Is Rent A Tax Deduction In Ontario Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent will factor into your eligibility for the Ontario Trillium Benefit or OTB Along with your annual income and age the rent you pay is part of the calculation for this monthly benefit

If you live in Ontario you may qualify for the Ontario Energy and Property Tax Credit OEPTC which is a part of the Ontario Trillium Benefit Though we technically are not claiming rent on our taxes the amount of rent property taxes or long term housing costs paid by you throughout the year is used to help calculate your benefit Claiming Rent on Taxes in Ontario If you live in Ontario you may be eligible for the Ontario Energy and Property Tax Credit OEPTC which is part of the Ontario Trillium Benefit OTB Using this tax credit is how to claim rent on taxes in Ontario

Is Rent A Tax Deduction In Ontario

Is Rent A Tax Deduction In Ontario

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

The Tax Deductions And Credits You Can Claim In Australia Your

https://www.taxback.com/resources/blogimages/20211123150053.1637672453254.ef2a32d3150203e35fb30b57f95.jpg

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

https://i.pinimg.com/originals/a4/c8/51/a4c85197b9f35d1d483da88c3145d8a2.jpg

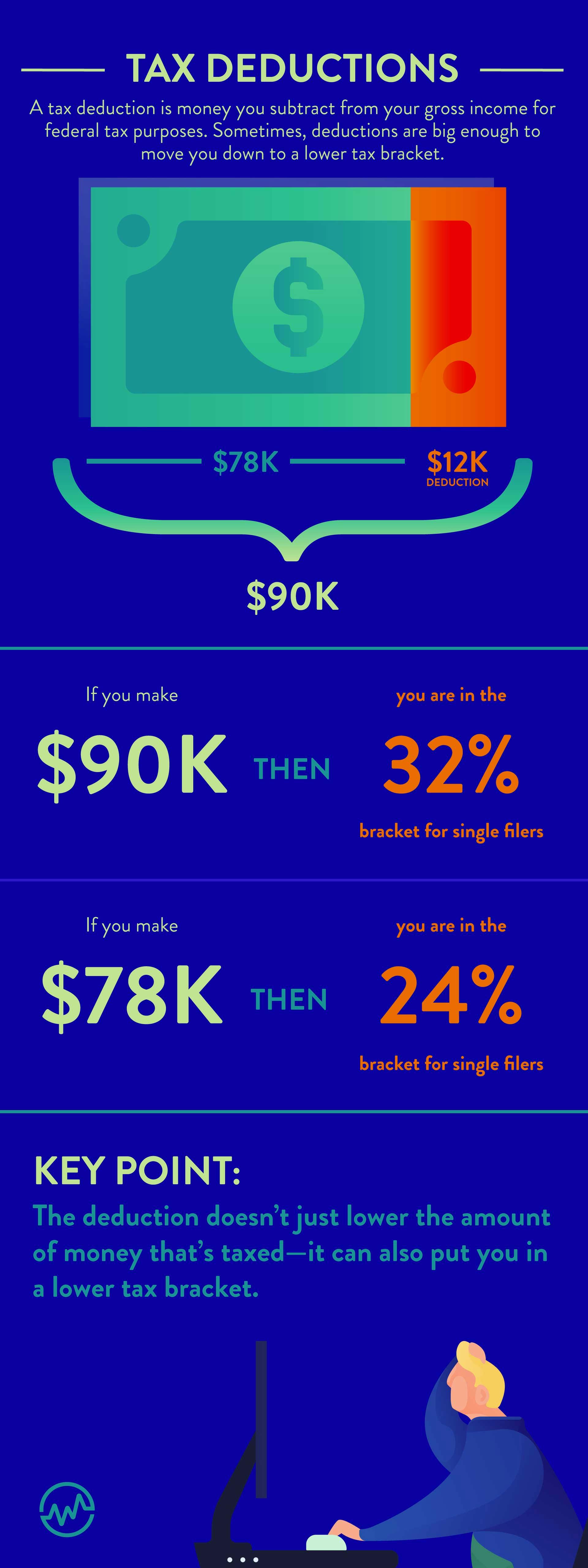

Key Takeaways In general rent payments can t be claimed on a tenant s tax return This rule does have a few exceptions which means some financial relief is available for tenants Here s how you can help your tenant get a tax break on their rent payments Tenants who live in Ontario Quebec and Manitoba may be eligible for tax credits that This guide will help you determine your gross rental income the expenses you can deduct and your net rental income or loss for the year It will also help you fill in Form T776 Statement of Real Estate Rentals To determine if your income is from property or from a business see Chapter 1

If you qualify for the small business deduction your Ontario rental income tax rate is 3 2 If you are operating as a sole proprietorship or partnership visit our Ontario personal income tax calculator to find your personal tax bracket Each province has their own tax brackets and tax rates In Ontario individuals can only claim rent as a tax deduction if they meet specific criteria To be eligible you must a Be a tenant renting a property in Ontario for residential purposes b Not be eligible to claim any other housing related benefits such as the Home Buyer s Plan or the Home Buyers Amount

Download Is Rent A Tax Deduction In Ontario

More picture related to Is Rent A Tax Deduction In Ontario

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

https://blog.churchillmortgage.com/hs-fs/hubfs/tax graphic_2020 (1).jpg?width=8333&name=tax graphic_2020 (1).jpg

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

https://secureservercdn.net/160.153.137.184/mms.194.myftpupload.com/wp-content/uploads/2022/01/Deduction-in-income-tax-where-House-rent-is-paid-and-HRA-not-received-768x505.jpg

There are as always some exceptions to this general rule If you re eligible for one of the following benefits or credits then you will be able to claim the rent you paid during 2023 on your return Clergy Residence Deduction Home Businesses and Employees Ontario Trillium Benefit Canada Tax News Why a rental unit in your home is not as simple as it sounds Find out about some of the legal and tax implications of a rental unit before you sign on a tenant For people currently renting or considering renting a portion of the home they own the tax considerations can be complex and the fallout costly if you don t do it

Yes income from your rental property s is taxable but not all of it As you will see later you can reduce your taxable rental income by deducting specific expenses like those you incur to get the rental property ready to rent or whilst renting out the property Types of tax deductions for Ontario Landlords Rental income tax deductions are the same for all of Canada s provinces and territories We covered the many deductions available to Canadian landlords in our B C specific guide but let s recap quickly here as well 1 Home insurance

Tax Return Tax Deductions For Cleaners

https://static.wixstatic.com/media/d1b86a_aa0500f092f74a918a998e41fb4b5839~mv2.png/v1/fill/w_940,h_788,al_c,q_90,enc_auto/d1b86a_aa0500f092f74a918a998e41fb4b5839~mv2.png

KTP Company PLT Audit Tax Accountancy In Johor Bahru

https://images.squarespace-cdn.com/content/v1/59bb3b0146c3c48c4746b775/1662986395184-RQAPOTH530653TSJCVA8/Slide5.JPG

https://turbotax.intuit.ca/tips/can-i-claim-a-tax...

Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent will factor into your eligibility for the Ontario Trillium Benefit or OTB Along with your annual income and age the rent you pay is part of the calculation for this monthly benefit

https://turbotax.intuit.ca/tips/can-you-claim-rent-in-ontario-5715

If you live in Ontario you may qualify for the Ontario Energy and Property Tax Credit OEPTC which is a part of the Ontario Trillium Benefit Though we technically are not claiming rent on our taxes the amount of rent property taxes or long term housing costs paid by you throughout the year is used to help calculate your benefit

How Do Tax Write Offs Work WealthFit

Tax Return Tax Deductions For Cleaners

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

What Is A Tax Deduction

Taxes In Canada Personal Tax And Business Tax In Canada YouTube

Can You Claim Rent As A Tax Deduction Leia Aqui Can I Use My Rent As

Can You Claim Rent As A Tax Deduction Leia Aqui Can I Use My Rent As

Printable Tax Organizer Template

Tax Cheat Sheet Tax Deduction Taxes

Rent Above Rs 1 Lakh Submitting Proof Obligatory For HRA Tax Deduction

Is Rent A Tax Deduction In Ontario - Is All of Rental Income Taxable in Ontario Generally speaking though gross rental income is reported when filing taxes only net rental income is really taxed Net rental income is the amount that is left after deducting allowable expenses Deductibles on Rental Income Tax in Ontario