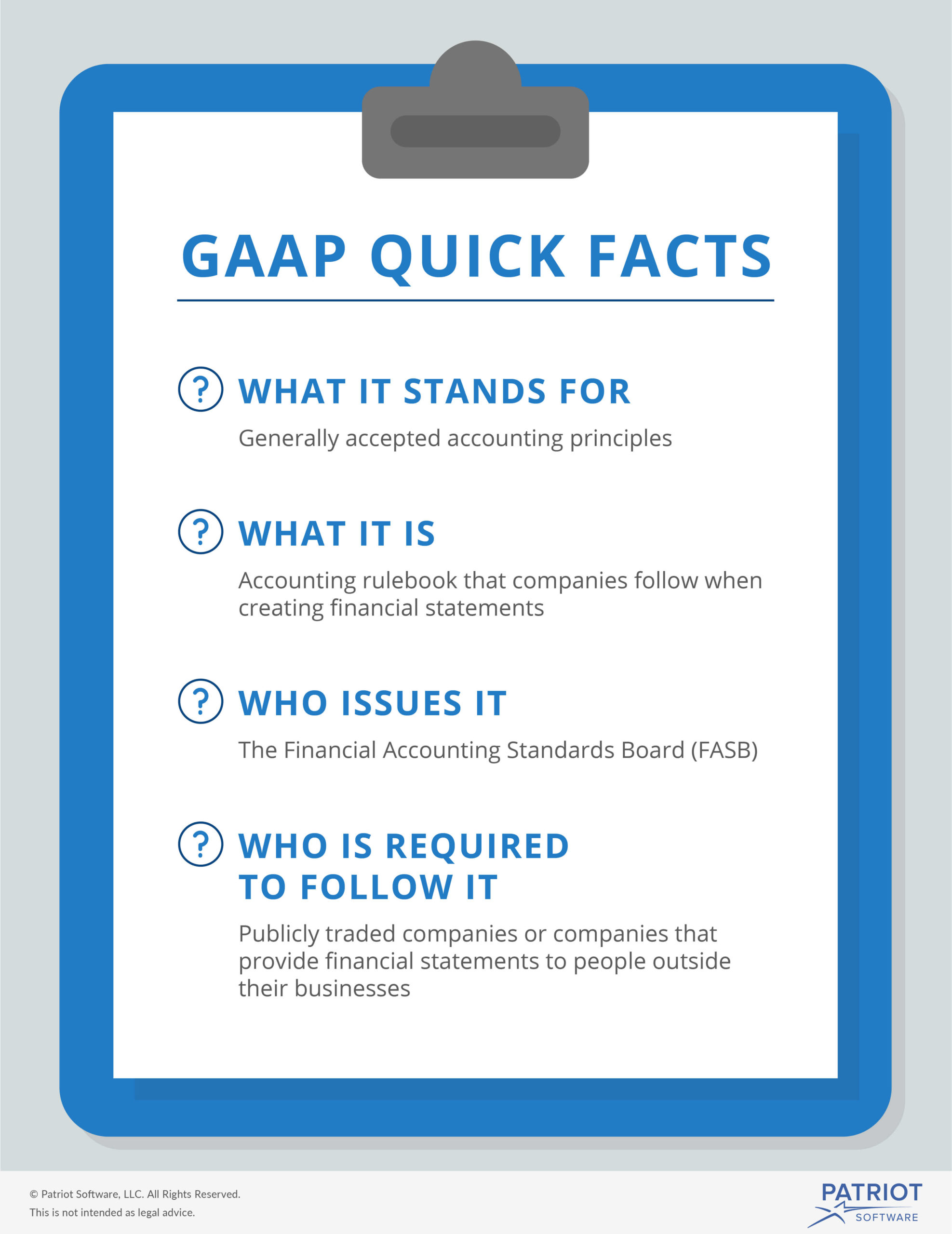

Generally Accepted Accounting Principles GAAP A Guide For 2020

https://www.netsuite.com/portal/assets/img/business-articles/accounting-software/social-general-accepted-accounting-principles-gaap.jpg

Web When he comes on rebate accounting there s an lot of nuance you need to understand on switch the type of rebate Here s a guide to help stuffed with solvents Here s a guide to Web 13 oct 2021 nbsp 0183 32 To account for ITCs entities can choose to employ the flow through method immediately recognizing the ITC income tax benefit when it arises or the deferral method initially deferring the ITC benefit and instead recognizing it over the productive life of the underlying asset

Web Accounting for vendor rebates can live complicated In those featured wee share few gemeinsames procedures challenging and solutions to make it easier for your team Web 7 Common Problems with Accounting for Rebates We have come across many problems with rebate management spanning commercial financial and operational processes

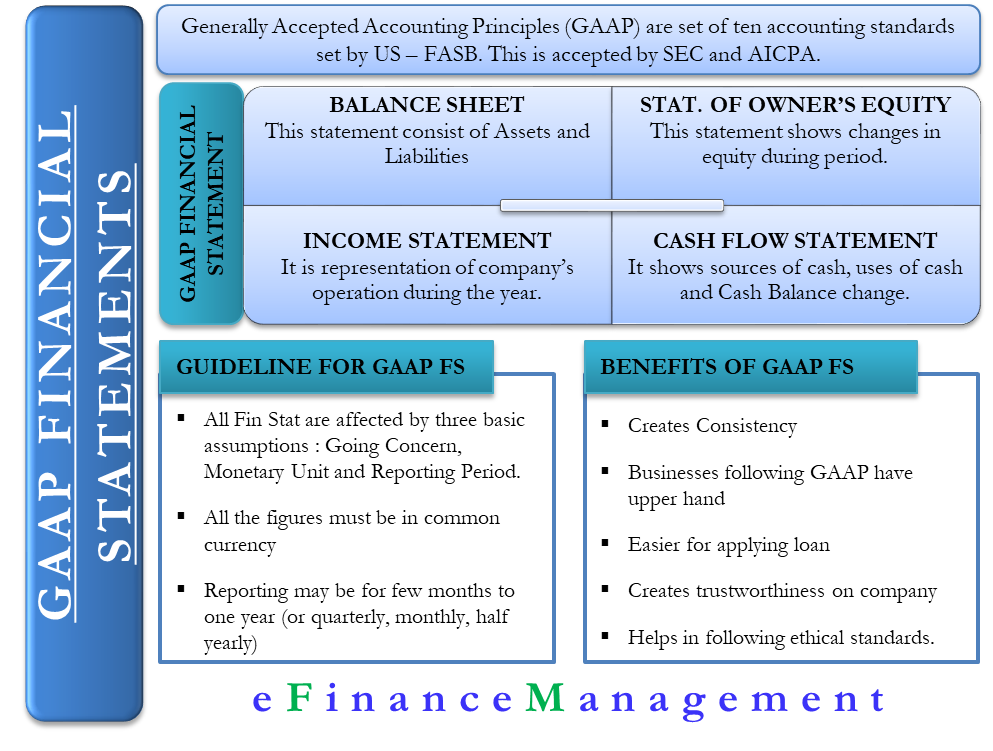

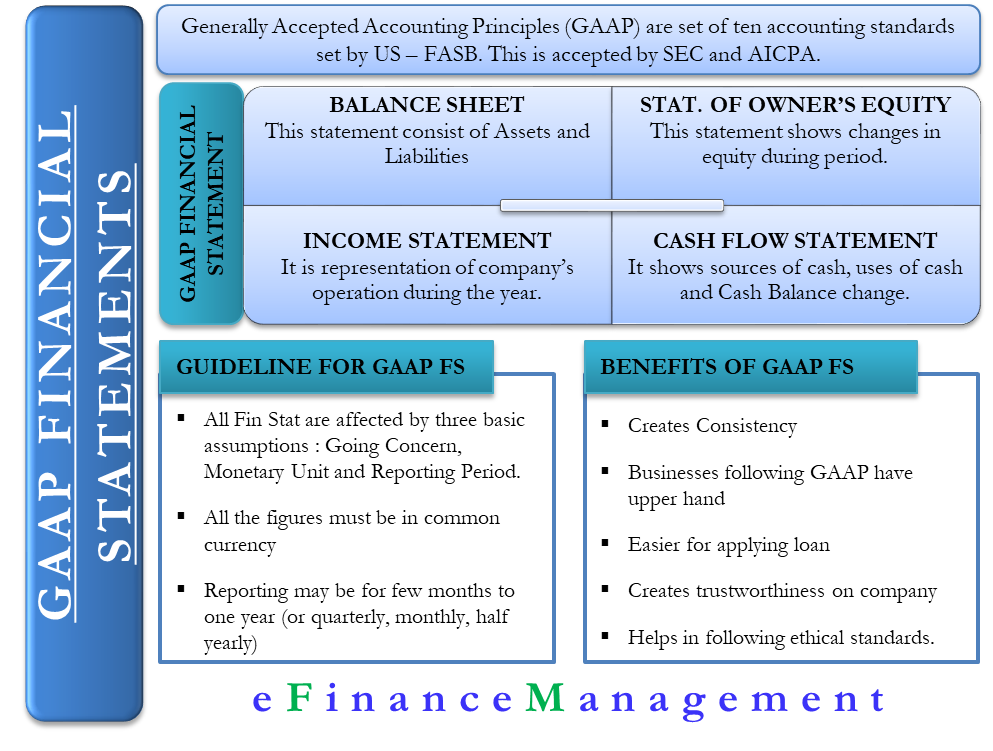

GAAP Financial Statements Requirements Benefits And More

https://efinancemanagement.com/wp-content/uploads/2019/10/GAAP-Financial-Statements.png

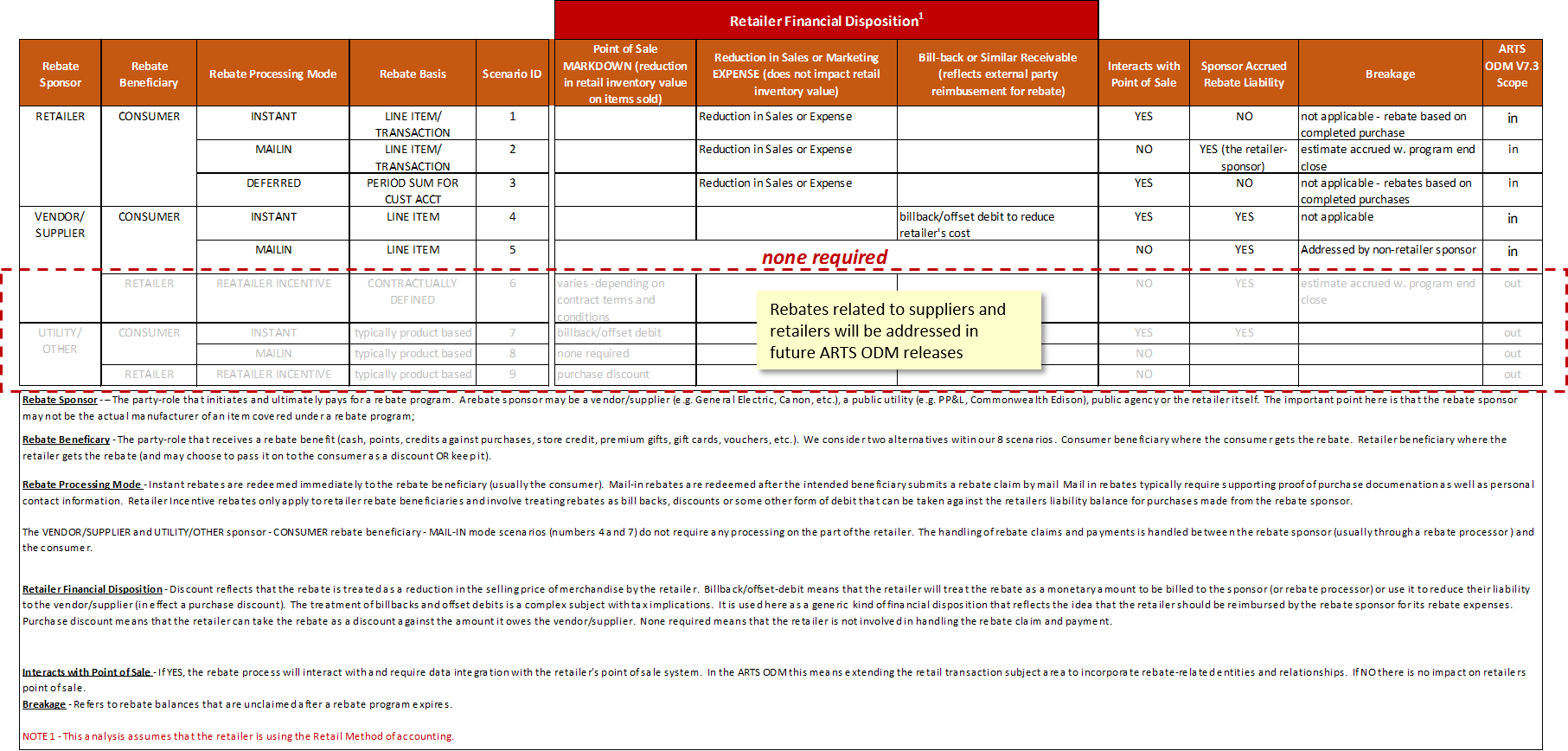

Understanding Customer Rebates

https://www.omg.org/retail-depository/arts-odm-73/arts_odm_v73_figure_0030_11.png

https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/inventory/...

Web 31 d 233 c 2021 nbsp 0183 32 If the consideration received has these characteristics it would be characterized as revenue or other income as appropriate and accounted for in

https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/financial...

Web 30 nov 2022 nbsp 0183 32 There is no specific guidance in US GAAP that addresses the recognition and measurement of government assistance received by a business entity Thus

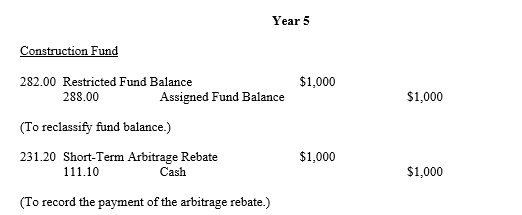

Arbitrage Rebates Office Of The Washington State Auditor

GAAP Financial Statements Requirements Benefits And More

IFRS VS GAAP Top 10 Differences Explorer Finance

Gaap Principles In Accounting Bhadrika Bramantya

US GAAP Meaning History Importance And More

ICYMI A Refresher On Accounting For Leases The CPA Journal

ICYMI A Refresher On Accounting For Leases The CPA Journal

Perfect Accounting For Marketing Expenses Us Gaap Mcdonalds Financial

GAAP Accounting 101 For Property Managers Buildium

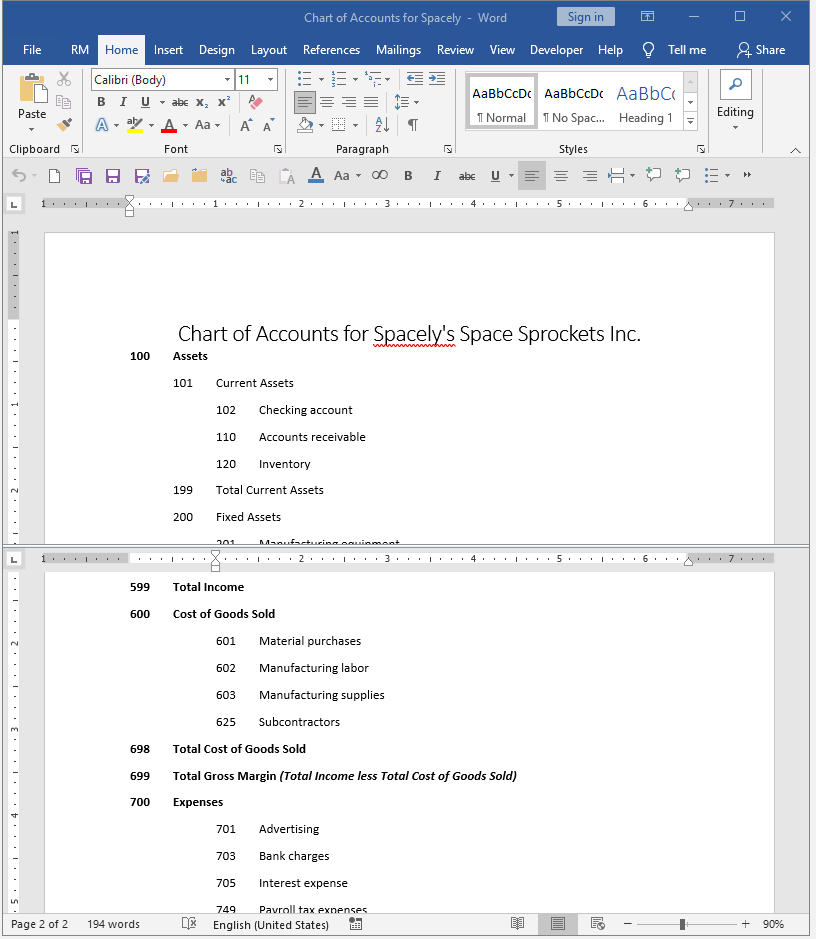

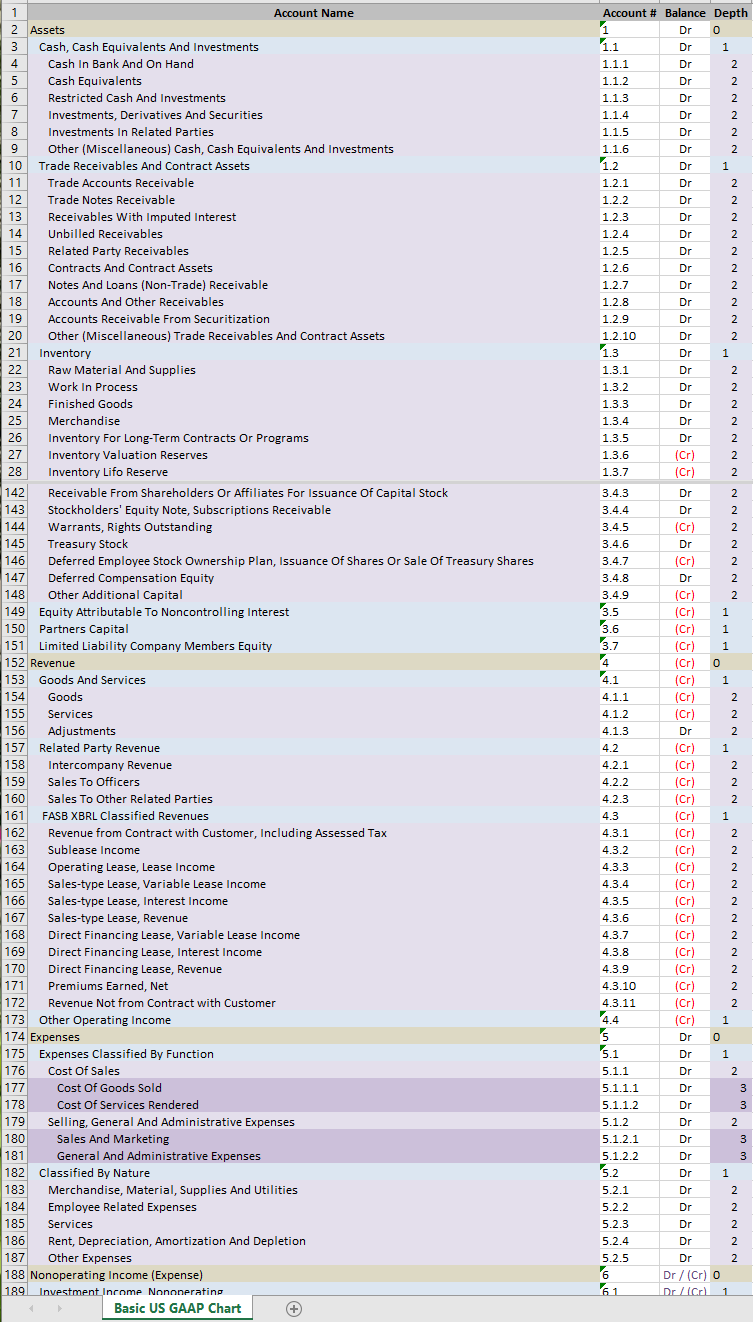

Perfect Ifrs Chart Of Accounts Excel Financial Statements Template

Accounting For Rebates Received Gaap - Web When it comes to rebate accounting there s a lot of nuances you need to know based on the type about rebate Here s one guide go help filled with solutions