Is Standard Deduction Applicable In New Tax Regime Fy 22 23 The only deduction that is allowed under the new income regime in FY 2022 23 is Section 80CCD 2 This deduction is linked to the employer s contribution to the employee s NPS account The maximum deduction that can

Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards Yes the standard deduction is allowed under the new tax regime for FY 2023 24 However it was not allowed as a deduction for FY 2022 23

Is Standard Deduction Applicable In New Tax Regime Fy 22 23

Is Standard Deduction Applicable In New Tax Regime Fy 22 23

https://www.zrivo.com/wp-content/uploads/2021/08/Is-standard-deduction-before-or-after-AGI-768x432.jpg

What Is Standard Deduction In India Plan Your Finances

https://www.planyourfinances.in/wp-content/uploads/2019/04/28.jpg

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/02/standard-deduction-and-tax-rebate-in-new-tax-regime-video-1024x576.webp

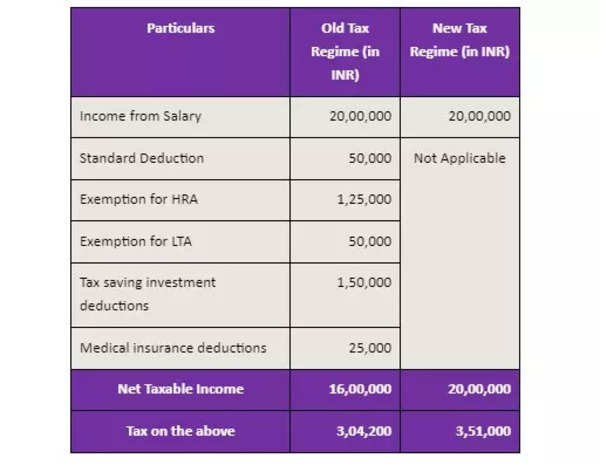

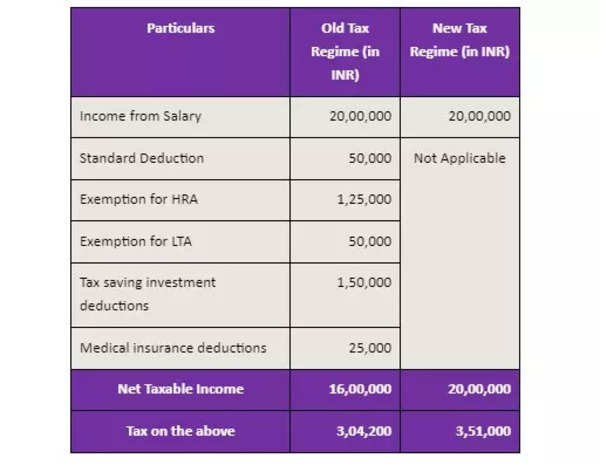

Earlier the Standard Deduction of Rs 50 000 was available under the Old Tax Regime but now the same has been made available under the New Tax Regime Now under the New Tax Regime taxpayer can enjoy a tax free 2 4 Available Deductions Exemptions a The new tax regime permits a standard deduction of Rs 50 000 for salaried persons and a deduction for a family pension being lower of Rs 15 000 or 1 3rd of the pension

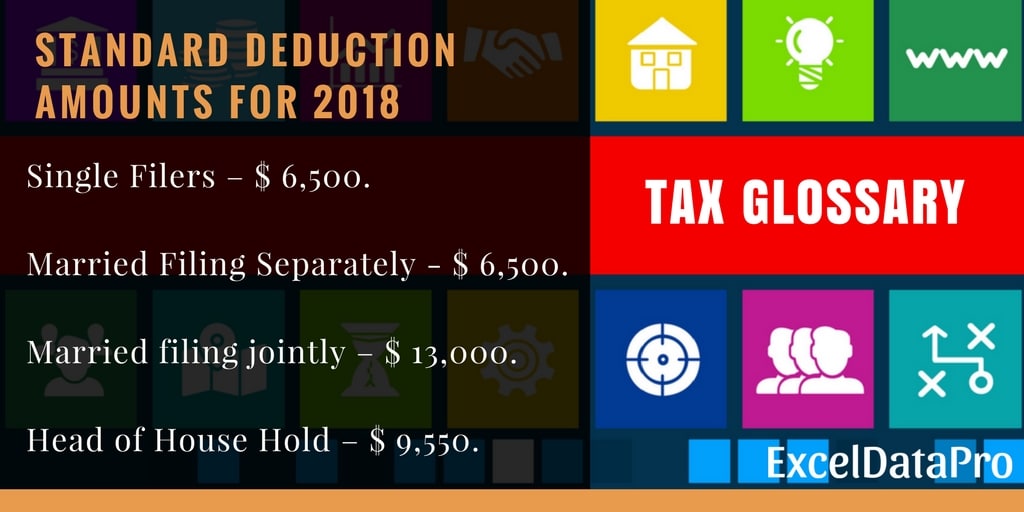

The standard deduction is provided to offer relief to salaried individuals from the tax burden A crucial update in this matter was made in the Union Budget 2023 where the Standard Deduction of Rs 50 000 on Salary The standard deduction is a flat deduction of Rs 50 000 under old tax regime and Rs 75 000 under new tax regime on the taxable income of salaried employees and pensioners irrespective of their earnings This

Download Is Standard Deduction Applicable In New Tax Regime Fy 22 23

More picture related to Is Standard Deduction Applicable In New Tax Regime Fy 22 23

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

https://enskyar.com/img/Blogs/Deduction-from-Salary-under-section-16-of-Income-Tax-Act.jpg

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

https://assets.blog.quicko.com/wp-content/uploads/2020/02/New-Tax-Regime-coverage-scaled-1-1024x512.jpg

Standard Deduction On Salary In India 2023 Limits Calims

https://navi.com/blog/wp-content/uploads/2022/01/tax.jpg

Yes a standard deduction of Rs 75 000 is available to taxpayers in the new regime So a salaried taxpayer will not be required to pay any tax where his or her income before For the financial year 2023 24 assessment year 2024 25 in India the standard deduction for salaried individuals is Rs 50 000 Standard deduction applies to income from

The following deductions under New Tax Regime are still available for tax payers The Standard Deduction of Rs 50 000 for salaried individuals and pensioners The deduction 5 Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old

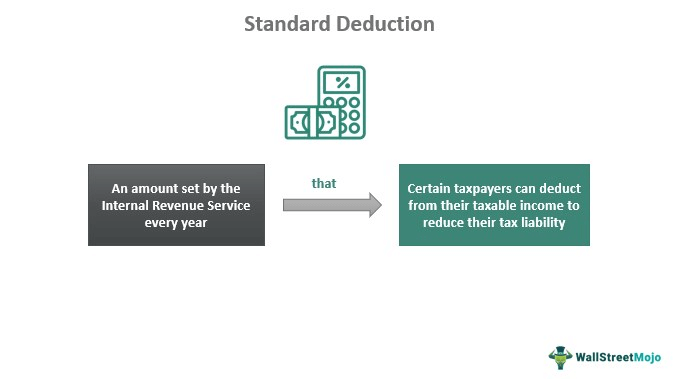

Standard Deduction What Is It Vs Itemized Example

https://www.wallstreetmojo.com/wp-content/uploads/2022/12/Standard-Deduction.png

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

https://economictimes.indiatimes.com › w…

The only deduction that is allowed under the new income regime in FY 2022 23 is Section 80CCD 2 This deduction is linked to the employer s contribution to the employee s NPS account The maximum deduction that can

https://www.incometax.gov.in › iec › foporta…

Am I eligible for Rs 50 000 standard deduction in the new tax regime Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards

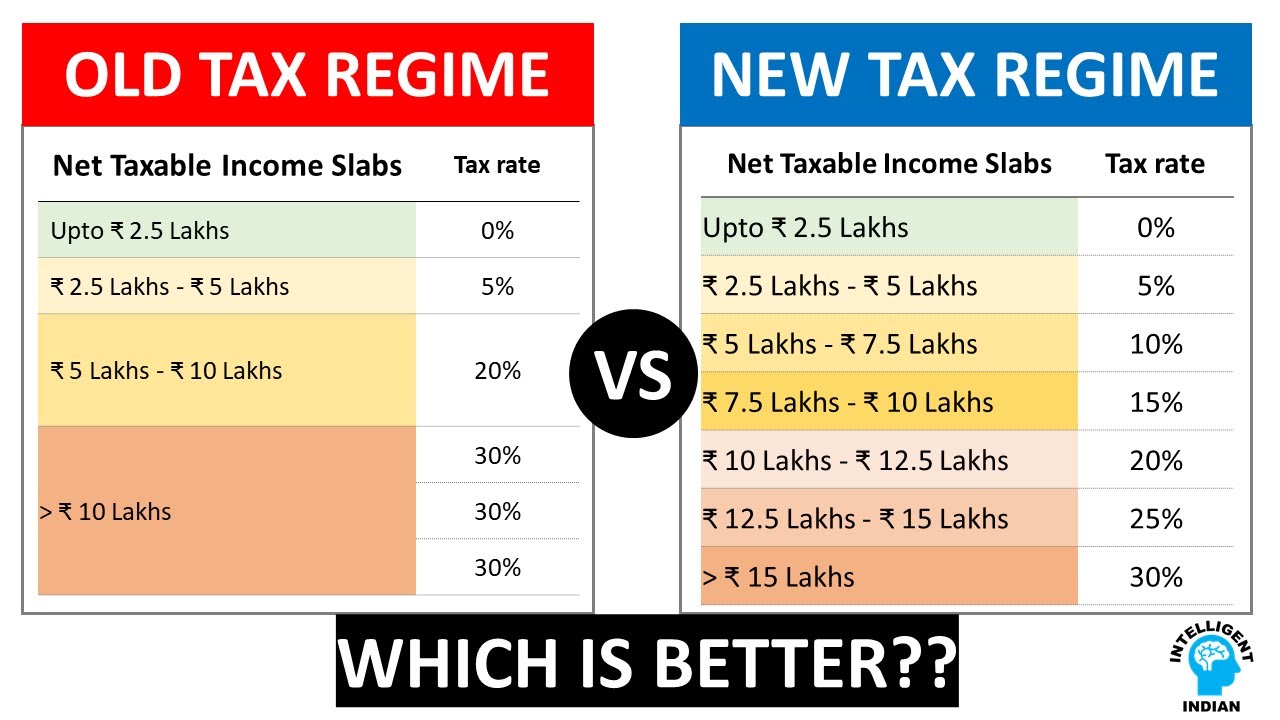

Old Vs New Tax Regime Which One Should You Pick

Standard Deduction What Is It Vs Itemized Example

Income Tax Calculator New Regime 2023 24 Excel Printable Forms Free

New Income Tax Regime Vs Old Tax Regime FY 2022 23 Deductions Salaried

What Is Standard Deduction For Salaried Employees FinCalC Blog

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

What Is Standard Deduction ExcelDataPro

Personal Exemption And Standard Deduction 201

Is Standard Deduction Applicable In New Tax Regime Fy 22 23 - What Deductions Are Available Under The Revised New Tax Regime Deductions in the new regime A Standard deduction for salaried individuals up to Rs 75 000 For FY 24 25 onwards