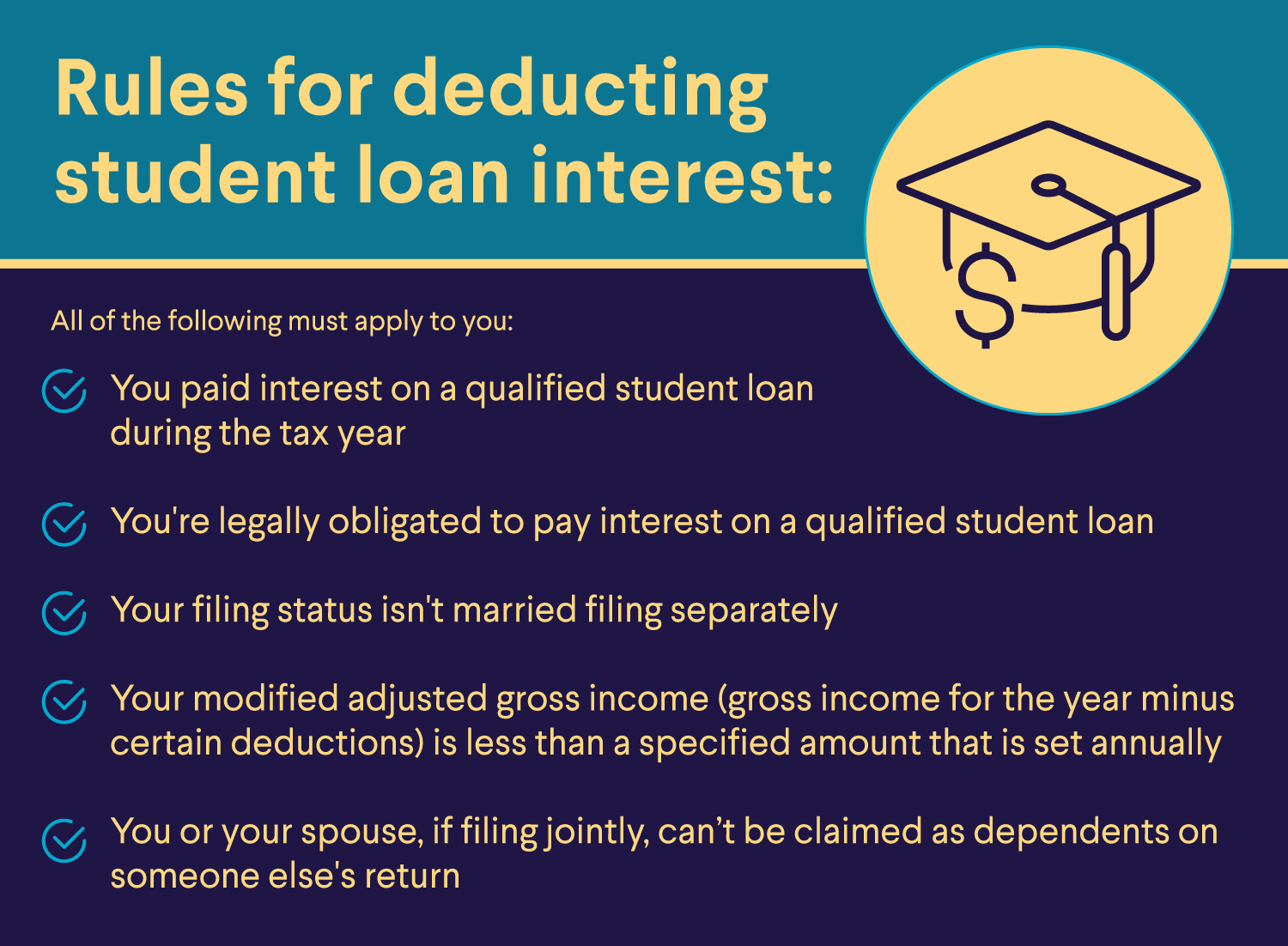

Is Student Loan Interest Tax Deductible Web 3 Jan 2024 nbsp 0183 32 You may deduct up to 2 500 of student loan interest paid in 2022 if you meet certain conditions such as filing status MAGI and loan type See the IRS

Web 25 Jan 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022 Web 25 Aug 2022 nbsp 0183 32 If your parents cannot fully support you it s common to get a BAf 246 G federal financial aid or a student loan If you have to repay these loans it s possible to save

Is Student Loan Interest Tax Deductible

Is Student Loan Interest Tax Deductible

https://149993554.v2.pressablecdn.com/wp-content/uploads/2020/02/Is-Student-Loan-Interest-Tax-Deductible-in-the-USA-768x484.jpg

Is Student Loan Interest Tax Deductible

https://images.foxtv.com/static.fox5atlanta.com/www.fox5atlanta.com/content/uploads/2021/02/1280/720/Credible-student-loan-taxes-thumbnail-1131866817.jpg?ve=1&tl=1

Is Student Loan Interest Tax Deductible

https://media.marketrealist.com/brand-img/m9k4Yav8X/0x0/stuloaninttaxded2-1598275058829.jpg

Web 26 Okt 2023 nbsp 0183 32 Learn how to claim up to 2 500 of the interest paid on qualified student loans as a federal income tax deduction Find out the eligibility criteria income limits and other tax breaks for higher education Web Vor einem Tag nbsp 0183 32 At a Glance Student loan interest payments may be tax deductible IRS rules and qualifications for the deduction Steps to claim the deduction Considerations

Web The answer is yes In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year You can claim the student Web 3 Apr 2023 nbsp 0183 32 The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to

Download Is Student Loan Interest Tax Deductible

More picture related to Is Student Loan Interest Tax Deductible

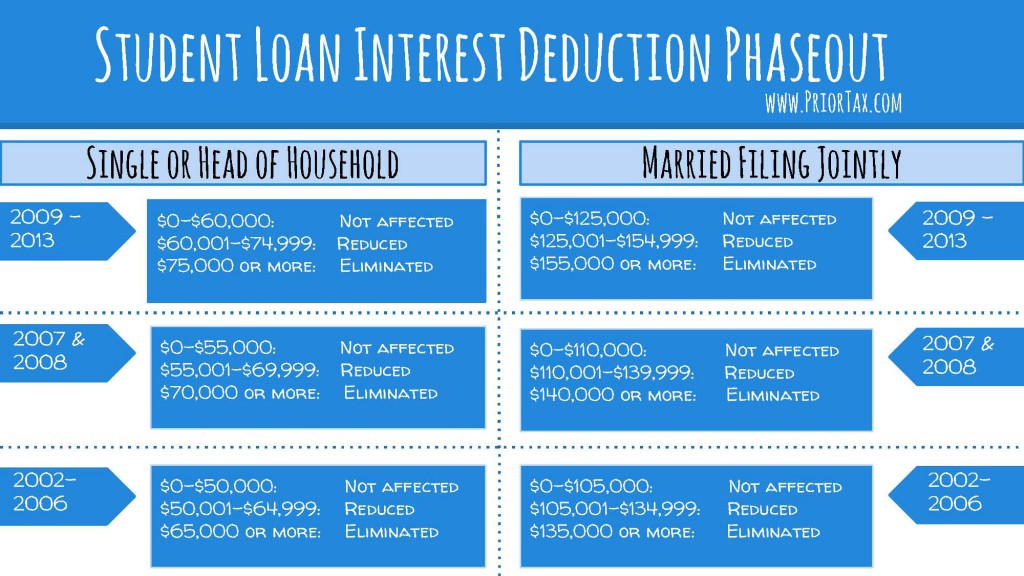

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

Is There Tax Savings For The Interest On Student Loan Debt

https://www.consolidatedcreditcanada.ca/wp-content/uploads/2021/08/Is-interest-on-student-loan-debt-tax-deductible.jpg

Is Student Loan Interest Tax Deductible RapidTax

https://www.blog.priortax.com/wp-content/uploads/2014/02/student-loan-interest-is-tax-deductible-2013.jpg

Web If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest paid on your 2022 federal tax return This is known as a student loan Web 3 Juli 2023 nbsp 0183 32 Luckily taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher

Web 6 Sept 2023 nbsp 0183 32 Yes If you paid student loan interest you can receive a tax deduction for that amount up to 2 500 Additionally some types of loan forgiveness are considered taxable income Web Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under

How To Claim The Student Loan Interest Tax Deduction In 2021

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

Are My Student Loan Payments Tax Deductible WNY Asset Management

https://www.wnyasset.com/wp-content/uploads/2022/04/WNYAsset_StudentLoanRepayment-1280x720.jpg

https://www.irs.gov/taxtopics/tc456

Web 3 Jan 2024 nbsp 0183 32 You may deduct up to 2 500 of student loan interest paid in 2022 if you meet certain conditions such as filing status MAGI and loan type See the IRS

https://www.nerdwallet.com/.../loans/student-loans/8-student-faqs-taxes

Web 25 Jan 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

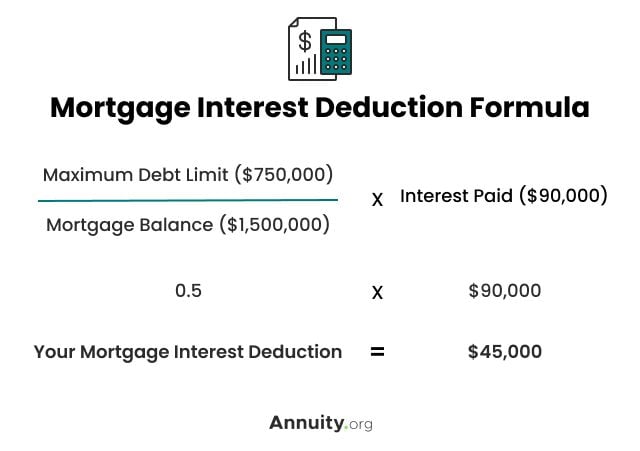

Mortgage Interest Tax Relief Calculator DermotHilary

How To Claim The Student Loan Interest Tax Deduction In 2021

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

Can Parents Write Off Student Loan Interest Leia Aqui Is Student Loan

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Are Student Loans Tax Deductible Bold

Are Student Loans Tax Deductible Bold

Is Home Equity Loan Interest Tax Deductible Members Heritage Credit

What Do I Do If I Can t Pay My Student Loans Leia Aqui How Long Can

Claiming The Student Loan Interest Deduction

Is Student Loan Interest Tax Deductible - Web 3 Apr 2023 nbsp 0183 32 The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to