Is Rent Tax Deductible In Ontario Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent will factor into your eligibility for

Can a Student Claim Rent on Tax Return in Canada A student cannot claim rent on a tax return in Canada as a deduction or credit However students in You can apply for the Ontario Energy and Property Tax Credit if you have a low to middle income and you live in Ontario This tax credit helps with rent and

Is Rent Tax Deductible In Ontario

Is Rent Tax Deductible In Ontario

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png?ssl=1

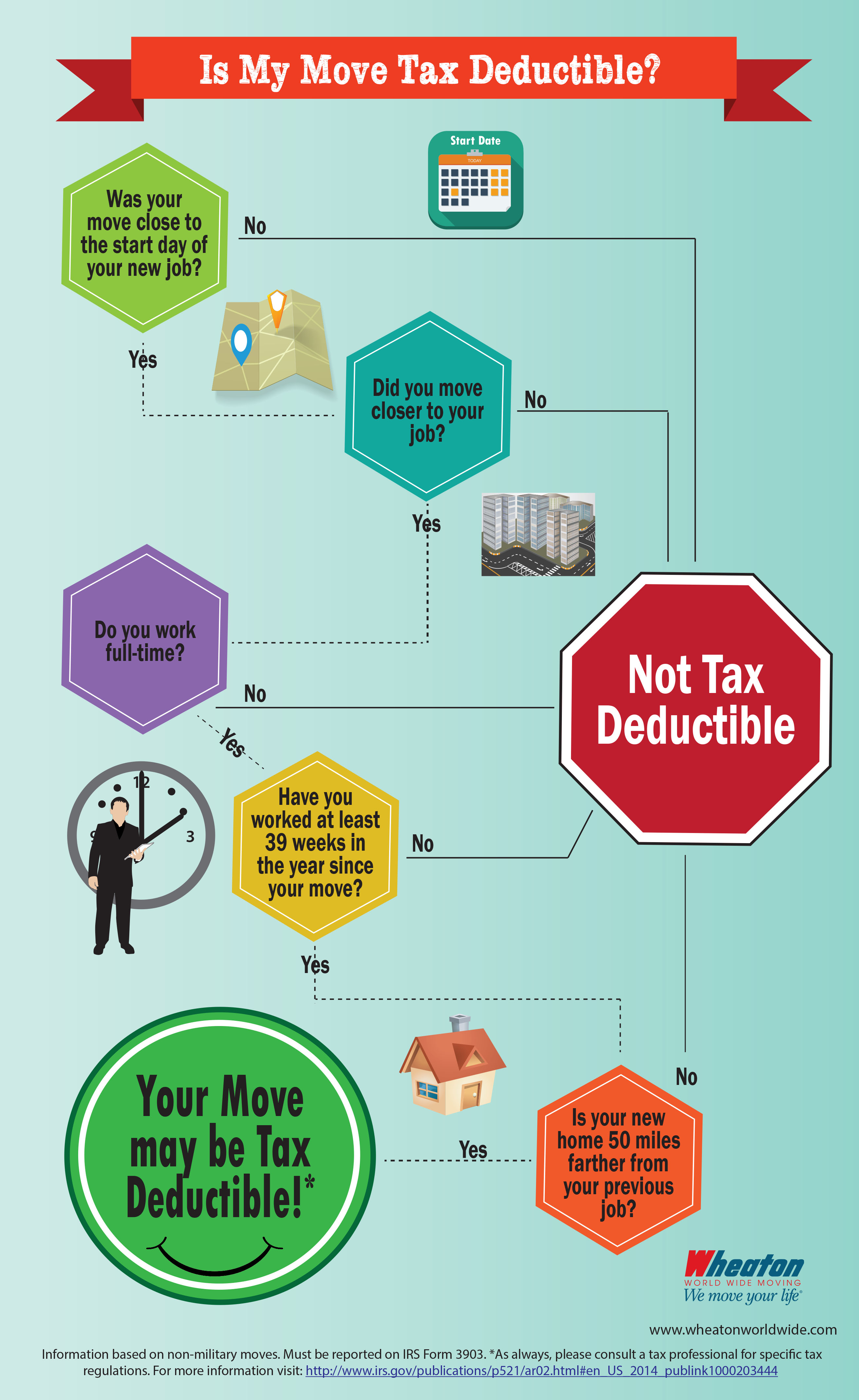

Infographic Is My Move Tax Deductible Wheaton

https://www.wheatonworldwide.com/wp-content/uploads/2015/04/Tax-Deductible-Graphic_Wheaton.jpg

The Master List Of All Types Of Tax Deductions INFOGRAPHIC

https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg

You can deduct any reasonable expenses you incur to earn rental income The two basic types of expenses are current expenses and capital expenses For more information on Qualify for a tax credit related to eligible rent payments in one of three provinces Ontario Quebec and Manitoba Deduct rent payments as an expense if

You can t claim a tax credit for the rent you paid during 2023 There are as always some exceptions to this general rule If you re eligible for one of the following benefits or If the amount owed to you has been included in the gross rental income it can be deducted What is rental income Rental income is revenue you ve earned from

Download Is Rent Tax Deductible In Ontario

More picture related to Is Rent Tax Deductible In Ontario

Understanding Deductibles For Renters Insurance Goodcover Fair

https://lh6.googleusercontent.com/mSiIwgI0bGasf21DpPtVuSGvudKIIjcctuVgZOdd1IrUgtEsnzAi6dNyX5jeUO80ALFqRmFgCg40K7QvQ9j8HaWYPhZS86VZmFY0PD5ugKD5u9s3hOEVTyo3newH27TZqF4d2KAx3Jf9LfwQk5VpB4tejEVHq3lmrxTTjQrhfnYJmO8N2g-g3psxEt-4Rg

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

Rental Property Tax Deductions Deducting Rental Expenses When No

https://i.ytimg.com/vi/rh7BJn3XxPM/maxresdefault.jpg

The first step is to calculate your gross annual income for the year You can include all rentals from January 1 to December 31 for a fiscal year Then calculate the In Canada the rent you collect from tenants is considered income and must be reported on your tax return That means you pay tax on it But the good news is you can deduct eligible expenses first How

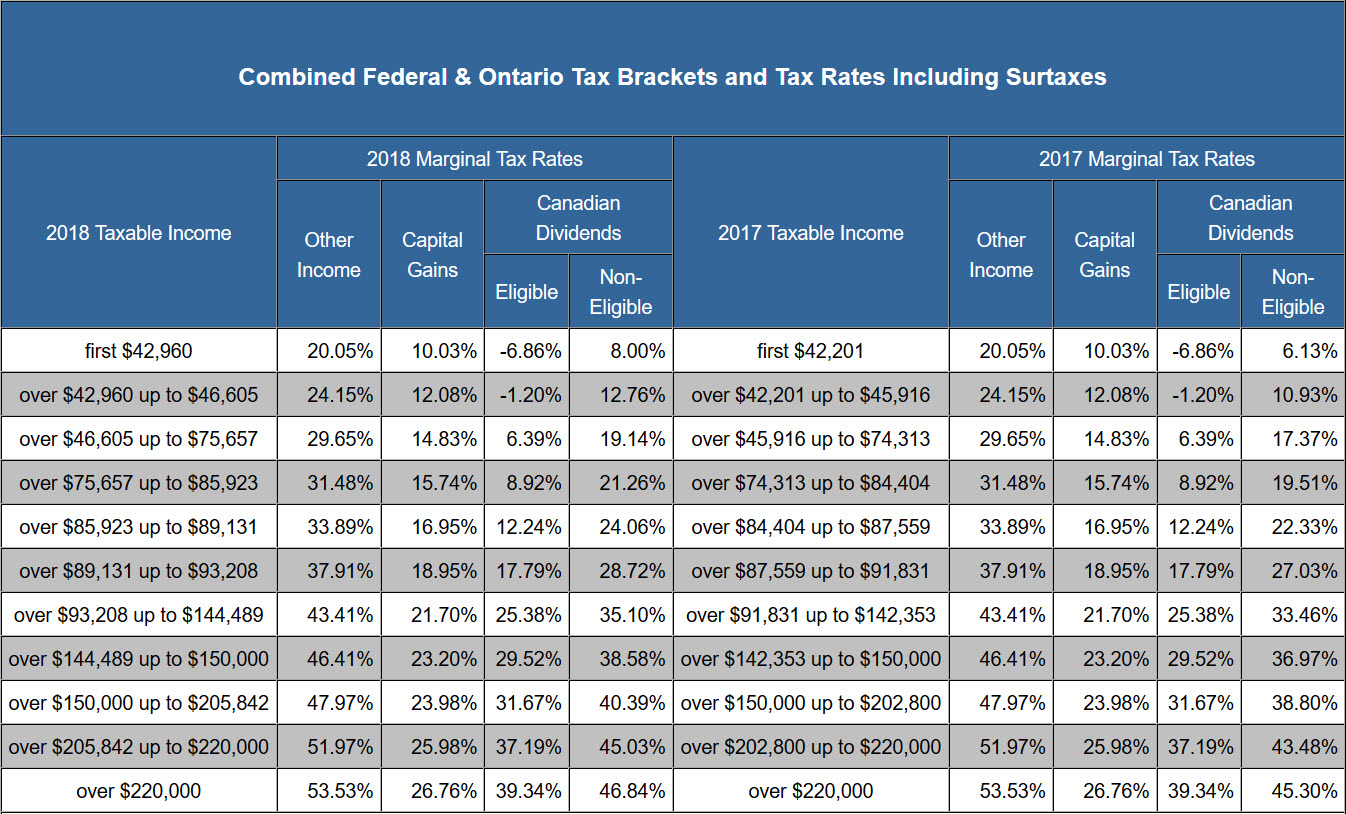

Yes there are special tax deductions available for rental properties in Canada These deductions are designed to help reduce the amount of tax you pay on income earned from rental properties Is All of Rental Income Taxable in Ontario Generally speaking though gross rental income is reported when filing taxes only net rental income is really taxed

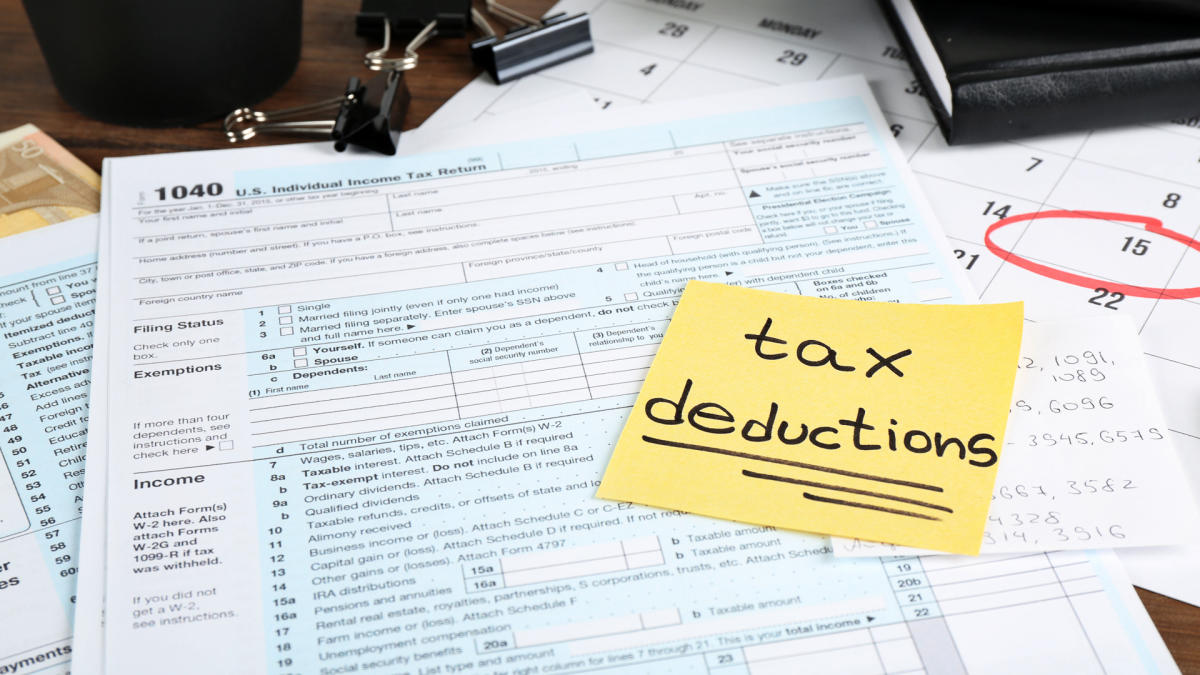

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/ny/api/res/1.2/4oVLwF5RIk.VRMeiL2y7jA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

Property Tax Special Assessments Deductible PROFRTY

https://accidentalrental.com/wp-content/uploads/2017/11/Rental-Tax-Deductions.png

https://turbotax.intuit.ca/tips/can-i-claim-a-tax-deduction-for-my-rent-3980

Claim rent on taxes on Ontario with Ontario Trillium Benefit If you are a renter in the province of Ontario your monthly rent will factor into your eligibility for

https://accountor.ca/blog/taxation/claiming-rent...

Can a Student Claim Rent on Tax Return in Canada A student cannot claim rent on a tax return in Canada as a deduction or credit However students in

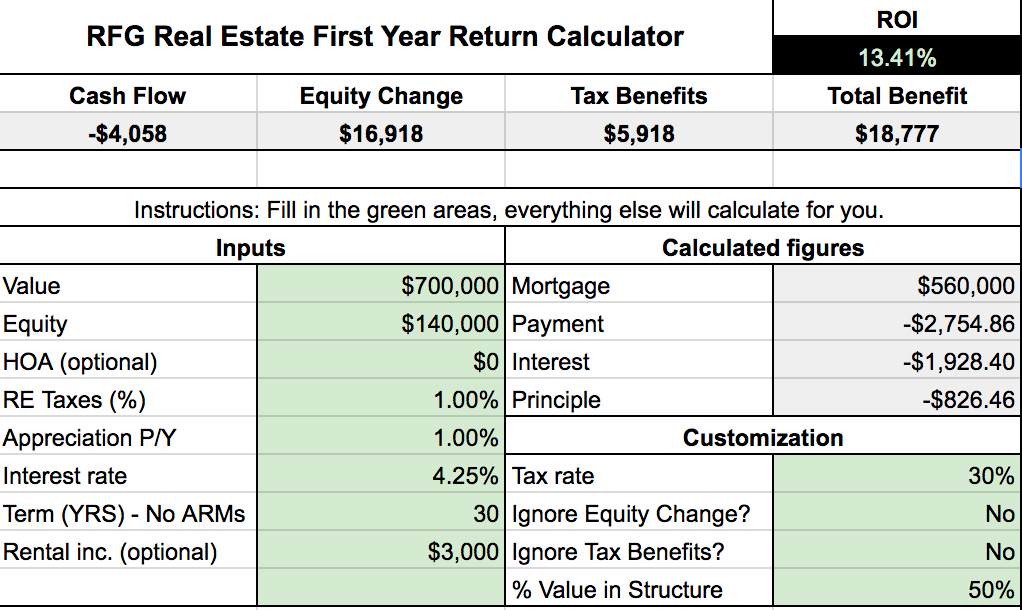

How Much Real Estate Interest Is Tax Deductible Real Estate Spots

What Does Tax Deductible Mean And How Do Deductions Work

Can I Deduct Rent On My Taxes

Ergeon How Your Fence Can Be Tax Deductible

Property Tax Special Assessments Deductible PROFRTY

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

Deductible Maryland Health Connection

The Handy Income Tax Deductions Checklist To Help You Maximize Your

Standard Deduction 2020 Self Employed Standard Deduction 2021

Is Rent Tax Deductible In Ontario - Qualify for a tax credit related to eligible rent payments in one of three provinces Ontario Quebec and Manitoba Deduct rent payments as an expense if