Ma Tax Rebate 2024 Calculator The Massachusetts Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Massachusetts the calculator allows you to calculate income tax and payroll taxes and deductions in Massachusetts This includes calculations for Employees in Massachusetts to calculate their annual salary after tax

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your In this past fiscal year Fiscal Year 2022 FY22 Massachusetts tax revenue collections exceeded the annual tax revenue cap set by Chapter 62F of the Massachusetts General Laws by 2 941 billion In accordance with the statute this excess revenue is being returned to taxpayers

Ma Tax Rebate 2024 Calculator

Ma Tax Rebate 2024 Calculator

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/MA-Tax-Rebate-2023.jpg

Income Tax Calculator FY 2023 24 2022 23 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp

Ma State Tax Form 2 Fillable Printable Forms Free Online

https://www.signnow.com/preview/544/877/544877146/large.png

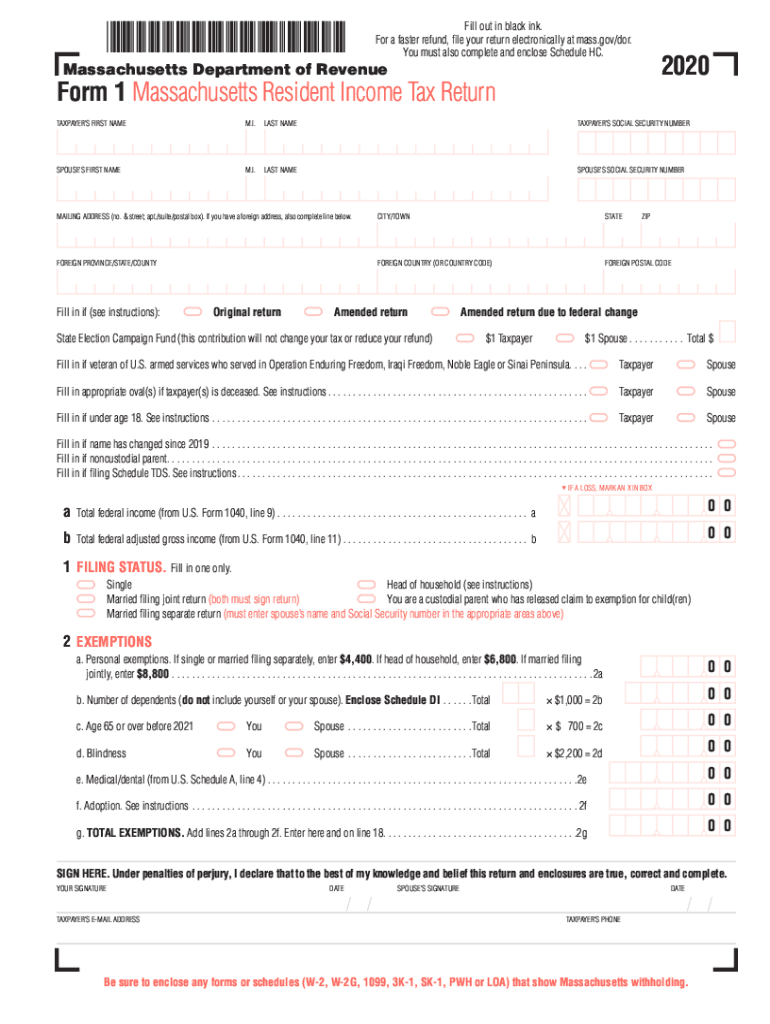

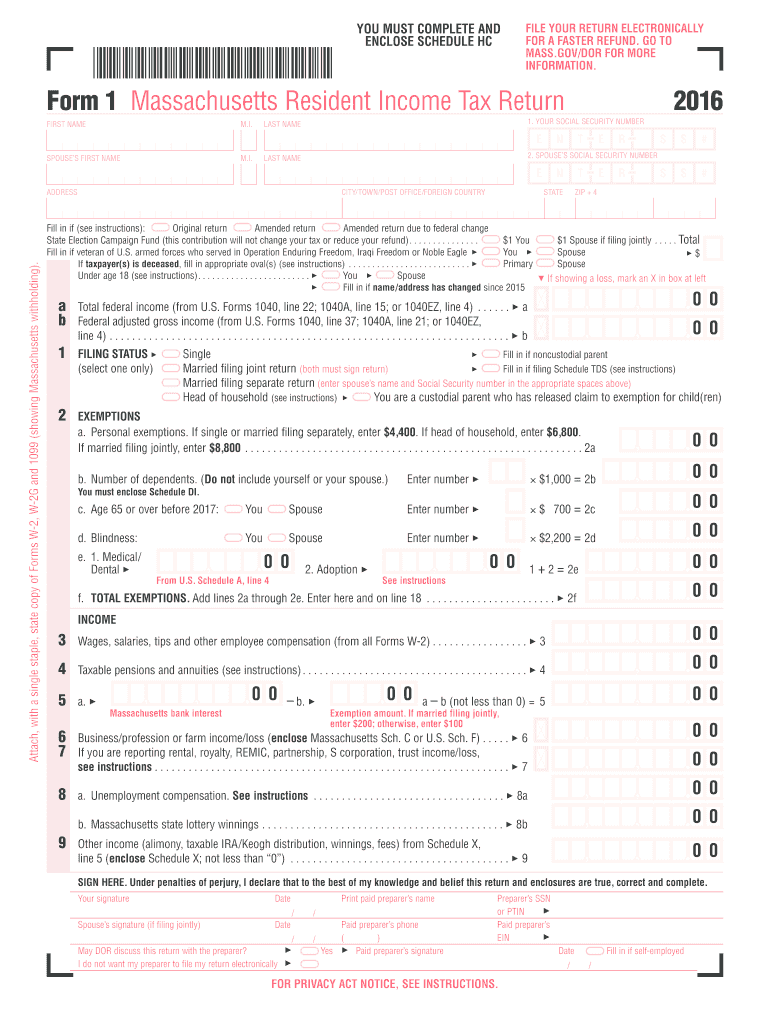

The calendar officially flipped to 2024 at midnight on Monday and that meant a new tax law would take effect in Massachusetts In October Gov Maura Healey signed a new bill into law that will bring hundreds of millions of dollars in relief to taxpayers The entire tax relief package carries a financial impact of about 561 million this fiscal year and more than 1 billion annually starting You ll only need Form 1 How it works Above the online tax refund calculator select yes on the left for full year resident or no on the right for part year resident The rest comes from your tax return On the Form 1 page 3 look for Line 32 or Income Tax After Credits Screenshot Next are the tax credits on lines 43 47 Form 1 page 4

Blog Post What To Expect With your Upcoming Tax Rebate Last month the Baker Administration announced that eligible Massachusetts taxpayers will receive a tax rebate connected to their 2021 filings Individuals should start seeing funds by check or direct deposit in November 11 02 2022 The Tax tables below include the tax rates thresholds and allowances included in the Massachusetts Tax Calculator 2024 Massachusetts provides a standard Personal Exemption tax credit of 4 400 00 in 2024 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduced the amount of Massachusetts state income that is

Download Ma Tax Rebate 2024 Calculator

More picture related to Ma Tax Rebate 2024 Calculator

Income Tax 2023 24 FY 2024 25 AY New IT Slab Rates Online Income Tax Calculator 2023 24

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

How do I find out my Massachusetts tax rebate From this Refund Estimator By Joe Dwinell joed bostonherald Boston Herald September 16 2022 at 5 34 p m So what exactly will you Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

In addition extension return and bill payments can also be made Visit the MassTaxConnect video tutorial How to Make an Estimated Payment Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887 6367 or 800 392 6089 which is toll free in Massachusetts The additional amount is 3 900 00 if the individual is both 65 or over and blind Retirement Plan Contributions 401 k 403 b SARSEP and 457 plans Calculated using the individual contributions limits for 2024 22 500 00 standard with additional 7 500 00 catch up for those 50 or older at the end of 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

How To Increase The Chances Of Getting A Tax Refund CherishSisters

https://cherishsisters.com/wp-content/uploads/2022/12/Tax-rebate-calculator-UK.jpg

https://ma-us.icalculator.com/

The Massachusetts Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Massachusetts the calculator allows you to calculate income tax and payroll taxes and deductions in Massachusetts This includes calculations for Employees in Massachusetts to calculate their annual salary after tax

https://www.forbes.com/advisor/income-tax-calculator/massachusetts/

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Income Tax Rebate Under Section 87A

Retirement Income Tax Rebate Calculator Greater Good SA

Property Tax Rebate Pennsylvania LatestRebate

Apply For A Tax Refund Online Tax Rebate Calculator

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

Ev Car Tax Rebate Calculator 2023 Carrebate

Printable Ma Tax Forms Printable Forms Free Online

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Ma Tax Rebate 2024 Calculator - You ll only need Form 1 How it works Above the online tax refund calculator select yes on the left for full year resident or no on the right for part year resident The rest comes from your tax return On the Form 1 page 3 look for Line 32 or Income Tax After Credits Screenshot Next are the tax credits on lines 43 47 Form 1 page 4