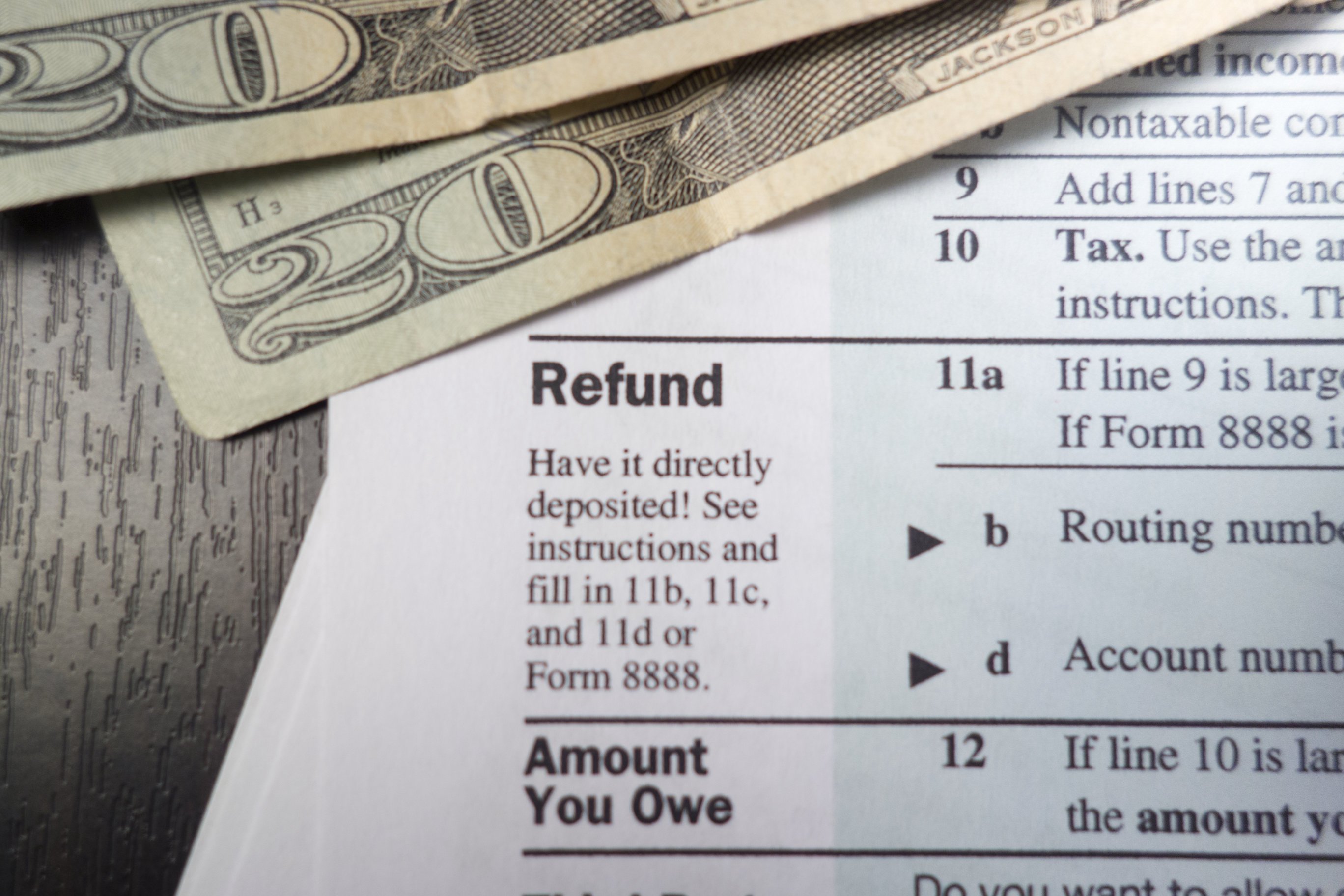

Is State Tax Refund Taxable It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized deductions on your federal income tax return You had the option to choose to deduct either state and local income taxes or general sales taxes

If the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit for example because the 10 000 tax deduction limit applied the payment is not included in income for federal tax purposes On last year s return if you itemized your deductions and were able to deduct your sales tax and not your state and local income taxes then your previous year s state refund is not taxable when you file this year

Is State Tax Refund Taxable

Is State Tax Refund Taxable

https://valuewalkpremium.com/wp-content/uploads/2019/02/Tax-Refund.jpg

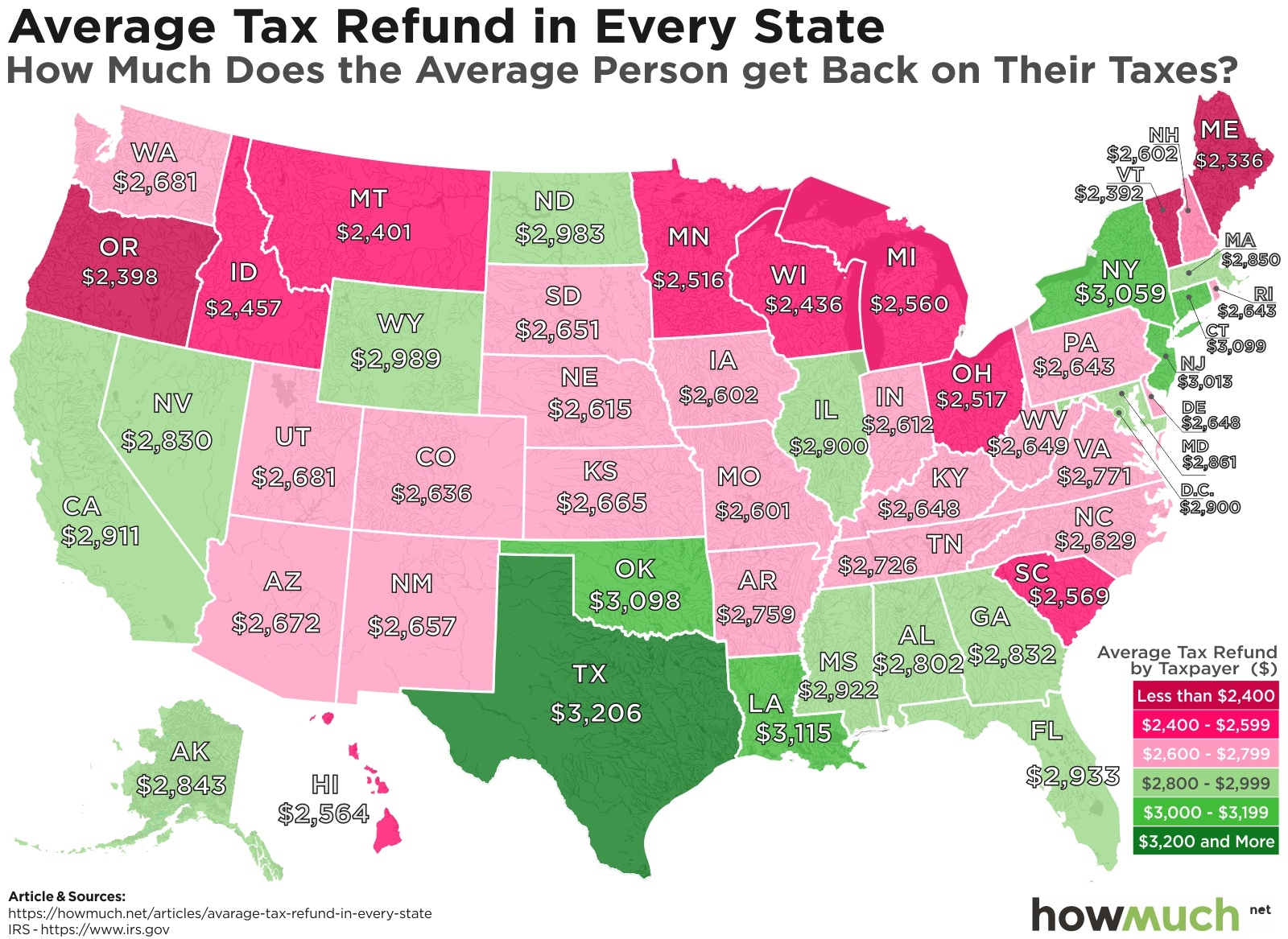

Taxes 2019 Why Is My Refund Smaller This Year

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

:max_bytes(150000):strip_icc()/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

Is Your State Tax Refund Taxable State And Local Refund Worksheet

https://displayhuset.com/e004bc72/https/ed36ce/www.thebalancemoney.com/thmb/OgdZ49xPR50N49QHywVsv6MExiQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png

Generally refunds of state taxes paid by individuals are only federally taxable to the extent a federal benefit was claimed for paying state taxes Yes report last year s state or local tax refund and we ll figure out if it s taxable or not If all three of the following are true your refund counts as taxable income You itemized deductions last year instead of taking the standard deduction

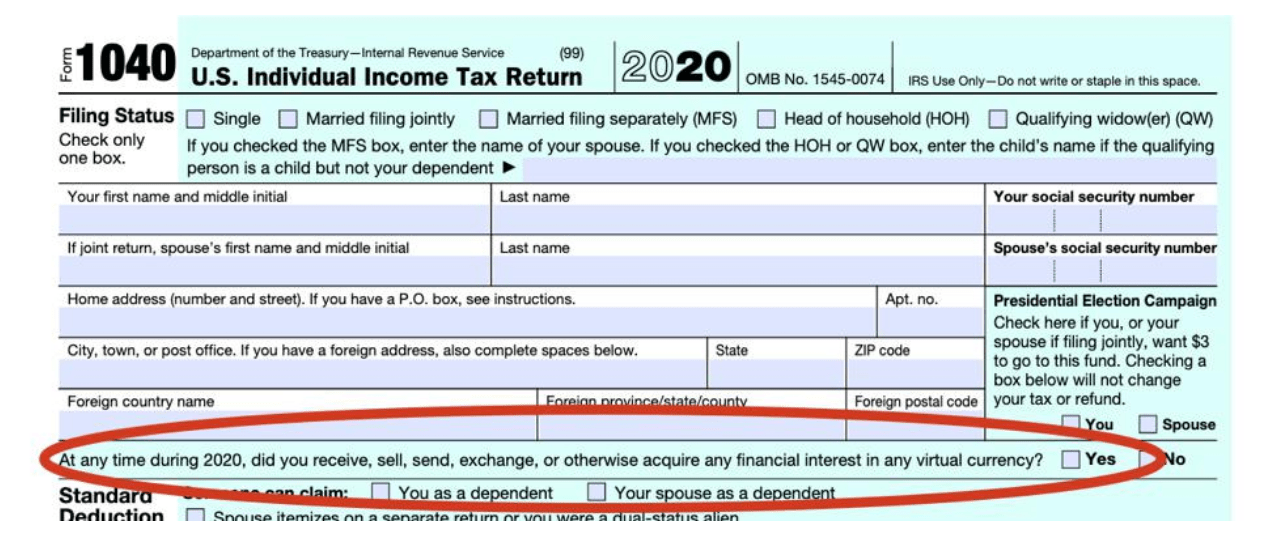

March 29 2019 TOPICS In Rev Rul 2019 11 issued Friday the IRS addressed how the long standing tax benefit rule interacts with the new 10 000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayer s federal income tax return As a general rule taxpayers who choose the standard deduction on their federal income tax returns do not owe federal income tax on state tax refunds The vast majority of taxpayers claim the standard deduction

Download Is State Tax Refund Taxable

More picture related to Is State Tax Refund Taxable

2021 Nc Standard Deduction Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

5 Ways To Make Your Tax Refund Bigger The Motley Fool

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

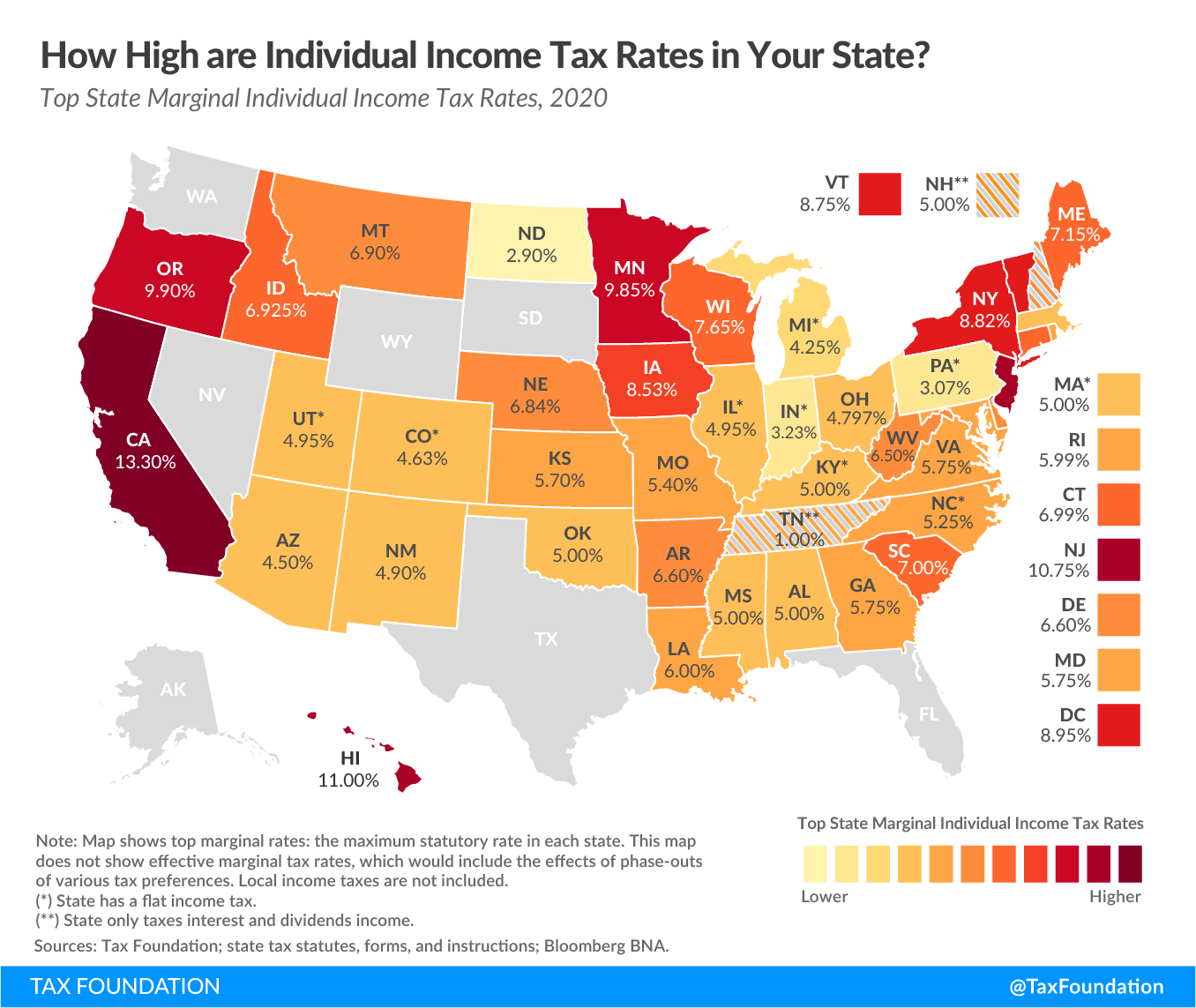

Taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state rebates and what it could mean for you The announcement does not affect state tax refunds received in 2018 for tax returns currently being filed The Tax Cuts and Jobs Act TCJA limited the itemized deduction for state and local taxes to 5 000 for a married person filing a separate return and 10 000 for all other tax filers

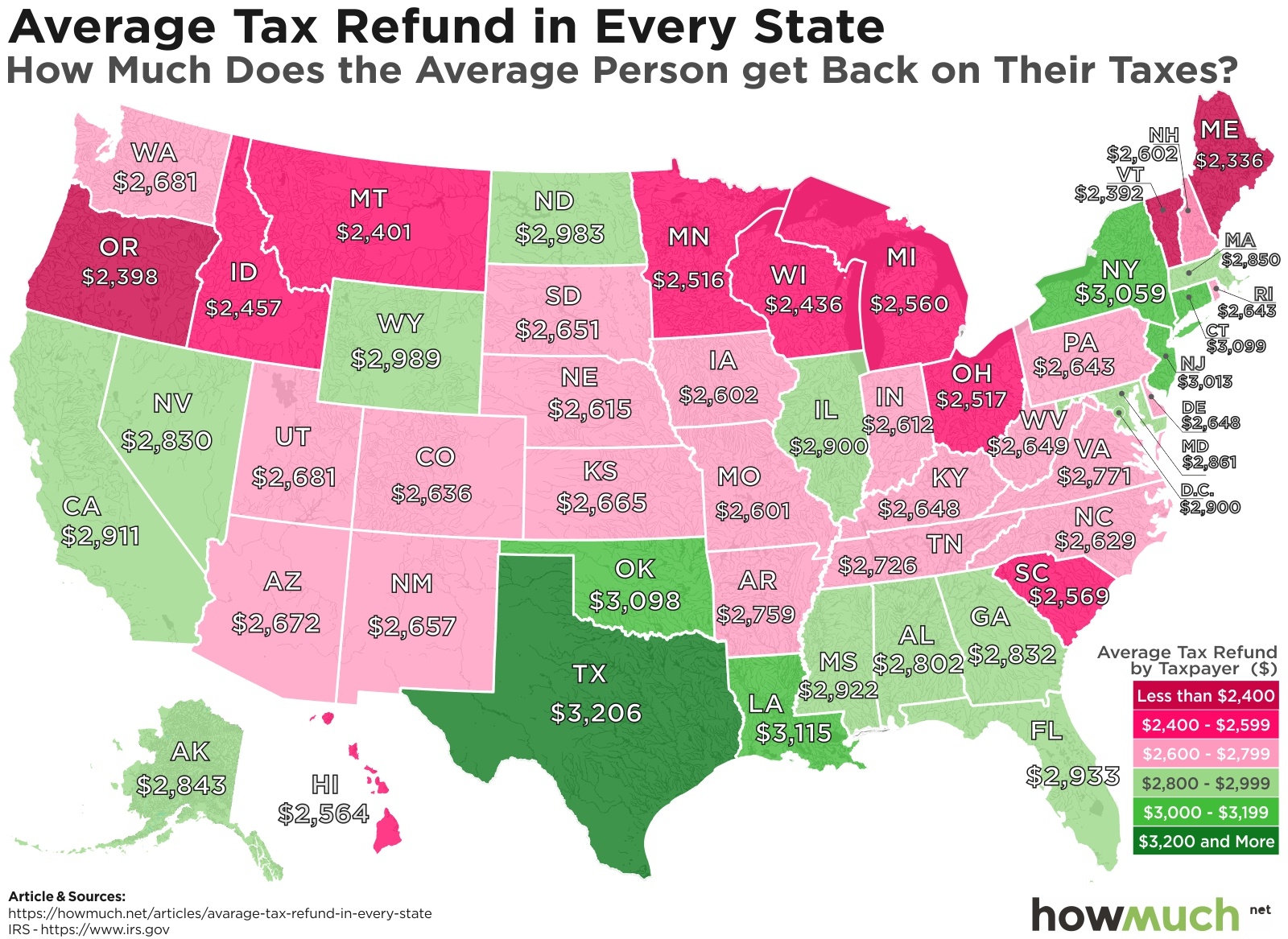

Seven states don t assess income tax so you won t file a state return in Alaska Florida Nevada South Dakota Texas Washington or Wyoming If you live in New Hampshire or Tennessee you re required to file a return if you have dividend or interest income but your earned income isn t taxed Is Your State Refund Taxable Whether your state refund is federally taxable depends on what you claimed on your taxes in the previous tax year Because most people claim the standard deduction they do not need to pay taxes on their state refunds

IRS Tax Charts 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-3.jpg

State Tax Refunds Are State Tax Refunds Taxable

https://1.bp.blogspot.com/-NvJ6PoFk2lM/Xassvldoa-I/AAAAAAAAAQE/_cq70vDF1TwrGzBh1DA4eWPhjzMIlJRsQCLcBGAsYHQ/s1600/State%2BTax%2BRefunds_%2BAre%2Bstate%2Btax%2Brefunds%2Btaxable_.png

https://www.hrblock.com/.../is-a-state-refund-taxable

It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized deductions on your federal income tax return You had the option to choose to deduct either state and local income taxes or general sales taxes

https://www.irs.gov/newsroom/irs-issues-guidance...

If the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit for example because the 10 000 tax deduction limit applied the payment is not included in income for federal tax purposes

Pin On Business Template

IRS Tax Charts 2021 Federal Withholding Tables 2021

Check IRS Where s My Refund IRS Refund Status 2023

What Income Is Subject To The 3 8 Medicare Tax

Expecting A Tax Refund Donate It Center For Work Education Employment

Estimate 2020 Tax Refund SanahJayden

Estimate 2020 Tax Refund SanahJayden

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

How Your Tax Refund Can Improve Your Credit

How To Check Your Income Tax Refund Status In Few Easy Steps YouTube

Is State Tax Refund Taxable - March 29 2019 TOPICS In Rev Rul 2019 11 issued Friday the IRS addressed how the long standing tax benefit rule interacts with the new 10 000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayer s federal income tax return