Is Special Duty Allowance Exempted From Income Tax What are Exemptions Under Section 10 Here is a list of exempted income under Section 10 Section 10 13A of the Income Tax Act covers House Rent

Any such stipend or advance that is set aside by an employer and paid for a specific expense is exempted from Income Tax under Section 17 2 of the IT Act 1961 Special allowances are exempt from tax under section 10 14 of the Income Tax Act 1961 Any such special allowance or benefit not being in the nature of a perquisite within the meaning of clause 2 of

Is Special Duty Allowance Exempted From Income Tax

Is Special Duty Allowance Exempted From Income Tax

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Salary/Perquisites.jpg

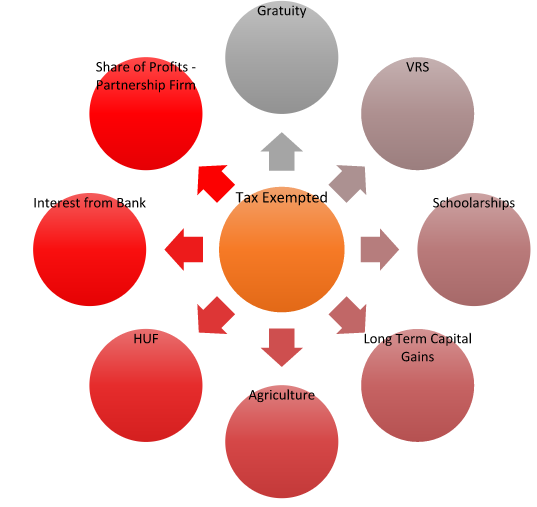

What Is Tax Exempted Allowance In Malaysia Feb 16 2022 Johor Bahru

https://cdn1.npcdn.net/image/1644969845ce64cfd351973997366449cbd063c225.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Exemption Income Tax Income Tax Deduction Agriculture Income Non

https://i.ytimg.com/vi/po5RG_Sm-TM/maxresdefault.jpg

Certain special allowances are exempted through sections 10 14 i and 10 14 ii of the Act An allowance qualifies for exemption under 10 14 i if the following Find out exemption limits and benefits of special allowances in salary The special allowance received by employees is exempt from taxes up to a specific limit in some cases This post explains what this

Certain allowances have been exempted from Income tax as per section 10 14 of the Income Tax Act Section 10 14 has two clauses i and ii Items prescribed under Special allowance prescribed as exempt under section 10 14 When exemption depends upon actual expenditure by the employee The following

Download Is Special Duty Allowance Exempted From Income Tax

More picture related to Is Special Duty Allowance Exempted From Income Tax

This Is The Portion Of Your Salary Exempted Deductible From Tax

https://nairametrics.com/wp-content/uploads/2018/06/Income-e1553592439695.jpg

Exempt Incomes And Allowances For Income Tax Filing

http://bemoneyaware.com/wp-content/uploads/2015/08/income-exempted-from-taxation.png

Occupancy Taxes On Vacation Rental Properties What You Need To Know

https://www.lodgify.com/blog/wp-content/uploads/2020/07/Are-there-any-exemptions-1.jpg

Section 10 14 of the Income Tax Act 1961 is also referred to as The Special Allowance Act Under this act section 10 exemption is made on the allowance based on the utilisation of the amount for the Find out the allowances available for different categories of taxpayers in India This webpage provides a list of exemptions and deductions that can reduce your taxable

Treatment of Special Allowances Section 10 14 for computing Salary Income Prescribed allowances which are exempt under section 10 14 are of the following two Special allowances can be exempted under Section 10 14 of the Income Tax Act but only if they are provided for specific job related purposes The exemption is

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

Request Letter For Special Duty Allowance Sample Letter To Request

https://www.lettersinenglish.com/wp-content/uploads/Request-Letter-for-Special-Duty-Allowance-Sample-Letter-to-Request-Special-Duty-Allowance.jpg

https://cleartax.in/s/section-10-of-income-tax-act

What are Exemptions Under Section 10 Here is a list of exempted income under Section 10 Section 10 13A of the Income Tax Act covers House Rent

https://groww.in/p/tax/special-allowance

Any such stipend or advance that is set aside by an employer and paid for a specific expense is exempted from Income Tax under Section 17 2 of the IT Act 1961

Civil Service Eligibility Under Special Laws And CSC Issuances NewstoGov

All You Need To Know On Exempted Income In Income Tax Ebizfiling

House Rent Allowance HRA Exemption Section 10 13A Income Tax CA Club

How To Claim Income Tax Exemption On Conveyance Allowance

Section 10 Of Income Tax Act Deductions And Allowances

Exempted Income Under Income Tax Act

Exempted Income Under Income Tax Act

7th Pay Commission Special Duty Allowance For Railway Employees Rate Of

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

All About Allowances Income Tax Exemption CA Rajput Jain

Is Special Duty Allowance Exempted From Income Tax - Find out exemption limits and benefits of special allowances in salary The special allowance received by employees is exempt from taxes up to a specific limit in some cases This post explains what this