Is Student Tuition Tax Deductible Some college tuition and fees are deductible on your 2022 tax return The American Opportunity and the Lifetime Learning tax

The deduction for college tuition and fees became no longer available as of December 31 2020 However you can still help yourself with college expenses through While new tax rules changed what s available student loan interest is tax deductible Additionally tuition and fees still count as qualified

Is Student Tuition Tax Deductible

Is Student Tuition Tax Deductible

https://preschool.org/wp-content/uploads/2021/08/tax-deductible_.jpg

What Is The Tuition Tax Credit In Canada

https://reviewlution.ca/wp-content/uploads/2022/09/reviewlution-guide2-10.png

Student Loan Repayment Vs Tuition Assistance Vs Tuition Reimbursement

https://uploads-ssl.webflow.com/620ed31d3077962fe420683d/629fac54a9b10b5ef2996b2d_towfiqu-barbhuiya-oZuBNC-6E2s-unsplash.jpg

There are several options for deducting college tuition and textbooks on your federal income tax return including the American Opportunity Tax Credit Lifetime Learning Tax Credits deductions and income reported on other forms or schedules The Tuition and Fees Deduction was extended through the end of 2020 It allows you to deduct up to

It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the There used to be a Tuition and Fees Deduction which allowed people to deduct up to 4 000 in higher education expenses That particular tax break no longer

Download Is Student Tuition Tax Deductible

More picture related to Is Student Tuition Tax Deductible

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/Unused-Tuition-Tax-Credit-Options.jpg

Is College Tuition Tax Deductible How To Ease The Financial Burden

https://media.marketrealist.com/brand-img/dwwJ-N4IO/1024x536/is-college-tuition-tax-deductible-1648663571830.jpg?position=top

Is Student Loan Repayment Tax Deductible US Student Loan Center

https://usstudentloancenter.org/wp-content/uploads/2017/07/Is-Student-Loan-Repayment-Tax-Deductable-768x512.jpg

If you re paying back student loans you may be able to deduct up to 2 500 in interest College is expensive but there are several valuable tax breaks that can help ease the pain The AOTC is worth up to 2 500 per eligible student Because it is a tax credit it should directly reduce the filer s tax bill not their taxable income As of this writing if the credit happens to bring the

March 06 2023 Tax year is a factor A s Tax Day draws near you may wonder if you re claiming every tax deduction possible Families of dependent college students and Can be claimed in amounts up to 2 500 per student calculated as 100 of the first 2 000 in college costs and 25 of the next 2 000 May be used toward required course

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

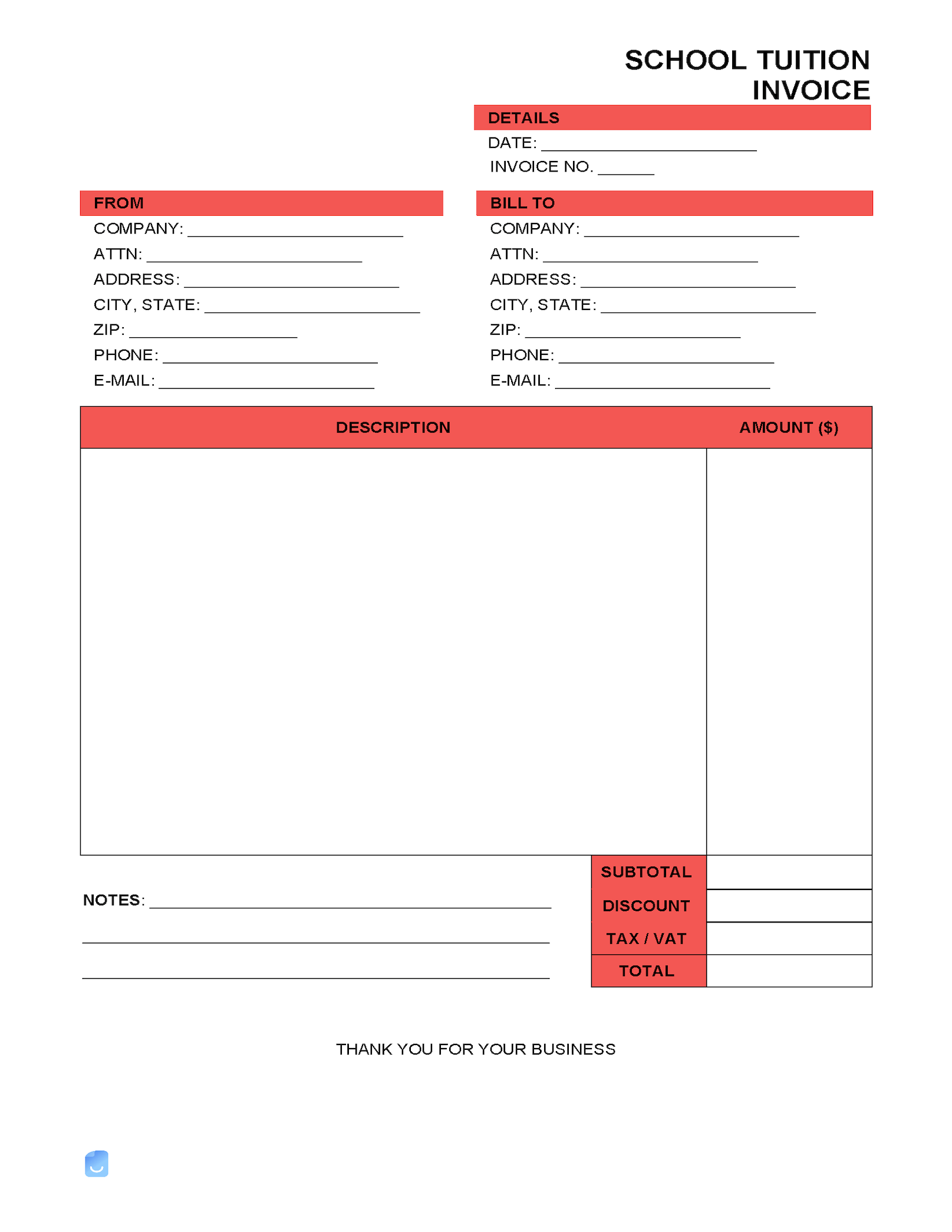

School Tuition Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/School-Tuition-Invoice-Template.png

https://www.businessinsider.com/personal-fi…

Some college tuition and fees are deductible on your 2022 tax return The American Opportunity and the Lifetime Learning tax

https://smartasset.com/taxes/is-college-tuition-tax-deductible

The deduction for college tuition and fees became no longer available as of December 31 2020 However you can still help yourself with college expenses through

Streetfighter 1098 Discount Dealers Save 59 Jlcatj gob mx

Tax Deduction Letter Sign Templates Jotform

Is Preschool Tuition Tax Deductible In 2021 Here s What To Know

Tuition Tax Credit In Canada How It Works NerdWallet

Is College Tuition Tax Deductible Fastweb

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

Tax Deductible Bricks R Us

Is Preschool Tuition Tax Deductible In 2020 Here s What You Need To Know

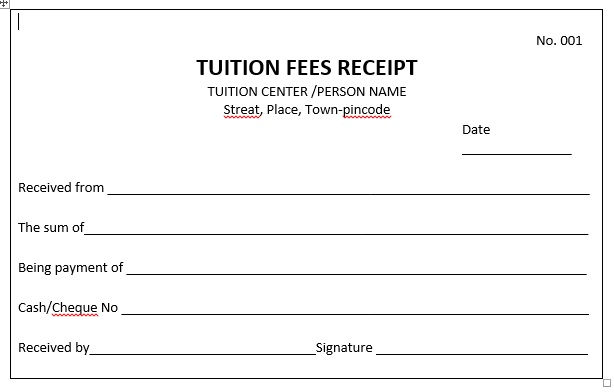

TUITION FEE RECEIPT SAMPLE COMPUTER STATION

Is Student Tuition Tax Deductible - Under certain conditions tuition training and tutoring costs may be deductible Contribution amounts For Coverdell ESAs the maximum contribution per