Is Supplemental Insurance Tax Deductible Yes your supplemental health insurance is deductible as a medical expense on Schedule A Itemized Deductions for Form 1040 You can deduct the amount that exceeds a

Yes your supplemental health insurance is deductible as a medical expense on Schedule A Itemized Deductions for Form 1040 You can deduct the amount that exceeds a Yes it is Premiums for the other Medicare programs Part B supplemental medical insurance Part C Medicare Advantage and Part D voluntary prescription drug

Is Supplemental Insurance Tax Deductible

Is Supplemental Insurance Tax Deductible

https://www.internationaltrisomyalliance.com/wp-content/uploads/2023/01/is-health-insurance-tax-deductible-for-self-employed.png

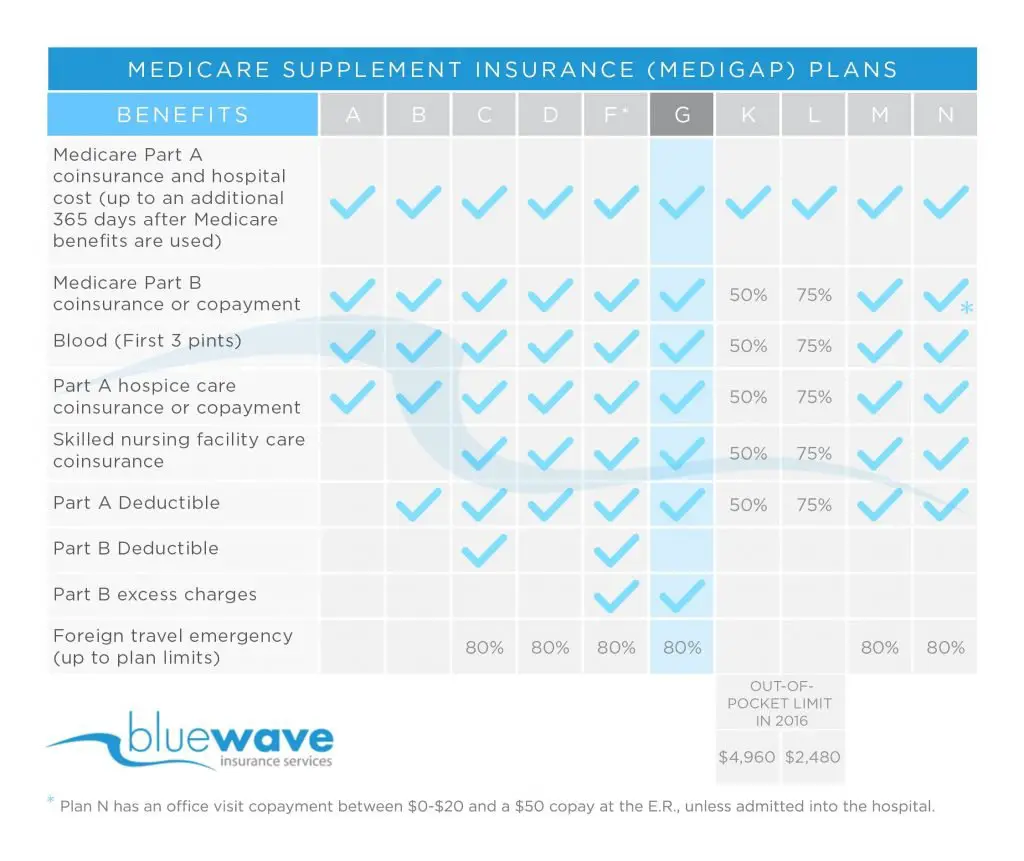

Is Medicare Supplement Plan N Good MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/cigna-medicare-supplement-reviews-plans-f-g-n-1024x861.jpeg

Health Insurance Deductible The Quick Guide Insurance Deductible

https://i.pinimg.com/originals/ef/4c/7c/ef4c7cc971e6117cdf36d3e403964d82.jpg

Learn how to determine if your health insurance premiums are tax deductible and understand the steps to accurately report them on your tax return Part D and supplemental If you pay for health insurance coverage before taxes are taken out of your employer s paycheck you can t deduct your health insurance premiums Generally speaking you can only claim

Supplemental insurance premiums may be tax deductible when itemizing medical and dental expenses on Schedule A of Form 1040 To claim this deduction your total medical Supplemental health insurance premiums can be considered taxable income for taxpayers who itemize their deductions on their tax return This means that premium amounts

Download Is Supplemental Insurance Tax Deductible

More picture related to Is Supplemental Insurance Tax Deductible

When Can I Deduct Health Insurance Premiums On My Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

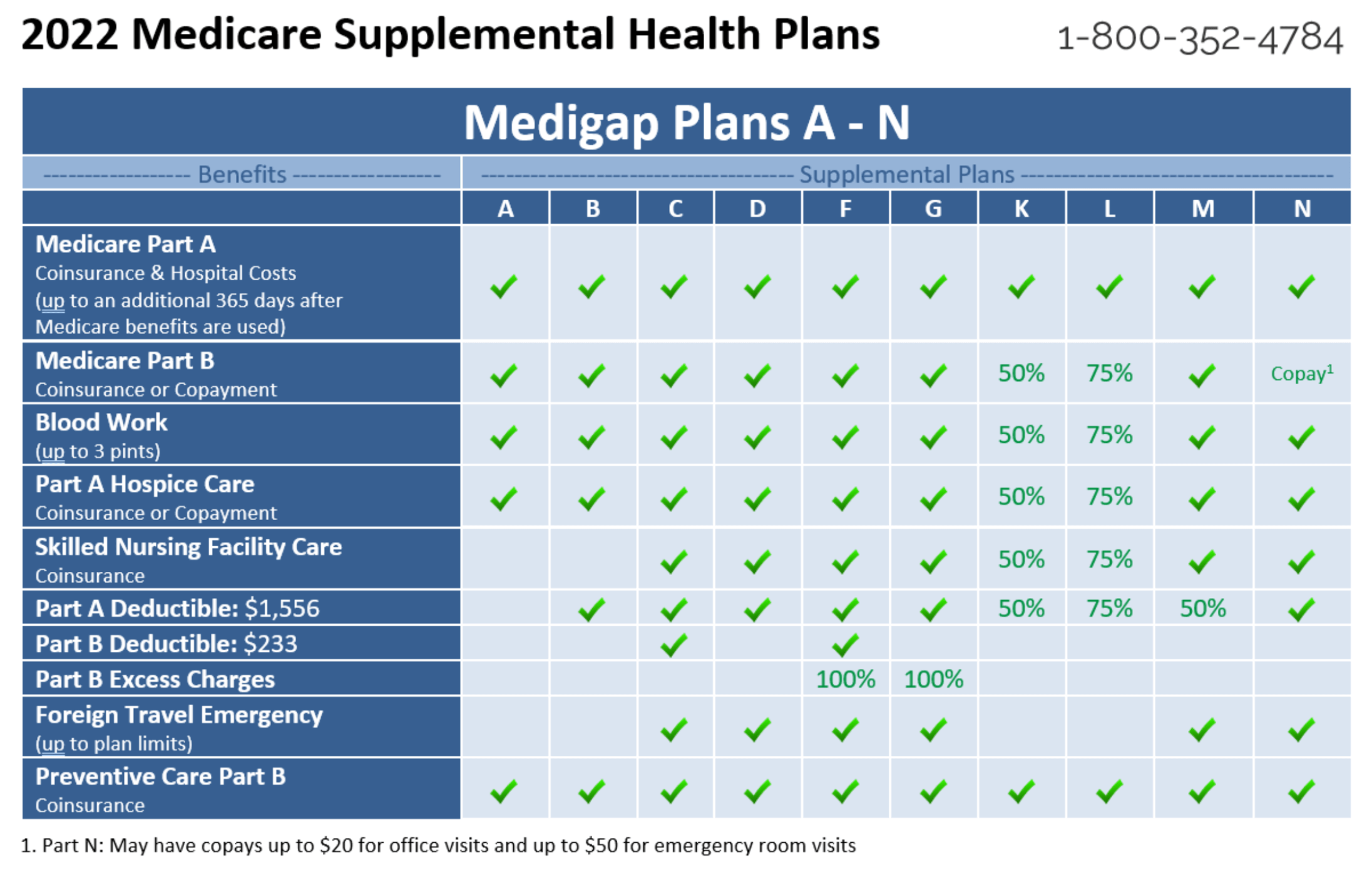

Medicare Supplemental Plans Health For California

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/2022-medicare-supplemental-health-plans.png

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/health-insurance-application-forms-banknote-stethoscope-is-health-insurance-tax-deductible-ss-Feature.jpg

Summary Medicare Premiums are tax deductible if your total healthcare costs exceed 7 5 of your adjusted gross income for the tax filing year You may choose to deduct Yes Medicare Supplemental Insurance also known as Medigap may be tax deductible depending on the circumstances If your medical expenses exceed 7 5 of your

[desc-10] [desc-11]

Is Car Insurance Tax Deductible Explore All Insights

https://images.ctfassets.net/uwf0n1j71a7j/27w4OpRBdDZmZQqBnKYakA/42a2771a177093256274121fc77cb43a/is-car-insurance-tax-deductible.png?w=3840&q=75

Supplemental Property Tax Bill

http://www.oscarsellshomes.com/img/supmtl prop tax bill - 04a crop.jpg

https://www.bankrate.com › taxes › are-medicare...

Yes your supplemental health insurance is deductible as a medical expense on Schedule A Itemized Deductions for Form 1040 You can deduct the amount that exceeds a

https://insuredandmore.com › is-supplemental...

Yes your supplemental health insurance is deductible as a medical expense on Schedule A Itemized Deductions for Form 1040 You can deduct the amount that exceeds a

Is Car Insurance Tax Deductible American Insurance

Is Car Insurance Tax Deductible Explore All Insights

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

Tax Deductions You Can Deduct What Napkin Finance

Is Medical Insurance Tax Deductible Grants For Medical

Is Homeowners Insurance Tax Deductible

Is Homeowners Insurance Tax Deductible

Supplemental Tax Bills YouTube

Medicare Part B Premium 2024 Chart

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

Is Supplemental Insurance Tax Deductible - [desc-12]